Summary:

- JPMorgan Chase has outperformed other banks in 2023, with a positive return in the first five months, due to a successful acquisition of First Republic’s assets and solid growth in Q1 earnings.

- The bank has a strong competitive position, with a focus on innovation and AI, and high liquidity coverage, making it less likely to fail in comparison to other banks.

- However, JPMorgan’s stock is slightly expensive for its sector.

- It faces risks including interest rate hikes and a potential recession in the second half of the year.

Jamie Dimon Drew Angerer

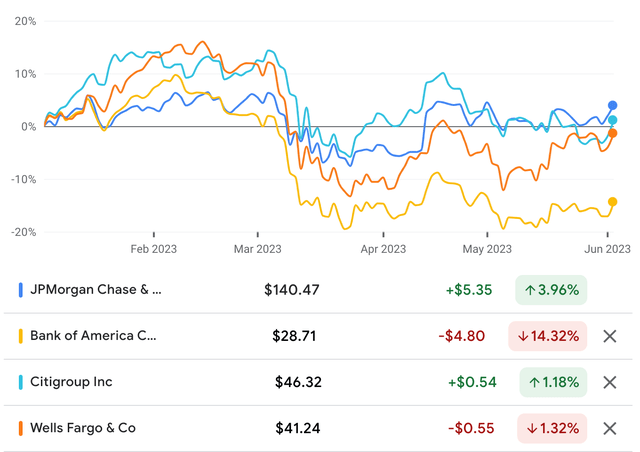

JPMorgan Chase (NYSE:JPM) has been one of this year’s best performing bank stocks. After a massive earnings beat and the successful acquisition of First Republic’s assets for a cheap price, the company’s stock achieved a positive return for the first five months of 2023 – and few other banks did.

Certainly, those who held JPM stock at the start of the year were rewarded. Or at least, they were rewarded more than those who held other bank stocks. While JPM has managed a positive return year-to-date, it is behind the S&P 500 for the year. Still, it is the best performing big bank in 2023 so far.

big bank performance (Google Finance)

To some extent, JPMorgan’s outperformance is deserved. First, the company’s acquisition of First Republic was on very favorable terms, with a $2.6 billion equity gain and the FDIC agreeing to cover 80% of potential losses. Second, JPM’s first quarter earnings release showed solid growth, with earnings up 80% year-over-year.

However, because of its outperformance, JPM stock is now richly valued for a bank. It currently trades at 10.3 times earnings, when the average bank stock P/E ratio is 8.46. Certainly, JPMorgan is growing faster than most banks are, but on the other hand, it only had one quarter of truly stellar growth in the last 12 months. When Canadian banks reported earnings last month, most of them increased their provisions for credit losses (PCLs), at both their Canadian and U.S. segments. If the same thing happens at U.S. banks, their earnings will likely decline, or at least grow less than expected.

Still, JPMorgan stock is a reasonably good value at today’s prices. It is expensive for a bank, but not for the markets overall. Its growth is very strong, and it recently closed a deal to buy only the ‘good’ parts of a failed bank, not the bad parts, and netted a large equity gain in the process. Accordingly, I will spend the rest of this article arguing that JPM stock is a pretty good value at today’s prices.

Competitive Landscape

One thing that JPMorgan has going for it is a strong competitive position. It has the largest market share of any U.S. bank, and it has advantages that could help it retain its lead in share.

For one thing, it has a strong balance sheet with a large amount of liquidity. This helps it stay afloat during banking crises and survive during events that lead to other banks failing. As we saw in March and April, banks can and do fail. JPMorgan, which has about 48% of its deposits covered by liquid assets, is less likely to fail than the others. This positions it well to acquire new assets if/when competitors go belly up.

Second, JPMorgan is investing heavily in innovation – more than most banks are. It has an entire AI research department in France, and is already using AI heavily in its business. It’s developing a ChatGPT-like investment advisor, and has long been using AI to automate mundane tasks that once took hundreds of thousands of labor-hours per year. The advantages stemming from JPMorgan’s AI investments may include new businesses (from the chatbot) and cost savings (from the internal automation).

Liquidity

Another thing that JPMorgan has in its favor is liquidity. Warren Buffett once said that banking is a great business as long as you don’t do something stupid on the asset side. He was referring to the need for liquid assets – namely cash and treasuries. If your whole balance sheet is a collection of 30-year mortgages, and you get an influx of withdrawals, you’re going to have a hard time paying off your depositors, because you can’t quickly turn your assets into cash. If, on the other hand, your assets are mostly cash and treasuries, then you’re likely to be able to survive a bank run, because those assets can be sold quickly.

How liquid is JPMorgan right now?

We can’t say for sure because it has been over a month since its last earnings release. However, we do know that at the end of March, JPM had:

-

$545 billion in cash and deposits.

-

$197 billion in available for sale debt securities.

-

$413 billion in held to maturity securities (which I will adjust down to $388 billion in fair value).

-

$2.3 trillion in deposits.

So we’ve got $1.13 trillion in liquid assets and $2.3 trillion in deposits, yielding liquidity coverage just slightly under 50%. This is a pretty good liquidity coverage because it implies that JPM could survive 50% of deposits being withdrawn. That would be an extraordinarily severe bank run if it occurred, so JPM would survive most scenarios the economy could throw at it in my opinion.

Valuation

Probably the sourest point of the analysis for JPMorgan is the stock’s valuation. Its earnings multiple is above-average for a bank, and it’s a similar story with the other multiples. At today’s prices, JPM trades at:

-

10.37 times earnings.

-

3.22 times sales.

-

1.49 times book value.

-

10.86 times operating cash flow.

-

11 times free cash flow.

By contrast, Bank of America (BAC) is at:

-

8.6 times earnings.

-

2.46 times sales.

-

0.91 times book value.

-

8.23 times operating cash flow.

-

8.37 times free cash flow.

Bank of America is a far cheaper stock despite having comparable liquidity (just under 50% of deposits). Now of course, JPM had the better earnings growth rate last quarter, but that was after JPM’s earnings declined severely in the first quarter of 2022. On a 5-year CAGR basis, BAC and JPM have about the same earnings growth rate: 14.1%.

None of this is to say that JPM is an actively bad buy today. The stock is cheaper than the S&P 500, and the underlying company is very profitable. It is however a little expensive for its sector, which is the main reason why I’ve been buying more BAC this year rather than diversifying into JPM.

Risks and Challenges

As we’ve seen, JPMorgan is a very liquid bank that is growing and whose shares are reasonably priced. It certainly looks like a good value. In fact, I think that the stock is a mild ‘buy.’ However, there are many risks and challenges for investors to watch out for, including:

-

More interest rate hikes. If the Federal Reserve continues hiking interest rates, it could have a negative effect on JPM’s liquidity. Interest rate hikes tend to improve bank profitability by raising the interest they collect on loans, but they also cause treasuries and other bonds to go down in value. In the first quarter, JPM reported $413 billion in held to maturity securities, but they were worth only $388 billion at fair value. So, the bank had about $25 billion in unrealized losses. Should the rate hiking continue, then these losses will likely increase, potentially leading to liquidity issues and an erosion of book value.

-

Higher risks. JPMorgan may face a tougher environment in the second half of this year than in the first. Many economists think we’re heading into a recession in the second half of this year. I’m personally skeptical of that claim, but I do think it’s possible that we enter a recession in the second half. If we do, then it will be a tough environment for banks. When the economy enters a recession, banks have to raise their PCLs, which creates an immediate on-paper hit to net income. Later, people usually do start defaulting more, causing a hit to revenue. If things get bad enough, systemic crises can unfold. In such scenarios, bank earnings tend to decline, along with their stock prices.

The Bottom Line

JPMorgan is a fortress of a bank. With ample liquidity, high profit margins, and a fantastic CEO, I believe investors can trust the company to weather whatever economic storms may be coming.

At the same time, the company is clearly a bit pricier than the average bank. It’s not as pricey as the S&P 500, but banks tend to trade at a discount to the broad market, as they typically have slower growth than tech companies. JPM scores a ‘D+’ on valuation in Seeking Alpha Quant, and I have to say I agree with that rating. Banks have low multiples for a reason, and JPM’s are actually high on a sector-relative basis. It’s for this reason that I’m personally buying Bank of America rather than JPMorgan Chase.

Nevertheless, I’d imagine that people buying JPM stock today will do pretty well over the long term. Stable, well capitalized and liquid, it has stood the test of time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.