Summary:

- JPMorgan was the first large bank to submit its earnings sheet for Q1’23.

- The bank’s earnings results prove that there is no financial crisis in the sector.

- While I see more upside potential with community banks, JPMorgan is a solid buy for investors.

winhorse

The first results in the banking sector have been reported and there is no evidence of a broader crisis that is afflicting the financial system. JPMorgan (NYSE:JPM) reported record revenue for the first-quarter despite fundamental turmoil in the community banking market. As a result, shares of JPMorgan soared more than 7% after the company submitted its earnings sheet for the first-quarter yesterday, and I believe they attest to the solidity of the US financial system as a whole. While JPM stock sells for a material premium to book value — the largest premium in the top tier bank market — I believe JPMorgan represents top banking value as the largest banking franchise in the U.S.!

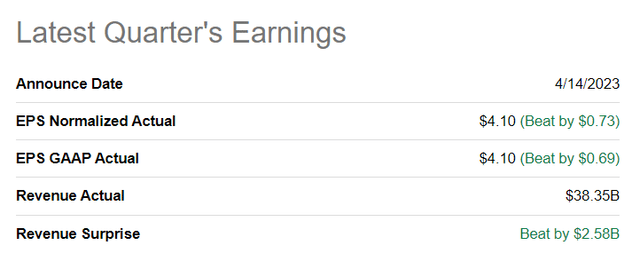

JPMorgan beats earnings easily

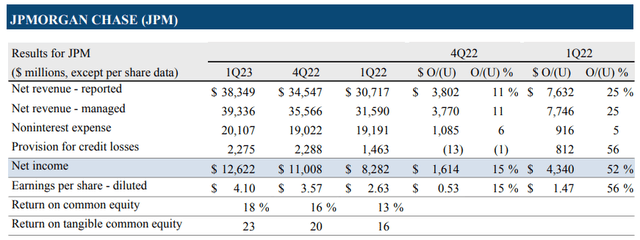

JPMorgan reported much better than expected earnings for its first-quarter with EPS coming in at $4.10 compared to an average analyst prediction of $3.37. Revenues also beat estimates easily and reached a new all-time record for the commercial bank at $38.4B.

JPMorgan achieved record revenue results and strong EPS out-performance chiefly because of net interest income tailwinds that supported the bank’s results in the first-quarter. JPMorgan’s reported revenues gained 25% year over year as the bank benefited from the Fed’s consistent interest rate increases in the last year: the bank’s net interest income soared 49% year over year to $20.8B although deposit balances decreased. JPMorgan also saw a significant profit boost in the first-quarter with net income soaring 52% year over year to $12.6B. Overall, JPMorgan’s results were impressive and fundamentally aided by the Fed’s attitude towards inflation. The bank’s largest segment, Consumer & Community Banking, saw 35% year over year revenue growth, chiefly because of material net interest income tailwinds: CCB delivered $16.5B in higher segment revenues.

Since the Fed has made clear it views inflation as its primary challenge right now, the market will likely continue to see incremental rate increases in FY 2023. Banks like JPMorgan are clearly profiting from it and I believe it is a strong reason to consider the bank as an investment just for this reason alone.

Decline in deposit base

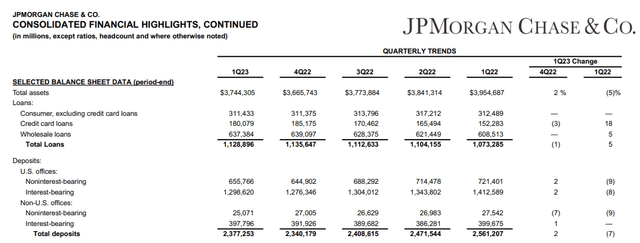

While overall results were great, JPMorgan reported a decline in its deposit base in the last quarter which came as a bit of a surprise to me as I thought the community banking crisis would result in deposit inflows to the largest financial institutions. Community banks like First Republic Bank (FRC), Western Alliance Bancorporation (WAL) and PacWest Bancorporation (PACW) have all seen huge deposit outflows in the last quarter as depositors feared that they wouldn’t be able to withdraw their funds when needed after Silicon Valley Bank failed last month.

In the first-quarter, JPMorgan’s deposit base shrank by $184B (7%) to $2.38T compared to the year-earlier period. With higher interest rates prevailing in the market, holding traditional bank deposits has become much less attractive for depositors in FY 2022 and so far in FY 2023… and funds have instead flowed to higher-yielding money market investments.

JPMorgan’s valuation relative to bank rivals

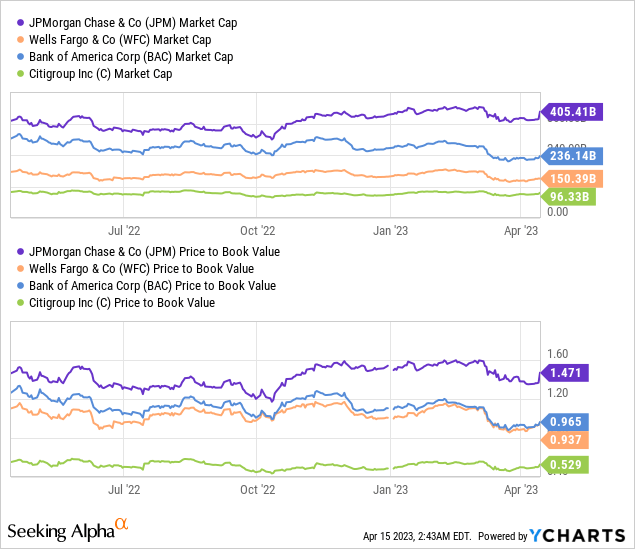

JPMorgan’s shares are selling for a 47% premium to book value right now which makes the bank the most expensive large-cap bank in the top tier banking sector. The top tier sector includes the four largest and most important financial institutions in the country, including Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C). JPMorgan currently has a market cap of $405B which makes it 1.7X larger than the second-largest bank in the U.S.: Bank of America. JPMorgan is also the largest U.S. depositary institution in the country, based off of balance sheet size, according to the Fed. Given that other top tier banks, like Bank of America, are trading at significantly lower P/B ratios than JPMorgan, I believe the risk profile for Bank of America is more attractive, but JPM still represents good banking value, in my opinion, as the bank clearly benefits from its large deposit base and growing net interest income.

Risks with JPMorgan

The biggest commercial risk for JPMorgan would be a down-turn in the economy and a potential deterioration of conditions in the financial sector which I currently do not see. However, if more banks were to fail, then all banks would suffer, including JPMorgan. The bank’s shares are selling at a large premium to book value at the moment and the commercial bank has the largest premium of the top 4 American banks, so there is definitely a risk that JPMorgan’s valuation multiplier factor resets in case the sector had to deal with a larger financial crisis.

Final thoughts

JPMorgan’s first-quarter results showed that the bank as well as the financial sector are not in a crisis. While there are risks to deposits generally due to higher interest rates, JPMorgan’s results were solid and the bank achieved a record quarter regarding revenues. As long as the Fed raises interest rates, I believe JPMorgan will benefit through rising net interest income. While JPMorgan is trading at the highest P/B ratio in the financial group of top tier financial firms, the premium is deserved, in my opinion, as the bank offers the largest balance sheet and arguably the safest destination for deposits. While I see more rebound and upside potential for Bank of America, due to the bank’s low valuation based on book value, I believe JPMorgan represents strong banking value for investors nonetheless!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.