Summary:

- JPMorgan’s strong performance has been driven by high net interest income and a favorable interest rate environment.

- Concerns linger about future earnings due to potential decreases in net interest income, but I think their diversified revenue model and strategic investments provide optimism.

- Lower interest rates could actually benefit JPMorgan through reduced loan charge-offs and strong performance in non-lending operations, supporting the potential for an upside in the stock price.

- I think shares remain a strong buy.

JoeDunckley

Investment Thesis

JPMorgan’s (NYSE:JPM) strong performance this year has been largely driven by the company’s strong net interest income. The banking giant has largely outperformed initial earnings expectations, and this has helped power the stock higher.

Their net interest income has been supported by a highly favorable interest rate environment, where higher rates have allowed them to capitalize on their strong lending activities. Higher rates have been a critical driver for the bank to post strong earnings, which in turn has propelled their stock.

However, with expectations rising that the Fed will soon cut interest rates, there are concerns among some market participants that lower net interest income (NII) could affect the bank’s future earnings performance. CEO Jamie Dimon’s recent comments highlight a cautious outlook on the economy as a whole, with him noting the potential for economic headwinds (no soft landing) despite the current strength in the bank’s financials.

So far this year, the bank has benefited from the Federal Reserve’s decision to maintain higher interest rates, with their net interest income coming in near record levels as a result of the “higher for longer” stance adopted by the Fed. This higher for longer stance is a product of the Fed keeping rates higher in order to squash the last bits of inflation we saw in 2021 and 2022.

While the market may be more cautious on JPMorgan’s future EPS as a result of peaking NII, I still remain optimistic. I think the bank’s highly diversified revenue model allows them to weather fluctuations in interest income through investment banking, asset management, and markets, which are not nearly as sensitive to interest rate changes. The bank’s diversified revenue model is complemented by the investments in technology and organic expansion, particularly in digital banking and fintech, to help capitalize on new opportunities. Overall, JPMorgan continues to be a strong buy in my opinion. I think once the market prices in the durability of their business model, we could see shares move even higher.

Why I’m Doing Follow-Up Coverage

Since my last research piece, JPMorgan shares have risen over 18%, with dividends, reflecting the market pricing-in their strong NII performance. The nation’s largest bank by assets is capitalizing on a higher than expected interest rate environment that has extended their record earnings period on net interest income. As I touched on above, the bank’s continued focus on innovation & the strategic acquisition of First Republic last year, has also played a crucial role in this growth. The bank is in a good position to buy assets when they are distressed. This has paid off handsomely.

Under CEO Jamie Dimon, the bank has met or exceeded analyst expectations for much of the last year by expanding their client base and supporting their revenue streams in investment banking and wealth management. Both sectors have seen impressive growth, with investment banking fees up 46% year-over-year through recovery in deal-making activities.

While the bank’s performance has been robust, I think there is still potential for more upside, even as interest rates are expected to decline. This might seem counterintuitive for a bank traditionally associated with interest income from loans. But JPMorgan is no ordinary bank. They are a financial services giant. Their well-diversified business model actually benefits from a lower interest rate environment under certain conditions. As rates decrease, the bank’s trading and asset management divisions should see increased activity through investor demand for other higher-yielding assets. I’m doing this follow-up coverage to show how this is actually a good time to get in.

How Lower Interest Rates Help JPMorgan

As Federal Reserve discussions about lower interest rates intensify, JPMorgan actually is expected to benefit from a reduction in loan charge-offs. Lower interest rates generally ease the financial burden on borrowers, as the cost of servicing debt decreases. A reduction in loan rates will likely lead to a smaller default rate on JPMorgan’s loan book, as borrowers find it easier to meet their repayment obligations (assuming the economy as a whole holds up underneath).

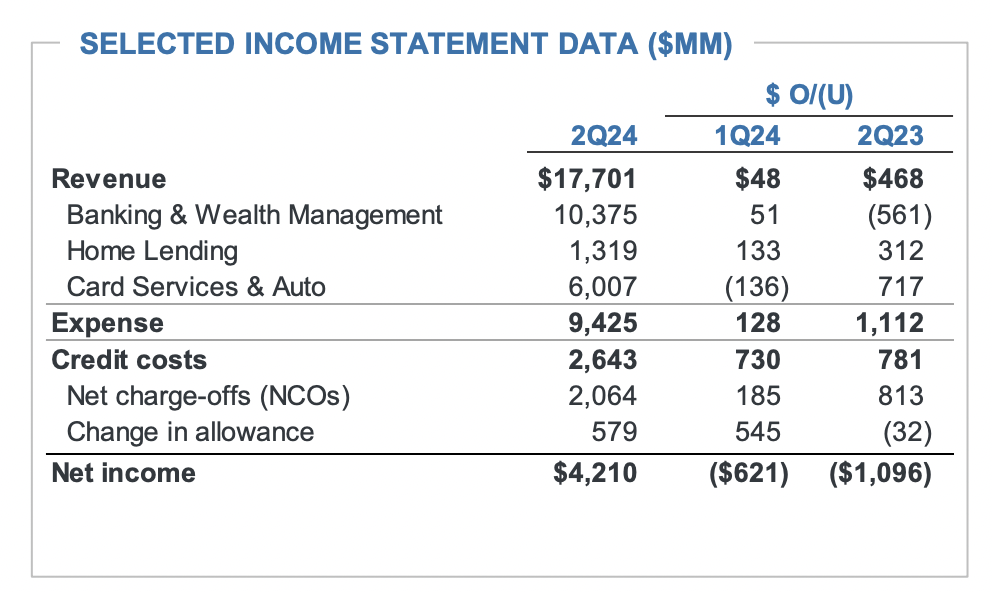

The bank had over $2 billion in loan charge-offs in Q2 this year as higher interest rates raised the default rate in their community banking loan portfolio. This is up by $813 million from the same quarter last year. Lower interest rates will help here.

Net Charge-Offs Analysis (JPMorgan)

Diving into their acquisition of First Republic Bank (which has now passed the 1-year mark), the bank has benefitted from an increase in assets, particularly in the wealth management and high-net-worth client segments, which have traditionally been strongholds for First Republic. Integrating First Republic’s high-touch, concierge-style banking services has allowed JPMorgan to attract and retain more affluent clients that lifted their client assets under management.

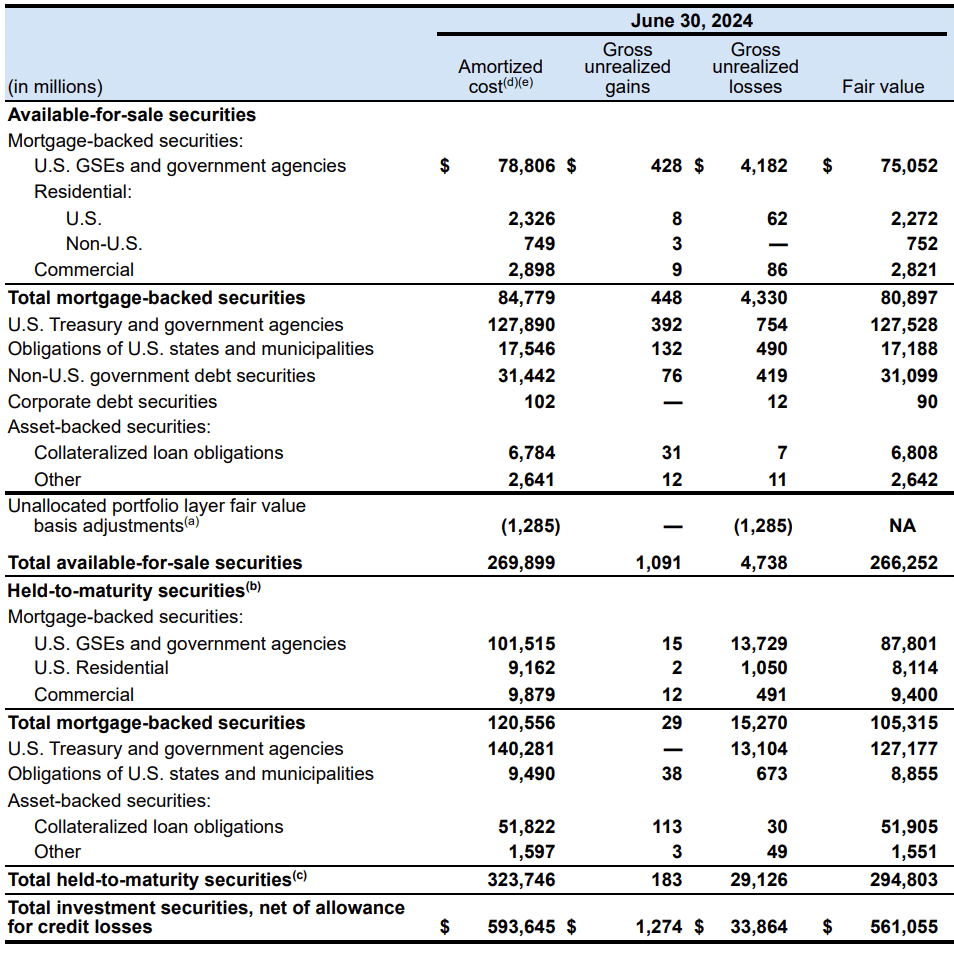

The downside has been an increase in the size of JPMorgan’s held-to-maturity (HTM) loan book. Many of the loans were acquired from First Republic and are being held to maturity (meaning their value is not immediately affected by fluctuations in market interest rates on the bank’s balance sheet). This has been a problem in a high interest environment. But it’ll be a tailwind for the bank as interest rates come down. These loans (often high-grade US Treasuries and CMBS) will trade back closer to par in a lower interest rate environment (10-Q).

HTM & AFS Loan Book (JPMorgan 10Q)

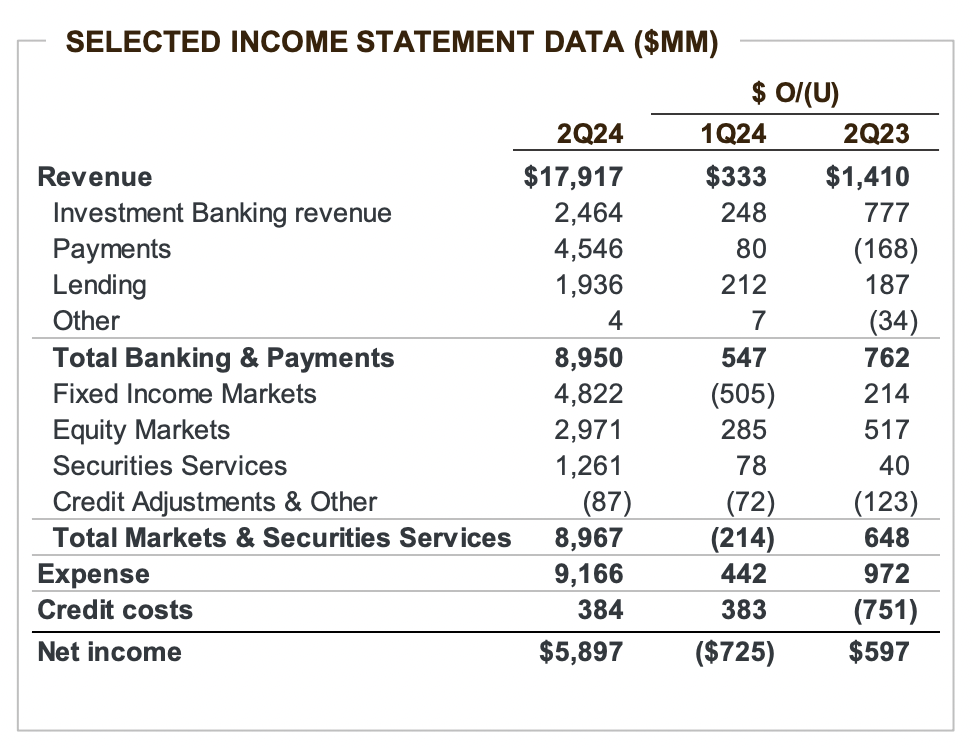

As we wait for HTM capital to get freed up for the bank to loan it back out, the bank’s markets division, which includes trading in bonds, equity markets, and equity derivatives, has seen a notable increase in activity, driving stronger revenue and net income growth. In one example, equity markets revenue surged by 21%, with the division benefiting from improved client activity

As the bank’s trading division continues to deliver robust revenue growth, these gains should provide a buffer against any compression in net interest margins that will come from a softer interest rate environment. In a lot of ways, the diversified revenue from trading and market activities serve as a real counterbalance so that the bank can maintain overall profitability even as loan margins face challenges.

Q2 Performance Data (JPMorgan)

To this point, CFO Jeremy Barnum remains optimistic about the bank’s non-lending performance during the 2Q earnings call:

In terms of the outlook, we’re pleased with both the year-on-year and sequential improvement in the quarter. We remain cautiously optimistic about the pipeline, although many of the same headwinds are still in effect. It’s also worth noting that pull-forward refinancing activity was a meaningful contributor to the strong performance in the first half of the year. Payments revenue was $4.5 billion, down 4% year-on-year, as deposit margin compression and higher deposit related client credits were largely offset by fee growth -Q2 Call.

Fee growth in markets, investment banking and other divisions is an excellent hedge. I think it’ll allow the bank to continue to excel.

Valuation

While the bank’s forward P/E ratio feels conservative given the tailwinds they have in their non-loan division, analysts share my sentiment and have been increasingly bullish, raising their forward EPS and revenue forecasts for the bank as JPMorgan continues to demonstrate solid resilience.

Despite higher expectations by analysts, JPMorgan’s P/E ratio remains roughly at the sector median, with a forward P/E of 12.23 compared to the sector median of 11.50, reflecting a modest premium of 6.43%. The market is still pricing the bank as if it were operating at roughly an average level of performance, despite robust fundamentals. The market is pricing the bank like they are just a traditional bank with a loan book.

With this, the market’s assessment underestimates JPMorgan’s diversified operations. The bank’s revenue growth is expected to be 9.59% year-over-year, higher than the sector median of 5.33% and showing no signs of slowing down even as expected rate cuts come into view. On the same note, the EPS growth rate for the next 12 months is forecasted at 12.38%, far outpacing the sector’s 4.05%.

I really think this discrepancy is powerful. The sector median bank is a loan/interest rate spread play. JPMorgan is showing on multiple fronts that they are far better than the sector median.

I think as we see the market price-in JPMorgan’s superior business model, we should see the bank’s P/E ratio expand closer to 15 times earnings to reflect how the business is more service/fee revenue driven vs. loans. If JPMorgan’s P/E ratio were to increase from the current 12.23 to 15 times forward earnings, this would represent a 22.65% increase in the stock, not including dividends.

Risk To Investment Thesis

The biggest risk, in my opinion, comes from rising loan defaults. CFO Barnum noted on their last earnings call that the bank’s loan charge-offs have moved up slightly:

In terms of credit performance this quarter, credit costs were $2.6 billion reflecting net charge-offs of $2.1 billion, up $813 million year-on-year, predominantly driven by Card, as newer vintages season and credit normalization continues. The net reserve build was $579 million, also driven by Card, due to loan growth and updates to certain macroeconomic variables -Q2 Call.

What’s key with this is that Barnum emphasized that the increase in charge-offs was in line with expectations and reflective of the ongoing credit normalization process, rather than a sign of broader credit deterioration.

I think that’s the key here. Loan charge offs are performing within expectations, which means that this helps form the base case. Outperformance from fee related businesses (payment transactions, Investment Banking, Markets, etc.) is helping the bank on the whole excel. While I think the market might see this as the bear thesis for the next 12 months, I expect management to prove them wrong.

Bottom Line

JPMorgan’s uniquely diversified business model, with its strong non-lending operations in markets, trading, and investment banking positions them well, in my opinion, even in a lower interest rate environment. Even with some likely headwinds from lower net interest income, the bank’s strong expected revenue growth, resilience in non-interest income segments, and strategic investments suggest a notable upside potential.

While it may seem backwards to invest in a bank when interest rates are expected to drop, JPMorgan Chase presents a unique exception and a solid contrarian play based on my research. The nation’s largest bank is less dependent on traditional lending compared to other banks, and more focused on revenue from markets, trading, and investment banking services (all of which do better when interest rates are low). These areas are expected to excel even as interest rates head lower, making JPMorgan a standout in the banking sector.

As rates decline, JPMorgan could benefit from reduced loan charge-offs, improving their credit quality and overall loan portfolio performance. This, coupled with strong performance in trading and investment banking, supports the case for a higher valuation with a P/E closer to 15. I think shares continue to be a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.