Summary:

- Sell-side consensus for JPM specifically is expecting $4.01 in EPS on $41.6 billion in revenue for expected y-o-y growth of -7% and +2% respectively.

- Last quarter, Q2 ’24, EPS grew +1% y-o-y, on +18% net revenue growth, but the quarter was muddled thanks to the substantial Visa non-operating gain.

- ROTCE continues to print high teens and low 20% range, best in class for the big banks.

subman

Given the economic backdrop being faced by the banks, it’s hard to envision that the large-cap banks won’t have another decent quarter in Q3 ’24.

It was surprising when compiling the weekly S&P 500 earnings update last week, to note that the financial sector is only expecting 2% EPS growth for Q3 ’24, on an approximate 4-5% revenue growth for the same quarter.

Sell-side consensus for JPMorgan (NYSE:JPM) specifically is expecting $4.01 in EPS on $41.6 billion in revenue for expected y-o-y growth of -7% and +2% respectively.

Last quarter, Q2 ’24, EPS grew +1% y-o-y, on +18% net revenue growth, but the quarter was muddled thanks to the substantial Visa (V) non-operating gain. ROTCE continues to print high teens and low 20% range, best in class for the big banks.

Capital market activity should be decent for Q3 ’24. The Corporate & Investment Bank (CIB) segment of JPMorgan is 35% of net revenue and represented 32% of segment net income as of the June 30 ’24 quarter, but net revenue and net income grew 44% and 43% respectively for the investment bank, the best y-o-y growth since – well – probably 2020 and 2021, although my y-o-y data doesn’t go back that far. Either way, it was the strongest y-o-y growth in 3 years.

Credit also looks to be in good shape. Consumer credit, like credit cards, are ticking up slightly, but the appreciation in home prices has undoubtedly helped consumer balance sheets. The traditional home, auto, and credit card charge-off data is not yet setting off alarm bells.

JPMorgan has been averaging 17-22% ROTCE (return on tangible common equity) for the last 5-6 quarters.

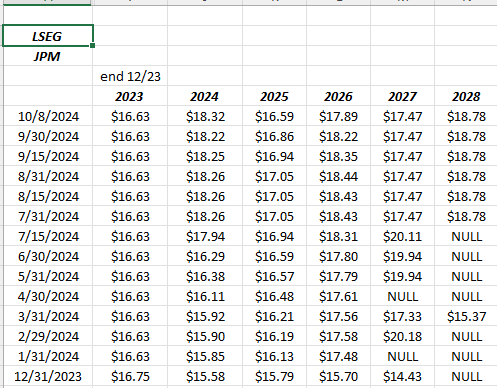

Estimate revisions:

JPM’s 2024 EPS estimate revision has been revised higher by 18% since 12/31/23 and 12.5% since June 30, ’24.

In calendar ’23, JPMorgan grew EPS +32% and net revenue +23%, so expectations were quite low for JPM coming into ’24. In fact, the sell-side consensus was expecting -2% net revenue growth and -8% EPS growth for ’24, as late as Q3 ’23. Today, the full-year ’24 “expected” EPS and net revenue growth for JPMorgan is +15% and +9% respectively.

Part of the EPS growth has been fueled by JPM’s share repurchases which has increased to $5.3 billion in Q2 ’24 from $2.8 billion in Q1 ’24. The dividend has also increased nicely, as the risk-based capital rules were less onerous than expected. Jamie Dimon is not afraid to level criticism publicly and loudly at the regulators on their degree of oversight over bank capital.

JPMorgan (the stock) rose 29.87% in calendar ’23 and is up YTD +26.7% as of Monday night’s close.

Valuation

There is no question that JPM is one of the more highly valued stocks on a book value basis, at 1.84x book, and then 2.21x tangible book value (TBV).

On a P/E basis, the bank is trading at 12x expected EPS over the next three years, with the average EPS from ’24 to ’26 expected at 5% per year.

However, operationally, JPMorgan has always run like a Ferrari (well, maybe the London Whale wasn’t so smooth), but the bank averaged 19% EPS growth in the last decade (2010 to 2019), while this decade has been more volatile given the pandemic, but if the +15% EPS growth expected in ’24 materializes, the 2020 to 2024 “average” EPS growth will be 16%, so take the above 5% “expected” 3-year EPS growth average somewhat skeptically.

The bank has always covered all the bases, with consumer, commercial, investment banking and asset and wealth management. The fact is Jamie Dimon built a stalwart juggernaut for the better part of the last 15 years, and the EPS, revenue growth and ROTCE reflect that.

Summary/conclusion

This blog has actually been trimming small amounts of JPM since the June quarter, as the future of Jamie Dimon becomes more and more (how shall we say) opaque.

Jamie will be around for a few more years, although he’s been advertised as a potential Treasury Secretary choice, should the Republican nominee win, but even if that doesn’t happen, it’s highly likely he steps down from the CEO position in the next few years, and at the very latest, by the end of the decade.

Some companies don’t respond well to the so-called “iconic CEO” departing. Jack Welch is one example, Jeff Bezos is another example, (maybe Starbucks (SBUX) is another example) although that’s still playing out.

I’m sure Jamie Dimon has a great bench in place, and JPM will continue to be a premier money center bank, but the fact is – post-Dimon – the culture will probably change, and the bank will be different.

In 2024, the S&P 500 is scheduled to have its second year in a row of +20% returns, so it’s likely that 2025 might not be as robust for the US stock market as the last few years, so the bank could have a tougher year just on economic and market fundamentals, although that’s not yet in evidence. JPM the stock, remains a top 10 client holding.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. All EPS and revenue data is sourced from LSEG. Investing can and does involve the loss of principal, even for short periods of time.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.