Summary:

- JPMorgan Chase & Co.’s second quarter earnings report fell short of expectations, but the stock price only dropped slightly.

- Management is focused on maintaining a return on equity of 17% or higher, with plans to outperform the industry even in a downturn.

- Concerns about potential tax increases, an inverted yield curve, and rising deposit costs are being addressed.

- This bank easily meets any higher capital requirements that the Federal Reserve may require.

- Clearly, the bank management sees challenges ahead and intends to have a solution to those challenges if they appear.

danielvfung

Probably the most outstanding feature of the JPMorgan Chase & Co. (NYSE:JPM) second quarter earnings report is the muted stock price reaction to what some consider a less than satisfactory earnings report. By some accounts, missing the expected reporting by $.11 per share could well have produced a stock price rout in this market. Yet, as this is being written, the stock price is a little more than 1% down for the day. All of us have known far worse results than that. In fact, for many of us, that is more or less a rounding error and certainly nothing to be worried about.

As I noted in the past article, management keeps everyone focused on the future. In some ways, that future focus reminds me of some winning football coaches who regularly “bad-mouthed” the team’s progress before the game, only to produce another win. Management has focused on “overearning” because the return on equity (or any one of several measures) is running above historical rates.

But this belittles (and maybe intentionally) the fact that this bank regularly earns 17% or more, and that is just a fantastic return for a large entity. At the same time, management reinforced that a return to 17% in the future should be expected. But what the discussion left out is that this management regularly builds a “better mousetrap” to send profitability upwards again in the future.

Economic Outlook

The elephant in the room is of course politics. The politics that are critical to banking would have to be the discussion of the tax cut parts that will expire in 2025. That amounts to a tax increase, and tax increases have been terrible for banking at the macro level for as long as I can remember.

On the other hand, if whatever decision happens to renew the expiring tax cut provisions, then we are left with a large deficit that likewise has to be dealt with. Since a decrease in government spending often cools off the economy as well (if not more sometimes), this likewise is not good for banking either.

Management avoided this whole political scenario by talking about deposits and lending (and of course “office”) in terms that would appear to neatly fit the macro discussion.

The yield curve is inverted enough that this came up in the conference call. Nearly every time the yield curve inverts, a recession follows. Timing, however, is another matter.

The Plan

In short, management appears to have “hunkered down” for a banking industry downturn. More importantly, they plan to make money throughout that coming downturn. I have long stated that management teams that state problems to shareholders typically have a solution (that you will like). It is the management painting a rosy picture with no trouble ahead that gets you into trouble time and again.

Even if earnings drop, the plan is to obviously outperform the industry as usual. What form that takes is up for discussion. But shareholders can believe this management is coming up with a solution that will be better than many should trouble arrive.

Earnings

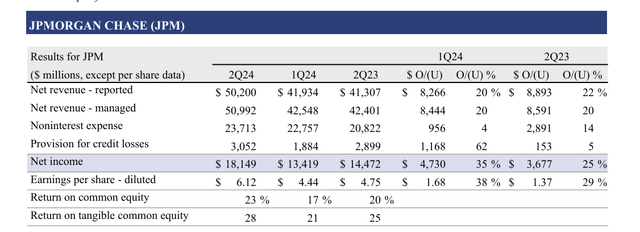

Earnings soared when management cashed in some appreciated Visa stock.

JP Morgan Chase & Co Second Quarter Earnings Summary 2024 (JP Morgan Chase & Co. Earnings Press Release Second Quarter 2024)

The market is, of course, concerned with recurring earnings. Those earnings came in closer to $4 per share (very roughly). At the same time, management reiterated that the full fiscal year guidance was still in effect. That would make sense since there are a lot of “moving parts” when it comes to banking. Therefore, it is much too soon to revise guidance due to market conditions.

There has been some concern about the costs of deposits for several quarters now. The conference call would appear to have the idea floated that the costs of deposits’ pressure to reprice is abating somewhat. But one quarter is hardly a guide to the future without confirmation elsewhere, and Jamie Dimon, CEO, has made public his fears of potential inflation ahead many times over the past year.

The Underlying Fear

Large banks do a lot of statistical analysis to match costs to potential revenue sources. So, there is always a fear of a macro event that causes the source of the matching to come undone. This management would appear to be meeting that fear by keeping extra liquidity on hand.

Another big fear in the banking industry is the potential increase in necessary capital to conduct business. Every time there is a “crisis” (like the one that resulted in the acquisition of First Republic), there is a “solution” of raising the capital requirement to put a stop to it in the future.

Clearly, any bank that suffers a “run” did not meet someone’s expectations of safety. However, punishing the whole industry for an inevitable bank run is probably not the solution either. The more capital required, the more the industry must earn on average to justify that capital. This has the unintended side effect of increasing the costs of any type of loan because the only way to resolve a profit issue is with a higher spread between costs and revenue.

A big bank like this one has several sources of profit besides traditional banking. Therefore, the pressure that other banks feel in a crisis is reduced here through that diversification. That makes a capital requirement (increase) even more absurd for a diversified money center bank.

This bank already has more than enough capital to meet whatever the Federal Reserve decides. Yet, the conversation about this was an important topic in the conference call. Not everyone can be above average, as is the case here. What the Federal Reserve decides will become apparent in a quarter or two.

Securities Market

Another topic was the effect of a few stocks dominating the latest rise in all the indexes. Management mentioned how this adversely affected the IPO market and really the stock market (and bond market) part of the business in general.

I have long stated that much of the market has been in a holding pattern or even a bear market, except for just a few stocks. Management appeared to confirm this idea with the business results. This usually marks the end of a bull market. Of course, that means a cyclical stock market downturn lies ahead. The yield curve inversion would appear to forecast this as well.

This business will probably see better days ahead, as it is likely near a cyclical bottom.

The Consumer

It would appear that the consumer is running “out of gas.”

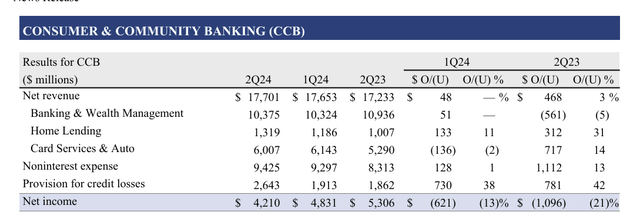

P Morgan Chase & Co. Summary Of Consumer Business (JP Morgan Chase & Co. Earnings Press Release Second Quarter 2024)

That “Provision for credit losses” may be noncash. But it is a sign of things to come. That climbing provision indicates a climbing risk level of the consumer business. Typically, a business slowdown follows a banking retrenchment to reset loan criteria to reduce the risk of losses.

The consumer has always been an important cog in the cyclical upturn part of the cycle. The fact that professionals see more losses ahead is not a very good sign for business in general.

Summary

JPMorgan Chase & Co. appears to be getting investors ready for some challenging times ahead. Those who remember the “presidential cycle” may well remember that the first year of a presidential term is often one of the worst years for investors of the four years.

Currently, this management seems to be confirming that a conservative outlook is best because storms lie ahead. But if things are going to get challenging, this is the management team to bet on during a time like that. A management that states challenges that lie ahead typically resolves the profit question in a way that outperforms the industry. This bank has a long history of outperforming the industry.

Meanwhile, management provided guidance for the year that remains unchanged. If that guidance has made it this far, then it is very likely there will only be small changes to that guidance as the year comes to a close.

Both the banking business and the “stock market” aligned business appear to be pointing towards a very conservative outlook. This is probably one of the times when management has the market prepared for those tough times ahead. The stock price movement itself seemed ready for the news. That is good news for investors.

For this reason, this stock remains a strong buy. This management is clearly planning for the most conservative outcome, while of course hoping for far better. In this business, that is definitely the way to go.

Risks

Probably the biggest risk is a macro event that would cause a matching assumption to come undone. Management does have extra liquidity as well as a group of experts and statisticians that would attempt to fix this, but it remains a risk of banking. Most likely, other banks would suffer far more than a diversified money center bank.

A loss of Jamie Dimon’s services as CEO would likely materially change the future outlook for this bank. He operates at a level that few CEOs in any industry can match (let alone banking).

The consumer appears to be running out of financial gas. That likely means a banking retrenchment is on the way. While this bank will likely outperform whatever happens, the severity of such a situation is difficult to forecast.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and JP Morgan Chase & Co. in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.