Summary:

- JPMorgan Chase only derived 55% of its Q3 2024 revenue from net interest income, making it less exposed to Fed rate cuts compared to smaller lenders.

- The bank’s series MM preferred shares have lost ground since September 2024 as expectations for interest rates have moved higher.

- I expect potential tariffs by President Trump to only boost inflation in the short term, allowing the Fed to reach its neutral rate by the end of 2026.

- An attractive current yield and some capital appreciation potential should allow investors to attain a very low double-digit total return by the end of 2026.

- Along with the size and effect of new tariffs, a key risk to consider is the uncertain relationship between Fed rate cuts and preferred stock prices.

designer491

Introduction

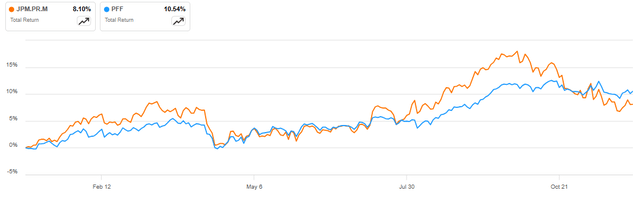

JPMorgan Chase’s 4.2% fixed rate preferred shares (NYSE:JPM.PR.M) have marginally underperformed the iShares Preferred and Income Securities ETF (PFF) so far in 2024, delivering a ~8% total return against the ~11% gain for the broad preferred and hybrid securities ETF:

JPM.PR.M vs PFF in 2024 (Seeking Alpha)

I also covered the preferred shares in June 2024 arguing they provided potentially higher total return potential relative to the bank’s common shares against the backdrop of Fed rate cuts.

As expected, since then, there has been little change in the safety profile of the preferred shares, which remains very robust. The outlook for Fed policy has turned more restrictive for 2025 as economists digest the potential size and impact of tariffs by the Trump administration. Ultimately though I expect any effect to be short-lived, with the Fed eventually reaching a neutral stance by the end of 2026.

This should allow the series MM preferred shares to deliver an annualized return of about 10.7% over the next two years, driven by a combination of capital appreciation and dividends. As such, I confirm my Buy rating for the series MM preferred shares.

Company Overview

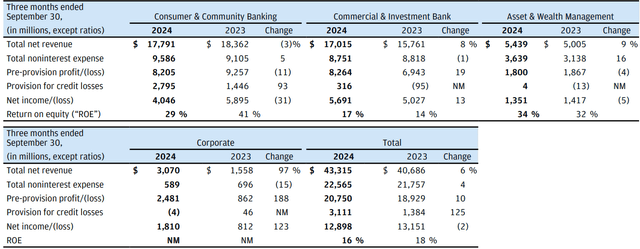

You can access all JPMorgan Chase results here. The largest US bank reports results in four main segments, Consumer & Community Banking at 41% of Q3 2024 revenue, Commercial & Investment Bank at 39%, Asset & Wealth Management at 13%, and Corporate at 7% of Q3 2024 revenue:

Segment results overview (JPMorgan Chase Form 10-Q for Q3 2024)

The bank generated 55% of its Q3 2024 revenue from net interest income (NII) leaving a 45% contribution for noninterest revenue. This makes JPMorgan one of the banks relatively less exposed to Fed rate cuts, as opposed to smaller lenders that are typically more dependent on NII.

Safety of preferred distributions

In Q3 2024 JPMorgan paid $286 million in preferred stock dividends, representing just 2.2% of its quarterly net income. Furthermore, the bank had $21.6 billion in cumulative preferred shares outstanding which are covered by stockholders’ equity of $345.8 billion, almost 16 times. As such, I deem the bank’s preferred shares some of the safest preferred issues you can buy, with ample margin of safety both in terms of earnings as well as stockholders’ equity.

The bank’s CET1 ratio of 15.3% also remains well above the 11.9% regulatory requirement.

Outlook for Fed policy

As explained in my previous article, my investment thesis largely rests on capital gains driven by Fed rate cuts complementing the 5.39% current yield on the series MM preferred shares.

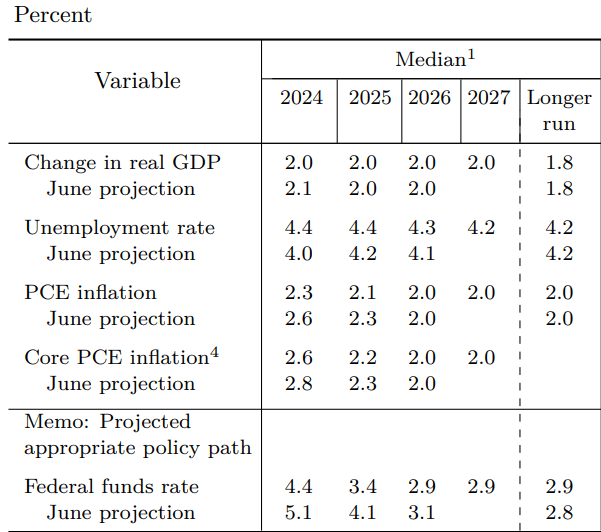

In recent months the Federal Reserve has already delivered 0.75% in rate cuts, bringing it closer to its 2.9% neutral rate:

Outlook for macroeconomic indicators (Fed September 2024 Summary of Economic Projections)

The election of President Trump has prompted economists to expect a bump in US inflation driven by new tariffs. However, as things stand, the magnitude and eventual effect of these new tariffs remains highly uncertain.

In any case, I expect the inflation uptick to be limited to 2025, which all else equal points to a more restrictive Fed policy in 2025 before the central bank reaches its 2.9% neutral rate in 2026.

Return potential of the series MM shares

As explained in my previous article, also taking into account the short-lived nature of the tariff-driven inflation uptick, my year-end 2026 target for the series MM preferred shares remains at around $21.7/share, representing 11.40% capital return potential relative to the current share price of around $19.50/share. On an annualized basis, the capital return potential alone stands at 5.3%. Coupled with the current yield of 5.4%, the total return should top 10%, or about 10.7% annualized.

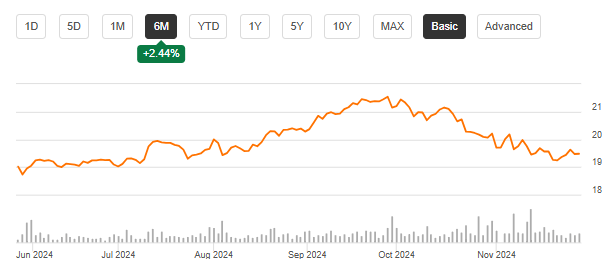

Recent price action in September 2024 which was driven by expectations for lower Fed rates resulted in the series MM shares reaching $21.54/share, marginally below my target. As such, I view the recent pullback as a buying opportunity with the caveat that returns may be backloaded in 2026 as markets digest the effect of Trump’s economic policy:

Price of JPM.PR.M over the past six months (Seeking Alpha)

US recession as a catalyst for the preferred shares

Banks are typically one of the most affected sectors in the economy during a recession, driven by lower NII, rising defaults, low loan demand, and muted capital markets activity. That said, JPMorgan’s standing as the largest US bank may make it a safe harbor in turbulent economic waters (as evidenced by the bank buying distressed regional lenders during the latest bank crisis). This, together with the Fed cutting rates below the 2.9% neutral rate, will increase the appeal of the series MM preferred shares. In a recession scenario, the shares may even approach par value, providing outsized benefits to preferred shareholders.

However, as things stand, a US recession is only a tail positive for the investment case, with Goldman Sachs (GS) estimating a 15% recession probability over the next year.

Risks

As highlighted above, JPMorgan is one of the safest preferred issuers, whether you look at dividend coverage by net income or the equity buffer that stands in line to take losses before preferred shareholders. As such, the risk of non-payment of preferred dividends is quite low in my opinion.

The main risk in the investment case rests in the uncertain relationship between near-term Fed rate cuts and long-term rates, which ultimately determine the price of fixed-rate preferred issues. As examined above, the Fed has delivered 0.75% in Fed rate cuts, or about 30% of the cumulative 2.5% reduction between the peak in rates of 5.25-5.50% and the neutral rate of 2.9%. However, this has resulted in only limited price appreciation for the preferred shares.

Conclusion

JPMorgan Chase’s 4.2% fixed rate preferred shares remain an attractive investment opportunity over the next 2 years as the Fed gradually normalizes policy. I estimate that the preferred shares may offer a 10.7% annualized return by the end of 2026, with a small probability of a larger payout in the unlikely event of a US recession over the next two years.

With a price of around $19.5/share well below the $25/share par value, I reckon that the opportunities clearly outweigh the risks, and as such I confirm my Buy rating for the series MM preferred shares.

Thank you for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.