Summary:

- JPMorgan Chase & Co. is rated as a Hold under current conditions.

- Conflicting forces make it difficult to determine the direction of JPMorgan’s share prices and total return potential.

- JPMorgan enjoys several key differentiating factors and better profitability than its peers, but concerns about over-earning and high valuation exist.

Michael M. Santiago

Thesis

The thesis of this article is to explain why I rate JPMorgan Chase & Co. (NYSE:JPM) as a HOLD under current conditions. To be perfectly clear, I am not arguing it is a bad bank. On the other hand, I view it as one of the best banking stocks. I’ve held it before and will be ready to own its share again under the right conditions and valuation multiples.

My argument is that I see conflicting forces in the near future. And as a result, I do not see a clear direction of its share prices or total return potential. In the remainder of this article, I will explain the following major competing forces in my view in detail:

- On the positive side, JPM enjoys several key differentiating factors compared to other big banks.

- As a reflection of these differentiating factors, JPM enjoys far better profitability than its peers currently.

- However, on the negative side, I am concerned that JPM could be over-earning on its equity and assets.

- Moreover, valuation is also high both by vertical comparison (i.e., compared to its peers) and horizontal comparison (i.e., compared to its own historical track record).

Differential business model

JPMorgan Chase enjoys several differentiating factors that set it apart from other big banks. According to an analysis using Porter’s Five Forces Model, competition from within the financial industry is probably the strongest force when analyzing JPM.

Within this group, JPM is the largest U.S. bank by assets. This sheer size provides JPM with significant advantages in terms of capital reserves, funding access, and risk diversification.

Even compared to other money-center banks, my view is that JPM enjoys the strongest brand recognition and reputation. Thanks to its scale and history, it is often ranked among the most valuable brands globally. As such, JPM enjoys a strong reputation for financial stability, reliability, and customer service. These features are invaluable for its to extract retail clients, major corporate clients, and high-net-worth individuals, and also expand globally.

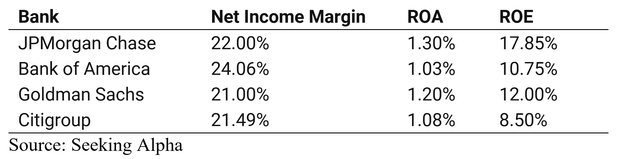

As a reflection of its differential business model, the bank enjoys far better profitability. Here is a table that compares the net income margin, ROA, and ROE of JPMorgan Chase with Bank of America (BAC), Goldman Sachs (GS), and Citigroup (C) for 2023:

As seen, JPM currently enjoys an ROA of 1.30% and an ROE of 17.85% as of its financial data provided by September 30, 2023. In comparison, other major banks’ ROE and ROA are far lower. For example, Bank of America reported an ROA of 1.03% and ROE of 10.75%. Citigroup reported a ROA of 1.08% and ROE of 8.50%. Goldman Sachs reported the second-highest ROA and ROE in this group (1.20% and 12.00%, respectively), but still below JPM by a wide gap.

Why I am concerned about over-earning

Now, the negatives. The biggest concern in my mind is that JPM might be over-earning now. According to this CNBC report, its CEO Jamie Dimon himself acknowledged that the bank was “over-earning” on net interest income and “below normal” credit costs. I totally share the same point of view and am concerned that both factors could normalize over time. For example, during the last earnings call, Dimon cautioned investors while American consumers and businesses were healthy, households were spending down cash balances. I am concerned that all these trends he mentioned could reverse course. Consumer spending could contract once households spend down their cash reserve (probably more quickly than anticipated due to the persisting inflation).

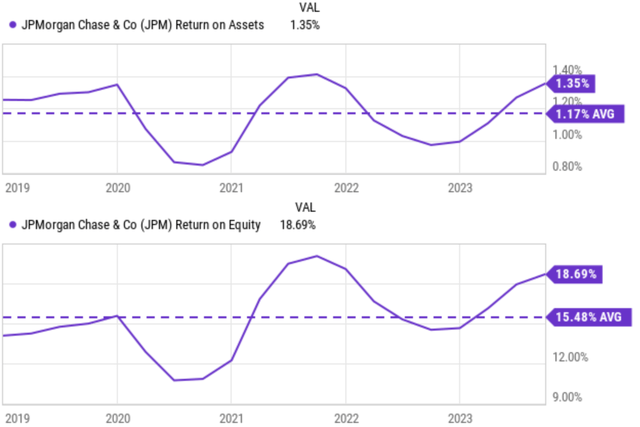

However, it is difficult to estimate the degree of over-earning. As a very crude estimate, I will just use the comparison of its current ROE and ROA against its long-term average. As seen in the chart below, in comparison to its own historical averages in the past 5 years, JPM’s current ROA and ROE are above its historical averages by 15% (in terms of ROA) and 20% (in terms of ROE). I feel that under current conditions, it is a better idea to be conservative and use its historical average profitability to model its future earnings powers.

Valuation is at a premium

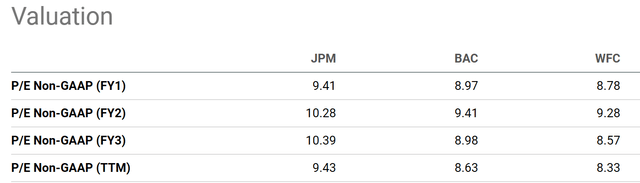

In addition to the concern of over-earning, JPM is also trading at a valuation premium in my view. When compared to its peers as seen in the chart below, JPM’s P/E ratio of 9.4x (on an FY1 basis) is higher than its close peers like BAC and Wells Fargo (WFC) by 5~7%, a small margin.

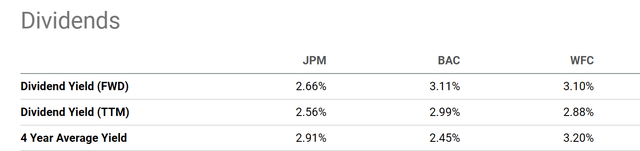

However, when evaluated in dividend yields, the premium is much larger. The following table shows the dividend yield of JPM compared with BAC and WFC. As seen, JPM’s current dividend yield is 2.66% on a FWD basis. Compared to its average yield of 2.91% in the last four years, this implies a valuation premium of about 9%.

In contrast, both BAC and WFC’s current yields are either higher than or close to their four-year averages. To wit, BAC’s current yield is 27% above its 4-year average, implying a large valuation discount. WFC’s current yield of 3.1% is very close to its 4-year average of 3.2% (within 3%).

Other risks and final thoughts

Besides the above considerations, another key uncertainty that I see is the rise of substitute products, such as new payment services and peer-to-peer lending. Note that uncertainty here does not imply downside risk only. It could be an upside for JPM. Such substitute products continue to threaten many traditional financial services, including many of JPM’s services and products. However, JPM has allocated considerable investments to modernize its technology and develop innovative digital solutions. At the same time, JPM also actively collaborates with FinTech startups to leverage their agility and disruptive technologies. These efforts should help JPM adapt to the evolving financial landscape and mitigate the downside risks.

To reiterate, my thesis is NOT to argue that JPM is a bad bank stock. My thesis is to analyze the conflicting forces beneath the stock under current conditions. I see both positive catalysts (differentiating business model and superb profitability) and negative catalysts (the possibility of over-earning and premium valuation) for JPMorgan Chase & Co. stock. Due to these conflicts, I do not see a clear direction of its total potential in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.