JPMorgan: Why Being Cautious Was Right And Still Is Right

Summary:

- JPMorgan Chase & Co. investors who chased its recent upside were likely stunned by last week’s sharp pullback.

- JPMorgan maintained its NII guidance, but the market likely asked for more.

- JPMorgan investors must be realistic and not fight against the Fed (potentially cutting rates).

- With JPMorgan Chase still not valued attractively, I explain the level that will excite me more.

winhorse

JPMorgan Chase & Co. (NYSE:JPM) investors suffered a well-deserved reversal as overoptimistic investors attempted to chase further significant upside, but to no avail. In February 2024, I cautioned JPM holders that it was timely to allow even leaders like JPM to take occasional breaks to refresh the bullish thesis, allowing the market to shake out late buyers. As a result, investors shouldn’t be stunned by the nearly 6.5% decline on Friday as JPMorgan posted its first-quarter earnings release.

I cautioned in my previous article that investors should have anticipated a peak in net interest income. It makes sense, right? In contrast, it doesn’t make sense for JPMorgan management to come out with guns blazing to telegraph another surprisingly bullish NII guidance when the Fed is slated to cut interest rates this year. Some hawkish commentators could point to the extreme possibility of no rate cuts this year. However, market participants are likely debating whether we could have two or three cuts. While it’s down markedly from the six cuts at the start of the year, NII is still expected to peak.

JPMorgan’s first-quarter earnings scorecard indicated that its NII fell 4% sequentially. Management attributed the weakness to ongoing “deposit margin compression and lower deposit balances.” The bank is also expected to continue facing “ongoing migration and yield-seeking behavior.” As a result, JPM investors should brace for more downside surprises in deposit performance.

As a result, investors who anticipated a more robust NII outlook from management were likely disappointed, as management maintained its $90B NII guidance. Moreover, more cautious commentary from management regarding the macroeconomic environment could pressure loan growth, further affecting its performance. Coupled with the recent hostilities between Iran and Israel, which could spiral into a new debilitating conflict, JPM’s premium baked into its valuation could face downward pressure as earlier investors take profit.

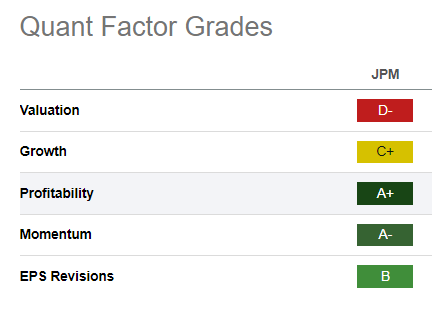

JPM Quant Grades (Seeking Alpha)

There’s little doubt that JPM is a high-quality banking play among bank investors. It has a best-in-class “A+” profitability grade and has consistently executed well (“B” earnings revisions grade).

JPMorgan management highlighted the strength of its banking franchise, with a RoTCE of 21% in Q1. Moreover, it has a robust balance sheet, with a CET1 ratio of 15%. JPMorgan maintains its prudent posture toward its balance sheet in response to regulatory uncertainties regarding the Basel III endgame framework. However, management highlighted that it retains the flexibility to “potentially free up significant capital, around $20 billion,” if the conclusion is less onerous than the extreme scenario. Therefore, JPMorgan likely still has upside surprises arranged for investors to bolster its earnings growth opportunities as we navigate the developments in the regulatory construct.

Notwithstanding my optimism, investors must ask themselves whether such bullishness has already been reflected in its valuation. Accordingly, JPM is valued at a forward adjusted earnings multiple of 11.5x, in line with its 10Y average of 11.6x. However, it has declined markedly from the 12.3x in late March, as JPM has given up all its gains from March and more. With JPM no longer undervalued, should investors consider other more attractively valued plays or continue to allocate more aggressively into the pre-eminent U.S. banking play?

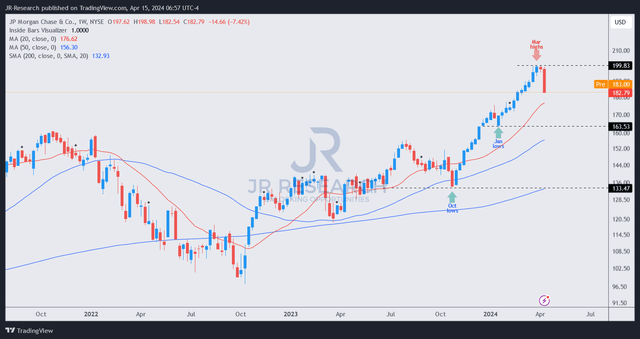

JPM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

The steep selloff has helped to deflate JPM’s near-term optimism, as seen above. Therefore, it has likely improved the entry levels, but not enough for me to turn bullish. JPM has shown tremendous resilience since it bottomed out in October, surging over the past six months without a meaningful pullback.

However, a bullish thesis requires me to have more confidence in JPMorgan Chase & Co. potentially generating alpha at the current levels. However, with JPM’s NII increasingly likely to have peaked and its valuation is not attractive enough, that could be a tall order.

I urge investors to consider a steeper pullback toward the mid-$160s zone for a potentially more attractive entry level to add exposure.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!