Summary:

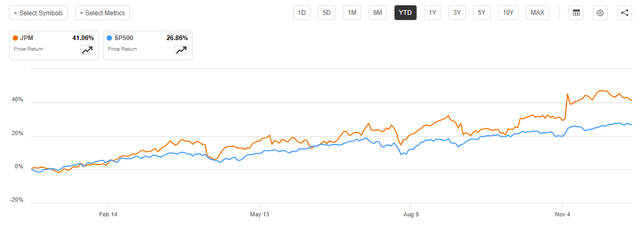

- J.P. Morgan’s stock has surged 41% YTD, outperforming the S&P 500’s 27% gain.

- Despite strong fundamentals like robust trading and investment banking performance, I am concerned about JPM’s high valuation at a 2.5x price-to-tangible-book ratio.

- Potential headwinds include rising operating expenses, cyclical risks in trading and investment banking, and vulnerability to macroeconomic cycles impacting credit quality and loan demand.

- I downgrade JPM to “Hold” due to its rich valuation and recommend a re-entry point at a 2x price-to-tangible-book ratio.

winhorse

Heading into 2024, I argued that J.P. Morgan (NYSE:JPM) is “best positioned to capture the bull run in bank stocks”. And indeed, JPM shares have performed fantastically YTD. Since the start of the year, JPM shares have risen about 41%, compared to a roughly 27% gain for the S&P 500.

Looking at 2025, however, I turn slightly more bearish on the set-up for JPM shares: While I continue to consider the J.P. Morgan franchise as highly attractive and competitive, I am concerned about the bank’s valuation – with the stock trading at a price-to-tangible-book ratio of 2.5x, a level that suggests limited upside potential for investors at current valuation, in my view. But lets look at the bull vs. bear debate for J.P. Morgan heading into 2025.

The Bulls Are Saying

With central bank policies across the world skewed slightly dovish (despite the recent hawkish undertone coming from Powell), J.P. Morgan is set to enjoy a strong 2025. A key argument for this is found in J.P. Morgan’s trading and investment banking segments: For context, in 2024, the bank’s commercial and investment banking divisions accounted for nearly 40% of its total revenue; and according to my expectations, JPM’s trading revenues are projected to rise by double-digit growth rates in 2025, driven by client demand for hedging and liquidity solutions as rate expectations change and the yield curve steepens (more on that later). Similarly, I expect double-digit growth rates for the investment banking franchise, reflecting increased corporate confidence in deal-making on the backdrop of the incoming pro-business/ pro-capitalism Trump administration.

At the same time, J.P. Morgan’s net interest income should remain at healthy levels, estimated in the range of $90-95 billion. Again, this is supported by a steepening yield curve. The argument for a steepening yield curve is anchored on investor anticipation of the incoming Trump administration’s growth-focused economic policies. As readers are aware, president-elect Trump’s agenda includes significant fiscal stimulus measures, such as substantial tax cuts and increased infrastructure spending, aimed at accelerating economic growth. This, in turn, is expected to elevate inflation expectations and expand the federal deficit, leading to higher long-term interest rates – which is favorable for lenders like J.P. Morgan.

The Bears Are Saying

Despite the overall positive set-up, J.P. Morgan faces a few headwinds that could pressure financial upside. Most notably, I highlight the likely earnings pressure coming from operating expense growth. Specifically, consensus estimates according to data collected by Refinitv expect that J.P. Morgan’s operating expenses could rise to $94-95 billion in 2025. Inflationary pressures on key personnel is a key component of this expense headwind; but also heavy technology investments to maintain a competitive edge in trading and asset management are expected to drive costs higher. In quantitative terms, J.P. Morgan is likely to face a 8-10% YoY increase in expenses for 2025, which could compress margins, especially if revenue growth slows.

I also highlight that J.P. Morgan’s performance in trading and investment banking revenues, although booming, is not without risk. Specifically, I point out that these segments are cyclical and depend heavily on market volatility and client activity, both of which could taper if macroeconomic uncertainties stabilize – something that I would expect in 2025. Additionally, investors should not forget that J.P. Morgan’s exposure to macroeconomic cycles leaves it vulnerable to credit quality deterioration and reduced loan demand if economic growth falters.

The strongest argument against investing in J.P. Morgan stock, however, relates to valuation concerns. Notably, J.P. Morgan’s stock is currently trading at a price-to-tangible-book ratio of 2.5x, which is significantly higher than the peer average of 1.9x. But even ignoring the relative industry benchmark, it is notable to point out that J.P. Morgan is also trading rich compared to its own historical benchmarks. Historically, over the past 10 years, J.P. shares have been trading around 2x; sometimes even at around 1.5x. Now at 2.5x, we are clearly at record valuation levels and I wouldn’t assume that further multiple expansion is in the cards.

Investor Takeaway

I have been a long-time bull of JPM stock. And heading into 2025, I continue to be optimistic on J.P. Morgan’s fundamental strengths—pointing out robust performance in trading and investment banking, healthy net interest income supported by a steepening yield curve, and a franchise that continues to capture outsized market share. Growth in trading revenues and advisory mandates could be supported by client demand for hedging, increased deal-making confidence, and favorable policy tailwinds.

However, even a market leader like J.P. Morgan can face headwinds, and valuation is front and center for J.P. Morgan: trading at 2.5x price-to-tangible-book, well above historical and peer averages, the rich valuation leaves limited upside potential, in my opinion, especially if operating expenses rise as expected and market activity does not match currently optimistic expectations. With that, I downgrade J.P. Morgan to “Hold” and target a 2x price-to-tangible-book valuation as a reasonable re-entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.