JPMorgan Chase: Time To Take Some Profit

Summary:

- JPMorgan Chase & Co. had a strong showing in earnings in 2023.

- The article argues that many of the catalysts that drove JPMorgan Chase’s earnings growth in 2023 are unlikely to continue into 2024, leading to concerns of over-earning and a potential decline in profitability.

- At the same time, the stock may be fully valued or even overvalued, leaving margin of safety.

Michael M. Santiago

Thesis

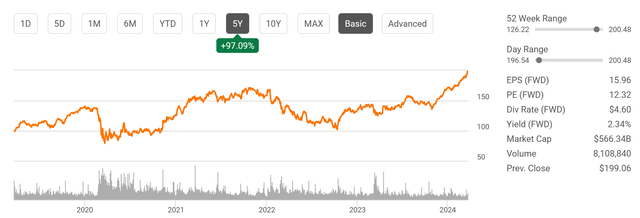

JPMorgan Chase & Co. (NYSE:JPM) had a strong showing in earnings in 2023. Fourth-quarter profits (released in Jan 2024) reached $3.78 per share, a healthy 6% increase compared to $3.57 per share in 2022. For 2023 as a whole, JPM’s bottom line surged almost 33% YoY, to $16.05 a share, versus the prior-year figure of $12.09. Thanks to such large earnings boosts, the stock price now hovers around a record high of ~$195 (see the chart below).

Against this background, the thesis of this article is to explain why it is time to take some profit if you have JPM shares. In the remainder of this article, I will explain why many of the catalysts that drove its 2023 earnings growth are unlikely to continue into 2024. As a result, I am concerned that JPM may have over-earnings on its assets in the past few quarters and the profit could normalize going ahead.

Furthermore, its current P/E ratio suggests the stock may be fully valued, leaving no room for margin of safety. The uncertainties with interest rates pose an additional risk to JPM’s future profitability. Loan demand could soften and the economy could slow if high rates continue. These risks, combined with its full valuation, create good odds for a large price correction in the near future in my view.

Next, I will elaborate on some of the key 2023 earning drivers and argue why they are unlikely to continue.

Earning projections

Many factors drove JPM’s 2023 EPS growth. And of course, the most important reason is that it is a fundamentally excellent bank.

However, there are quite a few other catalysts – largely one-time events in my mind – that contributed a nonnegligible amount to the EPS boost. For example, JPMorgan’s fourth-quarter performance was bolstered by a nearly 20% surge in net interest income. This jump stemmed from a combination of higher interest rates and a rise in revolving credit card balances within their Consumer & Community Banking division. It’s also important to note that this reported profit excludes a special $0.74-per-share charge levied by the FDIC.

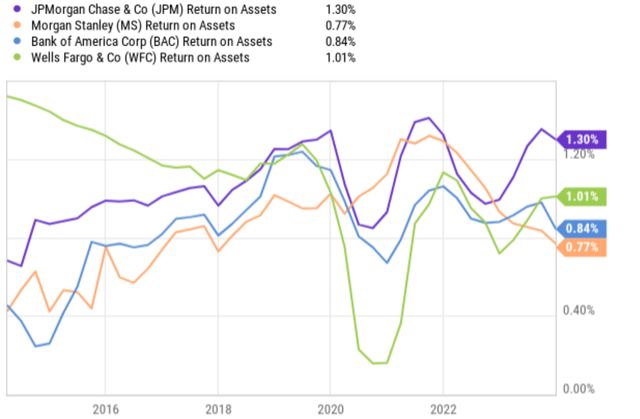

The combined effect is that JPM currently has a higher return on assets compared to its own historical average and also to its close peers, such as Morgan Stanley (MS), Bank of America Corp (BAC), and Wells Fargo & Co (WFC). JPM’s return on assets now sits around 1.30%, while all the others are close to 1% – the golden standard for the banking sector.

Given such a ROA and the one-time nature of some of the 2023 EPS drivers, I am concerned that JPM is currently over earnings and profitability would renormalize. There are a few other risks of concern in the near future. The top one on my mind is the company’s significant increase (almost 21%) in its provision for credit losses in the last quarter of 2023, partly due to a rise in charge-offs (loans that are unlikely to be repaid) within the card services segment. If high inflation and high interest rates persist, I am worried that such issues could become even worse.

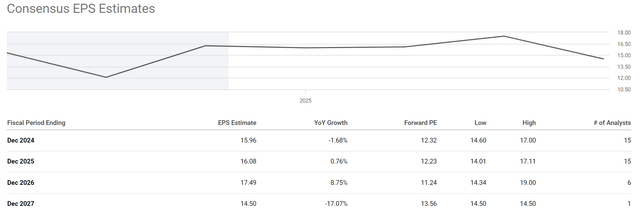

As such, analysts have a relatively negative view of JPM’s EPS over the next few years. As seen, analysts project EPS to decline slightly to $15.96 in FY 2024. Also, the overall consensus between 2024 and 2027 is a decline in EPS, falling to $14.50 in 2027. As mentioned, I think JPM is over-earning now and share the consensus view that its earnings could renormalize (i.e., decline) in the next years.

Valuation

JPM currently trades an FY1 P/E of 12.3x, already a bit above its long-term median P/E of 11.5x. Considering the possibility of EPS decline in the next years, the P/E ratio could be as high as 13.56x based on 2027 EPS, substantially above its historical average.

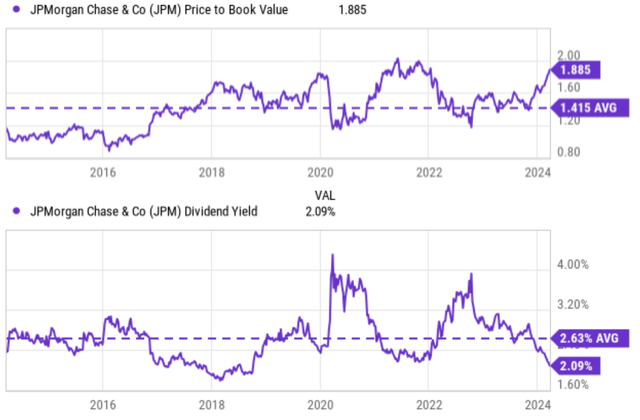

Its current valuation multiples are even more concerning in terms of other metrics. As seen in the top panel of the chart below, JPM’s current price-to-book ratio (P/B) of 1.885 is far above the historical average and actually close to the highest level in at least 10 years. Its historical average P/B ratio is only around 1.415 over the past five years. As seen in the bottom panel, the dividend yield sends the same signal. Its current dividend yield is 2.09%, far below its historical average and near the lowest level in at least 10 years. Its average dividend yield has been 2.63% over the last 10 years.

Other risks and final thoughts

My above analyses are largely geared toward the near-term risks facing JPM. In the longer term, peer-to-peer (P2P) lending is the top risk in my mind, having the potential to disrupt the traditional banking industry in a few ways. P2P platforms could connect (already are connecting in my view) borrowers and lenders directly, bypassing banks as middlemen. This can lead to lower interest rates for borrowers and higher returns for lenders, as banks’ profit margins are squeezed. As P2P becomes a more and more accessible source of financing for businesses and individuals, it can put huge pressure on banks to be more competitive with their service fees, loan products, and interest rates.

Although after all, JPMorgan Chase & Co. is still the strongest bank in my view and there are plenty of upside risks. JPM is a leader in all its segments and has a strong track record of growing market share across all of them, including consumer banking, commercial banking, and investment banking. As a truly global bank, JPM benefits from diversification across different economies. While an economic downturn in one region might hurt profits, growth in another region can help to offset those losses. This diversification could be an advantage compared to peers who are more concentrated in specific regions. Finally, reputation and client relationships are intangible but crucial assets for banks, and I can hardly find another bank that can match JPM’s history and reputation. These things do not show up on the financial statements but are an important moat for JPM. The reputation and client relationship could help JPM retain customers even if competitors offer slightly better rates or products.

To conclude, my goal is NOT to convince you that JPM is a bad bank. It is an excellent bank. My thesis is simply that I don’t see good odds for its stock price to go much higher from here because I do not believe many of the earning drivers in 2023 can continue. On the other hand, I see a few risks (e.g., valuation risks and interest rate uncertainties) that could cause large downward corrections in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.