Summary:

- JPMorgan competes at an elite level in consumer and business banking, investment banking, and asset/wealth management.

- The company has been resilient in the face of the banking crisis earlier this year.

- We believe JPM stock is the strongest US bank and is trading at an attractive level for long-term investors.

Michael M. Santiago

Thesis

In a sector built on confidence it’s important to stick with the strongest companies. In our opinion JPMorgan Chase & Co. (NYSE:JPM) stands above the rest regarding their size and competitive positioning. JPMorgan’s current valuation remains attractive relative to their three biggest competitors when their strong competitive positioning is taken into account. We believe the bank is best of breed and that now is a good buying opportunity for long-term investors.

The Banking Game

Our thesis revolves around the simple premise that in banking, size and strength is all that matters. It’s very difficult to meaningfully differentiate in banking, and those who do usually end up taking outsized risks (Silicon Valley Bank, Signature, Silvergate, etc). For this reason scale and prestige is the primary way that banks can improve their competitive positioning. Scale allows banks to unlock additional operating leverage and reduces the risk of deposit outflows. Prestige allows banks to operate in areas such as wealth management and investment banking.

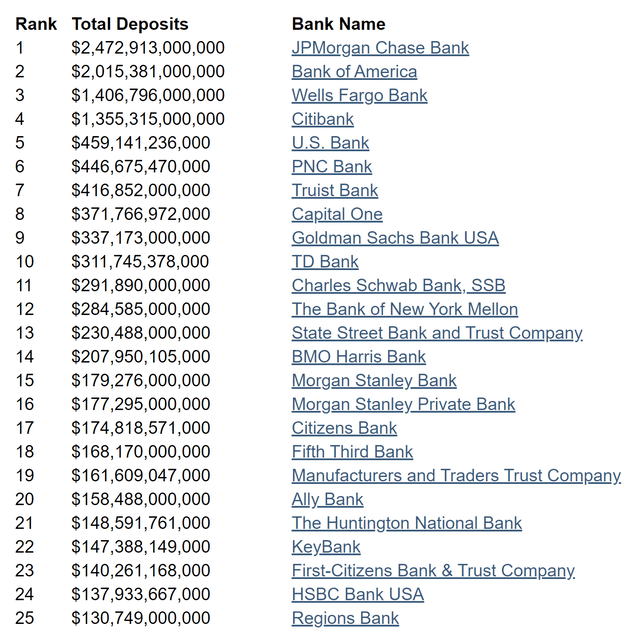

The following is a ranking of all banks in the United States in terms of “Total Deposits”. This comparison is based on data reported on 2023-03-31. As we can see, the four biggest US banks sit far above the rest in terms of total deposits. JPMorgan sits at the top of this elite group.

Banks Ranked by Total Deposits (US Bank Locations)

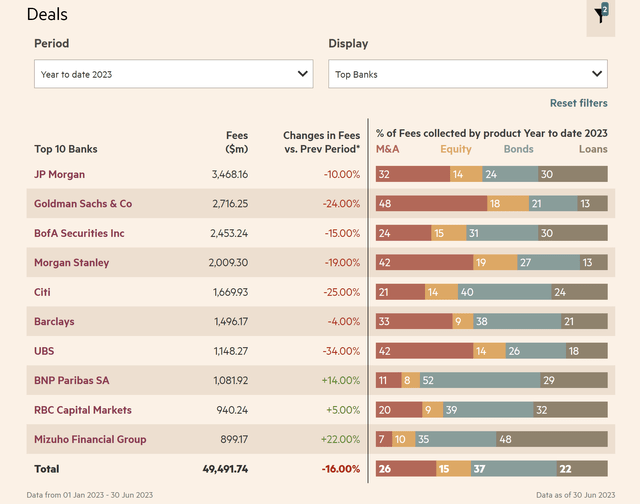

According to 2023 league tables JPMorgan is on top as far as investment banking fees are concerned. While this has been a slow year for deal activity, JPMorgan has been able to perform better than many of their competitors. This implies that the company has strong competitive positioning in this area.

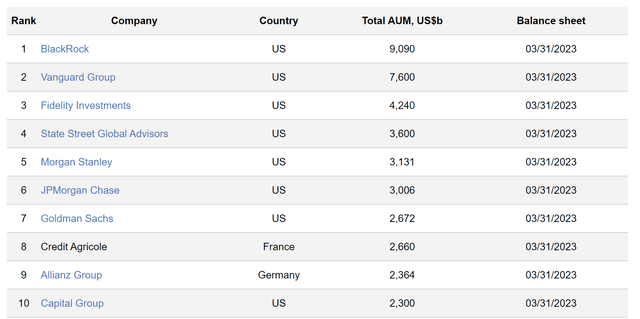

As far as wealth management is concerned JPMorgan isn’t the largest but they are competitive. The company ranks 6th globally in terms of Asset & Wealth Management AUM, and their total AUM continues to grow. According to JPMorgan’s Q2 earnings presentation:

AUM of $3.2T was up 16% YoY and client assets of $4.6Twere up 20% YoY, driven by continued net inflows, higher market levels and the impact of the acquisition of GlobalShares.

For the quarter, AUM had long-term net inflows of $61Band liquidity net inflows of $60B

World’s Top Asset Management Firms (ADV Ratings)

JPMorgan is elite in terms of consumer and business banking, investment banking, and asset/wealth management. The company did not see any material impact during the banking crisis, implying that they have strong risk control measures. While this is just anecdotal, from our own experience and conversations people often refer to JPMorgan as having a strong internal culture regarding risk management and execution. Given their dominant positioning in many areas of their business, resiliency in the face of the banking crisis, and long-term track record of success we are inclined to believe that this is true (for the time being).

We believe that JPMorgan is the strongest US bank. The company has a diversified business and represents a way to gain exposure to the banking sector without taking an outsized amount of risk tied to interest rates, credit conditions, or the economy.

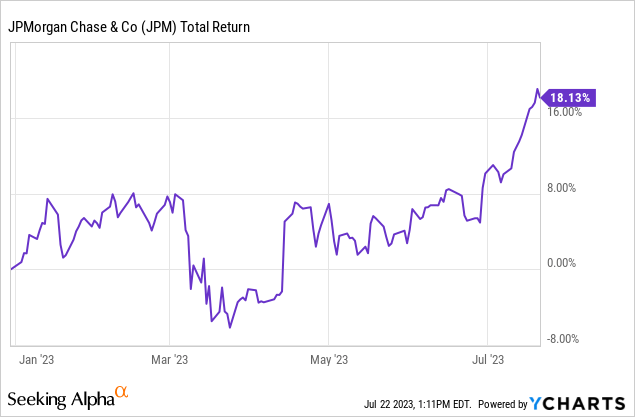

Price Action

JPMorgan’s share price took a hit during the banking crisis earlier this year but has since rebounded as the financial system has remained relatively resilient. If an investor believes that the banking system remains on solid ground, JPMorgan could have more room to run. This is especially true if the IPO window opens and the markets rally, giving more fuel to their investment banking and wealth management units.

Valuation

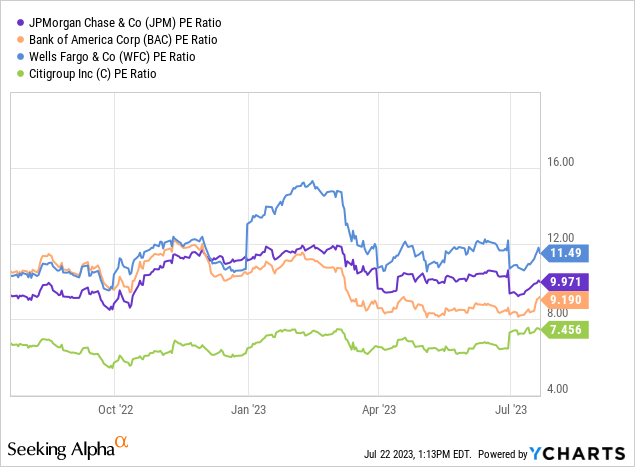

JPMorgan is trading at an attractive valuation relative to their three biggest banking peers. On a PE basis the company is about middle of the pack, which is a bit surprising considering their competitive positioning within the industry. We believe that JPMorgan could easily trade at a premium to all of their large bank peers, potentially even in the 13x trailing PE range.

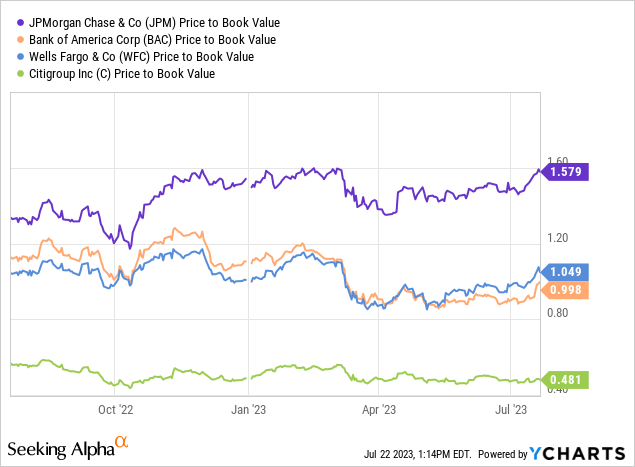

We believe that a premium should be assigned to JPMorgan for their size and strength. That premium is currently reflected in PB valuations of the four biggest banks. We can see that JPMorgan trades at a significant premium in this area, with a PB of over 1.5. Compare this to Citigroup (C) with a PB of under 0.5 and it’s easy to see which bank the market believes has the stronger future prospects.

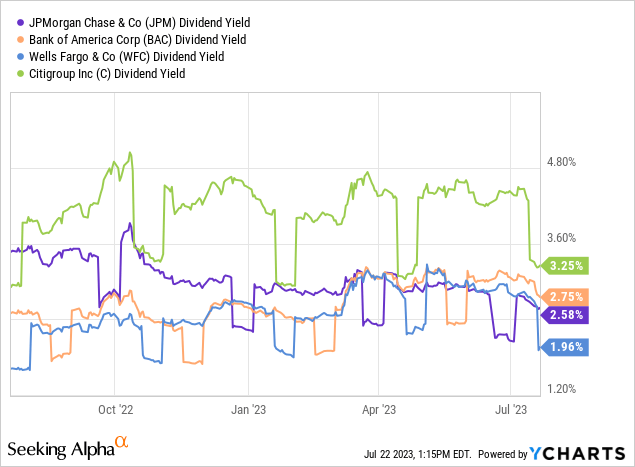

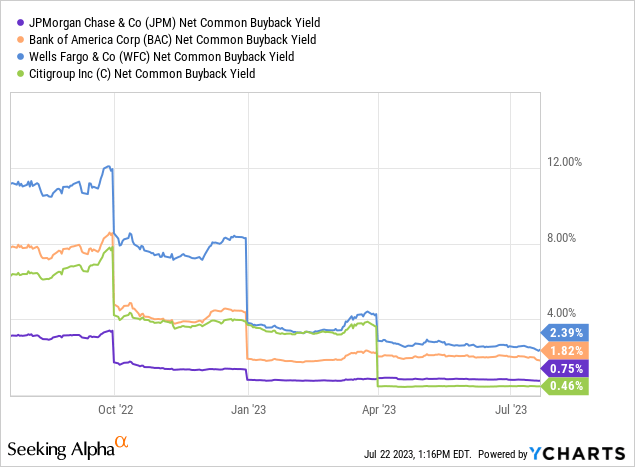

On a dividend yield basis JPMorgan trades middle of the pack with a reasonable 2.58% yield. Combine this with a net buyback yield of 0.75% and an investor will receive a combined dividend and buyback yield of 3.33%. While this currently trails the US 10-year yield of 3.837% and may be lower than some dividend focused investors would like, it’s important to remember that the bank isn’t going anywhere and will likely be able to continue growing their earnings at a steady clip.

As banking becomes more digital and the usage of AI tools becomes more widespread it’s likely that JPMorgan will be able to boost their profitability through productivity and efficiency gains. This positive margin catalyst could catch the market off guard, resulting in a rerating of the shares. In the meantime investors get to own a steadily growing company that is dominant in their sector while collecting a reasonable dividend.

Risks

A potential risk to JPMorgan is increased regulatory scrutiny regarding big banks and the associated regulatory burdens/fines that are sure to come with it. This could impede JPMorgan’s business in the short-term, but over the long-term the trend towards consolidation in the banking sector seems likely to continue. If the regulatory burden on big banks is going to increase going forward it certainly helps to be the biggest and strongest bank and the one that can most easily comply with a higher regulatory burden.

Another risk is the potential for their investment banking and wealth management divisions to face increased competition and lower profitability. While this is certainly a possibility, JPMorgan has a long and storied history and a reputation that makes it unlikely that the company will be unable to effectively compete in these areas going forward.

Finally, there is the risk that customers begin to demand a higher interest rate on their deposits, causing JPMorgan’s NIM to contract. This seems likely to occur in some form. Fortunately for investors the size and scale of JPMorgan means that the company will likely be able to offset any NIM contraction with efficiency gains in other areas.

We view the risk profile of JPMorgan to be rather muted and believe the risk/reward is favorable at these levels. We believe that JPMorgan is the “safest” investment out of the four biggest banks and the banking sector as a whole.

Key Takeaway

JPMorgan has a diversified business and competes at an elite level in many areas. We believe the company is the strongest US bank and is trading at an attractive valuation. Long-term investors who are interested in gaining exposure to the banking sector can take a closer look here as long as the financial environment remains stable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.