Summary:

- JPMorgan’s bull run is expected to continue, as the company is enjoying multiple tailwinds on both macro and company levels.

- On top of fundamental strength, I highlight the renaissance of the fed put, which could potentially significantly change the risk perception of investors towards financial institutions.

- With a more favorable perception of JPM’s risk profile, the bank’s valuation may be set for a rerating, potentially trading up to the valuation of a typical GARP stock.

- I view a >$300/ share price as possible, projecting a P/E of around ~20x. This would be a valuation similar to the price multiple seen in the broader U.S. equity market.

Michael M. Santiago

My Fundamental View On JPMorgan Remains Very Bullish …

Heading into 2024, I assigned a “Strong Buy” rating to JPMorgan (NYSE:JPM) stock, arguing that shares were poised to re-rate to the upside, as several fundamental drivers provided a bullish tailwind to the U.S. leading financial institution. Specifically, I present three primary arguments:

Firstly, I point out reasons for optimism relating to the anticipations of a dovish pivot in monetary policy, with the FOMC indicating potential significant rate cuts. This shift is now once more supported by recent updates, with the Fed confirming previously set expectations of a total of 75 basis points worth of rate cuts in 2024. This, paired with a consistent uptrend in GDP growth projections, could support a strong “Soft Landing” thesis that could drive commercial activity in the U.S., and consequently bank lending/ activity.

Secondly, as monetary policy is set to shift dovish, the banking sector is poised for stabilizing net interest income: Specifically, Fed funds rates in the range of 4.25-4.75% could reduce funding costs for borrowers, enhancing the bank’s lending volume, while deposit costs are set to fall. All things considered, I argue that JPMorgan’s net interest income in 2024 is likely to consolidate at $82-84 billion, marginally lower than the previous year, but still supportive. Additionally, I highlight that an economic environment of strong GDP expansion and dovish monetary policy is poised to revitalize investment banking sectors, particularly Equity Capital Markets (ECM), Debt Capital Markets (DCM), and Mergers & Acquisitions (M&A), all areas where JPMorgan holds significant market share. Overall, I continue to project that JPMorgan is poised for an incremental revenue increase of $3-4 billion over the previous fiscal year for the bank. On that note, a recent research note by Morgan Stanley strengthens my confidence in projecting accelerating investment banking activity, as the bank’s research team highlighted (emphasis mine):

We’re bullish on a rebound in capital markets activity, with M&A, ECM, and DCM as a percent of US nominal GDP running near 3-decade lows. We expect activity to inflect sharply this year and build through 2025 and 2026, as pipelines build across investment banking products. Our leading indicators for activity are flashing bright green, with stock markets higher y/y, volatility down, issuance up, credit spreads tighter and CEO confidence rising. In addition to higher investment banking fees, record high stock market levels should drive up market-based revenues in asset management, wealth management and trading.

(Source: Morgan Stanley research note on large-cap banks, dated 20th March: Capital Markets Rebound to Drive Up Money Center SOTP Valuations)

Thirdly, and this relates specifically to JPMorgan vs. peers, I highlight that while JPMorgan’s competitors might also benefit from the favorable industry tailwinds of 2024, their capacity to seize growth opportunities appears comparatively constrained. Bank of America faces challenges due to extensive unrealized losses, Citigroup and Wells Fargo are undergoing intensive restructuring and compliance improvements, and Goldman Sachs, along with Morgan Stanley, are navigating internal transitions and market shifts. Notably, UBS is likely to allocate resources towards the integration of Credit Suisse. All this should help JPMorgan to take wallet share from institutional clients. On a related note, I point out that JPMorgan bolstered its industry leadership in 2023, with an inflow of nearly $60 billion in new deposits. The bank also managed to acquire the wealth management company First Republic at a minimal cost.

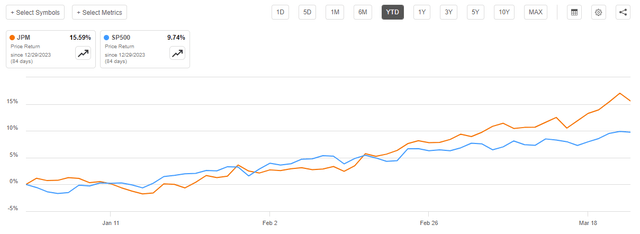

As a result, and in accordance with my thesis, JPMorgan’s bull run has continued strongly into early 2024: Since the beginning of the year, JPM shares have surged by about 15.6%, comfortably beating the 10% increase for the S&P 500 (SP500).

… But JPM’s Valuation Trends Clearly Below The S&P 500

Despite this positive cocktail of tailwinds, JPMorgan stock continues to trade cheap, with shares priced at a 12x P/E, both on trailing and forward (2024) earnings. Notably, there is about 85% upside, if JPM shares would be priced at a valuation similar to the P/E implicit in the S&P 500. Why is that so? One potential, and in my opinion highly likely, reason for the discount relates to the perceived elevated risk of banking stocks (remember the banking turmoil during the GFC, but also last year). This thought has been well reflected in Big Short investor Steve Eisman’s commentary during a discussion with CNBC in Q4 2023:

I happen to think the whole banking sector is uninvestable.

With that frame of reference, I highlight recent implications that suggest the renaissance of the Fed put, which could potentially significantly change the risk perception of investors towards financial institutions, and bring JPM’s valuation closer to the price multiple seen in the S&P 500.

The Renaissance Of The Fed Put Could Reduce Risk Implications

The “Fed put” concept captures the belief among investors that in times of market downturns or economic stress, the Federal Reserve will step in by altering its monetary stance. Similar to a put option in finance – which grants the owner the right but not the obligation to sell an asset at a set price, offering a safeguard against dropping prices – this notion suggests that the Fed acts as a safety net, potentially leading to increased risk-taking among investors under the presumption that the Fed will mitigate any significant market losses. This idea is not based on any explicit policy of the Federal Reserve but has evolved from observing the Fed’s responses to past financial disturbances, such as the 2007-2008 financial crisis and the market downturn at the onset of the COVID-19 pandemic, where the Fed undertook considerable measures like cutting interest rates and purchasing assets to support the economy and financial markets. Notably, the S&P 500’s lowest point during the COVID-19 downturn coincided with the Fed’s announcement of its market support initiatives. In that context, the apprehension about a potential recession in 2022-2023, as well as the banking turmoil, was intensified by doubts over the Federal Reserve’s willingness or ability to provide the same level of economic support observed in earlier crises, as the focus under Powell’s leadership shifted towards maintaining price stability rather than spurring economic growth. But now, with inflation at around 3% annually while interest rates climbed above 5%, the Federal Reserve is once again poised to offer an implicit backstop for market prices, poised to step in during instances of economic distress or market volatility. This assumption is broadly confirmed in Powell’s commentary provided during the latest FOMC press conference. For the first time during this monetary cycle, Fed chair Jerome Powell highlighted in his introductory remarks that an unexpected rise in unemployment might lead the Fed to reduce interest rates, highlighting that

… an unexpected weakening in the labor market could also warrant a policy response

Accordingly, with the Fed having regained the capability to reduce rates swiftly and to augment its balance sheet, there are profound implications for the performance of financial assets, such as bank stocks. Historically, bank stocks have shown higher sensitivity to Fed policies compared to other sectors. During the 2008 crisis and the COVID-19 pandemic, while all sectors benefited from the Fed’s interventions, bank stocks, in particular, showed notable recoveries post-intervention, reflecting their direct ties to monetary policy and the broader economy.

JPMorgan Shares Could Be Trading Towards The S&P 500 ~20x P/E Multiple

With the Fed put providing a strong sentiment tailwind, JPMorgan shares may now be fully exposed to the company’s fundamental strength heading into 2024 and beyond, pointing to arguments highlighted in the intro section of this article. On that note, I argue that investors will likely consider pricing JPM shares more in line with a typical GARP asset, contracting JPM’s steep discount vs. the S&P 500. On that note, I view a >$300/ share as reasonable, projecting a P/E of ~20x.

Investor Takeaway

JPMorgan’s bull run is expected to continue, as the company is enjoying multiple tailwinds on both macro and company levels. On top of fundamental strength, I highlight the renaissance of the fed put, which could potentially significantly change the risk perception of investors towards financial institutions. With a more favorable perception of JPMorgan’s risk profile, the bank’s cheap valuation may be set for a sharp rerating, potentially trading up to the valuation of a typical GARP asset. I view a >$300/ share price as possible, projecting a P/E of around ~20x. This would be a valuation similar to the price multiple seen in the broader U.S. equity market. In line with my analysis and fundamental view on JPM, I continue to view shares as a “Strong Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.