Summary:

- The Corporate & Investment Bank division faces easier comps in 2023.

- Per one sell-side firm $10 bn of share repos are expected in 2023 thanks to improvement in capital ratios.

- The dividend has been kept stable at $1 per share for 7 consecutive quarters.

- The question remains (and more clarity will come with Q1 2023 results), but how much in deposit migration did JPM benefit from SVB, and what are the lurking risks ?

- Fair value on JPM approximately $150 – $165, making stock about 20% too cheap.

subman

JPMorgan Chase & Co (NYSE:JPM) probably the premier US and even global bank in the world today, reports their Q1 2023 financial results before the opening bell on Friday, April 14th, 2023.

Frankly, the earnings preview really doesn’t require a “War & Peace” analysis since so much of 2022’s bad news was driven by the operating profit segment at the Corporate & Investment Bank (CIB) part of JP Morgan, which segment has averaged 39% of JPM’s total net revenue and 43% of net income the last 8 quarters.

It shouldn’t take readers too much insight to figure that the CIB was a huge driver of JPM’s profitability during late 2020 and 2021, given the zero interest rates, the IPO activity, the debt issuance volumes and generally very liquid nature of the capital markets.

2022 put an end to all that (as was expected). Here’s a table showing the year-over-year (y.y) growth of CIB revenue and net income for 2022:

| Q4 ’22 | Q3 ’22 | Q2 ’22 | Q1 ’22 | |

| net rev go | -9% | -14% | -10% | -7% |

| net inc gro | -27% | -37% | -26% | -26% |

Source: JPM’s earnings release detail

Now the good news for shareholders, and readers, is that JPM starts lapping these ugly comp’s in Q1 2023 and throughout the rest of the year, so even a modest rebound in capital market activity will help the overall results.

If in 2023, the CIB segment revenue is just flat to +low-single-digit growth, even that slow growth should lever to CIB’s bottom-line and start contributing to overall EPS in 2023.

Capital:

Jamie Dimon has been vocal about some of the capital stress tests and other measures of “capital adequacy” for the big banks, but improvement in some key capital ratios at JPMorgan, had the sell-side analysts expecting a fairly sizable stock repurchase plan for 2023, up to $10 billion in size.

The dividend has been maintained at $1 for 7 consecutive quarters, which may be one indication that the bank is favoring share repurchases over dividend distributions, but I also can’t help but wonder if post Silicon Valley Bank, JPMorgan may take a more conservative view of both forms of capital return.

EPS and revenue estimates:

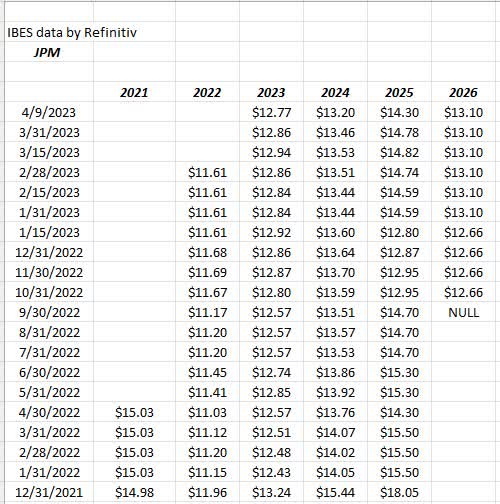

JPM EPS estimate revision trends (IBES data by Refinitiv )

JPM’s 2023 EPS estimate was firm through most the 4th quarter of 2022 and early 2023 but has now weakened a little post Silicon Valley Bank.

JP Morgan revenue estimate trends (IBES data by Refinitiv )

Revenue estimates for 2023 and 2024 have been firmer over the last 15 months, probably due to increasing estimates on net interest income (NII).

(One note of clarification: the 2021 and 2022 EPS and revenue final are not “actual” EPS and revenue prints. Once the 4th quarter of each year are released, the estimates are NOT converted to actual on the excel add-in, but are found on the valuation spreadsheet.)

Here’s JPM’s recent y.y EPS and revenue growth history for 2021 – 2023 (estimated) just so readers can see the volatility:

| calendar year EPS / rev growth | EPS gro | Rev gro |

| 2023 | +7% est | +9% est |

| 2022 | -22% | +7% |

| 2021 | +73% | +1% |

Summary / conclusion:

JPMorgan printed $15.33 in EPS in 2021, which was the high water mark, and the stock hit $175 – $177 per share in late 2021 as well.

Fair value for JPM (per Morningstar) is thought to be $146 per share, while this blog’s internal model puts “fair value” (based on a modified “price-to-book / ROE” valuation) around $162 – $165.

JP Morgan actually saw PE expansion in 2022 rising from 9x at the end of 2021, to 12x at the of 2022, despite the sharp decline in EPS in 2022.

One of the big advantages of owning JPMorgan, versus say a Goldman Sachs (GS) is the EPS delta shareholders get with just a normal healthy capital market environment, surrounded by the more stable operations of a traditional mainstream consumer and commercial bank.

If you want pure, unabashed, “beta” buy Goldman’s stock, but if you want risk-adjusted return, I’ve always preferred JPMorgan, even more so than Bank of America.

That being said, Silicon Valley Bank and now the Fed data on Friday, April 7th, 2023, showing a $105 billion credit contraction, could throw a wrench into what was expected for JPM and the big banks to be deposit beneficiaries of regional banks after Silicon Valley Bank’s collapse.

It still shocks me today how so many opinions are or were proffered on CNBC – said with absolute certainty – about who the winners and losers will be post SVB. It’s natural to assume corporations with uninsured deposits will want to seek out the safety and security of the larger banks with their post-2008 capital reforms, and that’s probably the case, but I’m expecting Q1 ’23 bank conference call commentaries to be quite informative and probably hold a surprise or two.

JPMorgan will likely be a winner in the deposit migration game, but let’s see what else is hiding in plain sight. The regulators and Congress are inflamed again, and I wonder if that could curtail share repurchases and dividend distributions even further.

(JPM has been a “top 10” client position for several years, and remains that way today, although rankings can change at any time, without the positions being updated.)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.