Summary:

- JPMorgan Chase & Co., the world’s largest bank by market cap, boasts a $600 billion valuation and is on track for a $1 trillion valuation.

- The bank reported 3Q net income exceeding $50 billion annually and maintains a strong CET1 capital ratio of 15.3%.

- Shareholder returns are robust, with $3.6 billion in dividends and significant share repurchases, contributing to a 6% annual return.

- The main risk is increased competition from new banks offering higher interest rates, potentially impacting JPMorgan’s growth.

winhorse

JPMorgan Chase & Co. (NYSE:JPM) is the largest bank in the world, by market cap, with a market cap around $600 billion as the company continues to hit all-time highs. As we’ll see throughout this article, the company’s impressive portfolio of assets, strong execution, and reliability, make the company a valuable investment as it moves towards a $1 trillion valuation.

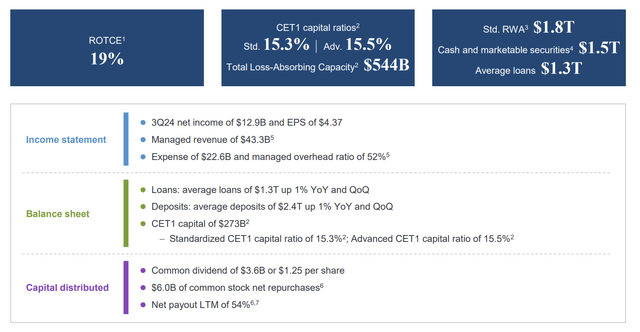

JPMorgan Chase 3Q Highlights

JPMorgan recently announced Q3 results, with annualized net income past $50 billion and annualized EPS at more than $17.

JPMorgan Chase Investor Presentation

The company continues to manage expenses of almost $23 billion and the company has loans of $1.3 trillion. Those loans increased up 1% YoY and QoQ and the company’s deposits are $2.4 trillion. The company’s CET1 capital is $273 billion, which is a 15.3% ratio that it can comfortably afford, one of the strongest ratios among large banks.

The company has continued to drive shareholder returns with $3.6 billion of dividends, a more than 2% dividend yield, along with lofty share repurchases that add roughly 4% to annual shareholder returns. The company’s payout ratio of 54% is one that it can comfortably afford. The company is driving both shareholder returns.

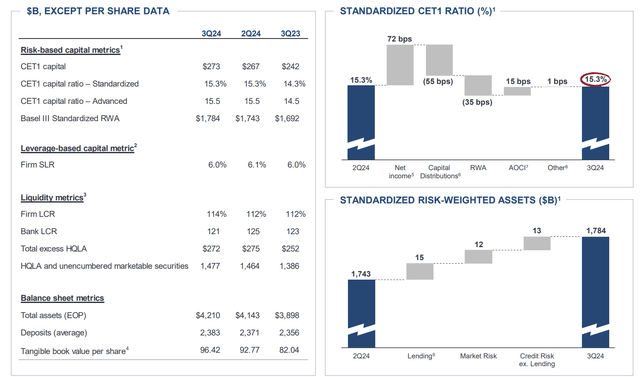

JPMorgan Chase Balance Sheet

The company’s balance sheet shows its fortress balance sheet as a bank, as it maintains one of the highest ratios.

JPMorgan Chase Investor Presentation

The company has CET1 capital, with just over $270 billion of capital. The company’s ratio is 15.3% and the company has plenty of liquidity. The company’s risk weighted assets are $1.8 trillion, which indicates that it can handle a substantial downturn. The company continues to be able to drive substantial capital distributions from its net income.

The company’s financial position enables high single-digit annual shareholder returns. In fact, the company’s financial strength enabled it to swoop in and acquire First Republic in the 2023 banking uncertainty, gaining strong assets and EPS growth at minimal cost, with FDIC support. No other major bank has the same strength and staying power.

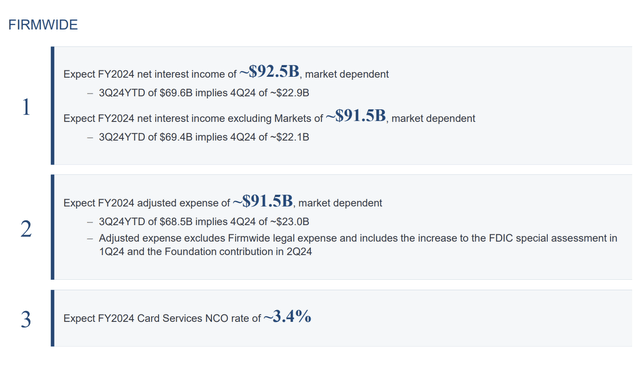

JPMorgan Chase Growth Potential

JPMorgan’s immense size and stable position in the largest economy on the planet enables it to have continued growth potential.

JPMorgan Chase Investor Presentation

The company expects FY24 net interest income of $92.5 billion, with $22.9 billion implied for 4Q 2024. Expenses are expected to come in just a hair under that, with other revenue providing the company’s profit. The company’s card services NCO rate of 3.4% is more than manageable in a high-interest rate environment and shows how the company continues to run a tight ship.

The company’s non-interest revenue is almost as high as its net-interest income, enabling substantial continued profits. The company’s stability means it does trade at a premium, but it does provide substantial resiliency in a downturn. The company has almost $100 in tangible book value per share, up $14 YoY to $96.

That’s substantial growth given the company’s P/B of >2, growth that will enable the company to move towards a $1 trillion valuation as its book value continues to grow. The company has seen total assets increased by almost 10% YOY, while deposits have remained roughly steady despite the company paying out a lower interest rate than many small banks.

As the FED moves to lower rates, that will decrease this source of risk for the company.

Thesis Risk

The largest risk to our thesis is that banking is a competitive industry. The banking industry has the influx of new banks with higher interest rates, such as Robinhood (HOOD) which offers >5% on savings. That could cause bank users to reallocate to plenty of other banks, which hurts JPMorgan’s growth rates over the long run.

Conclusion

JPMorgan Chase is the strongest bank in the country, as evidenced through the company’s rescue of First Republic. It’s provided the company with a strong source of assets and net income growth, with minimal risk. At the same time, the company continues to operate from a position of strength, with minimal charge-offs, and continued net income and book value growth.

At the same time, JPMorgan Chase has gotten past most of the major risks it faced, stepping in during the 2023 banking crisis, and handling low savings rates to customers as the FED raised rates. Now that the FED has begun to decline rates, we see the worst as being over for the company. We expect the company to generate strong cash flow and returns going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.