Summary:

- I upgraded JPMorgan stock in mid-March amid the throes of the regional banking crisis. That thesis has played out accordingly, as JPM outperformed its 5Y total return.

- However, JPM suffered its steepest pullback since March recently, as investors adjusted to structural and cyclical headwinds that could affect its earnings momentum.

- Despite that, I assessed robust dip-buying support over the past three weeks, suggesting buying sentiment is increasingly robust.

- I argue why investors who missed adding amid peak market pessimism in March shouldn’t miss capitalizing on its recent decline.

Drew Angerer

I last updated JPMorgan Chase (NYSE:JPM) investors amid the throes of the regional banking crisis in mid-March 2023. Accordingly, I upgraded my thesis to Buy, urging JPM holders to capitalize on the market pessimism to add to their positions. I added that the bank has “substantial liquidity and a less exposed securities portfolio. Hence, investor fears appear overblown.”

That thesis has played out accordingly, as JPM has surged nearly 14% on a total return basis since my update, notwithstanding the recent steep pullback from its late-July 2023 highs. As such, investors would still have outperformed JPM’s 5Y total return of 7.9%, suggesting why risk/reward is vital for leading banking stocks like JPM that aren’t usually priced at a discount relative to peers.

JPM topped out in late July 2023, which is justified. I believe the market correctly anticipated a higher-for-longer Fed, as the market adjusted to increased risks of a liquidity crunch, leading to a hard landing. JPMorgan CEO Jamie Dimon has also remained cautious, as he did not rule out a recession moving forward, even as the US economy has remained resilient.

Dimon also corroborated the strength of the US consumer in a recent September conference. However, the secular headwinds from the Basel III endgame proposal could impose significant additional capital requirements, leading to more uncertain earnings dynamics moving forward.

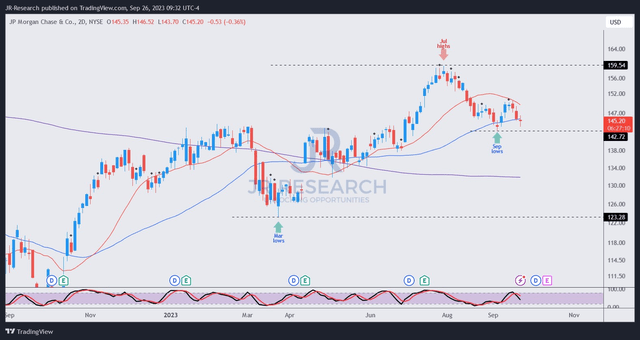

As such, I believe the market is likely pricing in such risks, as JPM fell more than 10% from its July highs toward its early September lows. However, dip buyers were assessed to have returned, helping to stem a further decline and robustly holding the $145 support level. It’s critical for dip buyers to bolster the support level to help sustain JPM’s upward bias, attracting momentum investors to return when the market returns to the risk-on mode after the recent pullback.

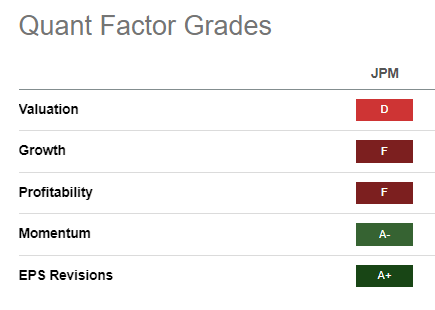

JPM Quant Grades (Seeking Alpha)

Notwithstanding its best-in-class execution, with an “A+” revisions grade by Seeking Alpha’s Quant, its “F” grades for growth and profitability suggest that its near-term earnings momentum could peak. Accordingly, while JPMorgan’s NII growth could be lifted by the Fed’s “hawkish pause,” I believe it’s prudent to assess that its NII growth profile is likely topping out as the Fed inches closer to its peak rate hikes.

As such, JPMorgan is expected to face increased execution challenges in FY24-25 as its NII growth tailwinds reverse into headwinds, impacting its profitability and earnings momentum. Coupled with a “D” valuation grade suggesting a relative premium, holders adding at the current levels must have conviction in the execution prowess of Dimon and his team.

JPM price chart (2-Day) (TradingView)

JPM buyers returned in early September, defending the pullback from its July highs. It likely spooked weak holders into giving up, as it was assessed to be JPM’s steepest decline since the capitulation in March 2023.

Notwithstanding my earlier caution about its growth profile and relative valuation levels, JPM’s buying sentiment has remained constructive over the past three weeks. As such, investors considering adding exposure at the current price can expect to have robust support from dip buyers looking to capitalize on its recent decline.

Takeaway

JPMorgan is one of the pre-eminent banking institutions in the US with a top-notch management team. Its execution has consistently been best-in-class, which could justify its premium valuation relative to peers.

Despite that, structural headwinds relating to the Basel III endgame proposal need to be considered. Also, cyclical headwinds due to the anticipated peaking of the Fed’s rate hikes could impede investor psychology from turning more bullish.

However, JPM’s buying sentiment has remained constructive over the past three weeks, supporting a timely buying opportunity amid the broad market selloff.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!