Summary:

- JPM’s scale, financials, and leadership have allowed it to uniquely benefit from banking sector turmoil this year.

- Through its quality comparable metrics, it is well-positioned to continue to do so.

- Extrapolating earnings trends show that JPM should be trading at a relative discount within 3 years.

- JPM ends up being a smart buy no matter how the banking sector performs in my view.

Michael M. Santiago

Overview

Bank failures have continued apace this year, with 3 significant banks having bit the dust so far in 2023: Silicon Valley Bank, Signature Bank, and First Republic.

The question that many market observers are now asking is who’s next. Yet, it is uncertain if there will be any more bank failures at all. Statements and opinions diverge widely on how exposed banks are as a whole, to which asset class, and if anymore will actually fail. There is a lack of consensus on the matter right now and a variety of data points to support both sides.

This article will not posit a view on the direction of the banking sector. Rather, this article will highlight the fundamentals of the very best bank of the bunch: JPMorgan Chase (NYSE:JPM).

Fundamentals

Starting with book value across the megabanks, we can see that JPM has the highest book value while also being a close second for book value per share – an excellent combination to have.

|

$MM |

||

|

Book Value |

Tangible BV Per Share |

|

|

JPM |

$221,343 |

$75.74 |

|

BAC |

$182,777 |

$22.93 |

|

C |

$164,194 |

$84.34 |

|

WFC |

$136,976 |

$36.40 |

Source: Excel, Seeking Alpha

JPM is also well in the lead for total deposits as well as deposits per share. It’s worth noting that during Q1 JPM experienced the best deposit flow relative to the other banks, with end-of-period deposits up 2% quarter-over-quarter.

|

$MM |

MM |

$ |

|

|

Deposits |

Share Float |

Deposits Per Share |

|

|

JPM |

$2,377,253 |

2,922.30 |

$813.49 |

|

BAC |

$1,910,402 |

7,972.40 |

$239.63 |

|

C |

$1,330,459 |

1,946.80 |

$683.41 |

|

WFC |

$1,362,629 |

3,763.20 |

$362.09 |

Source: Excel, Seeking Alpha

As to loan-to-deposit ratio, all the big banks look to be on relatively conservative footing. JPM is a close second (0.55% absolute) to Citigroup in terms of keeping its loan-to-deposit ratio low.

|

$MM |

$MM |

% |

|

|

Deposits |

Net Loans |

Loan-to-Deposit Ratio |

|

|

JPM |

$2,377,253 |

$1,147,309 |

48.26% |

|

BAC |

$1,910,402 |

$1,033,892 |

54.12% |

|

C |

$1,330,459 |

$634,826 |

47.71% |

|

WFC |

$1,362,629 |

$934,871 |

68.61% |

Source: Excel, Seeking Alpha

JPM posted the best return on equity for Q1 2023.

|

$MM Quarterly |

MM |

% |

|

|

Net Income |

Total Equity |

Return on Equity |

|

|

JPM |

$12,622 |

$303,082 |

4.16% |

|

BAC |

$8,161 |

$280,196 |

2.91% |

|

C |

$4,606 |

$209,019 |

2.20% |

|

WFC |

$4,991 |

$183,220 |

2.72% |

Source: Excel, Seeking Alpha

JPM is the clear leader among the big banks when it comes to these core banking metrics.

Valuation

Considering a one-year horizon, JPM is trading relatively expensively as compared to its peers. It is the only megabank trading at a P/E FWD premium at present. This in of itself can be considered a positive indicator of the market sentiment’s as to the firm’s prospects.

| P/E TTM | P/E FWD | P/E FWD % Premium | P/E FWD Fin. Sector Median | |

| JPM | 10.02 | 9.51 | 12.99% | 8.42 |

| BAC | 8.21 | 8.01 | -4.81% | 8.42 |

| C | 6.38 | 7.57 | -10.11% | 8.42 |

| WFC | 10.95 | 8.05 | -4.36% | 8.42 |

Source: Excel, Seeking Alpha

Extending these valuations into the future presents a different picture. If we take each bank’s 3 year EPS CAGR and extend it forward for 3 years, JPM will actually be trailing the sector median by 2.06% at current prices. Given its robust fundamentals metrics and strategic positioning I would consider this cheap.

|

Basic EPS |

EPS TTM |

EPS FWD |

EPS 3 Year CAGR |

EPS 2024 (Est.) |

EPS 2025 (Est.) |

EPS 2025 (Est.) |

|

JPM |

13.58 |

14.30 |

4.02% |

14.88 |

15.47 |

16.10 |

|

BAC |

3.34 |

3.42 |

5.04% |

3.59 |

3.77 |

3.96 |

|

C |

7.21 |

6.08 |

-4.49% |

5.81 |

5.55 |

5.30 |

|

WFC |

3.50 |

4.76 |

-8.37% |

4.36 |

4.00 |

3.66 |

|

Share Price |

P/E TTM |

P/E FWD |

P/E 2024 (Est.) |

P/E 2025 (Est.) |

P/E 2026 (Est.) |

|

|

JPM |

$136.05 |

10.02 |

9.51 |

9.15 |

8.79 |

8.45 |

|

BAC |

$27.41 |

8.21 |

8.01 |

7.63 |

7.26 |

6.92 |

|

C |

$46.02 |

6.38 |

7.57 |

7.92 |

8.30 |

8.69 |

|

WFC |

$38.33 |

10.95 |

8.05 |

8.79 |

9.59 |

10.47 |

|

Megabank Median P/E |

8.37 |

8.49 |

8.63 |

|||

|

JPM P/E Premium to Median % |

9.24% |

3.61% |

-2.06% |

Source: Excel, Seeking Alpha

Unique Factors

JPM may be unique as a company due to its distinguished financial metrics, but it is also unique because it has Jamie Dimon at the helm. While generally well-known and well-regarded, Dimon has freshly proved his acuity again this year through the First Republic acquisition. First Republic’s high net-worth customer base is expected to help grow JPM’s wealth management business, which has been a key focus area across the large banks in recent years.

Furthermore, JPM this year is demonstrating a very rare quality for a bank – antifragility. Coined by Nassim Taleb, antifragility refers to the capacity for something to grow in response to shocks or volatility in its environment.

JPM is proving itself antifragile this year and has uniquely benefited from the shocks and volatility occurring within the banking sector. Through its sterling reputation and quality balance sheet, JPM has provably gained deposits while also having executed successfully on the strategic First Republic deal. Year to date, JPM is well ahead of any other bank in directly growing its business from turmoil in the banking sector.

This is logical as size and survivability are critical for banks operating in this high-risk environment. The biggest, most secure banks have an advantage in this market and JPM is the epitome of that.

If more banking sector volatility is on the horizon, JPM will be uniquely positioned to continue capitalizing on it.

Risks

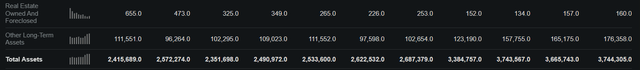

While JPMorgan may be positioned well relative to its megabank peers and the banking sector at large, it is not immune from ongoing economic stressors affecting the banking sector. Particularly salient here are continuing warnings around risks in the commercial real estate domain – something JPM has mentioned itself.

JPM’s real estate exposure is nonetheless quite limited relative to its overall assets.

The more significant risk factor here would be interest rates. JPM has benefitted significantly from higher interest rates, with the current slate of increases driving its entire net income interest of $1.7B (+$2.3B YoY). Once interest rates start to decrease again, this will materially impact JPM’s top and bottom lines. The caveat here is that the firm’s relative valuation may end up preserved as the entire banking sector would be forced to contend with this.

Conclusion

I think JPM will continue distinguishing itself in this market environment and outperforming in the long-term; this stock’s a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.