Summary:

- JPMorgan Chase & Co.’s latest earnings report showed strong results, but it was a lack of guidance change that could indicate weaker results later in the year.

- JPMorgan’s valuation doesn’t make it a screaming deal, but the long-term investor can still look to dollar-cost average into a position.

- The recent dividend increase and growing dividend over the last decade can make it a great fit for a dividend growth investor.

danielvfung

Written by Nick Ackerman.

By most standard metrics, JPMorgan Chase & Co. (NYSE:JPM) certainly isn’t the cheapest bank to invest in, but investing in the best often means you aren’t getting the cheapest. When investing in JPM, you are gaining exposure to one of the most important financial institutions in the world. Their last earnings report saw their shares slide initially, plus the overall market was pulling back, and that certainly didn’t hurt.

Since then, shares have been back on a trend higher. Seeing the shares take a decline isn’t overly surprising after it has been on such a solid rise through the start of 2024. The company’s shares were hitting up against not only its 52-week highs, but its all-time highs as well, surpassing the levels we last saw in late 2021.

They also pay a dividend, a growing dividend at that with a recent increase; as an investor who’s mostly focused on income, that makes it a great fit for my Core Portfolio. In my Core Portfolio, I target relatively larger companies that could be considered leaders in their respective industries. It also includes companies where the dividends are trending higher over the long term.

Latest Earnings And Future Potential

In the company’s latest Q1 earnings, it posted a solid beat on both the top and bottom lines. Earnings and revenue were both up solidly year-over-year, thanks in large part to First Republic.

JPM had acquired most of the “assets and assumed the deposits and certain other liabilities of First Republic Bank from the Federal FDIC” around a year ago during the mini-banking crisis.

Net income was up 6% or up 1% excluding First Republic, while net revenue was also up 8% or 4% with First Republic. Net interest income was similar, rising 11% but only up 5%, excluding First Republic.

However, despite what was positive news, the shares sold off initially, and this was in large part thanks to no change in guidance. When a company smashes earnings by a fairly wide margin but sees no material guidance lift for later in the year, it suggests that the latter parts of the year could be relatively lackluster.

In particular, the net interest income guidance saw hardly any change at all, despite the market now fully expecting fewer rate cuts. Of course, as a bank, NII is incredibly important as it is a main gauge of profitability. Roughly speaking, it is what the bank is earning in terms of its interest from its lending operations versus what it is paying out on its liabilities.

Being the behemoth bank that it is, JPM also has meaningful wealth management and investment banking that will contribute to its operations as well. NII for the quarter was $23.2 billion, while revenue was $42.5 billion – leaving roughly $19.3 billion in noninterest revenue.

Therefore, it is not as sensitive to interest rate changes as a large portion of the regional or small local banking institutions are. Still, not seeing a shift in guidance could indicate that they see weakness in the later parts of this year, where rate cuts are expected. From analysts, they have been increasing their earnings revisions higher for both 2024 and 2025

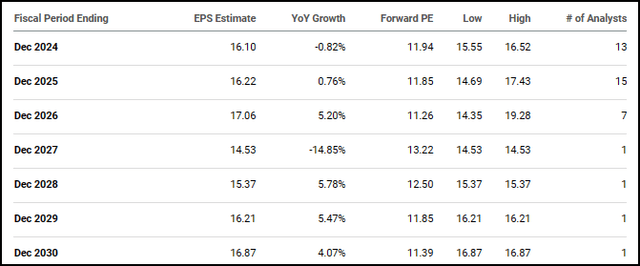

Analysts expect JPM to post $16.10 EPS for the year, which would actually be a slight decline year-over-year. That’s also even though analysts believe JPM will see revenue grow over 4% for the year.

JPM Earnings Estimates (Seeking Alpha)

Earnings posted in Q1 came in at $4.63, leaving another $11.47 EPS for the other 9 months of the year. If it came in perfectly even with each quarter – which it wouldn’t – that would be ~$3.82 EPS in each of the next three quarters. In the last three quarters of 2023, JPM posted $12.12 in EPS.

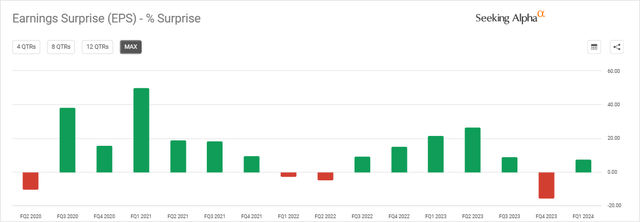

I believe this sets up JPM to probably easily clear earnings expectations, which isn’t something that is all that unexpected given the rather consistent history of being able to do so.

JPM Earnings Surprise History (Seeking Alpha)

Taking A Look At Valuation

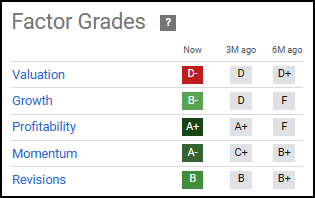

JPM has a lot of going for it, which includes potential for shareholders that invest in the company. However, valuation isn’t really one of them. Besides being at a near all-time high as being one of the clues, the factor grades also send up a red flag. The company gets a big red “D-” grade, while all the other metrics here indicate that JPM is a solid investment.

JPM Factor Grades (Seeking Alpha)

The valuation factor grades here are based off sector median grades and how rich or poor each metric looks relative to its peers in the financial sector. Now, the financial sector is incredibly diverse, and this is based on 690 peers in its sector. We know that there aren’t 690 other JPM-like institutions in the U.S. or even around the world, for that matter.

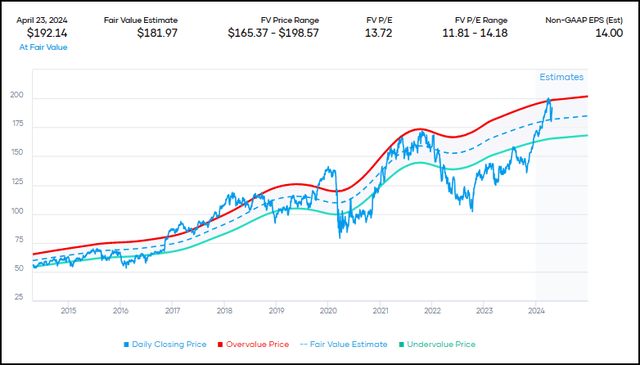

However, even relative to just itself, JPM is looking to be trading near the higher end of its historical fair value P/E range. In that way, it could be a bit better to start to try to determine an appropriate valuation.

JPM Fair Value Range (Portfolio Insight)

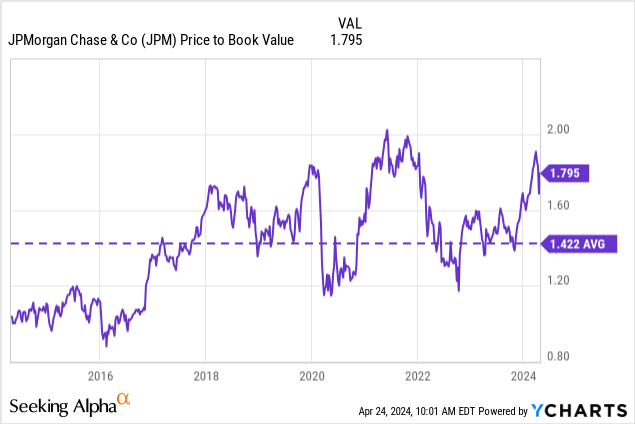

Another popular metric is the P/B for banks, which is another metric that is looking at least a bit stretched historically.

YCharts

Of course, the P/B and P/E are things that can increase over time – or at least hopefully are increasing over time. The book value per share in the latest quarter came in at $106.81, and the tangible book value per share came in at $88.43, which was up 13% and 15%, respectively.

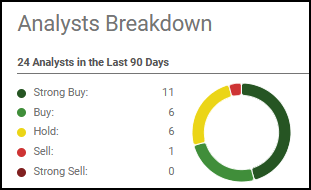

One of the few places where JPM isn’t looking too stretched is on Wall Street, where analysts overall rate JPM a “Buy” and even have most analysts in the “Strong Buy” camp.

JPM Analysts Breakdown (Seeking Alpha)

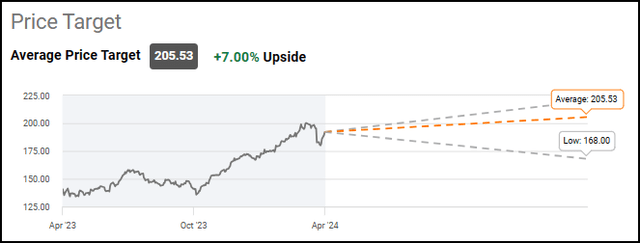

The average price target is at around $205.50 – which would be about 7% of the upside from the current levels.

JPM Price Target (Seeking Alpha)

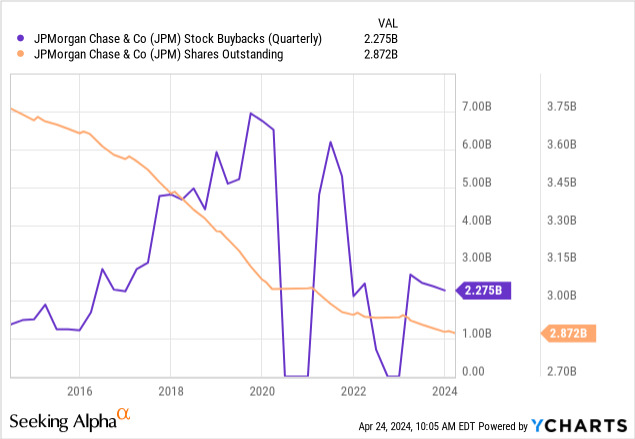

A couple of notes to add to this, though, is that share repurchases slow down book value growth but can help EPS. Over the last decade, JPM has routinely done buybacks and reduced its overall shares outstanding.

YCharts

So that’s certainly something to be aware of, but the average P/B and where it is currently trading can still be helpful to provide some overall context in terms of valuation.

One of the other areas probably worth arguing is that with the expectations that JPM can and is likely to beat earnings going forward, that also means its forward P/E would otherwise be lower than it is right now.

Dividend Bump

The latest increase was a bit of a surprise, as it was somewhat “off-schedule,” at least historically, where they had generally been increasing it starting with the Q4 payout. That is, if the Board chose to raise the dividend at all, as they were one of the banks that kept it steady in 2022. This latest increase could have been playing a bit of catchup to hold it steady, then.

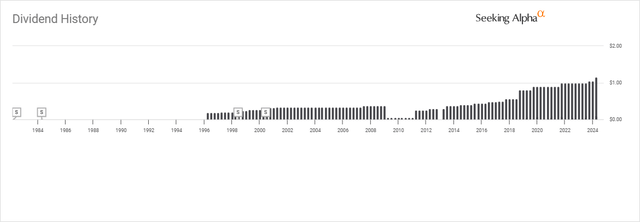

JPM Dividend History (Seeking Alpha)

That said, due to when the quarterly dividends fell, JPM could still boast 9 years of consecutive increases. That is despite the eight quarters of the dividend remaining at $1 from Q4 2021 to Q3 2023. Similarly, it was eight quarters from Q4 2019 to Q3 2021, but that was during the Covid pandemic when banks were restricted from increasing dividends.

Conclusion

JPM is a banking juggernaut that plays a huge role not only in the U.S. economy but also around the globe. It’s the largest bank in the U.S. and the fifth-largest bank in the world when it comes to total assets. JPMorgan Chase & Co. shares are not a screaming buy here, as we are near all-time highs, but a long-term investor can still potentially use a dollar-cost average approach to build out a position.

Given the attractive and growing dividend, that could be another way to slowly build a position further as well, through reinvestment of the dividend. Sometimes, paying a premium for a premium operation is okay as, over the long term, shares have a good chance of appreciating as earnings trend higher.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.