Summary:

- JPMorgan Chase presents a compelling buy opportunity due to its strong financial performance in 2023 and low exposure to commercial real estate.

- The bank’s net interest income has significantly increased, fueled by higher interest rates and the strategic impact of the First Republic acquisition.

- JPMorgan Chase is well-positioned to generate additional profits in a higher interest rate environment, thanks to its “fortress balance sheet” and limited exposure to unrealized losses.

Bloomberg/Bloomberg via Getty Images

Investment Thesis

I believe that given the now higher than expected Fed funds rate this year, JPMorgan Chase & Co. (NYSE:JPM) presents a compelling buy opportunity, underscored by its remarkable financial performance in 2023, and low relative exposure to commercial real estate. Their financial robustness is partly due to the bank’s effective navigation of the higher interest rate environment, which has significantly bolstered its net interest income (NII) to $89.3 billion, a 34% increase from the previous year. Their strategic acquisition of First Republic further amplifies JPM’s financial strength, contributing to a net revenue jump, bringing total revenue to $158.1 billion, up 23%.

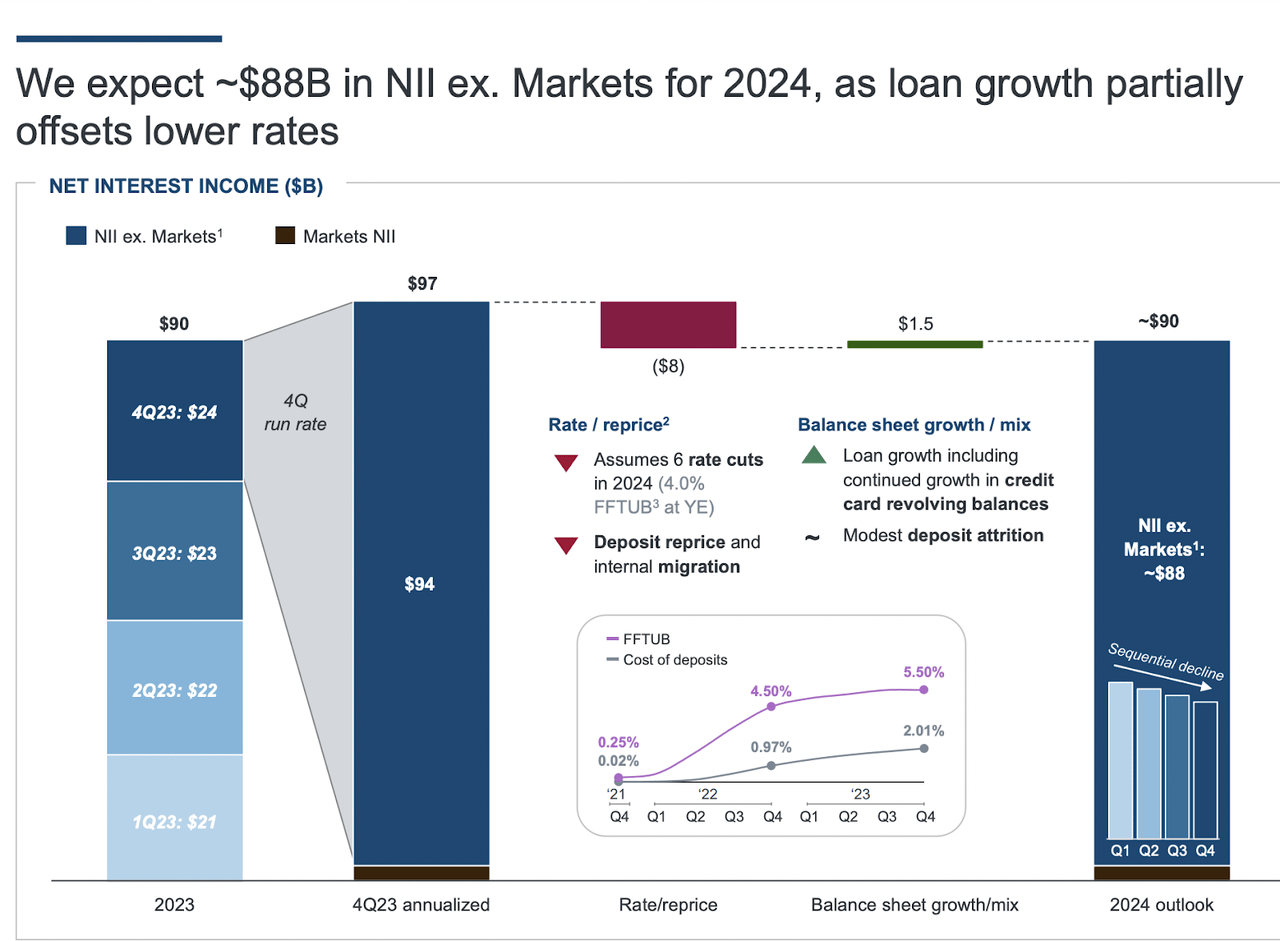

The stock’s valuation, trading at a relatively low P/E multiple, becomes even more attractive when considering the bank’s sensitivity to interest rates. With a forecast for “higher for longer” interest rates (less than the 6 interest rate cuts forecasted by the bank at the beginning of the year), JPMorgan stands to benefit from an environment that favors its net interest income, potentially adding billions to its profits without incurring disproportionate losses thanks to its self-described “fortress balance sheet.” I believe the stock is a strong buy.

Background & 10-K Review

In my opinion, JPMorgan experienced a remarkable 2023, recording a net income of $49.6 billion, representing a significant 32% increase compared to the previous year (2023 10-K). This surge in profitability translated to earnings per share of $16.23. The bank’s return on equity (ROE) was an impressive 17%, with a return on tangible common equity (ROTCE) reaching a strong 21%. I believe a key component contributing to this was their net interest income (NII), which jumped to $89.3 billion, marking a 34% increase from the previous year. JPMorgan’s growth in NII was fueled by higher interest rates and the strategic impact of the First Republic acquisition.

On top of this, the bank demonstrated robust asset management, with total net revenue surging to $158.1 billion, marking a 23% increase. Beyond NII, this revenue jump was also driven by a diversified portfolio of non interest revenue (NIR), which climbed to $68.8 billion, up 11% from the prior year. The NIR growth was also partly attributed to the First Republic’s influence, including an estimated $2.8 billion bargain purchase gain, enhanced Markets non interest revenue, and higher asset management fees.

On the other hand, the banking giant faced increased expenses, which climbed to $87.2 billion—up 14% due to higher compensation costs and $2.9 billion FDIC special assessment coming from the fallout of the collapse of Silicon Valley Bank. Loan loss provisions were recorded at $9.3 billion, considering $6.2 billion of net charge-offs and a strategic addition of $3.1 billion for the allowance of additional credit losses.

Finally, and one of my favorite highlights in the 10-K, JPMorgan’s adept management of its loan portfolio showed results in its non-performing assets. These NPAs only stood at $7.6 billion at the end of 2023, a slight 5% increase, predominantly due to wholesale non-accrual loans. With this modest uptick in NPAs, amid substantial revenue and net income growth, I believe this underscores the bank’s effective credit risk management and the resilience of its loan portfolio in a fluctuating economic environment. The bank (I believe) truly lives up to its self ascribed branding of “fortress balance sheet.” This is part of the reason I am so excited about the opportunity here, in light of higher interest rates.

Why Interest Rates Staying Higher Matters for JPMorgan Chase

Like most fractional reserve banking institutions, the financial performance of JPMorgan Chase is intricately linked to its sensitivity to interest rates, a key factor that influences its net interest income. In a higher interest rate environment, banks like JPM typically benefit from wider net interest margins—the difference between the interest income generated by banks on their asset investments and the interest paid out to depositors.

JPMorgan Chase’s sensitivity to interest rates is a critical component of its financial performance. Given what I believe to be a higher than expected interest rate environment, JPM is well-positioned to generate additional billions in profits. The bank’s loan book is described as a “fortress balance sheet,” indicating that the higher rates should not lead to disproportionate losses.

JPM NII Sensitivity (JPM Q4 2023 Earnings Presentation)

Valuation

As a result of higher for longer interest rates, I think the bank could see up to $4 billion in additional net income flow down to the bottom line from higher than expected Fed funds rates.

At 12.5x times forward earnings (this is normal in the long run for a large-cap bank’s P/E) we could see an additional $50 billion in market cap potential. Given there are 2.89 billion shares outstanding, this equates to a marginal EPS gain of $1.384/share. This (with a forward P/E multiple of 12.5 times earnings) produces $17.30/share in potential upside

On top of this, I also think the current expected EPS could also see a forward P/E multiple expansion, with the concerns about NII income abating for the 2024 operating year. JPMorgan is expected to earn $15.92/share this year and currently trades at 11.24 times forward earnings. If we apply this same 12.5x forward P/E multiple to the current expected EPS, we get an additional $20.06/share in upside from a multiple expansion.

In total, I think there is around ~$37.4/share in upside here. This would imply approximately 21% share price upside from here.

Why I Do Not Think This Is Priced In

JPM’s management guided for 6 rate cuts in 2024 causing approximately $8 billion in a NII decrease. Given that the Federal Reserve is forecasting only 3 rate cuts (and this is looking more likely than 6 rate cuts at this point) I think about ½ of this loss in NII is being unappreciated or not yet priced into the stock ($4 billion in NII upside).

Risks To Thesis

While most of Wall Street is worried about the impact commercial real estate loans will have on banks, and some analysts, like Seeking Alpha analyst Paul Franke are also concerned about an economic downturn, I believe JPMorgan can weather this with their strong balance sheet.

For example, while JPMorgan had $143.507 billion in commercial real estate assets on their books at the end of Q4, the bank reported a substantial loan loss reserve of $24.8 billion as of December 31st, which supports the bank’s preparedness for potential credit losses (in commercial real estate or otherwise). This reserve provides enough loan losses for up to 17.3% of commercial real estate loans to go bad. And, given that they built up this loan portfolio throughout 2023 (they grew from just $107.999 billion at the end of Q4 2022), I assume the quality of these loans is higher too, given the risk of commercial real estate debt was well known last year.

This significant reserve underscores the bank’s prudent risk management practices and provides a buffer against potential defaults, including those that might arise within the real estate loan portfolio.

Takeaway

I believe, in light of JPMorgan Chase’s robust 2023 performance (driven by significant net income growth, a substantial increase in net interest income, and effective management of credit risks), the bank presents a compelling investment case. The financial giant’s strategic positioning to benefit from higher for longer interest rates, combined with its solid “fortress balance sheet” and substantial loan loss reserves, positions it well for continued financial success in spite of sector wide concerns around loan losses in commercial real estate. With what I believe are manageable risks related to its credit exposures, JPM stands out as a strong buy for investors seeking a resilient bank and profitable addition to their portfolio at a compelling valuation. I believe that the risks well outweigh the reward here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.