Summary:

- The leading US banks exceeded the minimum capital ratio requirements in the Fed’s annual bank stress tests.

- JPMorgan stock is valued at a premium, suggesting investors didn’t expect poor stress test results.

- JPM will not likely increase its stock buybacks aggressively, as it doesn’t make prudent financial sense.

- However, JPM’s financially stable earnings projections suggest a higher-for-longer Fed should benefit JPM.

- I explain why caution is still warranted on JPM, as market leadership has also rotated out of JPM recently.

danielvfung

JPMorgan: Banks Passed The Fed’s Stress Tests

JPMorgan Chase & Co. (NYSE:JPM) investors have likely anticipated the positive results from the Fed’s annual bank stress test for 2024. The Fed’s stress test results demonstrate the resilience of the US banking industry under a hypothetical severe recession scenario. Accordingly, the 31 banks assessed were found to have exceeded the minimum CET1 capital ratio requirements. However, the projected hypothetical losses of $685B suggest “large banks would endure greater losses than in the 2023 test.”

Notwithstanding the potential increased losses, the decline in the overall CET1 capital ratio to 9.9% from 12.7% easily cleared the Fed’s “regulatory minimum of 4.5%.” Therefore, I assess the confidence in the leading banks in repurchasing more stock in the first half of 2024 as not misplaced.

Diversified banks’ forward normalized P/E of 11.1x is below the banking industry’s 10Y average of less than 13x. Therefore, capitalizing on the excess capital buffer to repurchase more shares seems to be an apt move.

JPM Stock: Valuation Is The Main Concern

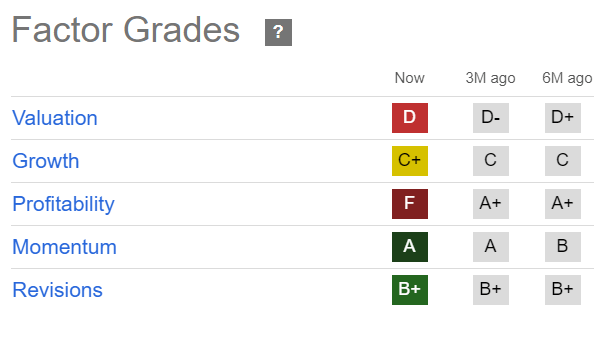

JPM Quant Grades (Seeking Alpha)

In my previous JPMorgan article in April, I updated JPMorgan investors to remain cautious. While I’m not bearish on JPM, I assessed that it’s no longer undervalued. JPM’s “D” valuation grade calls for caution, suggesting investors could be too optimistic about JPM’s future earnings prospects.

JPM’s forward normalized P/E of 12.3x is nearly 20% above its financial sector median of 10.4x. While not assessed as significantly overvalued, JPM is not immune to potential macroeconomic headwinds and the Fed’s potential interest rate cuts in 2024. Therefore, its premium valuation could scupper the market’s expectations of a more substantial valuation re-rating if its earnings results disappoint.

JPMorgan: Investors Must Be Wary Of “Over-Earning”

Observant JPM investors should know that JPM believes it’s”over-earning” on net interest income. Despite that, its robust banking franchise has also allowed JPMorgan to maintain its confidence in keeping to its 17% RoTCE target. Therefore, banking investors’ confidence in maintaining JPM as a core holding is justified. Furthermore, the potential for JPMorgan to improve its capital allocation through potentially higher dividend payouts could help sustain JPM’s recent buying sentiments.

Despite that, JPMorgan CEO Jamie Dimon cautioned investors that the bank will maintain prudence when assessing the opportunities for higher stock buybacks. Given the constructive results of the Fed’s stress tests, the possibility of a lower level of increased capital requirements could be strengthened. Hence, investors are urged to monitor the changes in capital allocation strategies closely as banks could “announce plans for dividends and buybacks” after the market closes on Friday.

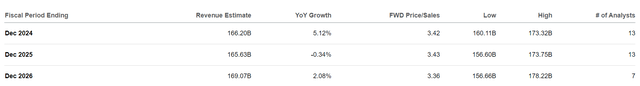

JPM earnings estimates (Seeking Alpha)

Notwithstanding Dimon’s commentary on stock buybacks in May, JPM stock has bottomed from the initial selloff triggered by his caution. However, buying sentiments are still relatively cautious, as dip-buyers aim to hold above JPM’s May 2024 lows at the $190 level.

JPMorgan is still projected to benefit from a growth inflection in JPM’s adjusted EPS from 2026 after lapping potentially more challenging 2024 metrics. Therefore, Wall Street seems confident that JPMorgan can navigate a potentially more challenging macro backdrop through 2026. Based on the Fed’s updated dot plot, economic growth is expected to slow further through 2026, but not significantly.

Consumer spending is expected to remain robust as credit card delinquency and charge-off rates have remained stable. However, these are backward-looking metrics. Therefore, investors must pay closer attention to JPM’s ability to maintain its relatively high NII earnings potential through the cycle.

While the Fed’s dot plot suggests a single cut by the end of 2024 is possible, the market could have assessed two cuts. Given its relatively higher asset sensitivity, a higher-than-expected rate cut possibility might temper investor sentiments on JPMorgan’s NII estimates.

JPM’s relative premium to its financial sector peers and banking industry peers could lead to a valuation de-rating. In addition, JPM’s TTM tangible book value per share multiple of 2.26x is well above its 10Y average of 1.83x, behooving caution. Therefore, JPMorgan will likely not aggressively lift its stock buyback cadence, as its shares are not assessed to be undervalued. In addition, the need for JPMorgan to remain nimble and set aside excess capital buffer could disappoint investors who are betting on more aggressive capital allocation changes.

Is JPM Stock A Buy, Sell, Or Hold?

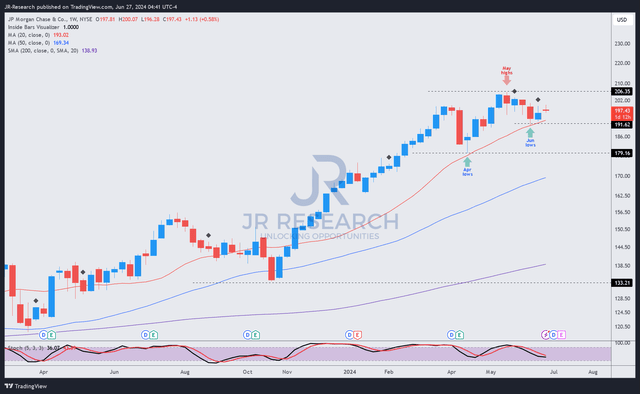

JPM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Dip-buyers solidly defended JPM’s April lows above its $180 level. Therefore, I expect buying support to be robust if JPM pulls back toward those lows.

However, JPM’s relative underperformance to the S&P 500 (SPX) (SPY) since it bottomed in June is a reminder that leadership has likely rotated out. Despite that, JPM buyers could still hold the $190 level resiliently, given the constructive results from the Fed’s stress tests.

Therefore, I have not assessed red flags in JPMorgan’s fundamentally strong thesis. However, I gleaned that the risk/reward seems well-balanced currently, suggesting that a Hold rating is still appropriate.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!