Summary:

- JPMorgan is set to report their Q2 ’23 financial results on July 14th, 2023, with analysts predicting $4.00 in earnings per share on $38.86 billion in revenue.

- In Q1 ’23, JPMorgan exceeded consensus estimates on EPS and revenue by 21% and 6%, respectively, largely due to net interest income of $20.7 billion.

- The bank’s stock is currently trading at 10x expected EPS for the next 3 years, and 1.5x book value and 1.9x tangible book value.

Michael M. Santiago

JPMorgan (NYSE:JPM) reports their calendar Q2 ’23 financial results before the opening bell on Friday, July 14th, 2023, with analyst consensus currently expecting $4.00 in earnings per share on $38.86 billion in revenue for year-over-year expected growth of 45% in EPS and +23% in revenue.

Those are healthy growth rates for a bank the size of JPM, but the fact is the bank and many other financials are lapping weaker comp’s from the first and second quarters of 2022.

In Q1 ’23, JPM beat consensus estimates on EPS and revenue by 21% and 6% respectively, based partially on net interest income (NII) of $20.7 billion, while consensus was looking for $18.8 bl in NII revenue, and fee income of $17.3 billion vs the $16.6 billion consensus. Return on total-capital-employed or ROTCE for JPM was 23% in Q1 ’23, a very robust number, according to Morningstar.

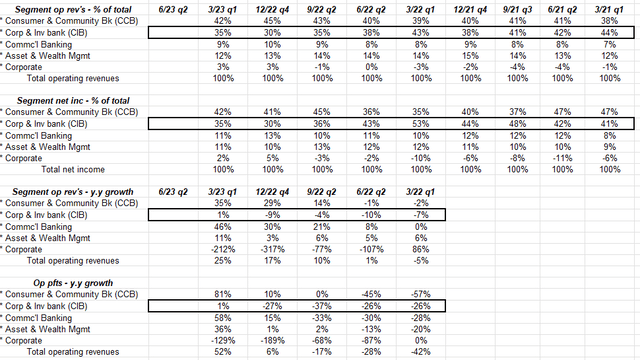

The capital markets (Corporate & Investment Bank or CIB) division of JP Morgan, which is where the earnings delta usually comes from, was 35% of total net revenue in Q1 ’23 and 35% of operating profit last quarter. The operating profit percentage over the last 8 quarters has varied from 30% in Q4 ’22, to 53% in Q1 ’22, thus readers can see the impact of the division on total results.

JPM’s Corp & Inv Bank division (JPM Earnings reports)

The point of the above table is to show readers the easier compares faced by JP Morgan’s investment bank division as we move through the 2nd half of ’23.

Valuation:

At $145 per share, what’s interesting about JP Morgan’s stock is that after the Q4 ’22 results were reported in January ’23, “consensus estimates” were looking for 8% EPS growth and 9% net revenue growth, which has since been boosted to an expectation of +22% EPS growth on +18% net revenue growth for calendar 2023 coming into calendar Q2 ’23 results.

JPM is trading at 10x expected EPS for the next 3 years, and 1.5x book value and 1.9x tangible book value. At its $172 – $173 all-time-high in October ’21, JPM was trading at 14x and 13x EPS for ’22 and ’23, and 2x book value.

There is no question the PE multiple on JPM has compressed over the last 18 months.

The one aspect to the Q1 ’23’s results that was noted was that $3 billion in stock was repurchased, but fully diluted shares outstanding changed very little, which usually tells you the repurchases were spent absorbing incentive stock options.

Conclusion / summary:

Unlike the decade of the 2000’s which saw TMT (tech/media/telecom) collapse in 2001 -2002, and it wasn’t just the stocks, it was widening credit spreads at the time as well, and then the near collapse of the banking business in 2008, despite the strict and rather onerous regulations which seems to have turned banks into regulated utilities since then, the “bigs” as they are now known, will win over the smaller, regional banks with the yield curve in the position that it’s in for the foreseeable future in this decade of the 2020’s.

Jamie Dimon, who is probably one of the top 10 CEO’s in the SP 500 if we ranked them over the last 23 years, probably regrets his “economic hurricane” comment in early 2022, but it hasn’t hurt bank results too much, and probably helped Jamie’s penchant for making economic forecasts.

As a big fan of Dr. David Kelly and JP Morgan Research, not to mention the Guide to the Market published every quarter, even David Kelly in a recent conference call (I think it was prior last week’s ADP and nonfarm payroll report) noted that “economic growth is surprisingly OK”.

While most free-market-capitalists as I think of myself typically abhor regulation of all types, the fact is JPM is poised to win in many different types of economies and market environments, and the current economy, despite the horrid consumer sentiment, and the recession calls by Wall Street investment banks over the last 18 months, just isn’t all that bad. In fact the economy is very good.

The last earnings preview written on JPMorgan in April ’23 (here) is still pretty valid, with the uncertainty caused by Silicon Valley Bank and the pressure of higher short-term rates having been alleviated by the Fed’s discount window. (With the Fed and it’s leadership having gone through 2008, the recent regional bank issues must seem quite in fact benign.)

While Morningstar’s fair value on the stock is $153 per share, with the potential for JPMorgan to eventually earn $20 per share in the next 3 – 5 years, particularly with the deposit flight from the regional banks, I still think the yield curve would need to return to a positive slope for big banks and JPMorgan to see serious PE and EPS expansion. Until there is some relief on the short end of the yield curve, the banks and financials will likely see PE compression as earnings power is built from within.

Jamie Dimon mentioned in one conference call last year that he thought if the unemployment rate went to 6%, then JP Morgan would have likely have to boost loan-loss reserves by $6 billion. The plus for the economy so far is that as banks have boosted reserves for the non-recession recession the last year, the losses of which have yet to materially increase, it just sets up the bigger banks for a bigger cushion if and when a recession does hit.

JPMorgan has been a top 10 client holding for most of the last 13 years, and the big banks are poised to outperform again in the event of softer landing and disinflation. The stock is cheaper on an absolute basis after falling from all-time-highs in late October ’21 near $173 per share, but it’s also cheaper on a relative basis as EPS estimates get boosted and the PE multiple compresses.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

JPM reports Friday, July 14 before the opening bell.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.