Summary:

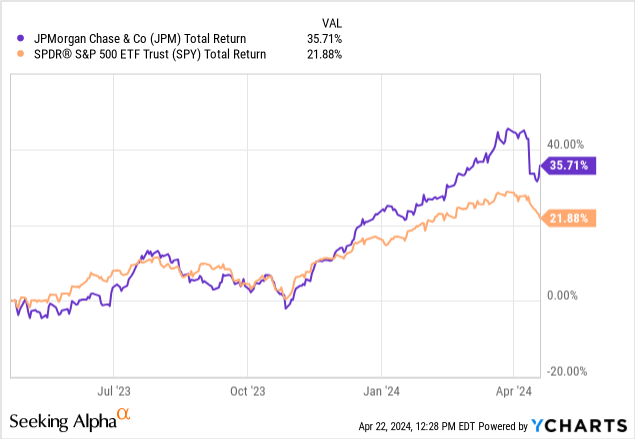

- JPMorgan has outpaced the S&P 500 in total return due to its strong price growth from growing revenues across segments.

- Although the starting dividend yield is only 2.5%, JPM has great dividend growth metrics with 9 years of consecutive raises.

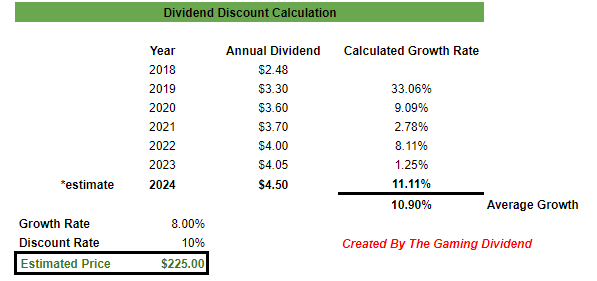

- Despite trading at a higher valuation, there is still upside potential. My dividend discount model estimates a fair value of $225 per share.

- The dividend has grown at a CAGR of 10.8% over the last decade, making this a great dividend growth stock.

winhorse

Overview

JPMorgan (NYSE:JPM) has been one of the strongest performers within my dividend growth portfolio. I was lucky enough to start a position in April 2020 around $92 per share. Now that the price has run up over 100% since my initial position, I decided it would be a good time to take a look at the business and reassess to determine whether or not I should continue holding on to my position. Even within the last one-year time frame, you may find yourself with the same question, as the price has now run up over 33%. The price run has allowed JPM to outperform the total return of the S&P 500 (SPY).

I initially viewed JPM as a solid dividend growth stock for my portfolio, even though the upfront yield was on the lower end. The current dividend yield sits around 2.5%, but the dividend growth is where the real value lies. While JPM hasn’t reached that aristocrat level yet, they still have a solid history with over 9 years of consecutive dividend raises while maintaining a relatively low payout ratio when compared against peers.

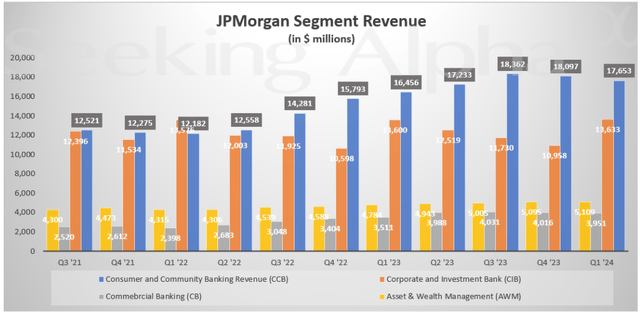

JPMorgan operates throughout several different segments including: Consumer & Community Banking, Corporate & Investment Banking, Commercial Banking, and Asset & Wealth Management. The company operates on a global scale and currently has a market cap of $533B.

Despite the price trading at the higher end of its historical range, I do believe there is still upside to be captured here. While the price run has caused JPM to trade at premium valuation multiples, I conducted a dividend growth model and came to the conclusion that there is still additional upside potential as JPM shows continued growth. Before we get to that, let’s dig into the solid financials that contribute to this future growth.

Financials

JPM reported their Q1 earnings recently and revenue growth was 9.4% YoY, coming in at $41.93B for the quarter. EPS (earnings per share) for Q1 was reported at $4.63 per share, which beat expectations by $0.50. JPM saw a growth in total deposits of 2%, with average deposits of $2.4T. Loan volume has also increased by 16% YoY, up to a total of $1.3T. Each of the previously mentioned segments also saw growth this last quarter. Despite challenging market conditions such as rising inflation or the higher interest rates.

Looking at the revenue broken down by segment, we can see that all segments experienced growth from Q1 of 2023. Growth in the consumer and community banking segment can be mostly attributed to the huge increase in home lending. There was a 64.7% increase year over year due to the high demand we are seeing across the nation with homebuyers. Within this segment, we also saw growth across baking & wealth management and card service & auto at 2.8% and7.9%

In the Corporate and Investment bank segment, net income climbed 8% YoY, totaling $4.8B, while total revenue was $13.6B. This growth can be attributed to the 27% YoY increase in revenue from the investment banking branch because of higher fees from debt and equity underwriting. This large growth from investment banking offset the decreases from the payments and lending categories, which saw losses of revenue by 1% and 51% respectively. Additionally, the lowered expense of amount of 4% in this segment due to lowered legal fees helped offset losses in other categories.

The Commercial Banking segment’s net income grew by 21% YoY due to higher noninterest revenue, increased IB fees, an increase in average loans, and increase in average deposits. Lastly, the Asset & Wealth Management segments saw a slight increase over the prior quarter, but was still down on a YoY basis. Net income totaling $1B and was down 26% YoY due to higher expenses that were mainly driven by compensation-related increases. However, total AUM (assets under management) did increase to $3.6T. This increase was a rise of 19% YoY, which was due to higher market levels and net flows.

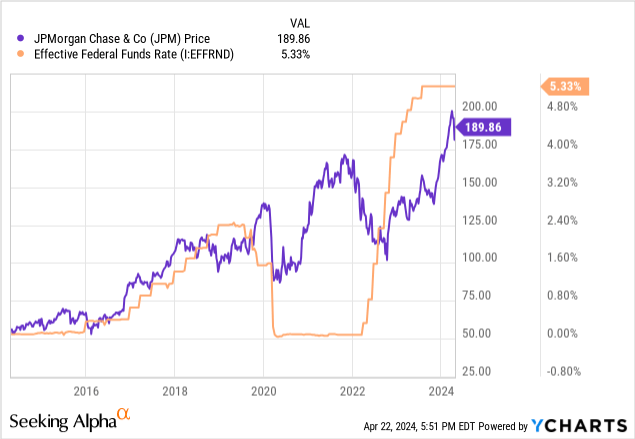

Elevated interest rates certainly had a positive impact on net interest income received from these segments as well. Since total depositors increased by 2% YoY, this means they were able to generate more interest income while the margin relating to how much they have to pay out to depositors is widened.

Dividend

JPM recently raised their dividend by 10%, to a new quarterly payout of $1.15 per share. The current dividend yield sits at about 2.5%. While JPM hasn’t yet reached aristocrat status, the dividend has been raised for over 9 consecutive years. The dividend remains ultra-safe with a payout ratio of only 25.6%, which is a major improvement of their 5-year average dividend payout ratio of 32.2%. For reference, the sector median payout ratio sits at 40%. JPM also has access to nearly $13B in cash from operations that can help them navigate through any potential headwinds.

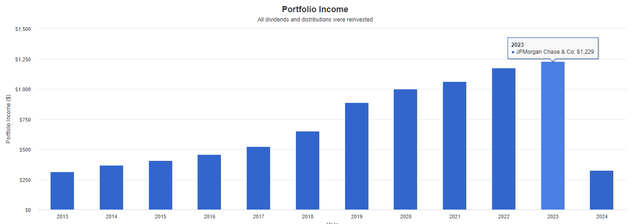

In terms of growth, I have been very pleased with the rate of raises throughout the last few years. Over the last 10-year period, the dividend has increased at a CAGR (compound annual growth rate) of 10.8%. Even on a smaller time frame of only 5 years, the dividend increased at a CAGR of 7.5%. When a stock yields below 3%, I ideally like to see the company raise the dividend by an average CAGR of at least 5%. I found that holding the stocks in your dividend growth portfolio to this standard helps ensure that you have a rising yield on cost over time. For example, the 5-year yield on cost now sits at 3.75% and will likely sit over 5% in another 5 years.

To demonstrate the power of yield on cost, I would like to demonstrate the power of reinvesting your dividends and holding for a long period of time. Using Portfolio Visualizer, we can see how the dividend growth would have played out over time with an initial investment of $10,000. This calculation assumes that no additional capital was ever deployed, but dividends were reinvested every single quarter. Starting in 2014, we can see that your initial investment would have yielded you $313 in annual dividend income. Fast forwarding to the full year of 2023, your income would have grown to be $1,229.

Valuation

As expected, the consistent price run has led JPM to sit at premium valuations. For instance, the current price to earnings ratio sits at 11.22x, which is slightly above the 5-year average P/E ratio of 11.04x and much larger than the sector median P/E of 9.96x. Despite this, the average Wall St. price target sits at $205.38 per share. This price target represents a potential upside of 9.4% from the current level. While revenue and EPS growth have both been strong, I can see the price eventually crossing that $200 threshold.

To support this stance, I think it’s fitting to also insert a dividend discount model here to help provide another source for an estimated fair price value. I first compiled the annual dividend payouts for JPM dating back to 2018. These dividend amounts have managed to grow at an average CAGR of 10.9% over this time period. With the recent raise to $1.15 per share, I estimate that the annual payout for 2024 will be $4.50 per share.

Revenue growth YoY has been 9.4% recently by the 5-year average revenue growth rate is closer to 7%. The most recent EPS growth is 10% so in an effort to take a realistic but conservative outlook, I input an estimated growth rate of 8%. The results come to an estimated fair price target of $225 per share. This represents a potential upside of 18.7% from the current price range. The dividend discount calculation’s estimated fair price target sits a bit higher than the Wall St. average, but I think it’s certainly possible to reach this level once we cross that $200 mark. When you paid this potential upside with the current dividend of 2.5%, you are looking at the possibility of locking in gains over 20%.

Author Created

We also have the potential catalyst of interest rate cuts, sending the price higher. While the probability of rate cuts happening this year continues to decrease, we may have this catalyst happen throughout the course of 2025. Inflation data still remains higher than expected, alongside a strong labor market that has low unemployment numbers. While I wouldn’t advise on trying to time when rate cuts will happen, this is a catalyst that will help stimulate the economy and markets and should send stocks higher. We saw a similar story play out when rates were cut to near zero levels in 2021.

Risk Profile

There were certainly some reported weaknesses within their portfolio. For instance, the lending activity within the Corporate & Investment bank segment saw a 51% decrease YoY. This was driven by market losses within their lending portfolio. I believe this is driven by customer volume moving away from banking institutions for lending. With peer to peer lending companies out there connecting directly with borrowers and lenders, this eliminates the need for a bank like JPM. However, I have a feeling that management saw this vulnerability and keeps it as a small portion of the segment’s total revenue.

JPM is also vulnerable to rate cuts if they do end up happening. A higher interest rate directly translates to higher levels of interest margin and profitability. While they’ve certainly been able to benefit from the 2% YoY growth in deposits, the opposite remains true if rates go down. Rates being cut means that the margin between the interest income generated and the interest they have to pay out to depositors shrink. This could have a negative impact on revenue and price movement if rates end up being aggressively cut.

Takeaway

JPMorgan is a strong dividend growth stock that has a low starting yield of 2.5% but delivers solid dividend growth. The dividend has increased at a CAGR of 10.9% since 2018. In addition, the dividend is well-covered and has a very low payout ratio of 25.6% in comparison to the sector median payout ratio of 40%. As we remain in a period of elevated interest rates, JPM continues to benefit from collecting higher levels of net interest income. It also seems like we are a few quarters out from these rate cuts taking place. In addition, I believe JPM to still have some upside potential based on my dividend discount calculation that landed me at an estimated fair value of $225 per share. Therefore, I rate JPM as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.