Summary:

- JPMorgan’s Q4 results will reveal the impact of lower interest rates on the fair value of its securities portfolio.

- The bank’s net interest income increased significantly in Q3 2023, allowing it to continue to handsomely cover preferred dividend payments.

- The Series M preferred shares of JPMorgan offer a dividend yield of just under 5.5%, making them an attractive addition to an income-oriented portfolio.

Michael M. Santiago

Introduction

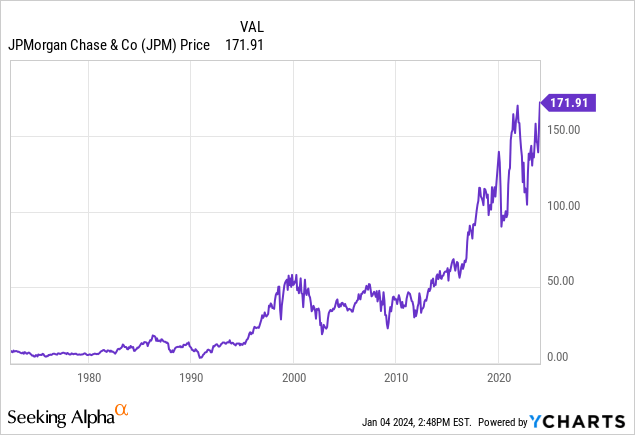

Although virtually all preferred shares issued by financial institutions are non-cumulative in nature, I still keep a close eye on some of the fixed rate issues. Despite the preferred dividends being non-cumulative, I still think they could be an interesting addition to my portfolio as long as the underlying bank is in good shape. That’s why I’m keeping tabs on the financial health of the largest banks in the US, with a specific focus on their ability to continue to pay the preferred dividends. As it has been a while since I had a look at JPMorgan (NYSE:JPM), I wanted to check up on this large financial institution after its preferred shares enjoyed a nice run.

Looking forward to the Q4 results

JPMorgan will report on its Q4 results before the end of this month and I’m looking forward to see how the lower interest rates on the financial markets toward the end of the fourth quarter had an impact on the fair value of the portfolio of securities available for sale as well as the unrealized loss on the portfolio of securities held to maturity.

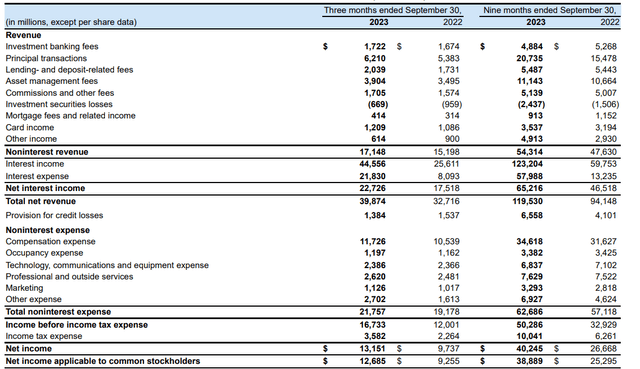

As you can see in the image below, JPMorgan was able to continuously increase its net interest income which jumped to $22.7B in the third quarter of 2023. That’s an increase of in excess of a quarter compared to the $17.5B in Q3 2022, and even if you’d compare it to the net interest income in the first few quarters of the year JPM is coming out ahead.

The bank also reported a total non-interest revenue of $17.15B and a non-interest expense of $21.76B which means the net non-interest expenses increased just slightly compared to the third quarter of last year but the provision for credit losses decreased to $1.38B. This, in combination with the very substantial increase of the net interest income (helped by the expanded balance sheet), resulted in a pre-tax income that’s more than a third higher than in the same quarter a year ago. After deducting the appropriate amount of income taxes, the net profit was $13.15B of which $12.69B was attributable to the common shareholders of JPMorgan. This represented an EPS of $4.33 based on the average share count of 2.93B shares outstanding.

Looking at the 9M 2023 results, the bank reported a net profit of $40.25B of which $38.9B was attributable to the common shareholders.

According to the footnotes to the financial results, the total amount of preferred dividend payments in the third quarter of 2023 was just $386M. Which means JPMorgan needed less than 4% of its net income after deducting the income attributable to non-controlling interests to cover the preferred dividend payments.

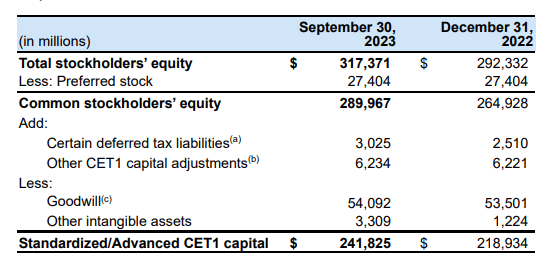

The financial institution also meets my balance sheet requirements. Not only is the CET1 capital ratio still exceeding 14%, the total amount of $317B in equity contains just $27.4B in preferred equity which means the balance sheet contains approximately $290B in common equity which ranks junior to the preferred equity. Of course, in a scenario where the bank fails, that seniority won’t matter much if a bank with a $4T balance sheet is collapsing. In case that unlikely event were to happen, I would expect both tiers of equity to be wiped out anyway.

JPMorgan Investor Relations

The fixed-rate preferred shares remain interesting

As explained in a previous article, I have been keeping an eye on several of JPMorgan’s preferred share issues but almost exactly two years ago I zoomed in on the Series M preferred shares (NYSE:JPM.PR.M).

In the third quarter of 2021, JPMorgan issued 80 million units of its Series M preferred shares. The M-series are a non-cumulative preferred share with an annual preferred dividend of 4.20% per year which results in $1.05 per share, paid in quarterly installments. The 80 million units have a total value of $2B, so this was a relatively sizable issue by JPMorgan, as the bank was obviously taking advantage of the low interest rates on the financial markets.

I like fixed rate preferred shares as there are no surprises when it comes to the quarterly preferred dividend. While I certainly understand investors who are looking to speculate on high short-term interest rates, I’m more interested in cash flow visibility, and that obviously is just a personal preference.

Based on the current share price of $19.14, the dividend yield of the Series M preferred shares is just under 5.5%. While that’s not spectacularly high, let’s not forget JPMorgan needs less than 4% of its attributable net income to cover the preferred dividend payments.

Investment thesis

Although I’m not a big fan of non-cumulative preferred shares as I like the additional safety net of preferred dividends having the cumulative feature, large banks like JPMorgan are generating plenty of profit and will likely continue to do so without jeopardizing the payment of preferred share dividends. As interest rates on the financial markets have decreased, the share prices of the preferred shares have increased resulting in a lower yield. That being said, the 5.5% yield is still somewhat attractive and could be an interesting addition to a diversified income-oriented portfolio. If interest rates continue to decrease, the preferred share price will continue to increase, paving the way to potentially generate capital gains.

I have a small long position in the Series M preferred shares of JPMorgan.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM.PR.M either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!