Summary:

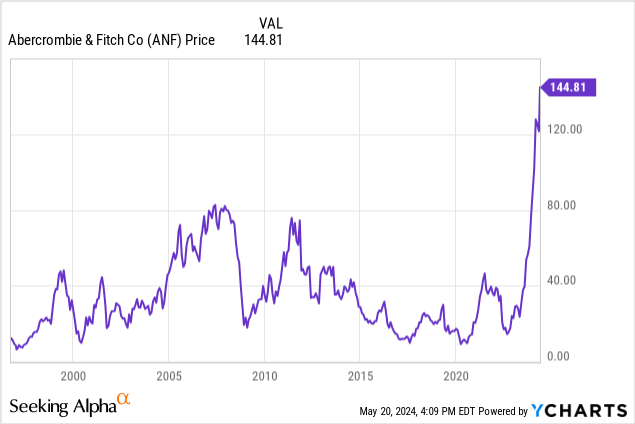

- Abercrombie & Fitch stock hit a 52-week high of $146.31 on May 20 and is up 1,430% since March 2020.

- Investors are pricing the stock, expecting interest rates to drop.

- The stock price is too high because I am expecting interest rates to remain higher for much longer.

- This has been a risky momentum trade lately.

Sundry Photography/iStock Editorial via Getty Images

Fashion retailer Abercrombie & Fitch Co. (NYSE:ANF) stock price has risen 1,430% since its low at the start of the pandemic in March 2020, but it is now overpriced trading with a P/E of 23.3x based on latest reported annual earnings, especially since management has guided for only a 4-6% sales increase this year. A major reason why I think ANF stock price is too high, is that investors are pricing in lower interest rates. I think rates will remain higher for much longer than the market is currently expecting. Using higher rates in stock pricing models results in significantly lower values for ANF.

Re-Branding Abercrombie & Fitch

The Abercrombie & Fitch brand name has been on a roller coaster over the last 25 years. Years ago it soared, as young consumers flocked to their stores to buy clothes that were marketed by preppy WASP models. Then, certain consumers attacked the brand’s image and statements made by their former CEO Mike Jeffries, that created a PR disaster, including when he stated:

That’s why we hire good-looking people in our stores. Because good-looking people attract other good-looking people, and we want to market to cool, good-looking people. We don’t market to anyone other than that…Are we exclusionary? Absolutely. Those companies that are in trouble are trying to target everybody: young, old, fat, skinny. But then you become totally vanilla. You don’t alienate anybody, but you don’t excite anybody, either.

It took years for the brand to regain acceptance. The comparison of the models in their old ads to their latest online ads reflects a dramatic marketing change that worked very successfully to bring in new consumers. Abercrombie & Fitch is now considered a DEI brand, which is a 180-degree change from the early 2000s.

Shopping Bag from Early 2000s

www.ibtimes.com

Model from Current Website

www.abercrombie.com

A&F has also moved away from focusing on sexuality with nude models in some of their ads to a more practical approach. Their target age market for the Abercrombie & Fitch brand is now slightly older than before. That is a change I strongly support, because 17-22 year olds’ tastes change too often and very quickly compared to those a little older than that age group. A more stable consumer makes for easier forecasting for demand/inventories. There is also an Abercrombie & Fitch Kids segment. Their Hollister brand still remains targeted towards 13-21 year olds. The younger ones are more likely to buy in stores because of potential fitting issues associated with buying online, since youth sizes are not as standardized as adult sizes.

CEO Fran Horowitz has been able to reposition A&F after former CEO Jeffries’ controversial management period. I often short companies that have inept and incompetent management, but this is not the case for A&F. Their management team is actually very good. I am shorting ANF because of the high stock price compared to a rational value – not because of poor management.

A&F vs. Other Apparel Retailers

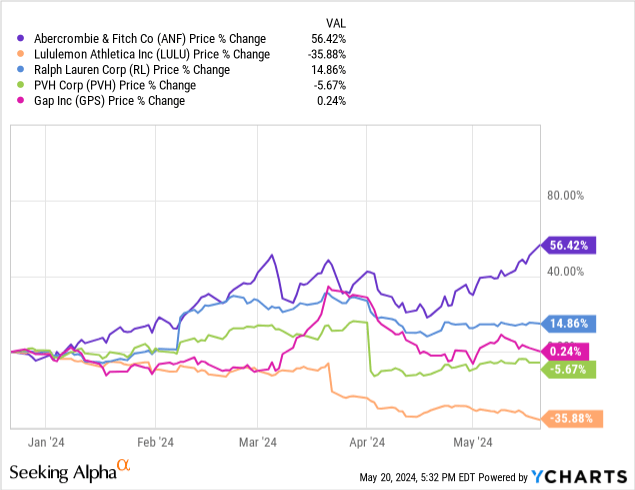

ANF stock price has significantly outperformed some other apparel retailers since Christmas 2023.

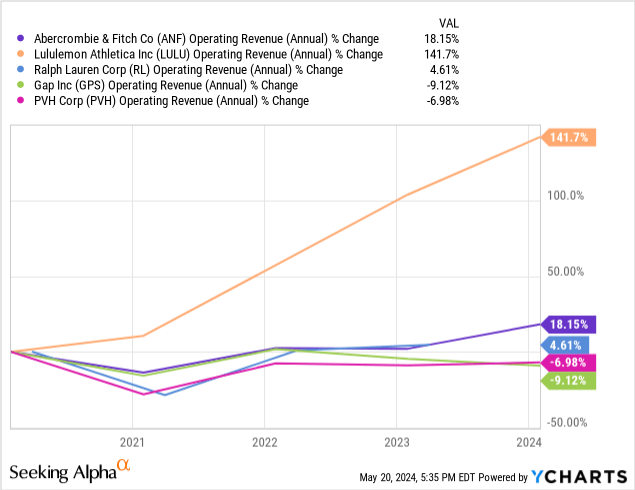

PVH Corp. (PVH), which includes Tommy Hilfiger and Calvin Klein brands, guided for a weak 6-7% decline in revenue this year. It seems that A&F might be taking some of their market share, because A&F management is guiding for a 4-6% increase. The revenue for many apparel retailers, except Lululemon Athletica (LULU), has actually declined in real dollars after adjusting for the impact from inflation since the start of the pandemic. (CPI Index has increased approximately 20% from January 2020 until January 2024.)

Abercrombie & Fitch Is Not a Low-Risk Investment

There are a number of risks associated with A&F that should be reflected in their P/E:

*Significant insider selling. Juxtaposed Ideas covered this risk in a recent Seeking Alpha article.

*A&F is a fashion retailer. Changes in tastes, especially by their younger customers can change quickly.

*They rely heavily on foot traffic, especially at malls. 70% of Hollister revenue comes from retail stores and 40% of Abercrombie & Fitch revenue comes from retail stores.

*The debt rating is not investment grade. S&P did raise their secured debt rating to BB+ from BB on April 23, but it still is below investment grade.

*They don’t pay a dividend, so there is no dividend yield that often protects a stock price from dropping to an extremely low price.

*The price of cotton could spike again. The spot price for cotton is currently about $0.76/pound compared to $1.50/pound two years ago.

*Their reported revenue and income have been very erratic for years.

*Almost all of their merchandise is imported and is subject to shipping disruptions.

*Many of their retailer peers have lower P/Es. Ralph Lauren (RL) has 16x. PVH Corp. (PVH) has 10x. The Gap (GPS) has 15x. (LULU has a higher P/E of 24x.)

Interest Rates – Higher for Longer: Impact on ANF Price

I think that interest rates will remain higher for much longer than many investors expect, and I have written articles on this issue. The impact of “higher for longer” is not reflected in the current valuation for most stocks. The P/E on 2024 expected earnings for the S&P 500 is just under 21x. This P/E is too high, which implies the stock market is too high, in my opinion.

Looking specifically at A&F to examine how expected interest rates impact ANF stock price. Using the present value of future earnings to estimate an appropriate stock price, we get dramatically lower values for ANF using various discount rates. To illustrate my point, I am assuming a 6% earnings growth for the next 5 years and 4% earnings growth after 5 years, which I consider as reasonable average growth rates. Using their latest annual EPS of $6.22 and a 9% discount rate, the stock value would be $141.15, which is close to the current ANF stock price. Using a 10% discount rate, the value drops to $117.45 and using 11% it drops all the way down to $100.53. A shift of 200 basis points from 9% to 11% results in a stock price decline of $40.62. To get close to the current ANF stock price, EPS would have to increase 10% for 10 years and then 4% after that using the 11% discount rate. I think that a 10% growth rate for such a long period of time is highly unlikely, given the competitive forces in the industry.

Investors, therefore, seem to be pricing ANF as if interest rates will drop significantly over the next year to 18 months. I strongly disagree. To lower interest rates, you need to get the rate of inflation down closer to 2%, which I think is very unlikely. It is highly unlikely the Federal Reserve will lower rates, if the rate of inflation remains high.

(Note: The Williams model uses dividends instead of earnings, but because A&F does not pay a dividend, I used earnings. This adjustment implies that a higher discount rate should be used than if dividends were used.)

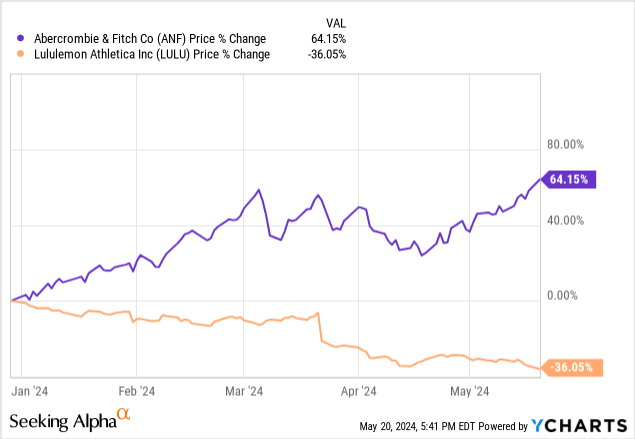

ANF Stock Price vs. LULU Stock Price YTD

I think that the sharp LULU stock price drop this year to date, while ANF stock price soared, should be a yellow flag for ANF investors. LULU stock price hit a 52-week low on May 20 of $323.66, while ANF hit a 52-week high of $146.31. The reality is that momentum trades can do a 180 turn.

Conclusion

CEO Fran Horowitz has done a great job rebranding Abercrombie & Fitch. The retailer had a dramatic improvement lately. The major problem I have is that the stock price is way too high, given the industry risks, and that I expect interest rates to remain higher for longer. Investors are currently way too optimistic, that the Federal Reserve will lower their Fed funds target in the near future.

I just sold ANF short. I am not, however, recommending retail investors to sell short, because of the risks associated with short selling. I rate ANF stock a sell.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of ANF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am also short LULU.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.