JPMorgan Chase & Co.: Here We Go Again

Summary:

- JPMorgan Chase’s stock price reaction to its good earnings report was due to focus on the earnings outlook rather than current results.

- CEO Jamie Dimon expressed doubts about the economy. The economic outlook can affect bad debt estimates (for example) and hence earnings.

- Economics has a weak foundation with the assumption of “man is a rational human being” combined with a refusal to include the results of research in psychology.

- This so-called bull market has a relatively narrow breadth, with many sectors correcting. That eliminates a lot of downside risk.

Sundry Photography

JPMorgan Chase & Co. (NYSE:JPM) had a stock price reaction that one would not normally expect for such a good earnings report. Then again, Mr. Market has been in a sour mood lately as less and less stocks move upward in what is typically the final leg of a bull market. Many sectors are already correcting as a result even though this is supposedly still a bull market. JPMorgan is likely the Cadillac of the banking industry. But even a premium idea like this is not immune to environmental worries and one-time events that have the market dithering over the future of the bank. Nonetheless, I like to consider buying good management on any pullback. Today represented a solid pullback opportunity to get in on one of the best managements of the industry.

Economics

Jamie Dimon, CEO, has long had his doubts about the economy and for good reason. Economics has a very weak underlying foundational assumption that man is a rational human being. The general failure of economics to allow psychology findings to alter this foundational assumption has led to a lot of disappointments for the soft science that has wanted to be predictable.

There are even numerous reports that more than a few economists do not understand the current economy. But this is what happens when economics states that including psychology makes the forecast equations models far too complex. Economics is now left with a casual analysis that they then claim is causal until it does not work like now.

This is something that economics has long struggled with since I took these classes as part of my MBA some 40 years ago. It is something that should have been resolved long ago. But as more than one economist has noted, “economics moves forward one death at a time”. Meaning that theoretical progress changes very slowly unless there is a disaster that necessitates a faster pace. This has frustrated me about economics ever since I studied it.

Jamie Dimon answered some questions regarding the pathway forward in various company communications including the latest conference call. Even though earnings were excellent, and the company reported a “beat” by most consensus reporting outlets, the way forward was guarded at best and the stock price today responded to that outlook.

Interest Rates

That meant that the emphasis was not on the earnings but on the way forward. Since my last article, hopes for up to seven interest rate cuts were reported in the last conference call. That has now changed to consider no interest rate cuts in the current year. Keep in mind that the company website also has other communications that go into more detail on this.

However, forecasting economics has long been at best a gamble. The forecasts tend to be fairly volatile and as Jamie Dimon points out, key parts of those forecasts that the market relies upon are often wrong. Meanwhile, Mr. Market gyrates from being optimistic about the future too pessimistic about the future. Fortunately for investors, when the market is clearly pessimistic, then the likely change is to optimistic, which results in higher stock price valuations assuming management continues its record of outperformance.

Since bankers tend to be conservative, a lot of the conference call was spent on the downside. That happens to be good for the stock price in the long run as well because it means that the downside is already priced in. This is the proof any investor needs that the market outlook is pessimistic. But the excellent management history that is likely to continue is not. Investors should be thinking about a contrarian opportunity where good management will again surprise investors to the upside.

The One-Time Event

The bank acquired First Republic (FEC). This acquisition allowed the bank to grow at a pace (and time) that surpassed much of the competition for the size of the bank. But then again, Mr. Market has never been a favorite to attach much value to one-time events.

Investors, on the other hand, can count on a series of one-time events that the market will not attach a premium for. But these events do raise earnings long-term at a pace the competition rarely matches.

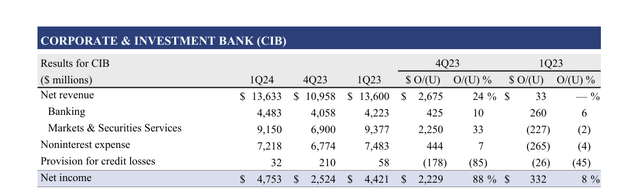

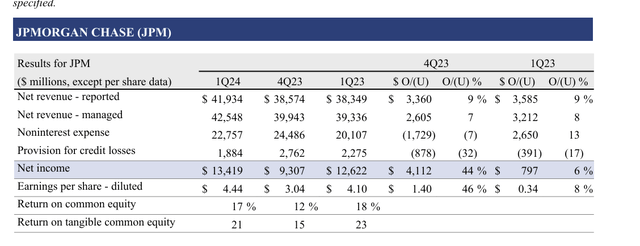

JPMorgan Chase & Co. Summary Of First Quarter 2024 Results (JPMorgan Chase & Co. Earnings Press Release First Quarter 2024)

As management reported, this is the last quarter that First Republic results will be broken out. Much of the results has been from the optimizing of operations at the acquired bank as the integration proceeds. The result of this is that cost-cutting, and better management, has increased the value of the assets acquired while resulting in higher earnings.

Stock Repurchases And Dividend

Management also mentioned that they ran out of opportunities to invest the money they have been making. Therefore, there is a goal to repurchase about $2 billion in common stock per quarter and the dividend was raised as well.

The new dividend rate was $1.15 which was above the $1.05 previous rate. This was announced about a month ago.

This is yet another part of the company story that the market undervalues. Management has a long history of dividend increases and stock repurchases that add value to the remaining shares outstanding. This is a program that helps to limit the downside risk while adding a few percentage points to the earnings growth rate that the market is so focused upon.

Another consideration is that the stock buyback program increases the safety of the dividend because the stock repurchase program can be decreased to meet adverse market conditions as needed (or even eliminated) first. The other defense of the dividend is the fortress balance sheet that allows management to “borrow” to pay the dividend while incurring either business or capital projects that “in total” exceed cash flow at the time.

As long as this pattern of shareholder returns continues (especially when combined with superior management), the outsized returns that this stock has generated should continue into the future.

Earnings

There was some concern that the growth rate had slowed. That is likely because the acquisition of First Republic generated some “easy growth” in the beginning that will now merge into a long term (large bank) growth rate.

Management also mentioned that they are over-earning (because the spread is wider than expected and some other reasons) and therefore have forecast a return to “normal”. Then again, “normal” has hardly ever been normal for this bank. Management has always found a way to outearn somewhere. But Mr. Market rarely values something like that because the reason keeps changing.

JPMorgan Chase & Co. Earnings Per Share Comparison (JPMorgan Chase & Co. Earnings Press Release First Quarter 2024)

Earnings per share grew 8% as shown above. Yet, Mr. Market again failed to value an outperformance in the face of considerable uncertainty and headwinds. Earnings will slow as the effects of the First Republic merger fades. But there will likely be other opportunities that the market labels as one-time events in the future that allow for accelerated earnings growth.

There were a lot of conference call questions on “office” real estate. Management specifically stated as an example that a 2% increase in interest rates could decrease prices roughly 20% in the particular discussion at the time. Now, admittedly, different parts of the real estate market are likely to feel the effects (and react differently). But a general point was made that if interest rates rise, then real estate values fall and critical assets with liens are worth less.

Often times, banks deal with this by limiting exposure to any one deal. Also, lenders can increase the down-payment requirements or shorten the length of the mortgage. However, if the problem is widespread enough, there could be repercussions even with diversification. This is where this company has a huge advantage.

JPMorgan Chase is in many countries with many different business environments. It is likely to suffer the least should something happen in any one place. This company often can compete for the best clients that often outperform any downtrend in any particular environment.

Management did mention that the Federal Reserve increased some fees and that credit cards have had climbing reserves. Depending upon which report an investor reads, the reaction today was from any one of several very conservative messages. In the stock market, hindsight is always twenty-twenty.

Summary

Here is what I think the market focused upon:

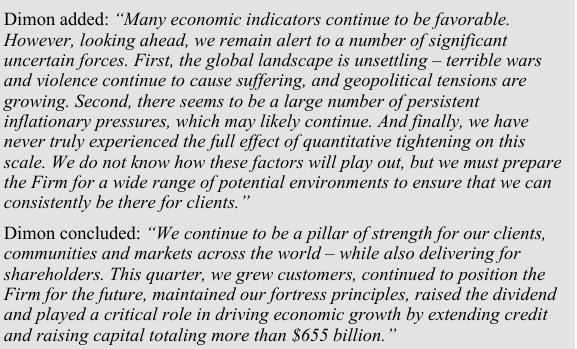

JPMorgan Chase & Co Jamie Dimon Comments To Shareholders (JPMorgan Chase & Co. Earnings Press Release First Quarter 2024)

The market focused too much on the first paragraph shown above and not nearly enough on the second paragraph. Good managements are very good at “poor mouthing” their future prospects to prepare for a likely expectations beat that will in the long run add value to the stock.

Mr. Market has long loved a conservative management that constantly beats expectations. This bank has a very good history in that respect.

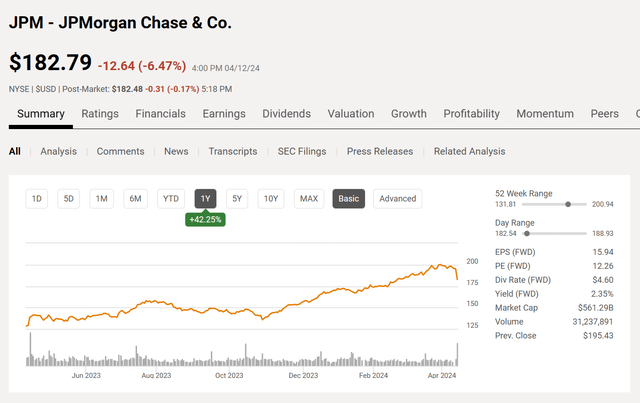

JPMorgan Chase & Co. Common Stock Price History And Key Valuation Measures (Seeking Alpha Website April 12, 2024)

Nonetheless, the market has long been concerned about a possible recession that so far has eluded everyone forecasting one. However, it is quite possible that the first year of a new presidential term could have a market correction. That year has been a historically poor year for investors on average for a very long time.

Then again, the market looks ahead. A recession, in particular, is not a particularly damaging event, and it usually passes rather quickly (within a few months).

No one is forecasting another 2020 or 2008. Either of these could have lasted a very long time without government involvement.

Therefore, this stock remains a strong buy as long as Jamie Dimon remains CEO at the company. His record of being in charge at this bank is virtually unmatched. Yet, the price earnings ratio shown above is roughly twelve for a company that increased the dividend and buys back its stock.

For a company with the financial strength of this company (and the size and diversification), the long-term shareholder total returns are among the best in the business. This is a quality issue that should be of interest to many investors.

In the long run, I would expect that price-earnings ratio to widen to at least 15. It may go past 20 if the banking industry earns the favor of the market as it does periodically. The total return with earnings growth in the 5% to 9% range should therefore be in the low teens at least.

Risks

Banking has a lot of assumptions when it comes to matching debts to income. A problem with those assumptions could cause an earnings hiccup or worse.

Interest rates are inherently volatile and have a very low visibility. The spread for banks can widen and shrink with little to no notice. This can unfavorably affect earnings.

As management noted in the conference call, “everyone” was in good shape in 1972 before the challenges of the 1970’s began. A similar situation happened in 2008 and 2020. These kinds of challenges do not give a lot, if any, notice. Being ready for the unknown is itself a challenge.

The current market stance of a lot of challenges for banks would appear to leave little downside risk for the stock. However, that view can quickly change.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.