Summary:

- JPMorgan Chase has seen significant growth in interest income and loans, leading to impressive ROTCE, but faces risks from potential changes in interest rates.

- The Federal Reserve is expected to lower interest rates, potentially impacting JPMorgan’s net interest income and overall revenue growth.

- While JPMorgan’s diversified revenue streams may offer some resilience, the stock’s valuation and potential macroeconomic headwinds suggest it may not be a compelling investment at this time.

William Barton

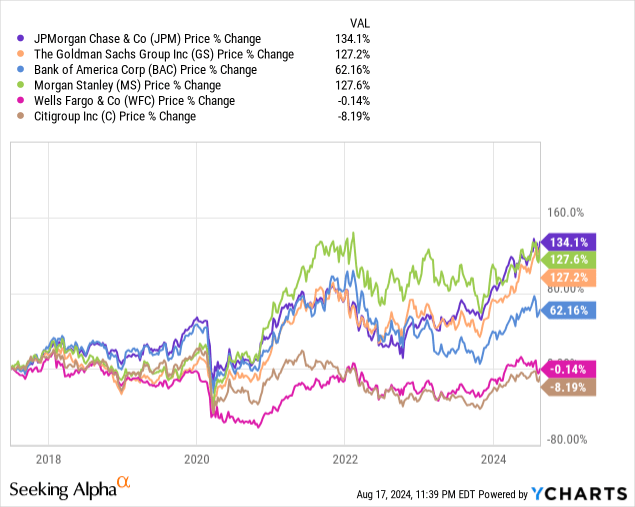

While JPMorgan Chase (NYSE:JPM) has been the best-in-class stock in the last few years, that doesn’t stop the company, especially a diversified bank, from being susceptible to changes in interest rates and the general macroeconomic environment. Hence, I think it might be time to at least trim the exposure to the banking sector, even the best and biggest winner, JPMorgan.

For the last two years, since the beginning of 2022, the banking industry has enjoyed an increase in the Fed funds interest rates from basically 0 to the current average of 5.33%. This dynamic has been the main driver for JPMorgan’s revenue increase from $102 billion at the end of 2020 to the current TTM of $161 billion. This is evidenced more clearly in the rise in net interest income at the end of 2020 from $54.4 billion to the current $92.6 billion, while non-interest revenue has risen by just $12.5 billion in the same period or around $16 billion, excluding variations from sales on securities.

The other dynamic that allowed the increase in interest income is the increase in the amount of loans that JPM now has. Combined with the First Republic acquisition, total loans have increased from $1 trillion in 2020 to $1.3 trillion in 2023. Also, credit card loans have increased in the same period from $144 billion to $211 billion, while average commercial banking loans have also increased from $219 billion to $268 billion.

The peak might be in

Those two dynamics, the increase in the amount of loans and the higher interest rates, have been essential for the bank to achieve an impressive current 20% ROTCE following the latest earnings report and 21% for the 2023 fiscal year. The ROTCE is an important measure because it shows how well an institution invests its own assets over time. In a bank, a good ROTCE is, in my opinion, around 14%, but the long-term JPM’s goal is around 17%. This is even more impressive, as the bank also has a considerable excess in HQLA of $275 billion. Those assets might not be producing the maximum returns for the bank, but instead, they help JPM to have a very strong balance sheet.

Unfortunately, the company’s CFO, Jeremy Barnum, in the most recent earnings call, has confirmed that the expected goal for JPM is still 17% and that macroeconomic headwinds or unexpected Basel III regulations would eventually lower the current exuberant numbers.

The Q2 earnings growth has stopped

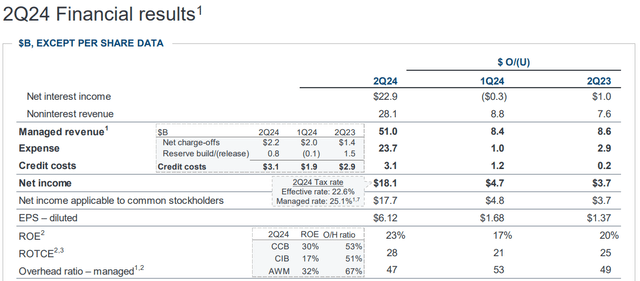

The Q2 earnings presentation has shown some important stagnation in the loan amount, especially compared with Q1 of 2024, and an increase in charge-offs compared to Q2 of 2023. For example, net interest income has barely moved while credit costs have increased. It is important to remember that JPM saw an exceptional increase in noninterest revenue due to the selling of Visa shares. That nonrecurring revenue, following the CFO, will help increase the balance sheet’s solidity.

JPM Financial Results Q2 2024 (JPMorgan)

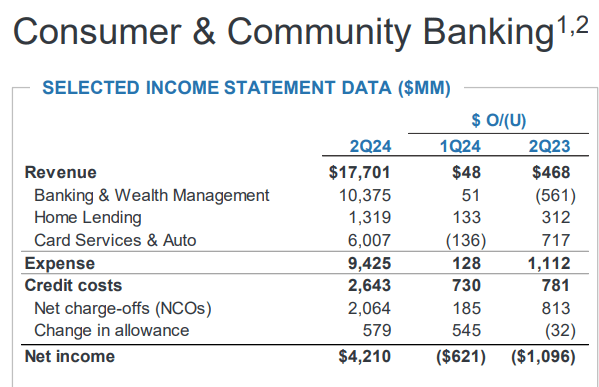

Going a little deeper, in CCB, the amount of loans is unchanged, but the credit cost is higher by more than $730 million compared to both QoQ and YoY, generating less net income. This situation helps to explain the stagnation in net interest income, a product of a lower ability to create high-quality loans at these high interest rates. This might mean, in my view, that there might be macroeconomic headwinds coming sooner rather than later.

JPMorgan CB Q2 2024 (JPMorgan)

The Federal Reserve is expected to lower interest rates

The other component, high interest rates, which have been important for the mentioned massive increase in JPMorgan’s revenues in recent years, is now at risk of getting severely trimmed. As the job market cools off with unemployment rising over 4.3%, and the inflation rate is also consistently decreasing, the Federal Reserve is seeing some pressure from the data to start cutting interest rates quite soon.

This might mean that net interest income across the board might be going to come down as new loans will be generated with lower interest rates. This includes, of course, JPMorgan’s total net interest income. This means that, eventually, we will see one of two scenarios. In the first one, in which nothing macroeconomically collapses, new loan generation could replace the interest income lost by lower interest rates. In this optimistic scenario, other variables can eventually lead to uncertainty, like deposit competition in a more stressed part of the economic cycle, lower asset prices for the stock markets, and higher net charge-offs. All of those variables could independently impact the stock price.

Now, in a bad scenario, where the Federal Reserve has to lower interest rates because something terrible happened, like a sudden unemployment increase or some sort of financial black swan, in my opinion, all the cyclical stocks might be sold quickly. This is even more so if you are exposed to the financial system and have a heavy loan exposure, like JPMorgan or any bank, for instance.

What would happen with JPM stock?

As mentioned before, I consider JPMorgan the best-in-class bank in America. Dimon’s management has been fantastic since the 2008 crisis, and the bank is now seen as the standard on Wall Street and the way to go in a crisis like what happened with the First Republic situation. Some of the specific measures the management has taken over the years have been a fortress balance sheet strategy, with tons of liquidity ready to be deployed in a financial stress scenario, an excellent capital allocation producing a great ROTCE, and great Wall Street activities execution, like trading and investment banking.

The investment banking and trading segments might show strength

Differently from any other bank in America, JPMorgan has an excellent mixture between being a more traditional bank, like Bank of America (BAC), Wells Fargo (WFC) or U.S. Bancorp (USB), and a Wall Street Bank like Goldman Sachs (GS) at the same time.

This revenue diversification is quite important because, in times when lower interest rates are projected, the bank can show some resilience due primarily to trading activities and, at some point, investment banking. For example, the bank has seen a significant 10% increase in Commercial and Investment Banking revenues from a year ago and an impressive 67% increase in net income from trading since 2019, from $14 billion to the current TTM of $24 billion.

Investment Banking specifically also saw a 46% increase YoY in the 2024 Q2, and the segment could see some resilience when interest rates come down, primarily because of the relatively low activity that the industry has seen in recent years after the 2021 IPO exuberance.

Valuation

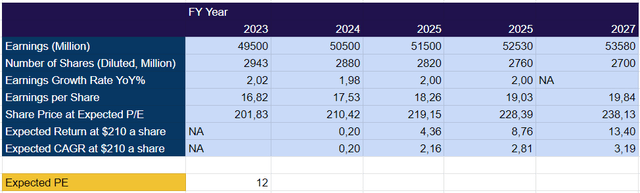

As mentioned by the CFO in the earnings call, the bank industry might begin to enter a stabilization/normalization period as lower interest rates emerge. Mr Barnum has also expressed that the revenues should go higher organically in line with GDP growth, or even slightly higher. Taking this into consideration, I provide a financial model with a slow but normalized 2% revenue growth, assuming there is not an economic collapse. The framework offers an eventual price projection for the year 2027, a total expected capital appreciation return, and a CAGR with the share price beginning at $210.

Image created by the author based on 10K projections (Author)

Additionally, to the 2% earnings growth expected from the organic GDP increase target, I also expect the bank to do around a 60 million share reduction over time to 2027. The results are quite disappointing, giving a result of a 3% CAGR from here to 2027 and with a 12 times PE ratio, which is high, in my opinion, for a company that is expected to barely grow due to lower interest rates. Compared with the usual average of 8% CAGR that a super diversified index such as the SP500 provides, JPM is not a compelling investment at this point.

This projection does not even count a really adverse macroeconomic scenario with high unemployment or a dangerous geopolitical event.

Upside risks

As mentioned many times before, JPMorgan is the best-in-class company in the diversified banking industry. For this reason alone, the company might continue to perform nicely and capitalize through a lower interest rates environment. For example, if there is a collapse in some medium-sized or regional bank, like what happened in March 2023, JPMorgan will likely come back to save the day again and get some decent assets at extremely discounted prices, like the First Republic acquisition, also referenced before.

Another upside risk that the bank could present is that the economy might continue to be so strong that when the Federal Reserve lowers interest rates, loan demand could boom. That could eventually provide enough support for the revenues to continue to grow, although it is really difficult to forecast; hence, I wouldn’t bet on that scenario happening.

Conclusion

JPMorgan is an excellent company with a fortress balance sheet and the best-proven management in the banking industry. Unfortunately, the tailwinds that have provided high returns for its shareholders are turning into headwinds for the revenues. Therefore, it is difficult to say that the stock is a buy or a hold at these richly valued multiples.

I think JPMorgan could see less volatility than other banks in a financial distress scenario. However, I still see a difficult fundamental upside for the business from here in the near to mid term, and with a fairly valued 12 PE multiple, the stock might not provide enough upside for the years to come; therefore, it is a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.