Summary:

- JPMorgan had a successful year in 2023 and I expect the largest U.S. bank to continue performing well in 2024.

- The banking industry is expected to benefit from rate cuts, supporting both credit volume and a softening deposit beta.

- I also foresee lower rates stimulating investment banking activities, especially in areas like ECM, DCM, and M&A volume.

- JPMorgan is well-positioned to capture the 2024 bull market in bank stocks with its strong balance sheet and global leadership position.

- I reiterate a “Strong Buy” recommendation for JPM stock; and revise the base case target price upwards to $243/ share, compared to $231 estimated previously.

Michael M. Santiago

2023 has been a winning year for JPMorgan (NYSE:JPM), and 2024 should be no different: Heading into the next year, I am bullish on the banking industry, as I see rate cuts supporting credit volume as well as capital markets and M&A activity. Moreover, sentiment on banks should rebound sharply as lower rates take of pressure from deposit beta, credit writedowns, and unrealized losses on balance sheets. On that note, JPMorgan looks best positioned to capture the 2024 bull market in bank stocks, referencing JPM’s $4 trillion balance sheet and global leadership position across verticals including consumer banking, investment banking, trading, as well as wealth & asset management.

I reiterate a “Strong Buy” recommendation for JPM stock; and revise the base case target price upwards to $243/ share, compared to $231 estimated previously.

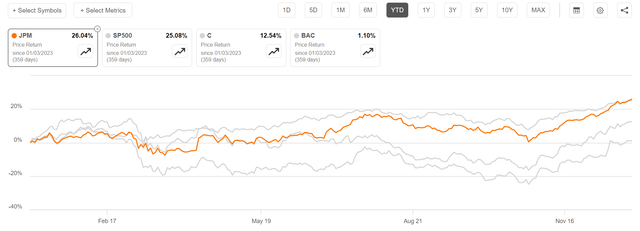

For context, JPMorgan stock has outperformed the market YTD. Since the start of the year, JPM shares are up 26%, compared to a gain of approximately 25% for both the S&P 500 (SP500), and a gain of 12.5% and 1% for Citigroup (C) and Bank of America (BAC), respectively.

Seeking Alpha

2023, A Great Year For JPMorgan …

In 2023, bank stocks faced a challenging macroeconomic environment, primarily driven by sentiment rather than fundamental weaknesses. In that context, the failures of Silicon Valley Bank and Credit Suisse in Q1 directed investor attention to concerns about the rate cycle’s adverse effects, particularly unrealized losses on balance sheets and increased funding pressures within the banking sector.

For JPMorgan, however, 2023 was an exceptional year: During the first 3 quarters, the bank added almost $40 billion in new deposits, acquired a leading wealth management franchise, First Republic (FRC) for pennies, and generated record profits. In fact, JPMorgan generated so much profits that the company needed to revise up its interest income projections four times in 2023, and Jamie Dimon suggested that the bank may be over-earning on rates. In numbers, JPMorgan accumulated $49.5 billion in distributable earnings during the trailing twelve months, a growth rate of close to 38% compared to the respective earnings for FY 2022. To underscore JPMorgan’s success in 2023, I point out that distributable earnings for Bank of America and Citigroup in TTM vs. FY 2022, were only +11% and -11.5%, respectively.

… Setting Up For a Record 2024

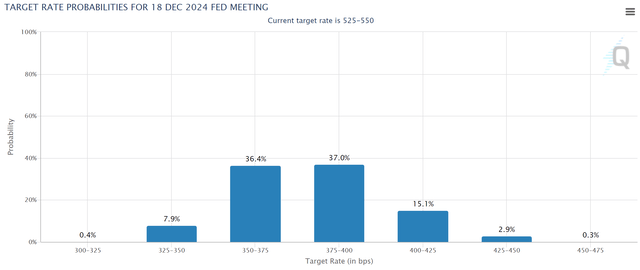

I am very bullish on banking in 2024. My positive expectation is largely anchored on a dovish pivot monetary policy, with significant rate cuts on the horizon. In that context, the FOMC’s recent update on December 13 surprised market participants with a notable downward revision in inflation estimates and an upward revision in GDP growth forecasts. This combination strongly supports the narrative of a “Soft Landing” outcome for the world’s largest economy, setting the stage for rate cuts. For reference, the FOMC now projects around 75 basis points worth of cuts in 2024, compared to 25 basis points worth of cuts expected in September. Traders, who have skin in the game through betting their own money, are even more optimistic: As modelled by the CME’s fed funds tracker, market participants are currently pricing a potential 150 basis points cut by the end of 2024, projecting rates around 3.75%.

CME’s fund tracker

Having discussed the outlook for rate cuts, it’s important for investors to acknowledge the favorable impact of a dovish shift in rates on banks’ net interest income. Specifically, the positive impact anchors on a softening deposit beta and the growing appetite for credit in an improving economic scenario (as lower rates stimulate macro activity). In my revised outlook, I now anticipate JPM’s net interest income could stabilize around $82-84 billion, only about $1-3 billion lower compared to the respective income achieved in the trailing twelve months.

Furthermore, if Fed funds remain below 4%, there’s a chance that funding costs could contract, providing an additional tailwind for net interest income. Should this scenario materialize, I have little doubt that major money center banks—JPMorgan, Bank of America, Wells Fargo, and Citigroup—will notably outperform deposit beta expectations once again, this time on a downward momentum.

As a final driver of JPMorgan’s earnings in 2024, I foresee lower rates stimulating investment banking activities, especially in areas like ECM, DCM, and M&A volume. In that context, it is noteworthy to point out that JPMorgan operates the world’s leading investment banking franchise, likely generating an incremental $3-4 billion in revenues compared to FY 2023.

While JPMorgan’s closest competitors will also enjoy an industry tailwind in 2024, their ability to proactively capture growth is more limited: Notably, Bank of America is grappling with substantial unrealized losses ($131.6 billion) stemming from low-interest assets that could weigh on its earnings for an extended period. Meanwhile, Citigroup and Wells Fargo are focused on restructuring, cutting costs, and bolstering internal controls to address regulatory concerns. The latter of the money center banks is also limited by a cap on its balance sheet size. Lastly, Goldman Sachs is digesting internal power struggles and a failed adventure in consumer banking, while Morgan Stanley is managing a CEO transition and European competitor UBS will focus resources on integrating Credit Suisse.

Raise Target Price at $243

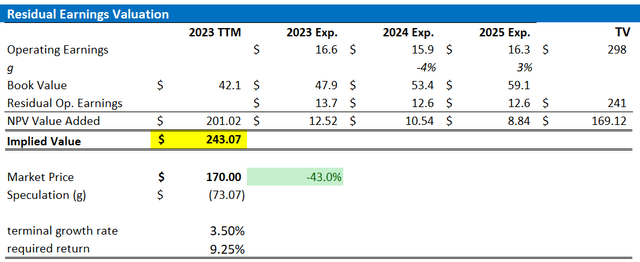

In line with my bullish outlook for JPMorgan’s consensus EPS through the next 3 years, I update the input for my residual earnings valuation model for the bank’s stock: I now estimate that JPMorgan’s EPS in 2024 will likely fall within the range of between $16.3 and $16.9. Similarly, I set my EPS expectations for 2025 and 2026 to $15.9 and $16.3, respectively. I continue to anchor on a 3.25% terminal growth rate, which I see about in line with nominal GDP growth plus 100 basis points to reflect a growth premium, while I lower my cost of equity requirement by 100 basis points, to 9%, mostly as a consequence of the lower Fed funds rate projections. On the backdrop of the highlighted input adjustments, I calculate a fair implied stock price for JPM stock equal to $243 (seeing 43% upside), compared to $231 estimated previously.

Analyst Consensus; Company Financials; Author’s Calculations

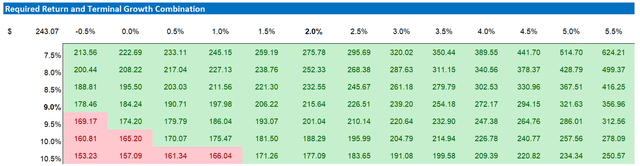

Below also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

Analyst Consensus; Company Financials; Author’s Calculations

A Note On Headwinds

In addition to a less favorable than expected macro backdrop, I view developments relating to updated capital rules under “Basel III Endgame” as the major potential headwind for JPMorgan in 2024. Specifically, I point out that the proposed U.S. B3E NPR1 could inflate JPMorgan’s Risk-Weighted Assets by 30%, equivalent to a $500 billion increase in value. This would potentially mandate a $50 billion top-up to JPMorgan’s required capital. In that context, CET1 requirements carry significant weight for investors: While higher capital demands can lead banks to be more cautious in their lending and investment strategies, they also limit overall growth potential and tie up capital that could otherwise be distributed in the form of dividends or buybacks.

Investor Takeaway

JPMorgan had a very successful year in 2023, and I expect the largest U.S. bank to continue to perform well in 2024. According to my expectations, the banking industry is expected to benefit from rate cuts, supporting both credit volume and a softening deposit beta. Moreover, I also foresee lower rates stimulating investment banking activities, especially in areas like ECM, DCM, and M&A volume. On that note, JPMorgan is well-positioned to capture the 2024 bull market in bank stocks with its strong balance sheet and global leadership position.

I reiterate a “Strong Buy” recommendation for JPM stock; and revise the base case target price upwards to $243/ share, compared to $231 estimated previously.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.