Summary:

- In this article, I will have a look at JPM’s finances – highlighting key consideration regarding the bank’s balance sheet and income statement.

- With a fortress balance sheet, paired with strong profitability, JPM not only appears positioned to navigate market distress but also positioned to thrive.

- For now, on the backdrop of a favorable interest rate environment, I continue to expect an EPS expansion for JPM through 2025.

- I advise to ‘buy’ the emotion-driven sell-off in banking stocks in general, and JPM in particular.

Mark Wilson

Thesis

On Friday, following a sudden surge in deposit outflows and an unsuccessful effort to raise equity, US regulators closed down Silicon Valley Bank (SIVB), an event that marks the most significant bank failure since the financial crisis.

I have already tried to ‘simply’ explain what happened to SVB Financial. And formulated an argument why SVB’s collapse has been caused by an idiosyncratic balance sheet risk. But as a quick refresher, here is the abbreviated explanation:

The COVID-crisis prompted an unprecedented liquidity flood. This liquidity flood, which has been seen as a Fed put, provoked a boom in venture capital activity. This boom flushed start-ups and founders with cash, and Silicon Valley Bank, which has positioned itself as the bank for the venture capital market, enjoyed an inflow of deposits … growing from $61.7 billion in 2019 to $173 billion as of December 2022.

Now, what should SVIB do with these deposits? With a compressed NIM spread (which was another consequence of QE), writing loans was not very attractive. So, SVIB decided to park the excess liquidity in U.S treasury securities and similar low-yield risk-free notes. Although these securities have been considered ‘risk free’, with the end of QE and start of QT these securities depreciated sharply in lock-step with rising interest rates. (Remember that the value/ price of a bond is inversely related to the interest rate level).

SIVB suddenly needed to struggle with falling prices of its holdings of fixed income securities. Meanwhile, concerns about a depreciating asset base were compounded by an outflow of deposits, as savers were seeking higher yield opportunities than parking cash at a bank. A balance sheet crunch was looming. And after the market woke up to SIVB’s struggles, the meltdown materialized quickly.

Expanding on the arguments of my previous coverage, in this article I will have a closer look at JPMorgan’s (NYSE:JPM) financial situation – highlighting important consideration with regards to the bank’s balance sheet and income statement.

In short: Anchored on a fortress balance sheet, paired with strong profitability, JPMorgan not only appears excellently positioned to navigate market distress, but also positioned to thrive. I advise to ‘buy’ the emotion-driven sell off in banking stocks in general, and JPM in particular.

For reference, JPM stock is up approximately 1.5% for the past twelve months, as compared to a loss of about 9% for the S&P 500 (SP500).

A Fortress Balance Sheet

Admittedly, analysing a bank’s balance sheet can be quite a daunting task, because agglomerating financial products/ instruments according to a handful of asset classifications may not always be as black and white as for a manufacturing company. However, even with a margin of safety to reflect some balance-sheet uncertainty, JPMorgan’s asset base projects the strength of a fortress.

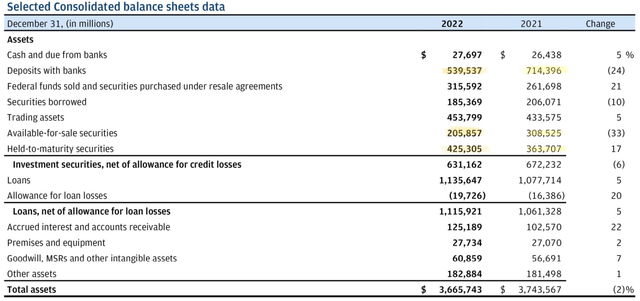

As of December 2022, JPMorgan deposited more than half a trillion dollars with banks, which …

…reflect[s] the Firm’s placement of its excess cash with various central banks, including the Federal Reserve Banks.

Needless to say, deposits with central banks are the securest form of liquidity. And JPM has $540 billion of it. True, the metric decreased as compared to December 2021. But the drawdown was primarily caused by an increase in ‘federal funds sold and securities purchased under resale agreements’, likely to take advantage of the higher REPO lending rates (U.S. Treasuries collateralized lending). This is good news.

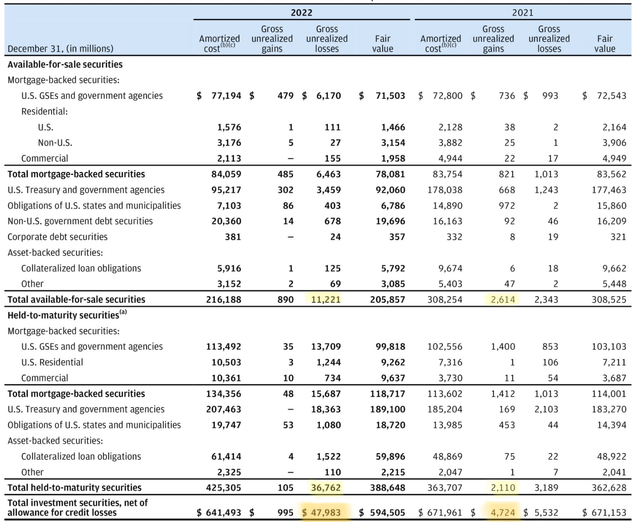

With regards to JPM’s asset base, I would also like to point out why I am not worried about the bank’s investment securities portfolio. First, as of December 2022, JPMorgan’s investment securities portfolio was worth $629.3 billion and enjoyed an average credit rating of AA+. Second, JPMorgan’s $629.3 billion securities portfolio is allocated to AFSS and HTMS according to a 2-to-4 ratio. With that frame of reference, further disclosures highlight that JPMorgan’s unrealized losses for the bank’s AFSS securities portfolio only accumulated to $11.2 billion as of December 2022. This number is ‘dwarfed’ by the bank’s FY 2022 $79 billion of interest income. Moreover, the loss in AFSS portfolio might not materialize at all, because these securities (mostly fixed income securities) can–and very likely will–be held to maturity. The thesis is supported by JPM’s capital management activity in 2022, when the bank moved $78.3 billion of securities from AFS to HTM.

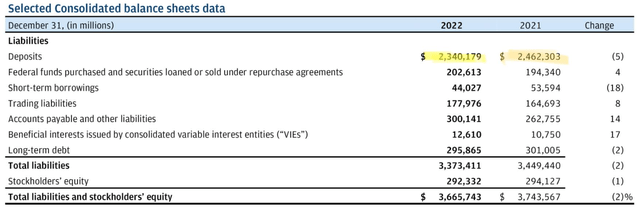

As previously argued, SVB’s collapse was likely rooted in the decision to invest client deposits in ‘overvalued treasury securities’. In that context, it is good to learn that JPM’s relative deposit expansion was more muted. As compared to a more than 200% deposit growth for SIVB from Dec 2019 to Dec 2022, J.P. Morgan’s deposit growth over the same period only was approximately 50%, growing from $1.56 trillion to $2.3 trillion.

Moreover, as compared to SVB, JPM likely didn’t go all-in on ‘overvalued’ U.S treasury securities, because in late 2021 Jamie Dimon even commented that [he] …

wouldn’t touch Treasurys with a 10-foot pole at these rates

To further support arguments about JPMorgan’s financial strength, I would like to point out that in 2022 relative to 2021, JPMorgan managed to decrease short-term borrowings and long-term debt from $54 billion to $44 billion and from $301 billion to $296 billion respectively. Meanwhile, the deposit base remained fairly stable.

All that said, netting JPM’s financial assets with the bank’s financial liabilities results in a net-creditor (net-cash) position of $688 billion!

Thriving Profitability On The Backdrop Of NIM Expansion

The SVB collapse might distract investors from the fact that banks are beneficiaries of rising interest rates, not victims.

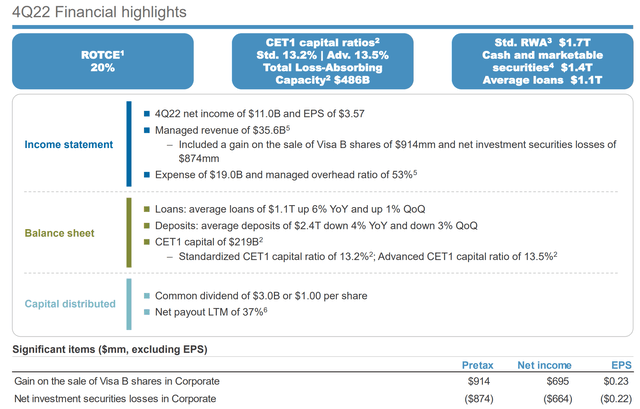

For the full year 2022, JPM’s revenues grew to $122.3 billion and the bank’s profitability remained close to the highest level for over a decade: For FY 2022, JPM’s accumulated $46.2 billion of pre-tax earnings tax.

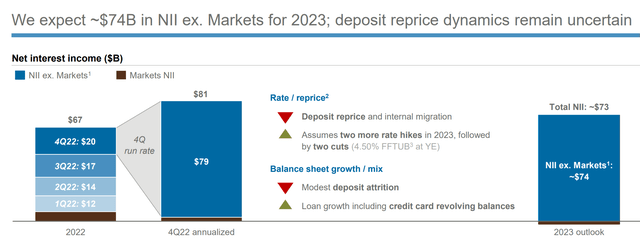

With regards to profitability, JPMorgan continues to benefit from a strong – and still expanding – net income margin. With that frame of reference, although JPM management expects deposit repricing (resulting in higher funding costs for the bank), management also believes that 2023 NII will grow in 2023 as compared to 2022, to $73 billion.

As an additional consideration in connection to JPM’s profitability, investors should also consider that investment banking activity, which is a key profit anchor for the world’s largest investment bank, has been depressed in 2023. In my opinion, it would arguably not be unreasonable to expect that at some point in 2023 deal making activity picks up again–further supporting JPMorgan’s financial strength.

Risks

In my opinion, bank investments are safer than perceived. But yes, due to balance sheet leverage, there is an elevated tail risk as compared to businesses outside of the banking industry. That said, some brands in the banking industry are still recovering from the financial crisis and valuations of some big financial institutions have not yet regained pre-crisis levels (for example Deutsche Bank (DB). All that said, JPMorgan’s strong CET1 ratio of 13.2% should provide protection in the most challenging scenarios.

Buy The Panic

Anchored on a fortress balance sheet, paired with strong profitability, JPMorgan not only appears excellently positioned to navigate market distress, but also positioned to thrive. For reference, JPMorgan’s pre-tax earnings for FY 2022 totaled around $46.2 billion, the second-highest profit in more than ten years – despite depressed investment banking activity.

If circumstances change, I am open to change my thesis. But for now, on the backdrop of a favorable interest rate environment, I continue to expect an EPS expansion for JPM through 2025; and I continue to promote a $219.25/share target price.

Disclosure: I/we have a beneficial long position in the shares of JPM, C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is not financial advise, but expresses the opinions of the author only.