Summary:

- JPMorgan Chase reported strong Q3’24 results with 11% growth in noninterest income and 3% net interest income growth, driven by card-related income.

- Despite declining net interest margins, JPM’s diversified revenue streams and asset management growth may support the bank in the instance of further rate cuts.

- Macroeconomic factors and potential rate cuts pose risks, but looser monetary policy could benefit the Company’s asset management and capital raising activities.

LewisTsePuiLung

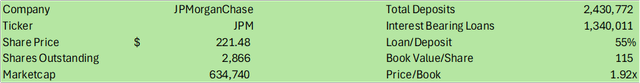

JPMorgan Chase (NYSE:JPM) (NEOE:JPM:CA) reported a strong q3’24 driven by noninterest income growing by 11% and net income growth of 3%. As net interest margins set course to decline, the bank offset this with fees primarily driven by card-related income. As macroeconomic uncertainty continues with improving macroeconomic data and lower expectations for rate cuts for the duration of 2024, JPM will likely remain in an easing position of growth as NII expectations are set for continued decline in eFY25. Given these factors, I rate JPM shares with a HOLD rating and a price target of $230/share at 2x price/book.

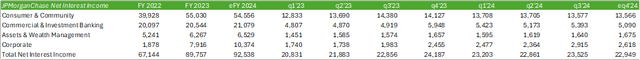

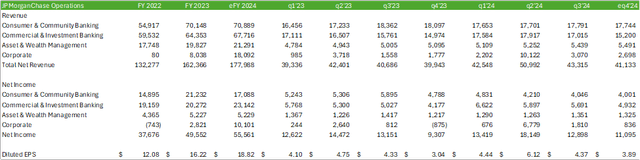

JPMorgan Chase Operations

Consumer & Community Banking

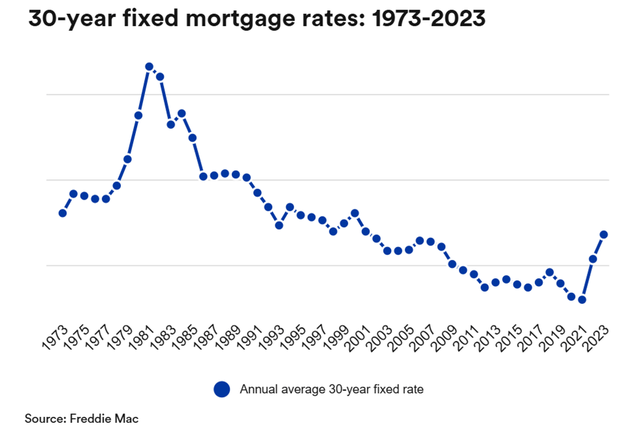

JPM experienced a -3% year-over-year decline in total net revenue in the CCB segment as a result of a -6% decline in net interest income and a -6% decline in mortgage fees & related income. Mortgage revenue was likely the result of the softening real estate market, as mortgage rates remain relatively elevated. Management mentioned in their q3’24 earnings call that the bank experienced a pickup in mortgage applications and refinancing.

Revenue declines were offset by card income, which grew 19% on a year-over-year basis, and asset management fees, which were up 15% from the previous year. The bank grew its provisions for credit losses by 93% from the previous year to $2,795mm.

Though home lending experienced an up shift in revenue by 3%, average subsegment loans declined by 5%. The bank has increased its home lending loans held-for-sale to $8.4b in q3’24, up from $4.7b in q1’24.

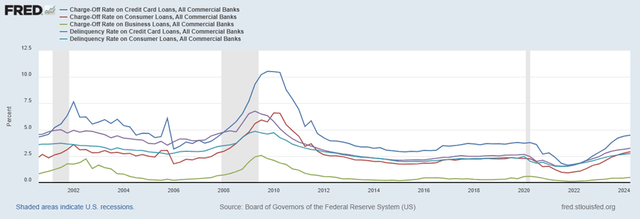

Net charge-offs also grew by 37% to $1,919mm across all sub segments, with card services being the driving factor, increasing by 44%. Auto loans charge-offs also grew by 13% to $113mm, with a 30+ day delinquency rate of 1.23%. In terms of total delinquencies and charge-offs, management believes that the increases in these figures are more normalization to historical averages as opposed to a growing concern.

Looking at historical FRED data, the figures appear to be above 2019 levels; however, when looking further back, figures are more aligned with 2006 rates.

Commercial & Investment Bank

CIB revenue grew by 8% on a year-over-year basis to $17b, driven by IB fees, which grew by 31% to $2.3b. IB fees were primarily driven by $1,076mm in debt underwriting, a 56% increase on a year-over-year basis. Equity grew by 26% from the previous year. In terms of the outlook, management provided a relatively conservative view given the regulatory environment for M&A and growing geopolitical tension. Management is seeing softness in new loan demand and revolver utilization despite an appealing capital markets environment for middle market and large corporate clients.

Asset & Wealth Management

JPM grew AUM by 23% on a year-over-year basis to $3,904B in q3’24 and total client assets to $5,721b. The bulk of the growth in the segment derived from private banking, growing 33% on a year-over-year basis. Looking at investment classes, fixed income was the largest share of asset migration. Equity experienced a 40% year-over-year growth rate as asset values continued to improve. Customers also appear to be moving more into liquidity, potentially to preserve dry powder, as equity valuations remain elevated.

JPMorgan Chase Financials

Given the current macroeconomic environment, I’m forecasting net interest income to come in at $92.5b for eFY24, driven by a slight contraction in net interest margins.

This should translate to total revenue coming in at $178b for eFY24, for a diluted EPS of $18.82/share. These figures fall into the higher end of analyst estimates for eFY24 at $169-172b in revenue and a diluted EPS of $16.95-19.95/share.

Macroeconomic Factors

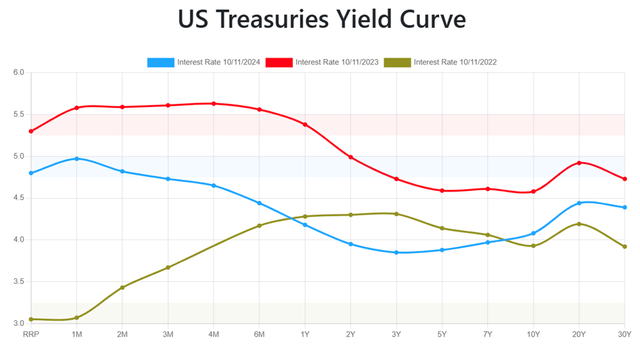

Management suggested in the q3’24 earnings call that the firm is extending the duration in order to hedge the risk of additional rate cuts. The yield curve has significantly contorted as the 10-year yield sits above the 2-year; however, the 3-month yield still remains ~55bps above the 10-year yield. Comparing the current curve to the last two years, the curve appears to have flattened, though still remains inverted.

Management suggested that further cuts to the Federal Funds rate can create a headwind for the bank; however, a steeper yield curve will be beneficial to the bank. In terms of capital raises, looser monetary policy can be seen as beneficial for enterprises to raise capital through debt issuances and refinancing of existing debt and be less dependent on equity issuances. Holding all else equal, looser monetary policy can help push up equity and fixed income values given this factor, providing an appealing scenario for JPM’s asset management segment.

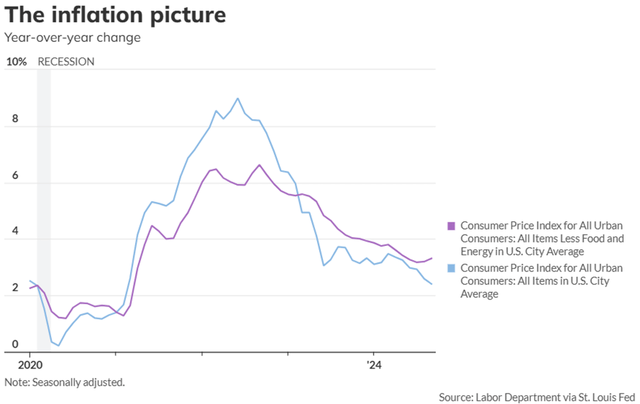

Economists had initially forecast another 25-50bps cut at the November meeting; however, improving economic data may push the Fed to declaring no additional cuts for the duration of 2024. The September CPI print came in at 2.4% year-over-year growth, down from 2.5% in August.

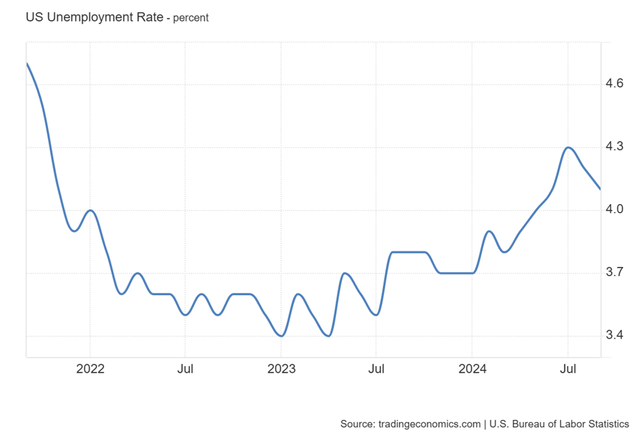

US unemployment also remains tame. I believe that this is driven by employers seeking to both retain current employees and limiting hiring to manage down costs.

Given that the Fed is using current data as direction for future cuts, I believe that these factors may lead to a 0-25bps cut in November.

Valuation & Shareholder Value

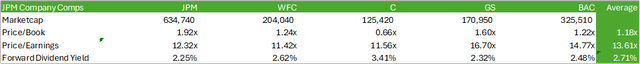

JPM shares currently trade at 1.92x price/book value to peer megabanks. This valuation may be justified given the financial strength and diverse banking services JPM has to offer, allowing for the bank to assuage any major swings in the CIB segment.

In q3’24, JPM reduced the share count by -2.26%; I believe management will continue to opportunistically buy back shares when appropriate. Jamie Dimon, mentioned on the earnings call:

If you look at it roughly, we have about a minimum $30 billion of excess capital. I look at it as you own the whole company and you can’t properly deploy it now is perfectly reasonable to wait. We will be able to deploy it. Our shareholders will be very well-served by just waiting… buying stock back at more than two times tangible book value is not necessarily the best thing to do, because we think we’ll have better opportunities to redeploy it or to buy back at cheaper prices at one point. Markets do not stay high forever.

Jamie Dimon

Given the high valuation JPM shares hold and the uncertainty of the macroeconomic environment ahead, I will rate JPM shares with a HOLD rating. Though shares have traded as high as 2.02x price/book in the last 12 months, I do believe that the current valuation makes JPM shares less appealing as an investor considering building a position. At 2x price/book, JPM shares can trade as high as $230/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.