Summary:

- JPMorgan Chase is expected to report strong Q2 earnings in mid-July, with CEO Jamie Dimon staying on board through 2026.

- The bank’s diversified business mix, focus on innovation, and cost-cutting measures make it an attractive investment despite headwinds in the banking sector.

- JPM shares are considered undervalued in my view, with a potential breakout as Q2 earnings approach and an improving macroeconomic landscape.

winhorse

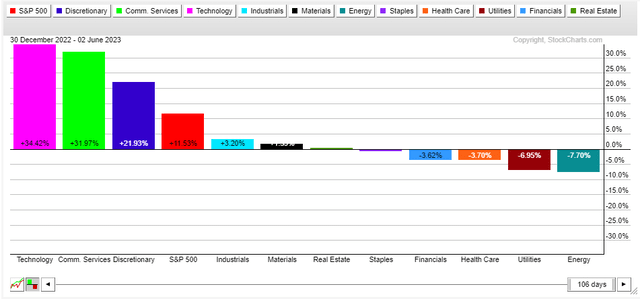

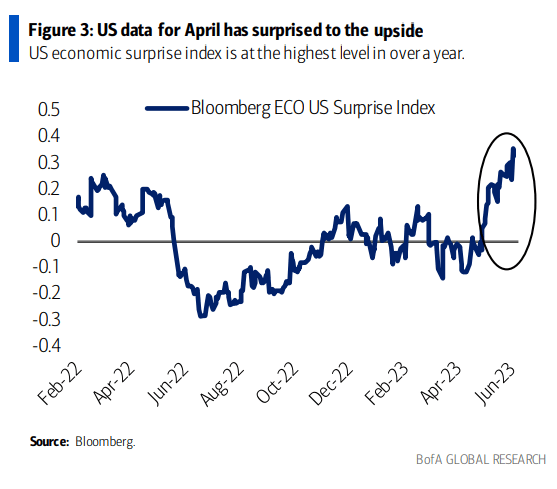

It has been all about tech and AI in 2023. But will banking buck its bearish trend soon? We got inklings late last week that the macro picture is turning more favorable amid easing inflationary pressures and a robust jobs market. While yield spreads remain troubling for lenders and M&A is less than impressive, I have a buy rating on JPMorgan Chase (NYSE:JPM).

The big bank is expected to report a strong Q2 in mid-July while CEO Jamie Dimon is seen as staying on board through 2026. Its universal banking model and fortress balance sheet are positive traits to benefit from an eventual economic upcycle even as the company expects a worsening credit environment and perhaps some unfavorable regulatory risks.

Financials Negative In 2023, Underperforming the S&P 500

US Economic Surprises: Best Level In More Than A Year

BofA Global Research

According to Bank of America Global Research, JPM is one of the leading global financial services firms and one of the largest banking institutions in the US, with nearly $4 trillion in assets. The company as it is today was formed through the merger of retail bank Chase Manhattan and investment bank JP Morgan. The firm has many operating divisions including investment and corporate banking, asset and wealth management, retail financial services, commercial banking, credit cards, and financial transaction services.

The New York-based $411 billion market cap Diversified Banks industry company within the Financials sector trades at a low 10.4 trailing 12-month GAAP price-to-earnings ratio and pays a high 2.9% dividend yield, according to The Wall Street Journal.

There are clearly headwinds and rolling risks in banking today. Higher funding costs pressure net interest margins and, for JPM specifically, the chance of heightened regulatory scrutiny following the acquisition of First Republic’s assets and liabilities earlier this year could be problematic. Negative sentiment is maybe the most seen in recent news that the big bank will cut 500 jobs from its tech and operations areas.

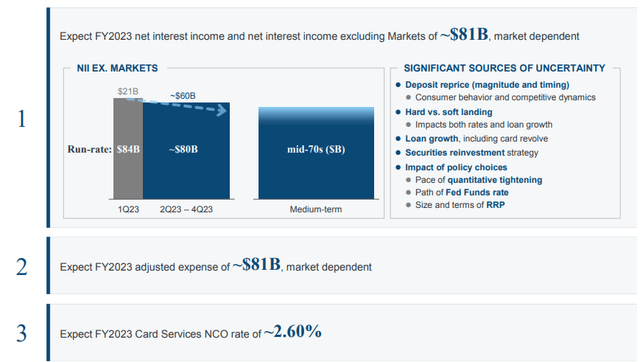

Shareholders, though, should like the cost-cutting move. The firm even raised its out-year net interest income outlook as a result of the FRC deal. What’s more, JPM remains focused on innovation – it filed for a ChatGPT-like investment advice service that could be a game-changer in the advisory world.

Key risks to a bullish outlook include deteriorating credit conditions should a recessionary scenario play out. Funding costs could be pressured further if the Fed cuts rates while depositors demand still-high interest rates. Investment banking continues to be soft, so a lack of pickup in dealmaking would not auger well for earnings.

JPM: NII Outlook, Key Macro Risks

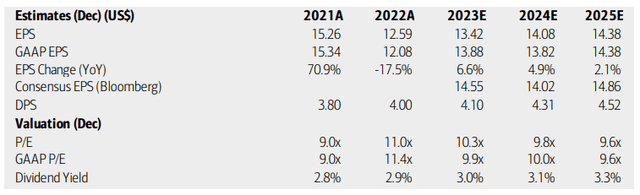

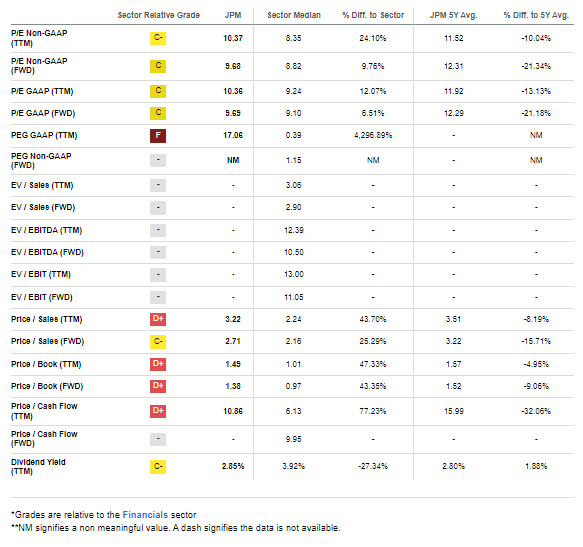

On valuation, analysts at BofA see earnings bouncing back nearly 7% this year, but per-share profit growth is then expected to climb at a more moderate pace in 2024 and ‘25. The Bloomberg consensus forecast is slightly more upbeat compared to BofA’s take. Dividends, meanwhile, are expected to rise commensurate with EPS growth. With earnings multiples that are nearing the single digits, shares appear attractive.

Considering its diversified business mix, the bank should be well-positioned to weather any future financial hiccups. JPM is also making headway in fintech – it launched a UK retail arm focused on digital banking recently as well as honing its Onyx blockchain platform. Profitability has been strong and resilient amid many challenges over recent quarters.

JPM: Earnings, Valuation, Dividend Yield Forecasts

If we apply a 1.55 price-to-book ratio, then shares should trade near $150. On an earnings basis, if next-12-month EPS verifies at $14.25, then an 11 P/E, slightly under its 5-year average, would put JPM shares’ fair value at $157 today. Thus, I assert the stock is modestly undervalued.

JPM: Shares Attractive On Valuation When Scanning P/B Metrics

Seeking Alpha

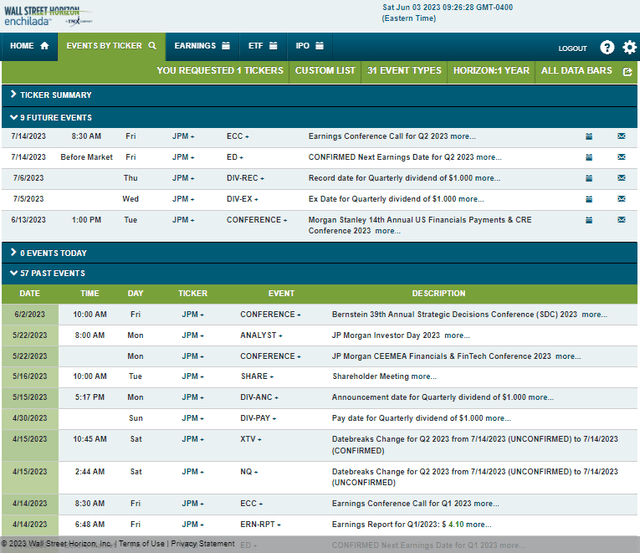

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Friday, July 14 BMO with a conference call immediately after results hit the tape. You can listen live here.

Before earnings season commences, JPM’s Jennifer Piepszak, Co-CEO of Consumer & Community Banking is expected to present at the Morgan Stanley 14th Annual US Financial Payments & CRE Conference 2023. Key industry news may break at the event, but at the very least I expect an overview of the uncertain CRE market to be discussed.

Corporate Event Risk Calendar

The Options Angle

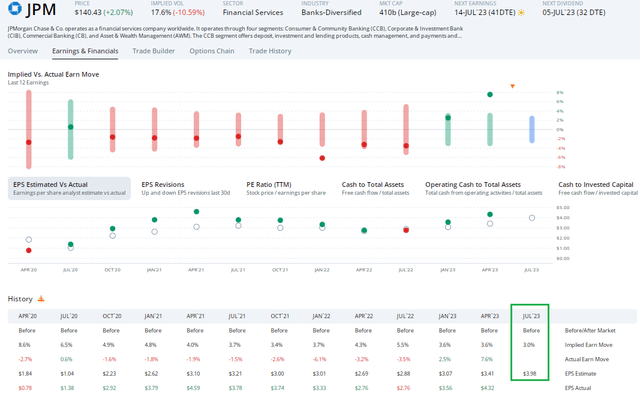

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $3.98 which would be a 44% increase from $2.76 of per-share profits earned in the same period a year ago. JPM moved big after the previous release – the 7.6% share price rise was the best reaction in the last three years, outdoing the expected 3.6% move. The firm has posted back-to-back stronger-than-expected quarterly reports that have featured bounces in the stock. Not surprisingly, there have been six analyst upgrades of earnings expectations since the mid-April Q1 release, per ORATS.

This time around, options traders have priced in a small 3.0% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the mid-July report. Lower implied volatility comes as the S&P 500’s VIX measure rests at more than three-year lows. Still, I would be willing to put on a long options premium play given these conditions.

JPM: Big YoY EPS Growth Expected, Small Share Price Move Seen Post-Q2 Earnings

The Technical Take

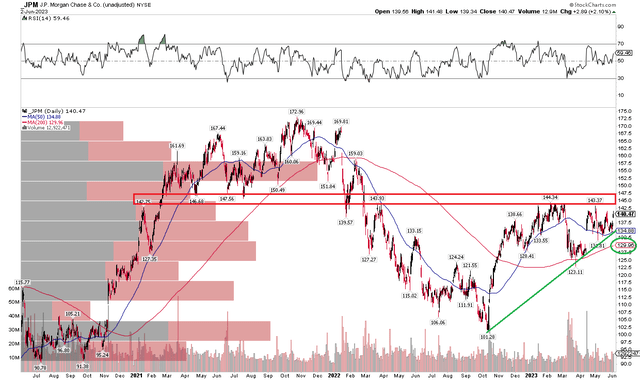

With shares undervalued in my view and amid a slowly improving macro backdrop, JPM’s chart is near a critical juncture. Notice in the graph below that shares have encroached on the key $145 to $150 range. Those were the lows from a topping pattern back in 2021. The stock rallied to said resistance on a few occasions throughout the year thus far. A move above $145-plus would lead to a bullish measured move price objective to the low to mid-$160s based on the $121 to $123 range lows lately.

Beyond those price levels to watch, take a look at the long-term 200-day moving average. Despite Financials sector volatility and downright underperformance compared to the S&P 500 in 2023, the trend indicator has been moving higher since the turn of the year. That tells me the bulls have regained control following the steep bear market from late ‘21 through October last year.

With an uptrend holding since last fall, I see potential with JPM as the Q2 earnings date approaches.

JPM: Shares Nearing A Breakout, Watching Uptrend Support

The Bottom Line

I have a buy rating on JPM stock. The fundamentals look a bit better today compared with earlier in the year amid a better macroeconomic landscape. JPM’s valuation is also fair to slightly undervalued while the chart is turning constructive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.