JPMorgan Earnings Preview: 2024 Will Be A Tough Compare Against 2023

Summary:

- Sell-side consensus as of today’s expects flat EPS growth in 2024 and 2025, while the stock sports a 13x and 12x multiple coming into Friday’s April 12th, 2024 earnings release.

- The book value (BV) and tangible book value (TBV) valuations on JPM are 1.9x and 2.32x (stock trading around $200) which are the highest BV and TBV valuations of the big banks.

- JPM recently boosted their dividend and looks like it is buying back stock again, so that could help Q1 ’24.

subman

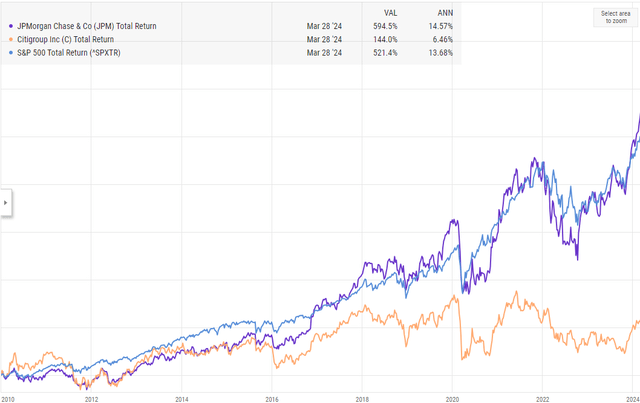

Last night, the Citigroup (C) earnings preview was written and comparing Citi to JPMorgan (NYSE:JPM), it’s interesting to see the difference between the two banking giants within the same sector: Citi has had little to no earnings growth, the valuation is all about the discount to book value and tangible book value, the historical ROE on Citi is mid-single digits, well below its peers, the stock has been stuck in the doldrums for years, and has greatly underperformed the S&P 500 for long time periods, particularly after 2008.

JPM, on the other hand, has been the mark of organizational stability, has (without argument) had the top CEO in the banking business the last 10-15 years in Jamie Dimon, since 2010 JPM has averaged 18% EPS growth per year, and has consistently generated return on tangible common equity in the mid-teens or higher.

Still, in investing, you can make a good case that Citi is the better stock (based on its valuation and potential for upside), even though JPM is by far the better bank.

The risk in JPMorgan at this point is execution: sell-side consensus as of today expects flat EPS growth in 2024 and 2025, while the stock sports a 13x and 12x multiple coming into Friday’s April 12th, 2024 earnings release.

The book value (BV) and tangible book value (TBV) valuations on JPM are 1.9x and 2.32x (stock trading around $200) which are the highest BV and TBV valuations of the big banks.

JPM recently boosted their dividend and looks like it is buying back stock again, so that could help Q1 ’24.

The big plus to 2023 (in my opinion) was JPMorgan acquiring First Republic (OTC:FRCB) via a special auction in May ’23, which was substantially accretive to JPMorgan and is expected to add $500 million a year to JPMorgan’s bottom line.

(Based on share count outstanding as of 12/31/23, and if my math is right, that’s equivalent to an additional $0.17 a share per year in EPS for JPM, just from First Republic.)

Performance:

Benchmarking JPM for the last 13 years vs. the S&P 500 as of 3/31/24, JPMorgan’s stock has outperformed the S&P 500 for the last 13 years by just under 100 bps per year.

JPM has been a top 10 holding for clients for most of the last decade and the current one. (Lowest cost basis is $35 per share.)

Summary/conclusion: Coming into Friday morning’s earnings release for Q1 ’24, watch the Corporate and Investment Bank (CIB), which was 27% of total net revenue and operating income as of 12/31/23.

Corporate bond issuance has been setting records in Q1 ’24 given how tight corporate high-yield and corporate high-grade credit spreads have been in the last few years.

After the robust Covid years in 2021, CIB’s growth slowed within JPMorgan, but with bond issuance and a potential return of the IPO market, investors might see some upside from the bank segment.

Expect credit quality to be solid, (written about last night with Citi). Jamie is pretty conservative with loan-loss reserves, and he’s actually been beefing up the bank’s reserves during 2022 and 2023, so that may taper this year.

Jamie did say in 2022, if the national unemployment rate reaches 6%, JPM may need to add $4-6 billion in LLRs (loan loss reserves) for that type of economy. If nothing else, the pace of LLRs can be slowed given the remarkable strength in the US economy.

JPM guided to NII (net interest income) of $88 billion in calendar ’24. Given the stability of interest rates, you’d think that would be an easy reach in Q1 ’24.

Corporate loans have been growing mid-single digits: again, given the strength of the US economy, there is no reason to think that figure won’t be reached.

Here’s the issue:

- 2023 EPS actual: $15.84 (32% YoY growth)

- 2024 EPS estimate: $15.91 (0% YoY growth expected)

- 2025 EPS estimate: $16.31 (3% YoY EPS growth expected)

2024 is a tough compare, but if the investment bank business improves and the rest of the business holds serve, and there doesn’t appear to be any credit issues on the horizon, (given US employment), $15.91 will likely be a conservative EPS estimate this year.

Ultimately, I think JPM can earn $20 in EPS in the forward years, but the stock rarely looks good on traditional bank valuation metrics.

Dr. David Kelly, JPMorgan’s Chief Global Strategist, may have had the best summary description of the US economy earlier this year when he said that – as far as he can tell from the JPM research work – there are no structural imbalances or excesses that could disrupt the US economy at this time. Presumably he was talking about the late 1990s technology and large-cap growth bubble, or the mortgage/housing crisis in 2008. Everyone has their eye on the commercial real estate and CMBS issues, but so far, that doesn’t look “systemic”.

JPMorgan is stretched technically: the stock has run from $100 in mid-2022 to close to $200 in early April ’24. That’s quite a rally in 21 months.

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal even for short periods of time. Markets are volatile and can change quickly. All EPS and revenue data sourced from LSEG.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.