Summary:

- JPMorgan delivered yet another all-around beat on Q4 earnings day, the eighth since the start of the COVID-19 crisis.

- The results were generally satisfactory, as interest margins widened. But the market environment and macroeconomic outlook can be concerning.

- The richer multiples are properly justified by JPMorgan’s consistently strong execution and the more balanced mix of revenues.

Andrew Burton/Getty Images News

JPMorgan (NYSE:JPM) delivered yet another all-around earnings beat on Friday, Jan. 13 — the 12th in the past 20 quarters and the eighth since the start of the COVID-19 crisis, 12 periods ago. Revenue growth of almost 18% and 46 cents in EPS above expectations, at face value, should have pushed the stock higher on Friday, but the opposite ended up happening in early trading.

Let’s review below the good (most of it) and the bad (some of it) in JPMorgan’s earnings print. We will wrap things up by revisiting the stock and discussing whether it makes sense to own it at current levels.

What worked well

Directionally, there wasn’t much about JPMorgan’s numbers that should have surprised investors and analysts. At a broad theme level, an environment of higher interest rates helped the bank on the consumer and commercial sides as interest margins widened but hurt the investment banking sub-segment.

What counted in favor of JPMorgan, in my view, was the company’s diversified business model and superior execution. I have made the argument many times on Seeking Alpha that JPMorgan stands out as a best-in-class bank that not only rides the macroeconomic and sector trends but also delivers results that are very often better than its peers’ performance.

Diversification, for example, is what largely insulated the bank from a sharp decline in investment banking activity — Wall Street’s black eye in late 2022. Although JPMorgan’s banking fees plunged by an astounding 58% YOY, even worse than the 47% decline seen in Q3, sub-segment revenues of $1.7 billion accounted for only 13% of CIB (corporate and investment bank) segment revenues and a mere 5% of the company’s top line.

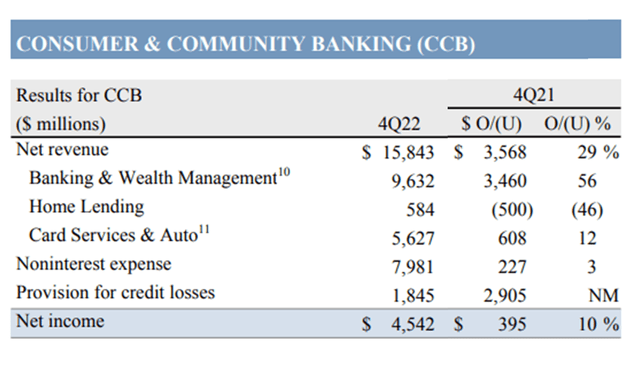

Consumer banking and wealth management, representing a sizable 28% of total revenues, were a key highlight in Q4. The business grew by a whopping 56% YOY, driven by the favorable interest rate environment. For comparison, Wells Fargo’s (WFC) consumer and small business banking grew by a more modest 36% in the period, while Citigroup’s (C) personal banking and wealth management division climbed by a much less impressive 5% YOY.

JPMorgan’s IR page

While many managers in the banking space like to argue that decreasing interest rates do not necessarily spell trouble for their financial results, JPMorgan was clearly competent at capitalizing when rates moved in the opposite direction. A similar phenomenon could be observed on the commercial banking side, with revenues that accounted for one-tenth of the total company’s top line growing by 30% in Q4.

Regarding execution, non-interest expenses that grew at 6% YOY, below the inflation rate, caught my attention. While JPMorgan cited lower legal expenses as a positive, I believe that tighter cost management (think of the few rounds of layoffs announced by some of the largest banks lately) could be playing a role in creating operating leverage as well. I expect to see the trend continue in what many forecast to be a challenging 2023.

Lastly, investors may have felt good about share buybacks that are expected to restart in 2023, as previously hinted at by JPMorgan’s executive team. During the earnings call, CFO Jeremy Barnum cited a high-level target of $12 billion in repurchases this year, which may have helped to turn bearishness into bullishness towards JPM during the trading session.

What could be concerning

Having said the above, JPMorgan’s earnings print was not flawless. For starters, and as previously mentioned, investment banking took a sizable hit primarily due to a deteriorating market environment and higher interest rates — although Jamie Dimon & Co. claim that JPMorgan remained the industry leader. Banking is unlikely to recover very quickly, in my view.

Also, additional provisions for credit losses looked particularly rich this quarter. On the consumer side, $1.8 billion vs. $529 million last quarter and a release of over $1 billion this time last year put quite a bit of pressure on segment profits, which managed to climb only 10% YOY against revenue growth of 29% (see table above). The story was not much different on the commercial side.

These numbers alone do not represent much, other than bottom-line headwinds that are confined to the quarterly results. But more concerning, they seem to represent a more downbeat view of the global economy, which can be seen when we contrast CEO Jamie Dimon’s narrative about the macro landscape in Q3 compared to Q4 (pay attention to the tone, as the difference can be subtle):

- Q3: “In the U.S., consumers continue to spend with solid balance sheets, job openings are plentiful, and businesses remain healthy. However, there are significant headwinds immediately in front of us […]. While we are hoping for the best, we always remain vigilant and are prepared for bad outcomes.”

- Q4: “The U.S. economy currently remains strong with consumers still spending excess cash and businesses healthy. However, we still do not know the ultimate effect of the (many) headwinds. We remain vigilant and are prepared for whatever happens.”

The slight pivot from cautiously optimistic to outright cautious could be reflected in consumer loan balances that continue to rise, signaling consumer balance sheets that are not quite as robust now as they were earlier last year and before. JPMorgan’s card service loans, the largest subcategory within the consumer segment, spiked by 20% YOY and 9% sequentially to $185 billion.

JPM remains a solid banking pick

At the end of the day, I think that JPMorgan’s Q4 results were solid. The stock could have a hard time climbing much further from here, considering (1) some level of uncertainty regarding the state of the global economy in 2023, and (2) the fact that JPM is up 37% since the end of Q3 last year — which, granted, at least bodes well for momentum.

However, I’m much more of an investor concerned about portfolio diversification across high-quality stocks than I’m a short-term trader. Given a longer time horizon, I think it makes sense to own the equity of a high-performing bank like JPMorgan.

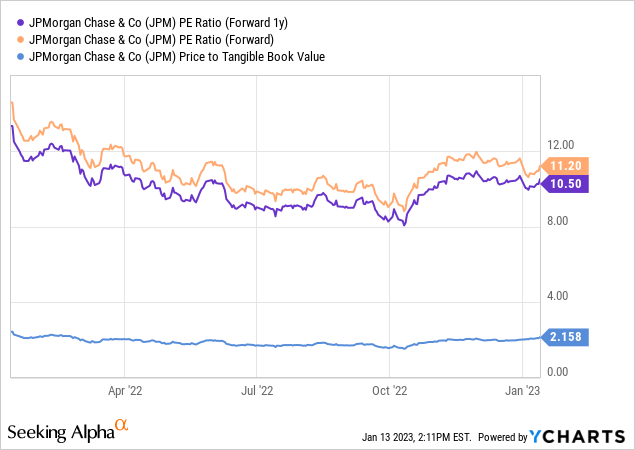

Valuations are not necessarily cheap (see the chart above), whether compared to recent history or to what I perceive to be lower-quality alternatives in the sector, like C or WFC. But I believe that the richer multiples are properly justified by JPMorgan’s consistently strong execution and the more balanced mix of revenues.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JPM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.