Summary:

- JPMorgan reported strong Q2 earnings, exceeding estimates and showing solid fundamentals amid high interest rates and geopolitical headwinds.

- The company is actively seeking growth opportunities, such as expanding in the EU and opening new offices in India.

- While there are some potential challenges ahead, including weakness in commercial property loans and potential downgrades of big banks, JPMorgan is well-positioned to weather these storms and is considered undervalued.

winhorse

Thesis

For over a decade JPMorgan Chase & Co. (NYSE:JPM) has delivered superior performance relative to the rest of the banking sector under the leadership of Jamie Dimon. During uncertain times in 2023, things are no different as JPMorgan’s fundamentals are solid amid high interest rates and other geo-political headwinds. The company reported excellent Q2 earnings even when excluding its First Republic acquisition. In addition, JPMorgan is still hunting for growth as shown by events such as its Chase expansion in the EU as well as new offices in India. There are, however, some storm clouds on the horizon as commercial property loans are showing weakness and the potential downgrades of big banks by Fitch could weigh on the financial sector, including JPMorgan. Nonetheless, I believe JPMorgan is in a strong position to weather these storms and in my view the stock is undervalued at current levels. I initiate JPMorgan at a Buy rating.

Earnings

Overview

In July, JPMorgan reported its Q2 earnings and showed strong results even before accounting for First Republic. EPS was reported to be $4.37 excluding First Republic versus a $4.00 Refinitiv estimate. Revenue was $42.4 billion versus an estimate of $38.96 billion. A notable figure would be its increase in net interest income of 44% to $21.9 billion beating the StreetAccount estimate by $700 million. In addition, JPMorgan raised its 2023 net interest income guidance to $87 billion, up $3 billion from its May revision. They also reported better-than-expected trading and investment banking activity.

Firm Wide Performance

JPMorgan Q2 Earnings Presentation

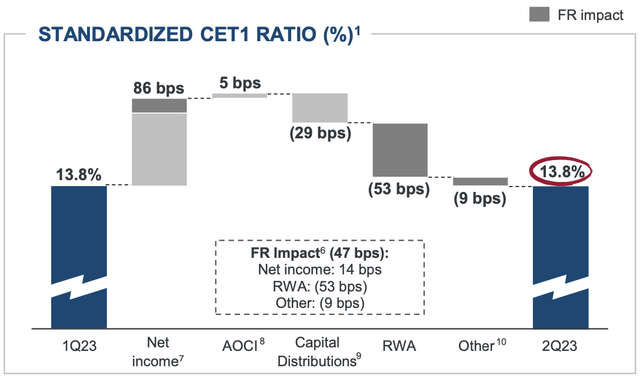

JPMorgan reported $42.4 billion in revenue which is up from $38.349 billion in the Q1 and $30.715 in 2Q22. However, Provisions for Credit Losses also increased from $1.101 billion in 2Q22 to $2.899 billion. Overall, net income growth was strong as it increased from $8.649 billion in 2Q22 to $14.472 billion. Both ROE and ROTCE also showed healthy progress as they increased from 13% to 20% and from 17% to 25% YOY respectively. In my view, these results are rock solid even though the past year has been full of uncertainties. I believe JPMorgan has done a great job in navigating a tough geo-political environment. Lastly, JPMorgan is on solid footing as it reported $494 billion in total loss absorbing capacity and a CET1 ratio of 13.8%.

Consumer and Community Banking

JPMorgan Q2 Earnings Presentation

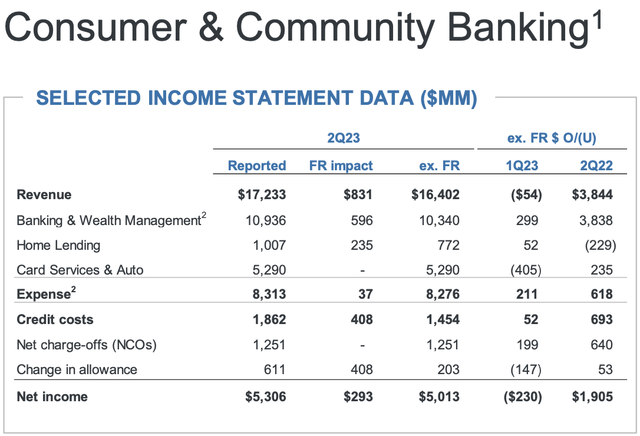

For this division, revenue was $17.233 billion which is up from $16.456 billion in Q1 and $12.558 billion in 2Q22. Within this division, Banking and Wealth Management showed strong growth QOQ and YOY as revenues were up 59% YOY, excluding First Republic, as a result of higher deposit margins on lower balances. Home Lending showed QOQ and YOY growth but revenues were actually down 23% YOY when excluding First Republic as a result of lower net interest income. Lastly, Card Services had a QOQ decrease but a YOY increase as a result of higher card service net interest income which was offset by lower auto operating lease income and card net interchange. Provisions were up significantly to $1.862 billion (including $408 million in reserves for First Republic) from $761 million in 2Q22. I believe this shows JPMorgan continues to be conservative with its business in the short term amid rate uncertainties. Overall, net income was $5.306 billion and is up 61% YOY excluding First Republic. From my analysis, JPMorgan’s Consumer and Community Banking division results were solid despite some mixed results in Home Lending.

Corporate & Investment Bank

JPMorgan Q2 Earnings Presentation

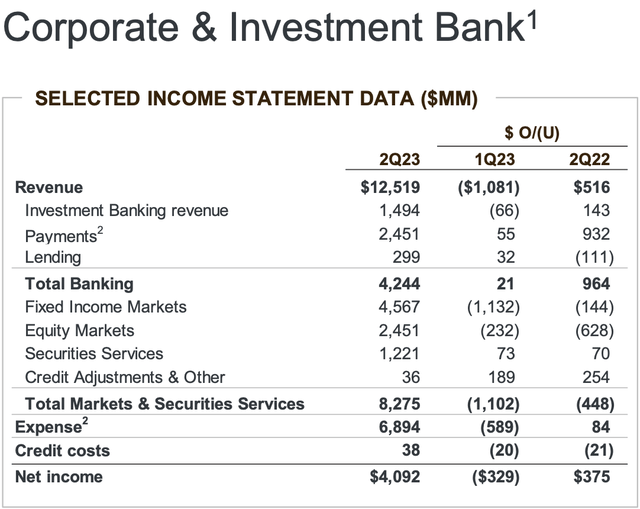

For this division, net revenue was $12.519 billion which is down from $13.600 billion in Q1 and up from $12.003 billion in 2Q22. Banking revenues were up both QOQ and YOY. Within the Banking unit, investment banking revenues were $1.5 billion. Its investment banking fees were down 6% on lower advisory fees but payments revenues were up 61%, on higher rates. However, its lending revenue was down 27% as a result of mark-to-market losses on hedges of retained loans. In its Markets and Securities unit results were down for both QOQ and YOY as markets revenues were down 10%, fixed income revenues were down 3% on lower revenues in macro businesses, and equity markets revenues were down 20%. However, Securities Service revenues were up 6% amid higher rates. Overall, for this division, net income was up from $3.717 billion in 2Q22 to $4.092 billion. I believe results were a mixed bag in this division as investment banking activity continues to be a drag on growth. In my view, the Market and Securities unit also showed weakness as it showed lacklustre results compared to the previous quarter and prior year quarter.

Commercial Banking

JPMorgan Q2 Earnings Presentation

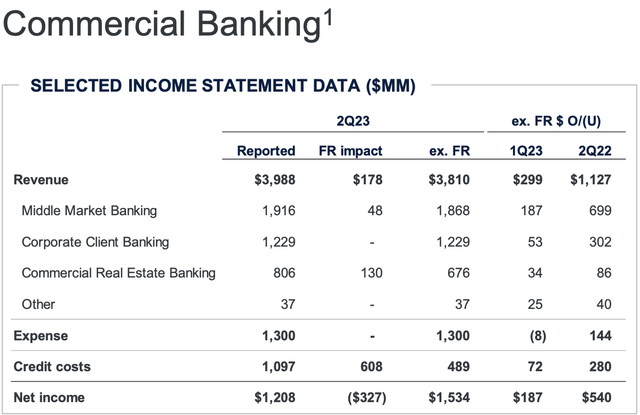

For this division, net revenue was $3.988 billion which is up from $3.511 billion in Q1 and $2.683 billion in 2Q22. Excluding First Republic, revenues increased 42% and is a result of higher deposit margins which were partially offset by lower deposit related fees. Net income was reported to be $1.208 billion which is up from $994 million in 2Q22. Excluding First Republic, net income increased 54%. Provisions for Credit Losses increased significantly YOY from $209 million in 2Q22 to $1.097 billion even though the current figures includes $608 million of reserves for First Republic. From my analysis, results were solid but with the great increase in provisions, JPMorgan is still reflecting a conservative stance in the near-term.

Asset & Wealth Management

JPMorgan Q2 Earnings Presentation

This division reported $4.943 billion of revenue which is up from $4.784 billion in Q1 and $4.306 billion in 2Q22. Excluding First Republic, revenues had an 8% increase as a result of higher deposit margins on lower balances and higher management fees on strong net inflows. Net income was up from $1.004 billion in 2Q22 to $1.226 billion. Excluding First Republic, net income was up 10%. For AUM, they reported $3.2 trillion which is up 16% YOY and Client Assets were reported to be $4.6 trillion, which is up 20%. This is a result of strong net inflows, higher market levels, and the acquisition of Global Shares. Again, in my view, this division reflected rock solid results as figures were strong across the board for this division.

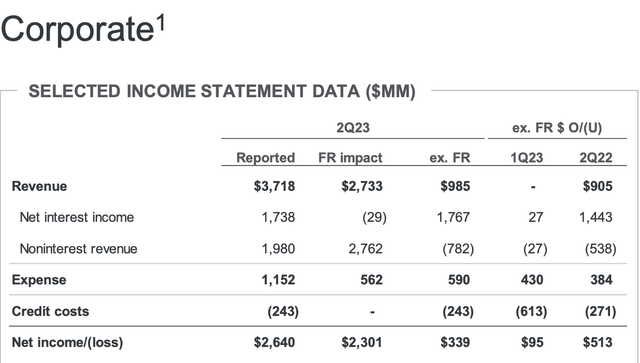

Corporate

JPMorgan Q2 Earnings Presentation

This division reported net revenue of $3.718 billion. Excluding First Republic, revenues were $1.0 billion compared to $985 million in Q1 and $80 million in 2Q22. This includes a net interest income of $1.7 billion which is up from $324 million in 2Q22 as a result of higher rates. It also includes $900 million in net investment securities losses as a result of losses on sales of US Treasuries and Mortgage Backed Securities. Overall, net income was reported to be $2.640 billion. Excluding First Republic, net income was $339 million compared to $244 million in Q1 and a $174 million loss in 2Q22. From my analysis, despite the losses in investment securities, the division still showed resilient results even without the inclusion of First Republic.

Concluding Remarks

In my view, JPMorgan showed excellent results overall. Across all the divisions, performance was generally strong compared to the prior year’s quarter. The Investment Banking and Markets and Securities units showed some weakness but the division as a whole still managed a YOY increase in both revenue and net income. Even without the inclusion of First republic, results were resilient. From my analysis, I believe it is clear that JPMorgan has proven its resilience amid tough geopolitical conditions and is in a good position should the environment deteriorate. By increasing provisions for losses and having a large loss absorbing capacity, JPMorgan is on rock solid footing.

Opportunities

It was recently reported by Zacks, that the JPMorgan Payments unit unveiled ‘Tap to Pay’ on iPhones for Merchants. This will create a seamless experience as clients will now no longer need a card reader or other hardware in order accept payments. This was reportedly created because of JPMorgan’s customer-centric approach and it reflects JPMorgan as an agile and innovative partner for merchants. Zacks also reported that JPMorgan plans to expand ‘Tap to Pay’ to all US merchants in the coming year and that this strategy could enhance their market share and help them seize cross-selling opportunities. In my view, this is a great opportunity to further streamline their business and attract new users to JPMorgan as a result of a simple to use system. I agree this new service could help to strength their position in the space and help to build their market share.

Businesswire reported on August 7th that JPMorgan had opened new offices in Mumbai and Bengaluru. The offices were stated to be state of the art facilities and will help to strengthen JPMorgan’s presence in India. It is reported that these offices will be two of the largest tech and operations centres globally for JPMorgan who already has 50,000 employees in India. The Mumbai office is located at one of Mumbai’s largest finance and tech hubs, Nirlon Knowledge Park. Daniel Wilkening of JPMorgan stated that “Mumbai and Bengaluru are an integral part of our sustained success, and these new facilities demonstrate our continued commitment to India and our people.” I believe this further expansion in India is another great opportunity for JPMorgan. With India’s rise on the global stage, JPMorgan is well positioned to benefit from the increase in economic activity.

JPMorgan is expanding its Chase online bank to Germany and the EU, Reuters reported in July. JPMorgan had introduced the service in the UK back in 2021 and now it is looking to expand it to other countries. However, it was reported that the timing has not been decided yet. Jamie Dimon stated that “In Germany, ‘Chase’ is not yet so well known, but worldwide it is a strong brand. We are also a trustworthy bank with a strong balance sheet – and private customers know that.” In my view, this is another great growth opportunity for JPMorgan. In the age of digitalization, offering online services for a large developed market could yield great returns for JPMorgan. I believe the digital nature of this business could mean even quicker expansion and also relatively low cost of expansion.

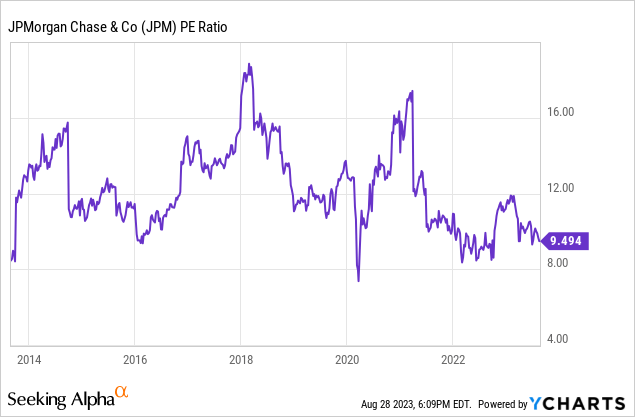

Valuation

Currently, JPMorgan’s P/E ratio sits at approximately 9.5. This is one of the lowest levels seen in the past decade. It is significantly below the high levels seen in 2018 and in 2021. The low levels seen in 2022 were in the low 8s. In the past few months, the combination of both favourable inflation data and economic growth data has significantly increased the possibility of a soft-landing and therefore I believe that JPMorgan is undervalued according to its P/E ratio.

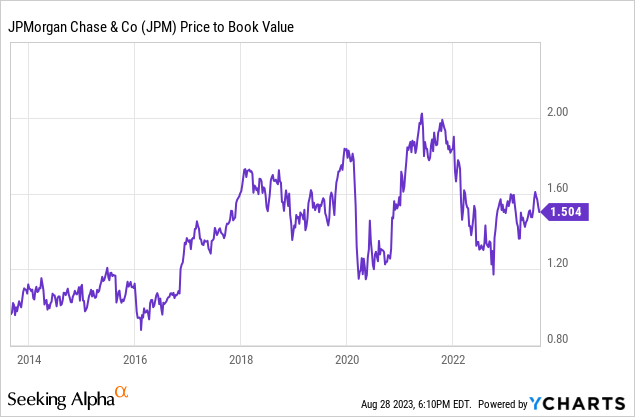

JPMorgan currently sits at a P/B ratio of approximately 1.5 which is at approximately a midpoint for the past decade. It is significantly lower than just prior to the pandemic and much lower than levels seen in 2021. Even though it has rebounded from the lows seen last year, as stated above, the possibility of a soft-landing has increased, justifying the rebound in the ratio. I believe JPMorgan is also undervalued according to its P/B ratio.

Overall, I believe JPMorgan is undervalued according to both P/E and P/B ratios. The uncertainties in the geopolitical landscape currently does not justify top range ratios but I believe these ratios can expand from here. Therefore, I believe JPMorgan would be fairly valued at around a 12.5 P/E ratio and a 1.75 P/B ratio. I initiate JPMorgan at a Buy rating with a price target of $160.

Risks

On August 7th, Bloomberg reported that banks are looking to sell property loans as they have become unappealing. It is reported that the commercial property loans market has dried up and that lenders, including JPMorgan, are trying to sell debt backed by offices, hotels, and apartments. It is widely known that the rise in interest rates has caused commercial real estate to become a hard hit area. Bloomberg reports that banks are trying to build liquidity and that some are willing to take losses rather than end up having foreclosures. A large unknown could be prices as there are reportedly too few sales to know the market price of loans. I believe this is a significant risk to the lenders in this space including JPMorgan. However, as discussed in the earnings section, JPMorgan can mitigate this as it has a lot of reserves to deal with potential losses.

CNBC recently reported that Fitch is warning that it may downgrade the entire banking industry’s rating causing sweeping downgrades to banks including JPMorgan. In June Fitch already cut assessment of the industry’s health from AA to AA- and now it says that it might cut the rating further to A+. Currently, Fitch rates JPMorgan as AA- and since individual banks cannot be rated higher than the industry rating, JPMorgan may be downgraded to A+. In my view, this is also a significant risk as the downgrade could potentially raise the borrowing costs for JPMorgan and erode its profit margins. This risk for JPMorgan is relatively less than many other banks as it is rated in the best category for the industry while some banks could be staring down a downgrade into non-investment grade status.

Conclusion

JPMorgan is rock solid. Its most recent earnings proves that as the growth in the majority of its businesses is strong even though the macro-environment is tough and geopolitical headwinds are flaring. To complement that growth, JPMorgan is still relatively conservative as it sets aside capital to deal will any upcoming speed bumps. I believe JPMorgan is in a great balance of growth and cautiousness at the same time. Evidently, JPMorgan is not shying away from making investments as it builds better services for merchants, opens new offices in India, and expands Chase online bank in Europe. Risks such as commercial real estate and Fitch downgrades could bring new headwinds to the banking sector but if that is the case, there may be no better bank to weather the storm than JPMorgan. Despite its strong positioning, JPMorgan trades at low P/E levels and mid P/B levels relative to the past decade. Therefore, I believe JPMorgan stock is currently undervalued and I initiate it at a Buy rating with a price target of $160.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.