Summary:

- JPMorgan reported strong Q2 earnings and its share price rose more than 3% in premarket trading.

- There are good signs that JPMorgan has recovered from a challenging period for the banking industry.

- However, the stock is a bit overvalued now and does not provide too much margin of safety at current price levels.

- I will wait for the next dip to see if I can grab shares around $125 assuming its current financials.

Michael M. Santiago

Investment thesis

JPMorgan Chase (NYSE:JPM) just reports its 2023 Q2 earnings report (“ER”). The ER is overall a strong show of the leading bank’s strength and resilience. JPM reported earnings beating market expectations both on the top and bottom lines. To wit, its EPS came in at $4.37 and exceeded market consensus by $0.61 (on a non-GAAP basis). And its revenue came in at $41.3B, representing a 34.5% improvement YoY and exceeded consensus estimates by $2.45B.

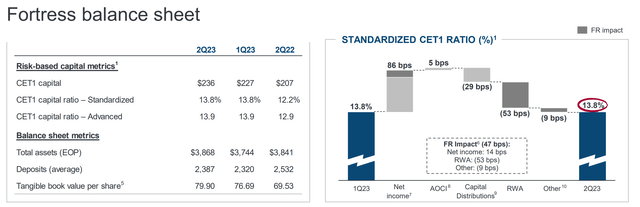

What is more important in my view is that the bank reported a strong balance sheet during/after a very turbulent period for the banking industry. Some media called the past 1 or 2 quarters the most challenging periods for banks since the 2008 crisis. Even after the First Republic transaction, JPM was able to maintain a strong standardized CET1 capital ratio of 13.8% as seen in the chart below. In the meantime, the bank sits on plenty of liquidity, a total of $1.4 trillion in cash and short-term securities. Although there might be some capital changes and liquidity ahead as the banking sector adjusts to new requirements, I have no concern that JPM will be able to meet these new requirements and maintain its fortress balance sheet. I will elaborate more on these uncertainties in the risk section.

In terms of valuation, I see the stock close to being a bit on the expensive side as analyzed next.

Buy good banks at TBV

Given our job experiences, we had many experiences with banking/financial stocks. As communicated in our earlier writings, we had so much success with the following rules that we consider them self-evident by now:

- Buying good banks near tangible book value (“TBV”) should be a no-brainer. By paying only for the book value, you get all the “other stuff” for free, such as future earnings and all intangible assets (reputation, customer relationship, et al).

- For the valuation of banks (or stocks in general), relying on a smaller but more dependable set of parameters is far more effective than using a large but more ambiguous amount of data.

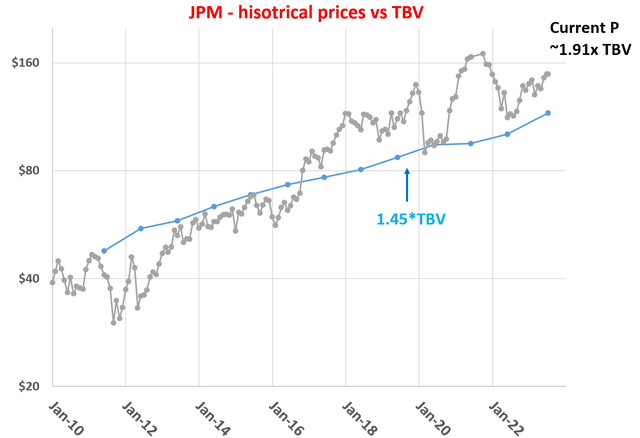

If the above is self-evident to you too, you should go all-in on JPM if it’s trading around $79, which is its current tangible book value (“TBV”) if you recall from the chart below. I would for sure.

The problem is that good banks are seldom for sale at or near TBV as you can see from the chart. As seen, JPM has historically been valued substantially above its TBV by about 45%. And at the prices as of this writing, it trades at about 1.91x TBV, about 32% above the historical average. It takes a lot of patience to wait for its prices to drop close to TBV, and these are truly exceptional entry opportunities. Given the rarity of such exceptional entry points (the last time it happened for JPM was around 2012 as seen), the practical question for me is how much premium I am willing to pay in addition to the TBV.

In the next section, I will explain a simple rule that I use to estimate this premium.

Author based on data from Yahoo Finance

10x dividends premium

The short answer is that I am willing to pay up to 10 times its dividends in addition to its TBV.

The reason is that I view dividends as the best indicator of a business’ true economic earnings. And for businesses that rely on tangible assets (such as banks), TBV and dividends are the two most simple and reliable parameters available (see my 2nd rule above). More details of this valuation method can be found in my earlier article. A brief recap is provided here for ease of reference.

- If you think like a business owner for the long-term, then investing in such stocks is nothing more than buying a piece of assets (monetary capital in the case of banks) to collect income (like rent). So the investment value consists of two parts: the value of the property itself and the future rent.

- A business’ total investment value should be the sum of both parts. And we approximate the first part by its book value and the second part by 10x of its dividends. In other words, the investment value (“IV”) of such a stock should be IV = BV + 10 x dividend.

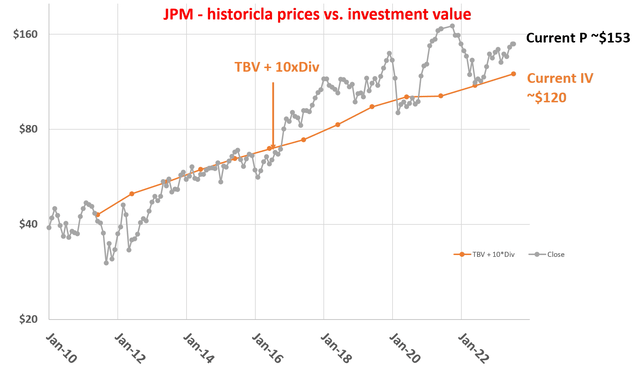

The chart below shows how this valuation model applies the approach to JPM. The chart compares JPM’s historical closing prices on a monthly basis to the IV calculated following the approach described. As seen, the IV tracked the long-term trend of the closing prices with excellent accuracy.

With the financials reported in its ER, JPM’s current IV turns out to be ~$120 ($79.9 of TBV plus 10 times its $4 annual dividends). As such, its current price of $153 (premarket on July 14) is about 27% above the IV estimated this way. It is not as alarming as the 45% premium quoted above based on the P/TBV ratio. But still quite a sizable premium and leaves little margin of safety.

Author based on Seeking Alpha data

Other risks and final thoughts

In addition to the valuation premium just mentioned above, I see a few uncertainties ahead. The remarks from Jamie Dimon, CEO of JPM, during the ER probably summarize these uncertainties best. These remarks are quoted below, and the highlights were added by me:

… there are still salient risks in the immediate view-many of which I have written about over the past year. Consumers are slowly using up their cash buffers, core inflation has been stubbornly high (increasing the risk that interest rates go higher, and stay higher for longer), quantitative tightening of this scale has never occurred.

Also, as mentioned at the beginning, there might be some adjustments in regulatory requirements given the recent turmoil in the banking sector. Dimon himself expects “material changes” to capital and liquidity with the finalization of the Basel III requirement. He went on to caution that these regulatory changes would likely have real-world consequences for the overall market and also end users.

To conclude, I see good signs that JPMorgan has recovered from a very challenging period for the banking industry. And furthermore, I see it well-positioned to weather uncertainties and regulatory changes ahead. However, the bank is currently valued at a sizable premium according to my assessment. Given its historical volatility, I think there is a good chance that its price would dip closer to the IV and I would feel more comfortable buying at around ~$125.

Finally, the valuation model I described above also applies to other bank-like companies and/or stocks that do not pay dividends. A good and recent example involves Berkshire Hathaway (BRK.A) (BRK.B). The modification involves replacing the dividend with the owners’ earnings. The modification is detailed in our earlier writing and with its help, we were able to identify a good entry point for BRK last October at prices around $260 (see our order alert here).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.