Summary:

- JPMorgan’s recent stock pullback is a buying opportunity.

- The bank’s long-term return on equity remains above average, as this management has long outperformed the industry.

- JPMorgan Chase’s current price-earnings ratio of less than 12 is modest, especially compared to high-fliers trading at over 30.

- Holding JPM stock is advisable due to its superior management and long-term industry outperformance.

- Even taking into account the one-time earnings from the sale of Visa stock, the price-earnings ratio is cheap for management of this stature.

danielvfung

The latest JPMorgan Chase & Co. (NYSE:JPM) common stock price pullback points to the importance of management evaluation mentioned in my last article. JPMorgan has long outperformed the industry, and that outperformance is likely to continue as long as Jamie Dimon remains CEO. Now, what the outperformance is worth is up to the evaluation of the stock by each individual when they research the investment. However, management did not suddenly get worse just because of the announcement at a recent conference. That should mean that a dramatic change in the value of the stock is not warranted. Instead, any stock price pullback is far more likely to be a buying opportunity.

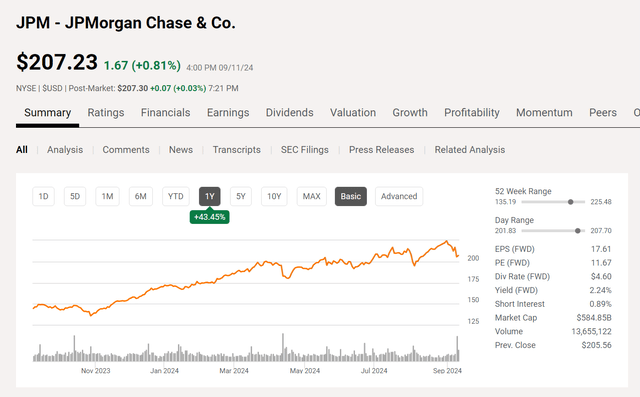

JPMorgan Common Stock Price History

Despite the clear outperformance of the bank, the stock still trades at a modest price-earnings ratio.

JP Morgan Chase & Co. Common Stock Price History And Key Valuation Measures (Seeking Alpha Website September 11, 2024)

One of the things confirmed during the latest conference is that long-term, the bank is likely to average the return on equity that it has averaged (and at times beaten that average) in the past. Management guidance for the long term is unchanged.

Clearly, the stock price reaction shown above for the last few days has been a “knee-jerk” reaction. This has long been a momentum market where risk evaluation went out the window because it has been a while since there have been serious losses sustained. When time passes that the risk of losses seems to fade, then “keeping up with the Joneses” becomes the motto regardless of risk. That means that the minute there is a hint of bad news, everyone “runs for the exits” to get into a situation where they can keep up with the perceived “benchmark performance”.

But a management like JPMorgan often will not underperform for long (if at all) despite any warnings about a challenging year. Therefore, a quarterly or even shorter time period to hold the stock is not indicated because this stock will likely treat an investor well over just about any long-term period. Therefore, even though traders make money with this stock, there is every chance a buy-and-hold strategy will work as well, if not better.

This is why it is so important to evaluate management when compared to competitor management. A “good enough” management is entering a period in the banking industry (when interest rates decline) where an “oops” is far more likely to happen because “who cares”. It is your money, not theirs, and they have several ways to replace losses if those losses occur to their holdings. You, as an investor, unfortunately get to put losses on your tax return.

The price-earnings ratio of slightly less than 12 is very modest for any superior management. This is especially true in a market like this, where “high-fliers” often trade for more than a price-earnings ratio of 30. Even eliminating the VISA stock sale gain out of the earnings does not change the argument.

There will come a day when this management gets far more appreciation from the market than is the case currently. Therefore, it is best to hold on to the stock while the story of superior performance to the industry holds, even if the next fiscal year will be challenging.

The News

This is what evidently caused the sell-off:

Okay. So, I’ll tell you. ’25, we have — the analyst consensus is a drop in NII of $1.5 billion from $91.5 billion to $90 billion. So that is – is not very reasonable because the rate expectation is lower by 250 basis points. So I think that, that number will be lower. We are not going to guide on that now, but the $90 billion is a bit too high.

This quote from Daniel Pinto, President and Chief Operating Officer, at the latest conference referenced earlier, obviously caused some market concern.

He went on to confirm the whole picture with the following quote:

Okay. So just to recap, trading up 15% year-on-year in 3Q, IB is flat to up 2% year-over-year in 3Q. And then it sounds like no change to the 2024 guidance of $91 billion of expense in NII, $92 billion in expenses. As we begin to think about 2025, consensus of $90 billion for NII, maybe be a little bit too optimistic. And I think consensus for expenses next year, [$93.7 or-so] (PH) billion it will be higher than that.

This summary by Jason M. Goldberg, Analyst At Barclays Capital, Inc. pretty much gave the whole picture as to what upset the market.

One thing about superior management is that if that management states the challenge upfront, then they will likely find a way to overcome the challenge, even if that process takes a fiscal year. This management has outperformed in the long term for quite some time. There will be flat years (or possibly worse) because it happens even to the best of managements. But the best of managements “pick themselves back up” and find ways to outperform in the future. That is a very different reaction to many managers listing all the reasons for underperformance.

Superior management often grades itself and finds itself lacking when there is an underperformance, whereas lessor managements often sweep this issue “under the rug” with a cheery message to shareholders.

Summary

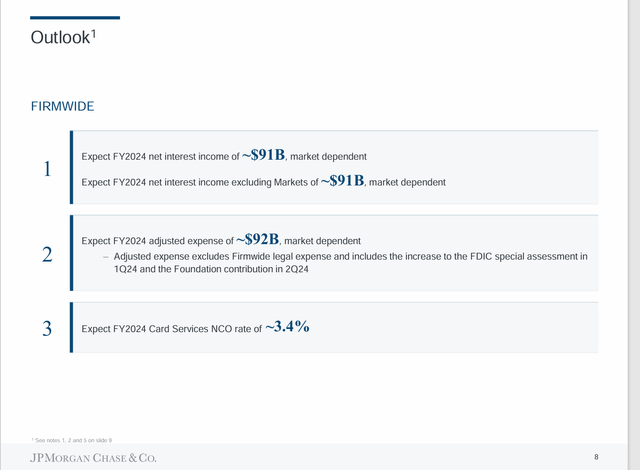

The outlook given by management at the end of the second quarter still holds, even with the news about the next fiscal year.

JPMorgan Chase & Co. Fiscal Year 2024 Guidance (JP Morgan Chase & Co. Earnings Conference Call Slides Second Quarter 2024)

The chances of the earnings outlook changing materially for the rest of the fiscal year are probably declining because there is less time for an issue to be significant in the current fiscal year.

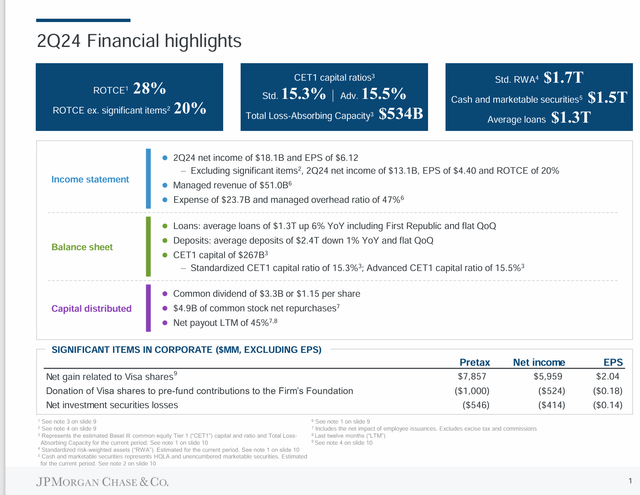

JPMorgan Chase & Co Second Quarter 2024, Earnings Report And Balance Sheet Health (JP Morgan Chase & Co. Earnings Conference Call Slides Second Quarter 2024)

Earnings without the special item noted above still make this stock fairly cheap in a market with a lot of expensive securities. But more importantly, the top items noted above demonstrate that this balance sheet is one of the best in the business.

If management can continue to profitably grow this business, then a challenging year like the one ahead should give way to a steady stream of higher earnings.

The long-term outlook of a total return that averages in the teens is likely unchanged. There will be lower years (like possibly next year) and there will be better years.

But good management, like the management here, will navigate the challenges better than less talented management. Therefore, any pullback, like the recent stock price dive, is likely a time to consider this as a strong buy.

One thing about challenges is that you just never know the extent of the challenge until you get there. Mr. Market often overreacts as a result. The economy is holding up rather well.

Now it is certainly possible that to reduce the federal deficit either by reducing government spending or by raising taxes, there will be a period of a slower economy. But this economy is in great shape to enable such a situation. It is not a situation that would likely last more than several months.

That implies a hiccup of a quarter or two, and then the market will be looking forward to better times. Generally, I hang onto a management like this one because such managements tend to outperform on the upside. A basket of this kind of management should do very well for a shareholder long term.

Risks

Basic money and banking theory states that it usually takes years of fiscal mismanagement to have a period of inflation. We had a period of low interest rates combined with increasing deficits and thought that, as a country, we were getting away with something (until we did not). If we, as a country, are a little smarter in the future, then high interest rates in the future will not be the threat that they have been for the last few years.

In fiscal year 2025, tax cuts expire. The choice is to either allow the tax cut to expire (which is a tax increase) or to reduce government spending to reduce the deficit. Either may temporarily dampen economic activity. But because politics are involved, a lack of understanding as to how this works could result in a solution that reignites inflation or brings about a depression rather than a brief recession.

One thing to note is that the public generally does not understand the time lag between a “Money and Banking” macro decision and its effect. Investors can get a basic money and banking textbook to prepare for this issue. As a result, the economy frequently cycles as it did the last 7 years or so, rather than performing in a steady growth situation.

Banks will therefore go through cyclical periods of above-average income, balanced out by challenging times. The valuation of a bank largely depends upon the average profitability throughout the business cycle and the conditions of the market when we get there. The conditions in the future, especially given politics, are nearly impossible to predict.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and JPMorgan and Chase in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.