Summary:

- JPMorgan achieved strong quarterly results driven by high net interest income.

- Proposed capital reserve requirements by Basel III endgame could impact shareholder returns in the coming years as profits are reserved to build CET1 capital.

- Changes in capital requirements could result in the repricing of services or exiting of business sectors.

- JPMorgan has a strong balance sheet and the stock is fairly valued based on its current book value per share.

Michael M. Santiago

Investment Thesis

JPMorgan Chase (NYSE:JPM) is the largest bank in the US and has benefited from the recent banking turmoil as clients leave smaller banks for the safety of large institutions. Revenue was high again this quarter as net interest income outperformed due to increased interest rates. The most predicted recession of all time continues to be pushed out as inflation pressures lighten. I don’t expect further banking crises, but JPMorgan is best positioned if one were to happen. The largest risk I see going forward are the proposed capital reserve requirements by Basel III endgame which could dampen shareholder returns as profits are directed to building CET1 capital.

Don’t Worry About a Banking Crisis

Banking stocks have been volatile since the collapse of Silicon Valley Bank in March. Despite no major bank failures since May, when First Republic Bank was acquired by JPMorgan, fears continue persist. Banks have seen deposits decline as customers move to money market accounts for higher yield, but further bank runs have not occurred.

Increasing yields have caused the value of bonds and loans banks hold to decrease. Banks must use the fair value of available for sale assets (assets that they plan to sell if liquidity needs arise) which results in mark to market losses. For held to maturity assets, banks can use the face value, thereby avoiding recognition of the decreased asset values. Banks have hidden their losses by classifying them as held to maturity, most notably Bank of America (BAC) which has over a $100B fair value decline in its held to maturity portfolio.

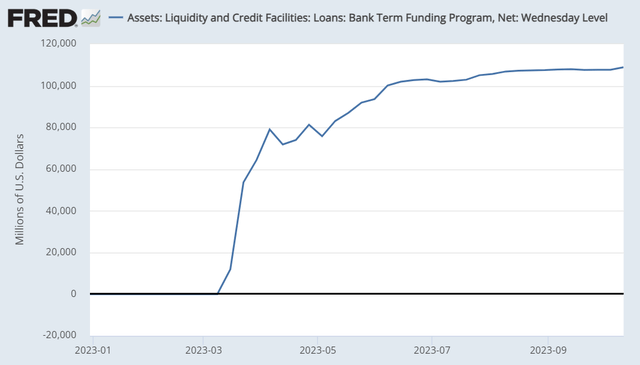

In order to prevent more bank collapses, the Federal Reserve introduced the Bank Term Funding Program. The program allows banks to receive a loan from the Fed equal to the face value of pledged collateral. Banks must pay the one-year overnight swap rate plus 10 basis points (mid 5% final rate), so this is an expense funding option. The usage of the facility has plateaued around $105B indicating the level of risk in the banking system is not increasing because banks are not seeking additional funding.

Bank Term Funding Program (BTFP) utilization (St. Louis FRED)

JPMorgan is the largest US bank and has the best balance sheet as well. At the end of the quarter the CET1 ratio had increased to 14.3% and the total loss-absorbing capacity was $496B. To put this into perspective, total loans outstanding was $1,310B. It would take 37.8% of all loans to default and be nonrecoverable to wipe out the loss-absorbing capacity.

Basel III Endgame Capital Requirements Could Change the Lending Landscape

The Basel Accords are a set of international recommendations on banking regulations. Each country’s central bank is ultimately responsible for writing the regulations that banks must follow. This leads to variances in how the accords are enacted and is the core problem with the Federal Reserve’s Basel III proposal. The Basel III accord was agreed upon following the great financial crisis in 2007-08. Basel III set standards for banks by defining required capital buffers, liquidity, and stress testing.

I am only focusing on capital requirements for this analysis because it is the target of the endgame rules. Banks provide a large range of financial products, each of which carries different levels of risk. To determine the expected level of risk, each asset the bank holds is multiplied by a risk weighting to determine the bank’s total risk weighted assets (RWAs). Riskier assets have greater weightings. To offset this risk, banks must reserve common equity tier 1 (CET1) capital. CET1 capital is primarily the shareholder equity the bank has.

Banks are currently required to have CET1 capital equal to their RWAs multiplied by a capital requirement. The regulatory minimum capital requirement is 4.5%. Additionally, banks are required to maintain a stress capital buffer (SCB) of 2.5% (minimum); the exact SCB rate is based on Federal Reserve stress test results. Lastly, global systemically important banks (GSIB) are required to maintain additional capital based on “overall systemic risk” which is determined by the Federal Reserve each year. JPMorgan’s current capital requirement (minimum CET1 ratio) is 11.4%. The actual CET1 ratio using the standard calculation method is 14.3% and the advanced method is 14.5%.

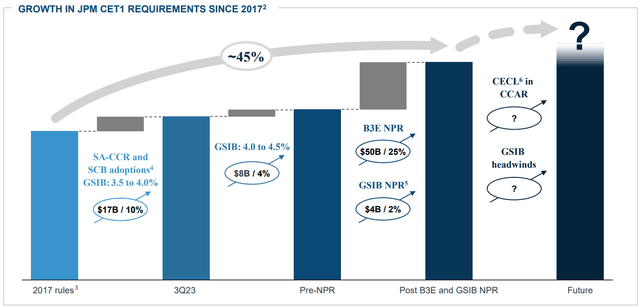

The breakdown of capital requirements over time is shown in the graph below along with new requirements if the Basel III endgame is accepted as proposed.

Growth of JPM CET1 requirements since 2017 (JPMorgan 3Q23 earnings presentation)

Capital Requirement Changes

Basel III endgame is the final implementation of the Basel III accords. The largest changes are to risk weights used to calculate RWAs. Under the original proposal by the Bank for International Settlements in 2017 risk weights would increase slightly. Under the Federal Reserve’s proposed implementation, the risk weights increase substantially.

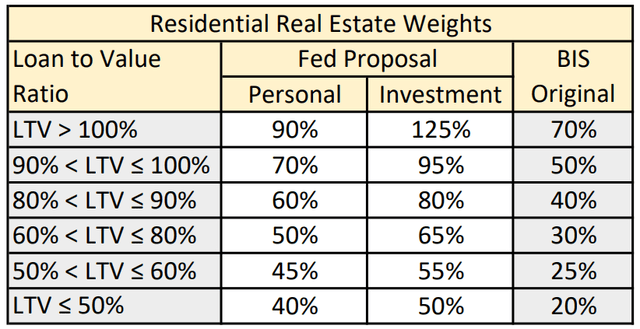

The chart below compares the Bank of International Settlements (BIS) original 2017 proposed weights to the Feds rule proposal that is currently in the comment period. I chose residential real estate because it’s something I care about, but weights for every category are included in the proposal (follow the link and search for “risk weights” if you want to see other requirements).

Residential real estate RWA weights (By author, data from Federal Reserve, BIS)

The Feds proposed weights result in capital requirements more than doubling for some LTV ratios. By doubling the risk weighting, the Fed is requiring banks to hold twice as much in reserve in case the borrower fails to pay.

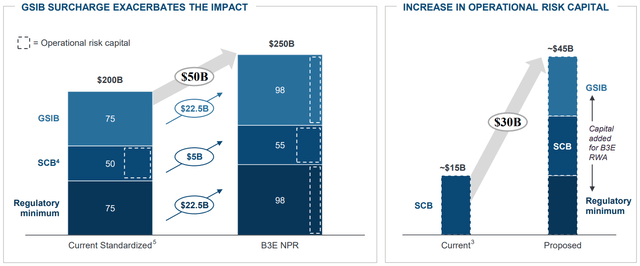

Under the proposed weights, JPMorgan will see its RWAs increase by $500B to $2,200B from $1,700B. The increase in RWAs will likewise cause an increase in required CET1 capital of more than $50B, which is 25% more than currently required. Every dollar in additional reserve requirement is money that cannot be lent.

Basel III endgame proposed capital requirements (JPMorgan 3Q23 earnings presentation)

Jamie Dimon and CFO Jeremy Barnum were clearly annoyed by the proposal and stated the following during the Q3 earnings call. Jeremy Barnum (CFO): “It’s important to start by asking why the proposed increase is so large given the repeated statement over time by policymakers that banks are well-capitalized and well-positioned to deal with stress. Given that context, the absence of detailed analysis supporting a capital increase of this magnitude is disconcerting and there’s a lot that does not make sense to us.”

Following up on an analysis question regarding the willingness of the Fed to work with banks, Jamie Dimon (CEO) said: “It’s a one-sided conversation generally. They say put in your comments… We don’t really know what’s going on inside the Fed, how many people get involved. In my view, it’s become a very politicized process as opposed to the technical analysis, I think that’s required to do it exactly right. So we’ll see.”

The proposed Basel III endgame rule is receiving comments until November 30th and all major banks plan to submit comments. On the Wells Fargo (WFC) earnings call, the CEO and CFO had similar complaints and concern about the proposal. The proposed capital requirements are scheduled to begin phasing in on July 1st, 2025 and will be fully required by July 1st 2028.

Increased reserve requirements will decrease the lending ability of banks. Jeremy Barnum presented three possible outcomes of the new requirements. First, they hope for changes to the proposal and said they plan to point out multiple technical errors in the Feds proposal, including a one trillion dollar miscalculation. Secondly, they will look to reprice offerings. Essentially, this means higher fees or less availability for some products. Lastly, they will exit lines of business that no longer make financial sense and cannot be repriced. One example they gave was renewable energy tax credit investments which see the RWA weight increase 4-fold, making the business unprofitable.

The Feds proposal is substantially stricter than the requirements that European banks must meet under their version of Basel III endgame. Besides lower weights, European banks will still be able to use credit risk modeling when setting reserve requirements. The Fed proposal also extends double counting of risk by increasing the stress capital buffer (SCB) while also applying a large global systemically important bank (GSIB) factor.

Financial Results

JPMorgan achieved another strong quarterly result as income was boosted by net interest income. EPS was $4.33, beating estimates by $0.36. Revenue for the quarter was $39.9B. Net interest income was $22.9B, noninterest revenue was $17.8B, and a $0.7B loss on securities was recorded. Net interest income was deemed to be “over-earned” because elevated interest rates have resulted in higher NII than historical norms. The largest source of NII is the consumer and community banking group which achieved a 41% ROE, compared to the firm wide 18% ROE.

In the future, decreased interest rates will pressure revenue, but for now I expect interest rates to remain elevated as the Federal Reserve keeps the Federal Funds rate higher for longer (despite many market analysts forgetting the “for longer” part). Based on Fed board member comments over the past months and declining inflation (despite elevated readings caused by the housing component using owner’s equivalent rent rather than a sane metric) I expect the Fed to hold interest rates steady, but I don’t expect cuts until mid to late 2024 when inflation has to drop near 2%.

Net charge-offs were $1.4B for the quarter, which is double from last year. Despite the increase, the rate of charge-off is not greater than expected, rather it is normalizing to pre-covid levels. Charge-offs were driven by increased credit card balances, while $250M in loan loss reserves were recovered for home lending because of improved delinquency rates.

Finally, JPMorgan has changed its economic outlook from a mild recession in Q4 or Q1 next year to no recession with GDP growth of 1% for the next year. They are conservatively modeling an increase in unemployment to 5.5% to ensure the bank is safely positioned, but they don’t expect it will happen.

Shareholder Returns

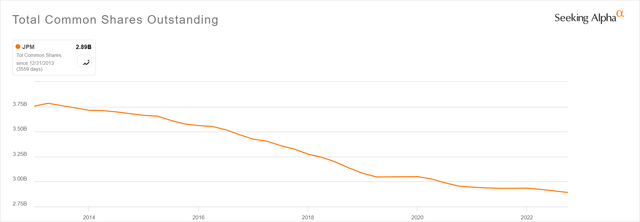

JPMorgan is a low growth stock, averaging 6.07% over the last 5 years. Share buybacks have played a large role in the stock price appreciation. Over the last 10 years, common shares outstanding have decreased from 3.76B to 2.89B, an 870M share reduction, equal to 23% of shares in 2013. At the same time, the stock price has increased from $53.96 to $148.00 per share, a 274% increase for a 10.6% CAGR.

Total common shares outstanding (Seeking Alpha)

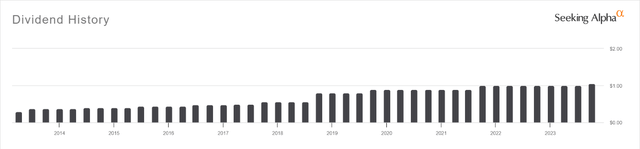

JPMorgan also pays a dividend that has increased over time. The current forward dividend rate is 2.84%. I wouldn’t invest here for the dividend, but I also won’t say no to extra cash.

Dividend history (Seeking Alpha)

While the dividend is consistently maintained over time, the rate of share buybacks is tied to financial performance and required increases to CET1 capital. In the last quarter, the CET1 ratio increased 0.5%. This was accomplished by increasing CET1 capital by $6.0B. Dividends were $3.1B while share buybacks were $2.3B. If the proposed Basel III capital reserve requirements are implemented as is, significantly more CET1 capital will be required which will depress the rate of share buybacks that can occur. This will reduce the rate of return and disincentivize holding JPMorgan shares.

Valuation

I believe the best way to value banks is through their P/E and P/B ratios. The forward P/E GAAP is 9.13, which is less than the 5-year average of 12.09. Superficially this would imply JPMorgan is undervalued, but NII is currently elevated above historic levels and I believe the market is pricing the eventual drop to normal levels once interest rates drop.

JPMorgan has a book value per share of $100.30 and a tangible BVPS (book value less goodwill and intangibles plus deferred tax liabilities) of $82.04 per share. This yields a P/B of 1.48 and a price per tangible book of 1.80. The 5-year average P/B (TTM) ratio is 1.56 which implies some upside. To match the average, the share price would need to be $156.00 per share; a 5.4% upside.

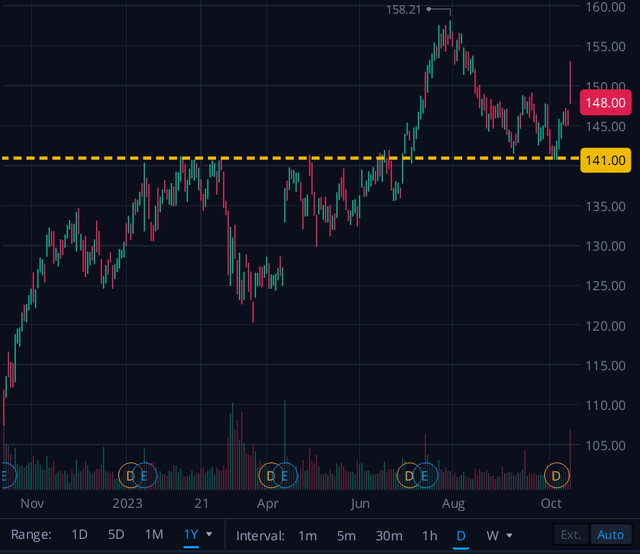

1-year stock chart (Webull, marks by Author)

Looking at the annual stock price chart, a resistance line at $141 per share was consistently bounced off from January to June. After breaking through in July, the line is now acting as support. There might be some giveback from the post earnings jump, but the share price is fairly valued and well supported.

Risks & Conclusion

JPMorgan is the strongest US bank and has the best balance sheet. Depending on how Basel III endgame is implemented, required increases in CET1 capital could be already met as a best case scenario or could result in a long hangover as profits are required to be reserved. We won’t know the outcome for several quarters and share buybacks will be lower as capital reserves are increased in anticipation of the new requirements.

Due to the strength and history of the company I believe they will overcome any near-term economic hardship. The share price is fairly valued, and revenues are likely to outperform for several quarters while interest rates remain elevated. Therefore, I am rating the stock a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.