Summary:

- JPMorgan Chase is the leading commercial bank and enjoys a wide economic moat and has shown strong financial performance since 2008.

- The bank’s diverse portfolio of financial services and massive scale give it a competitive advantage over its peers.

- While there are some concerns about future expectations and a potential recession, JPMorgan is well-equipped to deal with even the most challenging of macroeconomic conditions.

- Shares appear to be fairly valued according to the intrinsic value calculation.

- Buy Rating issued.

Michael M. Santiago

Investment Thesis

JPMorgan Chase (NYSE:JPM) (JPMorgan) is one of the most established and renowned commercial banks in the world. Their massive scale and portfolio of financial services creates a wide economic moat that has helped the firm to outpace their closest competitors both in terms of returns, margins and growth. A strong showing by JPMorgan stock in 2023 has surprised investors especially given the overall complexity present in the banking sector due to increasingly bearish macroeconomic conditions. Nonetheless, a recent drop-off in share prices and some mixed financial results have muddied the waters in terms of future expectations from the banking giant. Given the modest 10% undervaluation and potential for a recession in 2024, I rate JPMorgan a Buy at best.

Company Background

JPMorgan.com | Homepage

JPMorgan is one of the most established commercial banks in the United States. The bank is the largest of the “big four” ahead in terms of market capitalization of peers Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C).

The years post-2008 have seen JPMorgan grow their business substantially through a combination of diversification strategies and sound capital management. The bank has built a robust balance sheet with strategically risk adverse loan provision at the forefront of their business practices.

While JPMorgan’s key rivals Bank of America, Wells Fargo and Citigroup have recently suffered from financial missteps that have placed pressure on short-term profitability, JPMorgan’s excellent management appears to have managed the difficult post-Covid macroeconomic environment a little better.

Jamie Dimon continues to lead JPMorgan as Chairman and CEO. Extensive experience at the bank combined with vast amounts of industry knowledge have allowed Dimon to effectively lead JPMorgan through a rapidly changing banking environment. His recent decision to sell some of his shares in JPMorgan has unsettled the market as it comes during a critical and difficult time even for the banking giant. This decision by Dimon places some doubt over the short- to mid-term future at the bank and has increased the uncertainty expected in the coming Q4 results.

Economic Moat – In-Depth Analysis

JPMorgan undoubtedly has a wide economic moat built primarily upon the bank’s wide portfolio of investment, commercial banking and consumer services.

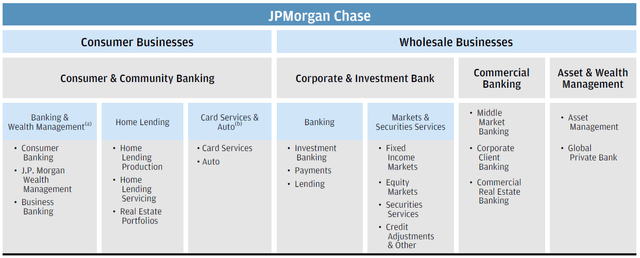

The bank has two distinct operational units consisting of the Consumer Business and Wholesale Business.

The consumer business mainly includes consumer and community banking services including banking and wealth management, home lending and card services and auto finance. The consumer and community banking division generates the most revenue for the bank but is roughly equal in terms of net income as their Corporate and Investment Banking division due to overall lower margins and an increased provision for credit losses.

jpmorgan.com | Consumer Banking

While competition within the consumer banking segment is strong particularly from rivals Bank of America and Wells Fargo, the overall diversity in services (banking, wealth management, house and auto loans) provided by the bank helps increase the amount of engagement per customer enjoyed by JPMorgan.

For an existing customer engaged with JPMorgan through a savings account, it is quite likely for the same client to then fund an auto or house loan through the bank rather than going to a competitor due to the already established relationship in place between the two entities.

This increased cross-selling thanks to a wide breadth of services is the key moat driver for JPMorgan’s consumer banking segment.

Furthermore, JPMorgan’s massive scale enables the firm to extract increased ROE and incomes from their consumer banking services especially when compared to smaller competitors. Many of the bank’s key services such as checking accounts, credit cards and investment platforms have substantial fixed costs which decrease in size relative to total revenues earned.

This provides JPMorgan with a key competitive cost advantage which in the long run (assuming revenues continue to grow) should continue benefitting the bank’s overall margins and returns.

jpmorgan.com | Large Corporations

JPMorgan also operates a substantial Corporate & Investment Banking business unit under the wholesale business umbrella. The corporate and investment banking segment mainly provides investment, payments and lending services to customers.

The markets & securities services division of the corporate and investment banking unit provides customers with access to fixed income and equities markets along with securities and credit adjustment services.

Once again, JPMorgan has excelled at diversifying the services provided to corporate grade clients with massive breadth being present within the business unit. The bank is the dominant market leader when it comes to investment banking and market access services thanks to the scale and global reach JPMorgan is able to offer their customers.

The corporate banking segment’s breadth allows JPMorgan to engage in significant cross-selling through the provision of multiple services to each corporate client. This generates tangible switching-costs for clients due to the interconnected nature of the bank’s products making a move to a competing bank’s services a difficult and laborious process.

JPMorgan’s extensive experience within the corporate and investment banking segment along with a historically dominant presence also increase the attractiveness of the bank’s services compared to those of its competitors.

Most corporate grade clients will recall the relatively limited exposure JPMorgan had to the CDO led market crisis of 2008 which illustrates the mostly conservative approach to capital management present at the firm.

Overall, the corporate & investment banking unit benefits from a wide and robust economic moat.

jpmorgan.com | Commercial Banking Services

Finally, JPMorgan also operates the Commercial banking and Asset & Wealth Management business units which also fall under the wholesale business umbrella.

While these units produce less revenue than the other businesses operated by JPMorgan, they are in their own right incredibly valuable assets especially from an economic moat perspective. The commercial banking business is one of the largest in the industry and services thousands of businesses every year.

The commercial banking business acts as another synergetic component of JPMorgan’s overall wholesale business portfolio which contributes tangibly to the moatiness of this entire segment.

JPMorgan’s wealth management business is also incredibly valuable to the firm. The bank has an established position within this industry with decades of expertise and knowledge on offer to customers. The business also benefits from the cost-advantages and operational synergies enjoyed by JPMorgan’s other operating units.

I believe the strong ROE (3Y average from FY22 backwards of 30%) also illustrates just how profitable the segment is for the bank.

Holistically, it is clear that JPMorgan has a wide economic moat thanks to their diverse and massive product portfolio generating tangible cost-advantages through the minimization of fixed-costs relative to revenue and through synergetic efficiencies unlocked as a direct result of their diversified operations.

I believe JPMorgan therefore harbors a wide economic moat that benefits the company in the form of tangible competitive advantages. While I do not believe that their position is unassailable, significant management missteps combined with perfected execution by JPMorgan’s competitors would be required for the bank to be superseded as dominant player between the big four U.S. banks.

Financial Situation

From an operating performance perspective, JPMorgan leads its peers both with regards to returns and margins from their businesses.

JPMorgan’s 5Y average net margin is 29.43% which is 2% above Bank of America’s net margin and leads Citigroup and Wells Fargo by over 10% each. The bank’s 5Y average ROA and ROE are 1.10% and 14.44% respectively which once beats all three of the other big four banks by at least 4%.

The bank had a financial leverage ratio of 13.84x in FY22 which is the highest of any of its peers.

From these basic operational performance indicators, we can observe the tangible economic moat drivers present at JPMorgan assisting the firm in outpacing its peers in terms of overall operational performance.

JPMorgan benefits from a positive feedback loop with these operational efficiencies whereby the bank is able to invest more into technological improvements and into the development of their service offerings while maintaining sufficient margins compared to its competitors.

While 2023 has presented banks across the world with incredibly difficult macroeconomic conditions, JPMorgan has been affected less than its three primary competitors.

While the liquidity turmoil witnessed in March and April of 2023 sparked fears of widespread contagion affecting the banking industry a whole, JPMorgan showed surprising resilience throughout the episode in a similar fashion as they did in 2008.

JPMorgan’s FY23 results have been mostly positive in 2023 with the bank continuing to illustrate their reliable ability to generate meaningful growth even during difficult macroeconomic conditions.

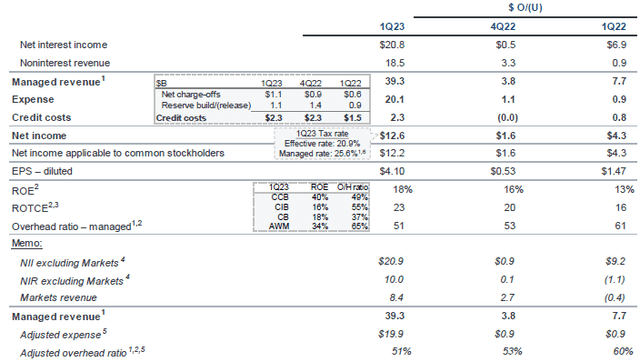

Q1 saw JPMorgan generate $39.3B in managed revenues with the majority of this sum being generated by NII. NII increased by almost $7B (50%) YoY thanks to higher interest rates driving growth particularly across the bank’s consumer and community banking segments.

Strong growth in the firm’s consumer segment NII was supported by a 5% YoY increase in average loans ($449.80) despite a 4% YoY drop in average deposits ($1113.00).

The commercial banking segment also saw net income up 58% YoY with revenues up 46% YoY thanks to higher deposit margins. Average deposits in the segment fell 16% YoY due to attrition in non-operating deposits as well as seasonally lower balances.

JPMorgan’s asset and wealth management business also saw net income increase 36% YoY. This was due to higher deposit margins on lower balances and a valuation gain of $339mm on the firm’s initial investment into the asset management joint venture in China as a result of taking 100% ownership of the project. AUM increase 2% YoY to $4.3T.

Overall, the bank saw average loans increased 6% YoY (flat QoQ) while deposits fell 8% YoY (3% QoQ). Expenses increased to $20.1B with a managed overhead ratio of 51%. This is down from 60% in Q1 FY22.

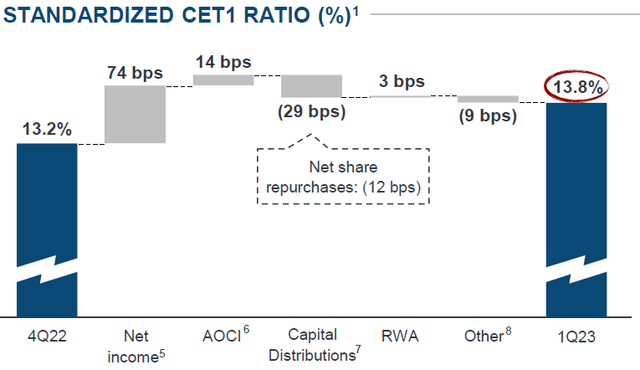

ROTCE for Q1 was 23% while the bank’s CET1 capital ratio was 13.8%. Std RWA was $1.7T with JPMorgan having a total Loss-Absorbing Capacity of $488B.

Q1 was fundamentally characterized by incredibly solid performance despite an uncompromising macroeconomic environment.

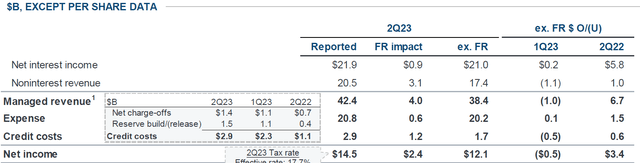

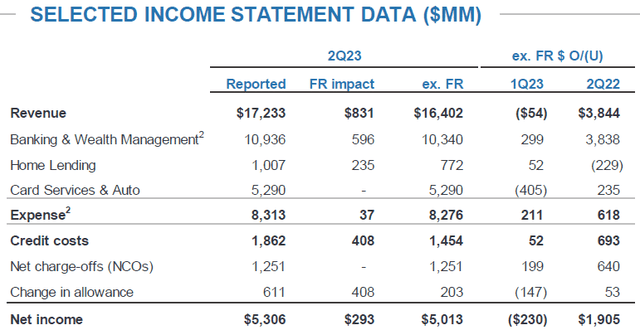

FY23’s Q2 saw JPMorgan continue their solid performance despite the integration of First Republic bank into JPMorgan’s operations.

Managed revenue increased 21% YoY ex-FR impacts with QoQ growth being down 2%. NII continued to show strong growth at 38% YoY with QoQ figures being essentially flatline. The drop in overall managed revenue QoQ was due to a 6% drop in NIR for Q2 primarily as a result of a drop in markets and securities services revenues given the souring macroeconomic environment.

Net income was flatline QOQ around $12.1B (ex.FR impacts) while ROTCE was 21% down 2% QoQ. ROE for Q2 was 17% which while still very healthy is down 1% QoQ.

The bank’s consumer & community banking business continued to see excellent YoY growth figures with net income up 61%. However, revenue and net income was mostly flatline all the while ROE dropped 2% to 38%.

ROE for the bank’s corporate & investment bank and commercial banking businesses was 15% and 21% which were down 1% and up 3% respectively QoQ.

Overall, Q2 saw results mostly flatline QoQ with YoY figures still being very healthy for the bank. These results were largely in line with what JPMorgan had forecast for FY23.

The newest Q3 earnings report saw managed revenues flatline at around $38.5B with net income unchanged at $12.1B. Expenses increased by $700M QoQ up over $1.7B YoY. This steady increase in expenses was largely attributed to increased spending on technological improvements along with an increased headcount being cited as the cause for higher compensation costs.

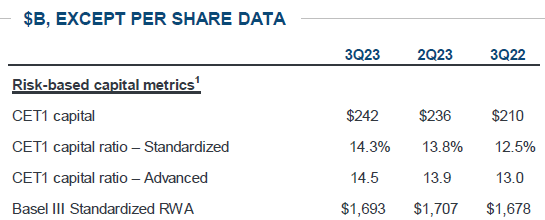

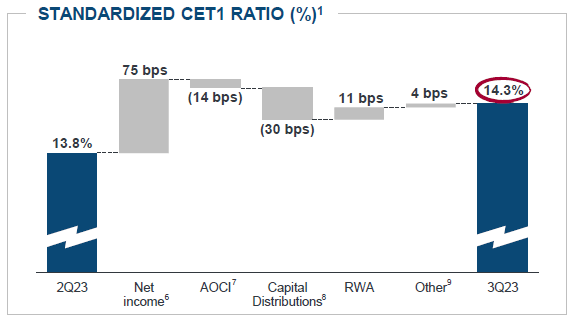

JPMorgan had a ROTCE of 22% (up 1% from Q1) along with a std CET1 capital ratio of 14.3%. Total loss-absorbing capacity was $496B. The bank had $1.3T average loans, $1.4T in cash and marketable securities along with a std RWA of $1.7T.

JPM FY23 Q3 Presentation

CET1 capital was up from $210B in Q3 FY22 to $242B in Q3 FY23. The CET1 capital ratio has improved 1.8% YoY. Firm SLR is up 0.7% YoY to 6% while total firm LCR remains 112%.

JPM FY23 Q3 Presentation

Total excess HQLA has fallen sharply YoY from $531B in Q3 FY22 to just $252B in Q3 FY23. HQLA and unencumbered marketable securities has dropped from $1.48T one year ago to just $1.39T at the end of Q3.

Overall, it is clear to see that FY23 has been characterized by strong YoY results with mostly flatline QoQ performance being achieved by JPMorgan. The bearish and inflationary macroeconomic environment has particularly hit the bank’s corporate and commercial banking operations with consumer and community performance suggesting that the U.S. consumer has been less affected.

While I do believe that the average consumer deposits and loans will drop moving into 2024 due to a higher for longer interest rate environment finally resulting in a slowdown in consumer spending, I do not foresee JPMorgan facing any outsized financial risk from this event compared to its peers.

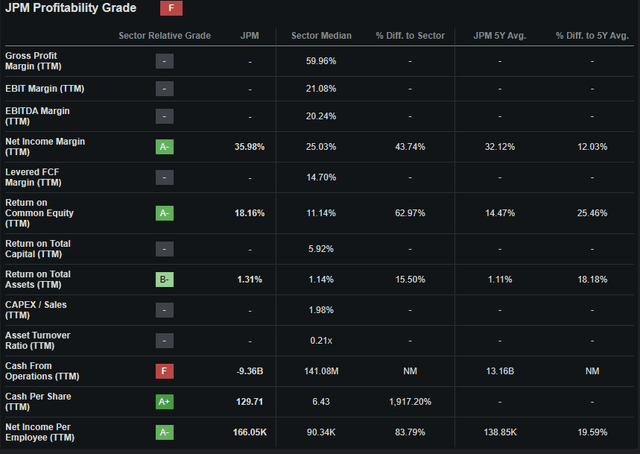

Seeking Alpha | JPM | Profitability

Seeking Alpha’s Quant Grades calculates an “F” profitability rating for JPMorgan which I believe to be a slightly pessimistic representation of their current situation. The relative grades assigned by the quant system do not in my opinion effectively capture the overall positive profitability present at the bank.

The significant negative cash from operations is mainly impacted by the First Republic integration and therefore cannot be considered a reliable indicator.

Moody’s credit ratings agency affirmed a reputable “A1” credit rating for JPMorgan’s senior unsecured domestic notes and maintained their LT issuer rating also at an “A1”. The outlook remains stable. Moody’s classifies “A1” ratings as being of “upper-medium grade” investment quality.

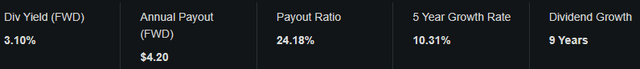

Seeking Alpha | JPM | Dividend

JPMorgan pays a healthy dividend with a current FWD dividend yield of 3.10%. The firm’s FWD annual payout is expected to be $4.20 with a payout ratio of 24.18%. The 5Y growth rate is 10.31% which is quite positive indeed.

Of course, it must be considered that banks have historically been quick to delete their dividend payments during recessionary economic periods which places the ultimate safety of JPMorgan’s dividend into question.

JPMorgan went ex-dividend on the 10/05/2023 with the payout date being 10/31/2023.

Valuation

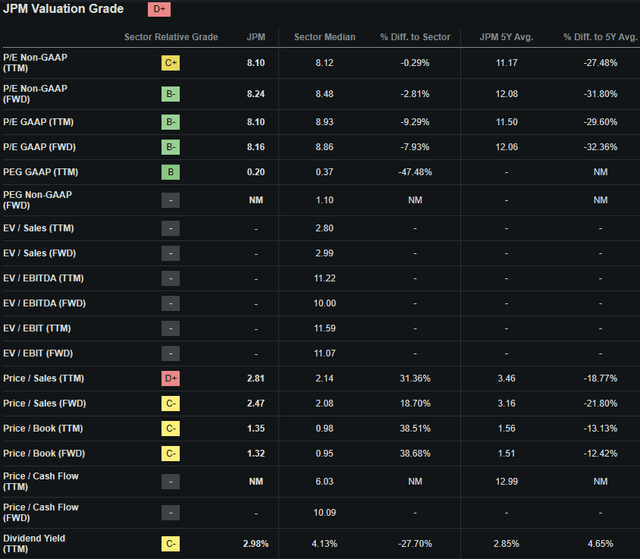

Seeking Alpha | JPM | Valuation

Seeking Alpha’s Quant assigns JPMorgan with an “D+” Valuation grade. I believe this may be an excessively pessimistic evaluation of the relative value present within JPMorgan stock perfectly illustrating how even incredibly accurate quant ratings can be misleading if considered at face value.

The bank currently trades at a P/E GAAP FWD ratio of 8.16x. This represents a huge 32.36% decrease in the firm’s P/E ratio compared to their running 5Y average.

Their FWD Price/Book of 1.32x suggests a fair intrinsic valuation in my opinion especially when considering the bank’s Price/Sales FWD of 2.47x.

Warren Buffett famously only likes to purchase shares in banks once their P/B ratio is below 1.00 with JPMorgan currently holding an excessively high metric to match this Buffet requirement.

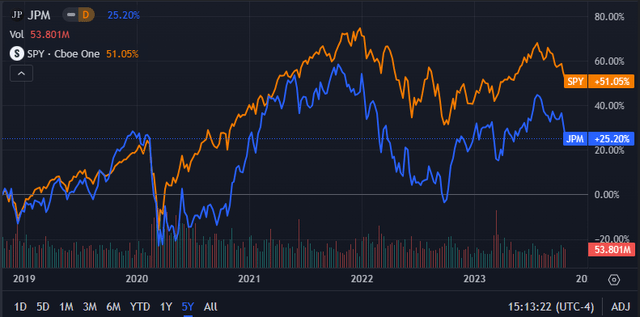

Seeking Alpha | JPM | Advanced Chart

From an absolute perspective, JPMorgan shares are trading at relatively average prices given their 5Y average.

Over the past five years, JPMorgan has underperformed the S&P 500 as a whole by around 25% despite a solid rally since late 2022.

When considering the turmoil witnessed within the U.S. banking industry earlier in 2023, it is surprising to see JPMorgan stock be so resilient through 2023 with investor confidence seemingly high in the bank.

However, a recent announcement by CEO Dimon stating his intention to begin selling shares in JPM starting 2024 is surprising and has resulted in a sharp drop in share prices as a reaction to this news.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison allow for a basic understanding of the value present in JPMorgan shares to be obtained, a quantitative approach to valuing the stock is essential.

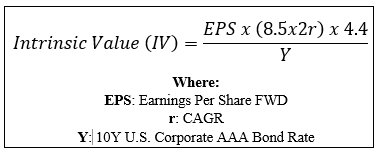

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using JPMorgan’s current share price of $135.69, an estimated 2024 EPS of $15.25, a realistic “r” value of 0.015 (1.5%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $150.40. This represents around a 10% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.01 (1%) to reflect a scenario where a globally spanning recession causes JPMorgan to struggle growing revenues, NII and NIM while expenses also fail to reduce, shares are still valued at around $137.00 representing a fair value for JPMorgan shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that JPMorgan stock is currently trading around a fair valuation.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The general uncertainty regarding the future direction of both the U.S. and global markets as a whole means predicting the direction for most banks from a qualitative side is essentially impossible.

In the long-term (2-10 years), I see JPMorgan continuing to lead the other three “big four” banks thanks to the tangible cost advantage and synergetic portfolio of financial products offered by JPMorgan. While periods of economic decline or uncertainty may lead to temporary headwinds which could impact profitability and growth, I believe the overall outlook if very positive for the banking giant.

Risks Facing JPMorgan

JPMorgan faces significant regulatory risk and a large amount of macroeconomic risk due to the nature of the global banking industry and the incredibly complex set of operations present at the bank.

Much like Bank of America and Citi, JPMorgan faces tangible risks arising from the threat of regulatory compliance requirements resulting in compromised fiscal performance. The proposed U.S. B3E NPR increases would require JPMorgan to increase their capital by 25% while the require capital for operational risk would have to be increased by $30B.

Such a requirement could see JPMorgan having to sell a portion of their assets at a loss which could significantly harm the profitability of the bank. Furthermore, the proposed decrease in credit card swipe fees could see JPMorgan lose out on some of their NIR particularly within their consumer and community banking business.

While I do not believe JPMorgan faces any significant liquidity risks or the possibility of default, a rapidly changing regulatory environment could lead to an overall drop in profitability for the bank and a significant contraction in returns and net margins.

JPMorgan also faces significant compliance costs to ensure their wide range of financial products and services comply with the requirements of regulatory bodies across the world. The significant geographic presence their corporate banking and investing business in particular requires large amounts of compliance tasks to be completed to ensure fines are avoided for lack of conformity.

While this risk is equally shared by peers Bank of America and Citi, JPMorgan is equally exposed to this threat.

From an ESG perspective, JPMorgan faces no tangible threats that could place a strain on their reputation or fiscal situation.

I believe the overall lack of major environmental, societal or governance concerns would make the bank an excellent pick for a more ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing in JPMorgan if these matters are of concern to you.

Summary

JPMorgan is undoubtedly the dominant player when it comes to the global banking industry and the “big four” U.S. banks as a group. Their massive scale, healthy net margins and consistent ROE illustrate that the bank’s economic moat is working well to help the firm earn outsized returns on their invested capital.

While FY23 has been relatively flatline in terms of growth, the bank has remained resilient despite a worsening macroeconomic environment and a slowly but surely softening U.S. consumer.

While I do see overall consumer demand dropping moving into 2024, I still think JPMorgan is best positioned to tackle the conditions presented by the market when compared to the banks three “big four” competitors.

The relatively modest undervaluation or worst-case fair valuation currently present in shares does little to promote the creation of a position in the bank from a deep value perspective. An investment in shares at present would most probably return the average cost of capital to shareholders.

Therefore, I issue JPMorgan a Buy rating at present. While I do believe the bank would make for an excellent long-term investment, the lack of discount in shares combined with a market currently offering many blue-chip companies at superb prices means I cannot issue a Strong Buy until at least a 25% undervaluation in shares is present.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.