Summary:

- JPMorgan Chase & Co. released guidance for the coming fiscal year projecting a quarterly downtrend in results.

- JPMorgan is a leader in the industry and has experienced significant growth over the past decade.

- The diversification and profitability point to a likely industry out-performance in the future.

- The guidance usually means the stock price has the negative priced in without the potential for upside surprises.

- The Seeking Alpha Quant System has JPMorgan Chase rated a strong buy.

Michael M. Santiago

JPMorgan Chase & Co. (NYSE:JPM) recently released guidance for the coming fiscal year. As with many companies, the market looks forward when valuing JPM stock (in many cases more so) rather than focusing on the latest earnings (unless there is an adverse unknown surprise). But that provides a potential asymmetric return for investors, because the downside guidance is likely priced into the stock while any upside surprise would lead to unexpected gains. Furthermore, a company of this stature is a leader in any industry recovery. Banking is cyclical. Therefore, downturns will give way to recoveries and the upside they promise.

But the other consideration is that JPMorgan is probably “the bank” in the industry that everyone else wants to be like. Rarely do you see a company the size of JPMorgan grow as this one has over the last decade.

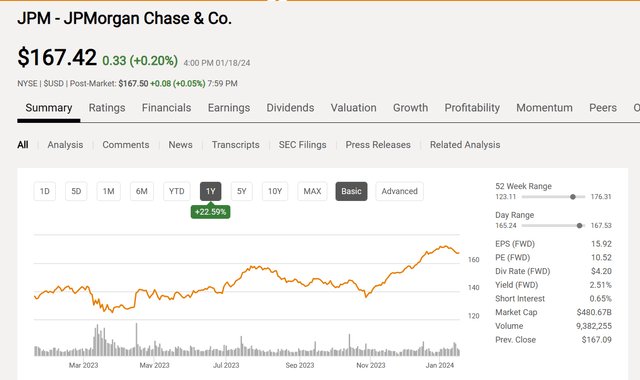

JPMorgan Chase & Co. Common Stock Price History And Key Valuation Measures (Seeking Alpha Website January 18, 2024)

The stock has roughly tripled over the past decade. For a company of this stature, a company such as JPMorgan does not usually grow at that pace. Instead, that return is usually accompanied by more risk (generally by investing in a smaller company). The stock has paid dividends as well for probably one of the best risk-adjusted returns in the stock market.

Now, management is cautioning investors that the coming fiscal year will not likely exceed the earnings of the past fiscal year, with each quarter likely to be lower. Combine that with the fact that economists have long expected economic headwinds (such as a recession) that really has not happened.

The price earnings ratio shown above, therefore, should not be a surprise to investors. But that price earnings ratio is also below the market average (by a mile). Add in the fact that long term, this is considered one of the safer investments with one of the best managements in the industry, and there is a contrarian opportunity for long-term investors. Remember that the market looks forward when valuing these stocks. Therefore, it is not unusual for a stock like this to rally before better earnings announcements arrive.

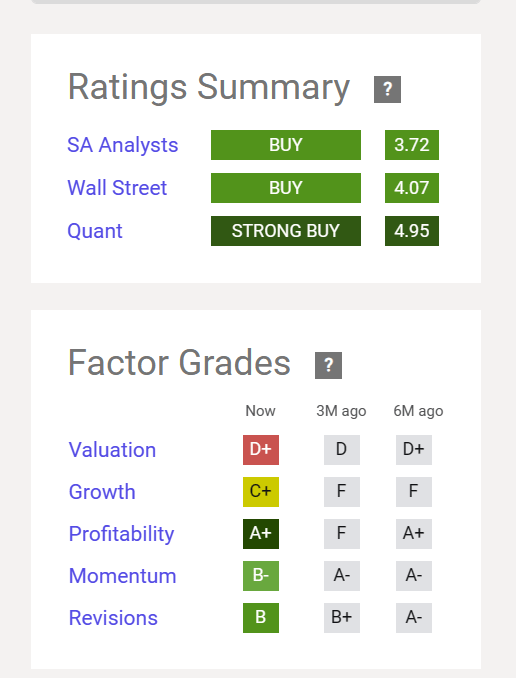

Seeking Alpha Website Quant System Ratings Of JPMorgan Chase & Co. (Seeking Alpha Website January 15, 2024)

Even the SA quant system has noticed the stock price enough to give this a strong buy rating. Because the management of this bank is considered about “as good as management can get.” There is likely to be “surprise upside” potential that is not factored into that quant system recommendation. Good management often provides another round of safety that many do not include in an investment decision evaluation.

Note that with management guiding to declining earnings, the stock price could possibly decline more. But the upside now clearly outweighs the downside risk when a “strong buy” rating like that is registered.

The other consideration is that because the market looks forward, there is an excellent chance that the market attitude will change during the fiscal year to counteract some or all (and more) of the earnings news. That would not be unusual for cyclical stocks.

Integration

One of the things that makes this company a profit leader is the integration with a lot of related services that may or may not follow the general banking trends. Several are significant enough to carry the bank to an unexpectedly decent fiscal year depending upon how the fiscal year unfolds.

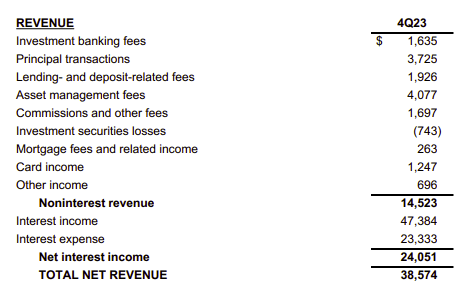

JPMorgan Chase & Co. Sources Of Revenue And Relative Significance (JPMorgan Chase & Co. Quarterly Earnings Press Release Fourth Quarter 2023)

Some like Investment Banking Fees, have a cycle that is similar to the banking industry. Others like Asset Management Fees tend to be more “steady as you go.” This gives the company a chance to outperform the bank industry because it is far more than just a bank.

It is also possible for “everything” to have a down year at one time. But that is highly unlikely.

As management noted, the acquisition of First Reserve helps to offset the effects of a down year. It is very likely that the company does not suffer an earnings decline to the extent of others in the industry due to that acquisition and the diversification.

Corporate Strategy

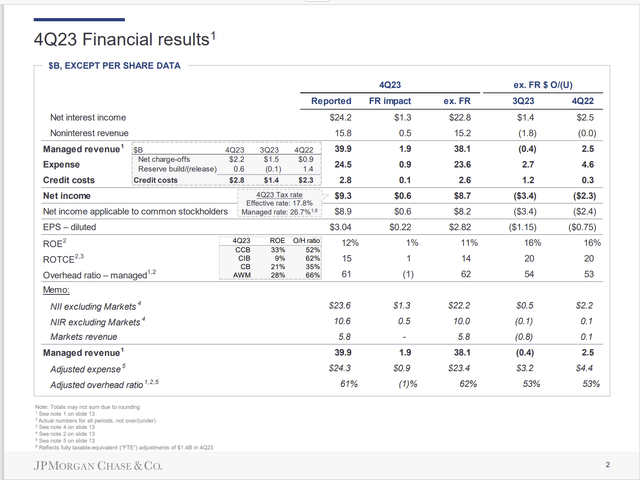

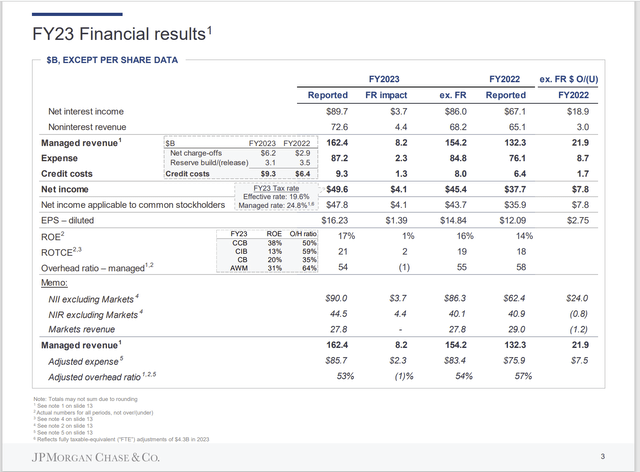

The thing to note below in the middle left hand side is that this year Consumer Investment Banking (CIB) was not particularly profitable.

JPMorgan Chase & Co Fourth Quarter Fiscal Year 2023 Summary Results (JPMorgan Chase & Co Corporate Earnings Presentation Fourth Quarter 2023)

But any time this happens, an integrated company like this one uses any of the divisions to attract a customer. Then the customer can be sold more products so that the company functions as a “one stop shop.”

Even if one division “permanently” remains less profitable, the “one stop shop” advantage is often an intangible that makes the whole diversification work. It is also likely at least partially responsible for the above average profitability of some of the other divisions shown above.

The net interest revenue next year will depend upon management’s ability to maintain the “gap” between interest income and interest costs. Management addressed this by stating that the cost to maintain deposits is expected to increase. They left open whether or not they can recover that by stating there is an expectation of “more normal” profits. However, this management has long beaten such a forecast. If it does not happen with this particular business, it could well be offset by an unexpected positive surprise elsewhere. So, there is likely a market expectation of “more of the same” without any guarantee.

Even if the coming fiscal year is a “down” year, an industry outperformance will be a plus for Mr. Market.

Moving Forward

An issue not discussed much is First Reserve. Management expressed a desire to discuss the whole corporation. But that desire leaves open the consequences of turning the First Reserve assets (that were acquired in the 2023 fiscal year) into something more profitable.

JPMorgan Chase & Co. Summary With And Without First Reserve (JPMorgan Chase & Co. Corporate Presentation Fourth Quarter Earnings 2023)

The return on equity for First Reserve particularly stands out compared to the profitability of JPMorgan. Just getting those assets to an ROE similar to the rest of the company would imply an upside potential of several times the $4.1 million noted above (for continuing operations without special one-time items). This implies a significant future growth potential ahead for these acquired assets that will likely occur over several years.

Probably the most significant profit improvement on those assets will happen during the next fiscal year. But there will also be profit improvements in future years as well.

Obviously, First Reserve was quite a bit smaller than the whole JPMorgan operations. But the asset is significant enough to add a billion or even billions to what management has projected to be a down fiscal year.

Management was kind of vague about the impact of the First Reserve assets in future years. But that could well mean that improved operations of these assets is something that will allow management to beat guidance over the next fiscal year.

JPMorgan & Chase remains a strong buy as long as Chairman and CEO Jamie Dimon remains with the bank. People like him who guide the bank to the record it has over the last decade and probably longer are extremely rare. In fact, I would expect that when he retires, the next Chairman and CEO, whether one or two people, is highly unlikely to keep that record going.

Buy good management when it is out of favor is probably one of the best ways to outperform the stock market long-term without a lot of trading. JPMorgan Chase & Co. stock has kind of traded in a range the last few years. But that happens from time to time. In the meantime, the overall business has progressed to produce a lower price-earnings ratio than has been the case in the past.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.