Summary:

- JPMorgan Chase & Co. announces 5% dividend increase and buyback continuation.

- The company has paid increasing dividends to shareholders on an annual basis since 2011.

- Stress test results and financials in general should comfort investors about the company’s ability to sustain and pay increasing dividends over time.

- JPM stock is in a good spot technically as well.

winhorse

JPMorgan Chase & Co. (NYSE:JPM) has long been a favorite stock of mine in the banking sector as I believed the company clearly differentiated itself from its competitors. For example, JPMorgan has always embraced technology with more ease while also being more committed to its shareholders. Hence, it was not at all surprise to me when JPMorgan was among the first names to announce a dividend increase after all 23 banks recently passed the stress test.

My previous analysis on JPMorgan was at the end of 2021 when I evaluated the stock’s outlook for 2022. The stock has since had a total return (including dividends) of -3.59% but has outperformed the S&P 500, which is down 7.27% in the same time period. This article evaluates the strength of JPMorgan’s new dividend, with a focus on recent events including the stress test results and the company’s outlook. Let us get into the details.

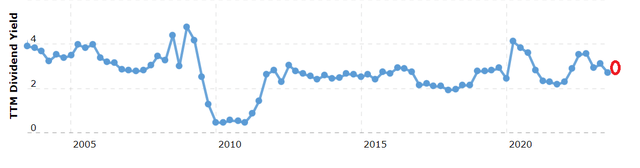

Current Dividend and Yield

The current annual dividend of $4.20 per share ($1.05/quarter) gives JPMorgan investors a current yield of 2.86%. This is more or less in line with major competitors like Wells Fargo & Company (WFC) and Bank of America Corporation (BAC). The near 3% yield is also close to the company’s average yield since 2010 as shown in the chart below.

Payout Ratio (Based on Earnings Per Share)

Based on JPMorgan’s forward earnings estimate of about $14.46, the stock has a forward payout ratio of 29%, which compares favorably to the 50% in 2014 based on 2015’s forward EPS. This is in line with Wells Fargo’s payout ratio based on its new planned dividend of 35 cents/quarter and slightly above Bank of America’s 26% but bear in mind Bank of America still has not released its capital plans and a dividend increase, if any, is likely to push its payout ratio up a bit at least.

Payout Ratio (Based on Free Cash Flow)

Generally speaking, I’ve been using Free Cash Flow (“FCF”) as my primary metric to evaluate dividend coverage due to the flakiness that can be attributed to EPS. However, let’s bear in mind Free Cash Flow is not the best metric to evaluate a bank, which primarily exists to help fund liquidity by lending its cash out. However:

- Total shares outstanding: 2.96 billion

- Current quarterly dividend: $1.05/share.

- Annual FCF required to cover dividends: $12.3 billion.

- JPM’s FCF in 2022: $107 billion.

- Payout ratio using 2022’s FCF: 11.50% (that is, $12.3 billion dividend by $107 billion).

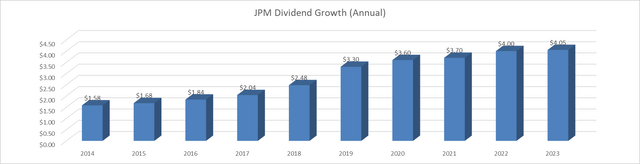

Dividend Growth Rate [DGR]

Seeking Alpha’s summary page lists JPM’s dividend growth streak at 8 but on an annual basis, dividends have been increasing every year since 2011 as can be confirmed on Seeking Alpha and JPMorgan’s investor relations website. In other words, we need to go back to the financial crisis of 2008/2009 to see the last time JPMorgan disappointed shareholders with a dividend cut. It is all the more impressive when you think many big-bank peers had to reduce their dividend payouts during COVID, including my other bank holding, Wells Fargo.

Going back to the dividend growth history, from paying 80 cents per share on an annual basis in 2011, JPMorgan has increased its dividend payout more than 5 times to reach the current dividend level of $4.20 per share (on annual basis). The dividend growth rate has fallen over the years but this is to be expected and even appreciated as the last thing I want as a dividend growth investor is a reduced dividend. In other words, slow and steady is perfectly fine with me.

JPM Dividend Growth (Compiled by author, data from Seekingalpha)

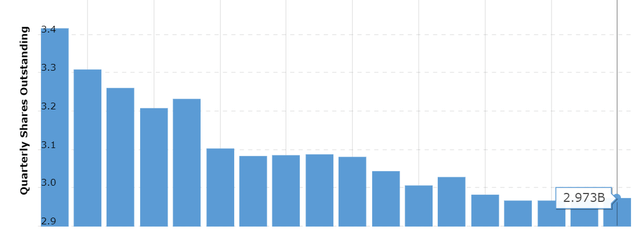

Buyback

This is another area that JPM has been getting better at over the years. Shares count has been on a continuous decline irrespective of the time frame you are looking at, despite the company’s start-pause approach when it comes to buybacks:

- 8% reduction in the last 3 years.

- 16% reduction in the last 5 years.

- 22% reduction since 2014.

As I’ve stated before, meaningful reduction in shares count has double benefit for shareholders of companies that pay dividends. Not only do buybacks enhance EPS, but also save money every single quarter as the retired shares do not demand/expect their quarterly dividend with wide eyes like we silly investors do.

JPM Shares Outstanding (macrotrends.net)

Extrapolation

I am not as comfortable projecting dividends with banks as I am with, say, consumer staples stocks. However, let’s assume a paltry 5%/yr increase on average per year over the next 5 years. The yield on cost should go up respectably for someone buying here, breaching the 3.50% conservatively.

| Year | New Annual Div/Share | Yield on Cost |

| 2023 | $4.05 | 2.77% |

| 2024 | $4.25 | 2.91% |

| 2025 | $4.47 | 3.06% |

| 2026 | $4.69 | 3.21% |

| 2027 | $4.92 | 3.37% |

| 2028 | $5.17 | 3.54% |

Outlook and Conclusion

The latest dividend increase is backed up by solid financial strength. While some Seeking Alpha investors seem to be disappointed with the 5% increase, let’s not forget it wasn’t long ago that we were all expecting a repeat of 2009 when regional banks started collapsing like nine pins. Better safe than sorry when it comes to my dividends, please.

Although this article is about JPM’s dividend, let’s take a quick look at the company and stock’s outlook.

- Growth Initiatives: InstaMed, a seamless healthcare payment provider, was acquired by JPMorgan in 2019 and was already paying off dividends when I last reviewed the company at the end of 2021. Fast-forward to half-time 2023, online payments in healthcare continue surging. For example, the number of transactions made on InstaMed network increased by 106% between 2019 and 2022. Payment volume increased by 437% in the same time period. This move to acquire InstaMed, once again, shows how JPMorgan is ahead of the curve, as the acquisition was done pre-COVID when online payments for healthcare weren’t as popular as they are now.

- Stress Test: JPMorgan was among the most improved banks in the recent stress test, adding gloss to an already strong profile. As a result, JPM’s stress capital buffer fell from 4% to 2.90% and the company felt comfortable enough to both increase its dividend and resume its buyback. In contrast, Bank of America has not yet announced its capital plans despite good stress test results and is in talks with the Federal Reserve to better understand the results. Citigroup Inc. (C) on the other hand has increased dividend despite increase in capital requirements. Neither of those situations compare favorably with JPMorgan in my opinion.

- Valuation: At a forward multiple of 10, JPM is cheap enough but is actually trading at slight premium compared to peers Wells Fargo and Bank of America. I believe this premium is deserved and is what I call the “Jamie premium” with JPMorgan having who I believe is the best banking CEO in the country. The clarity in which he communicates is refreshing and he not only indicated the company is strong at this moment but is also prepared to face tighter scrutiny if needed:

“We continue to maintain a fortress balance sheet with strong capital levels and robust liquidity, and we remain prepared for a broad range of potential outcomes, including potentially higher future capital requirements from the finalization of the Basel III capital rules“

- Price Target: Analysts have a median price of $160, which is about 10% higher than the current price. Including the near 3% yield, that would represent a satisfactory (to me) return of 13% from here.

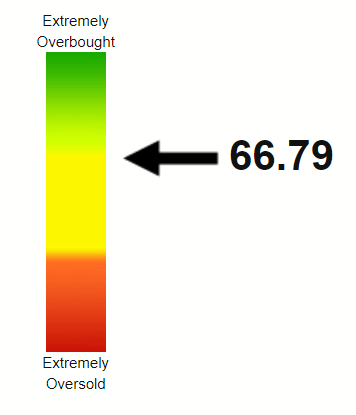

- Technical Strength: From a technical perspective, despite a 30% gain in the last one year, JPMorgan’s stock has a Relative Strength Index (“RSI”) of 66 as shown below. This is my preferred sweet spot as it shows accumulation while leaving further room to the upside before the stock gets over extended.

JPM RSI (Stockrsi.com)

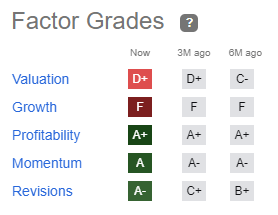

- Risks: The biggest risk for bank stocks in my opinion is Federal Reserve policies. Generally speaking, banks tend to do well when rates are higher as the impact of spread between what a bank pays as interest (say, savings account) and what it charges as interest (say, mortgage) is more pronounced. The fact that Federal Reserve did not raise rate for the first time in 15 months is almost immediately followed by news that they are ready to start increasing rates again. Finally, investing is all about choices and although JPMorgan stock’s valuation looks fair on stand-alone basis, the stock does not compare favorably among its peers (from valuation perspective) as confirmed below by Seeking Alpha’s D+ rating. For example, Bank of America is trading at a forward multiple of 8 compared to JPMorgan’s 10.

SA Rating (Seekingalpha.com)

To conclude, I continue being invested in JPMorgan and believe the stock is a buy despite trading near 52-week highs as the interest rate picture gets clearer and the bank’s financials remain robust. Last but not the least, I remain a believer as long as Jamie Dimon is at the helm.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.