Summary:

- JPMorgan reported strong net profit in Q1 with a total net interest income of $23.1B.

- Loan loss provisions are increasing but still a fraction of total earnings profile, indicating stability in the US banking sector.

- Series EE preferred shares issued by JPMorgan offer a 6% fixed preferred dividend yield, making them an attractive investment option.

josephmok/iStock Unreleased via Getty Images

Introduction

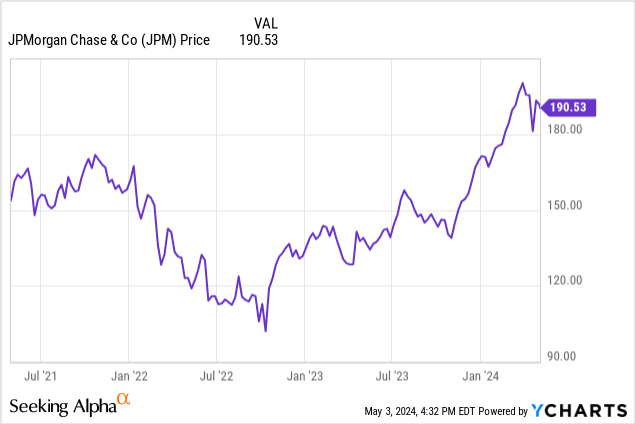

JPMorgan (NYSE:JPM) doesn’t need a lengthy introduction as I think every investor is aware of this household name in the financial sector. I currently have no position anymore in JPMorgan but I’m keeping an eye on some of its preferred shares as I think it could still make sense to pick up some of the fixed rate preferred shares which are currently yielding around 6%. That also means I need to keep an eye on JPM’s financial performance and health to ensure the preferred dividends are still well covered and the balance sheet remains robust.

A strong net profit on the back of lower loan loss provisions

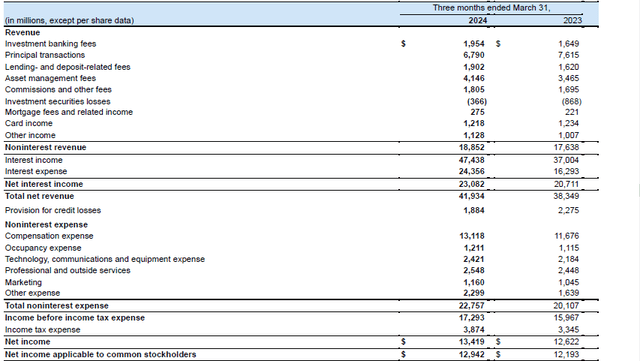

In the first quarter of the current financial year, JPMorgan reported total net interest income of $23.1B, which is an increase of in excess of 10% compared to the first quarter of last year as the total interest income increased by almost 30% and that $10.4B interest income increase was higher – in absolute numbers – than the $8.1B interest expense increase, thus leading to the net interest income increase.

JPMorgan Investor Relations

JPMorgan also reported a $1.2B increase in non-interest revenue, offset by a $2.6B increase in the non-interest expenses. This resulted in a pre-tax and pre-loan loss provision income of just under $19.2B. After deducting the almost $1.9B in loan loss provisions, JPM reported a pre-tax income of $17.3B and a net profit of $13.4B of which $12.94B was attributable to its common shareholders. This represents approximately $4.45 per share. Keep in mind this includes a $725M charge related to the FDIC special assessment.

Some authors here on Seeking Alpha have published “alarmist” articles on how the loan loss provisions in the US banking system are increasing. While JPMorgan saw a decrease, there’s another argument to be made about the wellbeing of the US banking sector. Sure, loan loss provisions are increasing, and that is to be expected when interest rates increase. But loan loss provisions are still just a fraction of the total earnings profile of a bank.

JPMorgan, for instance, generated a pre-tax and pre loan loss provision income of in excess of $19B and it needed less than 10% of that amount to add to its provisions. On a full-year basis, JPM will likely generate north of $70B and potentially even north of $75B in pre-tax and pre loan loss provisions which means the bank can absorb tens of billions of additional provisions per year before reporting a loss. With $1.3T in loans on the balance sheet, JPM’s earnings are basically sufficient to write off about 6% of its entire loan portfolio per year. And that’s a scenario I just don’t see happening.

While some banks may be weaker than others (and I consider JPM to be a very robust financial institution), I’m not bearish on the US banking sector and perhaps this would be a good moment to separate the wheat from the chaff.

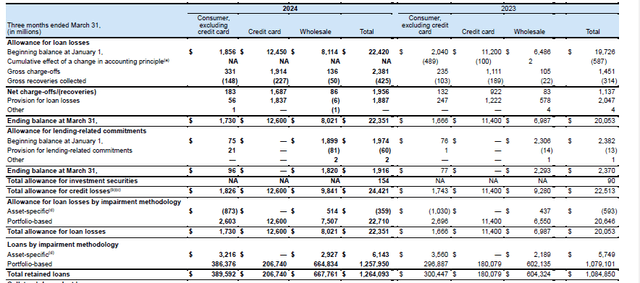

Looking at JPM’s balance sheet, and more specifically the loan book, the overview below shows the majority of the loan loss provisions are related to the credit card risk. About 97% of the total loan loss provision in the first quarter was related to credit cards where the total allowance increased to $12.6B on a $207B credit card portfolio. The $1.84B in additional provisions was necessary to cover the $1.69B in net charge-offs and add about $150M in extra provisions. JPM expects the net charge-off rate on the credit cards to remain below 3.5%.

JPMorgan Investor Relations

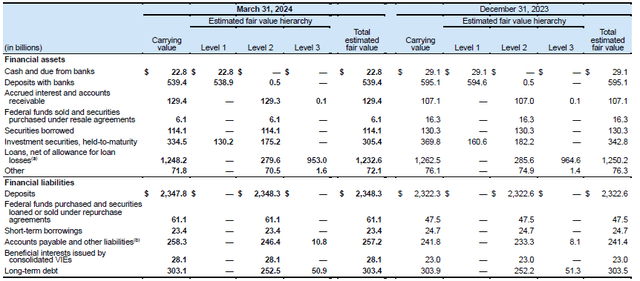

Looking at the fair value of the loans and the securities held to maturity (shown below), there only is a small difference between the fair value and the carrying value. As you can see below, there’s a $29B unrealized loss on the securities held to maturity while the fair value of the loan book is $1.23B compared to the $1.25B loan book. The total difference is approximately $45B. A high amount in absolute numbers but this represents just over 1% of the total assets and just 15% of the total common equity base. It really isn’t something I’m losing my sleep over.

JPMorgan Investor Relations

The preferred shares: Some are more appealing than others, but the dividends are well covered

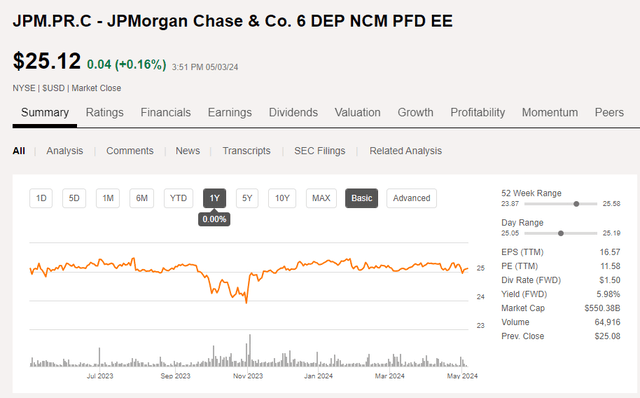

I recently started to keep an eye on the Series EE preferred shares issued by JPMorgan. There are 185,000 shares of $10,000/share outstanding but the depository shares, trading as (NYSE:JPM.PR.C) represent 1/400 th as the principal amount of the depository share is $25. This means the total size of this issue is $1.85B. The preferred shares are currently trading at a small premium to the $25 principal value but were trading slightly below $25 when the shares traded ex-dividend on May 1.

Seeking Alpha

These preferred shares pay a 6% fixed preferred dividend yield and the annual preferred dividend of $1.50 is payable in four equal quarterly tranches of $0.375.

As shown in the income statement, JPMorgan’s net profit attributable to its common shareholders was $12.9B and this already included the almost $0.4B in preferred dividend payments which means the bank only needed about 3% of its net income to cover the preferred dividends.

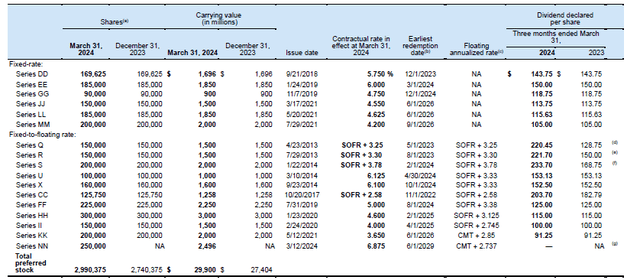

Meanwhile, looking at the balance sheet, there was about $29.9B in preferred capital outstanding as part of a total of $337B in equity. This means there was in excess of $300B in common equity, which ranks junior to the preferred shares. Subsequent to the end of the first quarter, JPMorgan retired $6B in preferred equity as the Series Q, Series R, Series S and Series U were retired.

JPMorgan Investor Relations

This wasn’t a major surprise as the first three had a floating rate with mark-ups of 3.25-3.78% above the SOFR making it pretty expensive capital.

Investment thesis

Although the preferred dividends and shares are non-cumulative in nature, they are still interesting vehicles to gain exposure to fixed income to a Tier-1 financial institution.

The Series EE preferred shares are quite attractive to me as for instance the Series MM is trading at a current yield of just around 5.5% while the Series JJ preferred shares offer a similar yield. The Series EE on the other hand offer a 5.96% yield based on the current share price of $25.15 but keep in mind these preferred shares can be called at any moment now.

I currently have no position in any of the JPM preferred shares, but a 6% preferred dividend yield is pretty appealing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!