Summary:

- Altria Group, Inc. has acquired NJOY for $3 billion, increasing its retail share and distribution of e-cigarettes and vapor products.

- The company’s e-vapor and oral tobacco businesses remain strong, benefiting from a stronger regulatory environment.

- Altria’s core tobacco business shows resilience, maintaining market share and focusing on its core products.

FotografiaBasica

Altria Group, Inc. (NYSE:MO) is a major tobacco company with a market capitalization of less than $80 billion. The company has had struggles with e-cigarettes, spending many billions of dollars on Juul, but it’s continued to run a well-operated business with reliable cash flow. The company’s dividends and reliable business improvements make it a valuable investment opportunity.

Altria NJOY

The company acquired NJOY Holdings, a company that makes e-cigarettes and vapor products, for roughly $3 billion.

During this time, the company has seen its retail share increase substantially, as the company has continued to increase distribution. In the last year, the company has increased stores with distribution from 35 thousand to more than 80 thousand. There was a huge jump after Q3 2024, as Altria used its strength to expand retail distribution.

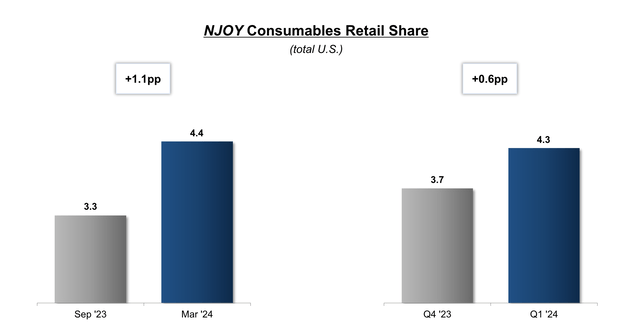

The company has increased its retail share from 3.3% to 4.4% in the last 2 quarters.

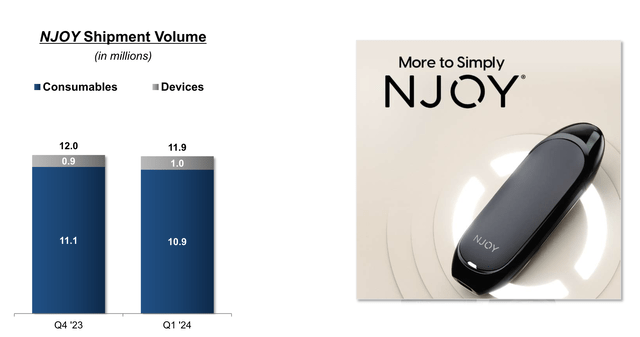

The company has managed to keep its shipment volume roughly constant, with a less than 1% decline in QoQ. The company’s Q1 24 results saw 1 billion devices sold, a double-digit growth in QoQ, but consumption decreased by roughly 1.5%. That resulted in 10.9 billion in consumables sold, versus 11.1 billion.

The fact that the company has kept volumes constant and continued to sell devices, in a declining market, shows the strength of the portfolio. Continued multi-billion dollar acquisitions need to remain strong.

Altria E-Vapor and Oral Tobacco

The company’s e-vapor and oral tobacco businesses overall remain quite strong.

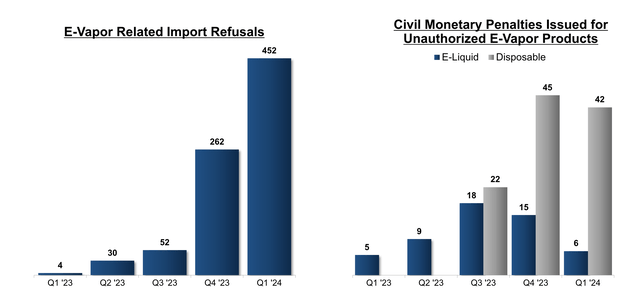

E-Vapor import refusals have increased dramatically by the FDA, and penalties have increased. Altria is benefiting from a much stronger regulatory environment around e-vapor, and the company’s consistent ability to work within the law and handle a complex regulatory environment. The company is well-established here.

We expect that increased regulatory burden will increase the strength of Altria.

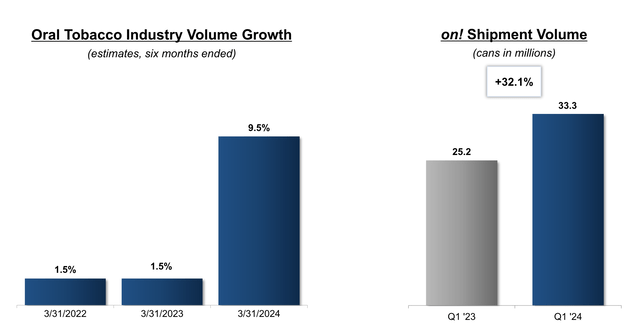

The company has also seen strong oral tobacco growth, as traditional cigarettes have struggled. The company saw 9.5% volume growth, and on! shipment volume increased by more than 30% YoY to more than 33 million cans. on! has seen its share of the oral tobacco market share increase from 6.4% to 7.1%.

The continued market strength here, supported by regulatory overburden, should support hefty shareholder returns.

Altria Tobacco

The company’s core tobacco business also appears quite strong.

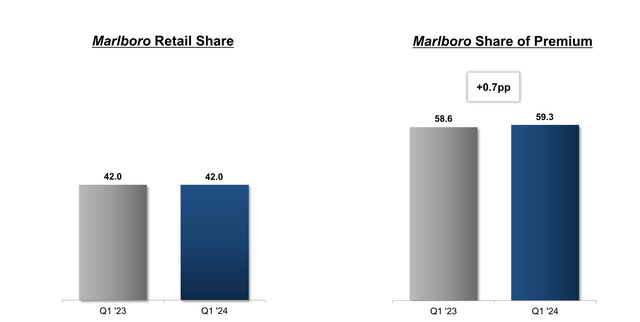

The company’s retail share has remained constant year over year. However, the company’s share of the premium market has increased by 0.7% YoY as buyers have increasingly shifted to discount buyers. The company’s ability to maintain market share here in a tough market shows the continued strength of its products.

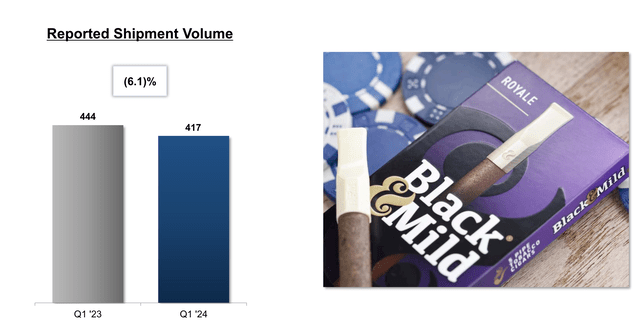

The company’s cigar business has struggled a bit, with shipment volume for the quarter expected to be 417 million units. That’s a 6.1% decline in shipment volume YoY, however, with the traditional industry declining by 10%, that’s not particularly surprising. The company’s continued focus on its core business here is important.

We expect it to continue making reliable profits.

Altria InBev

Altria is changing its capital allocation with a plan to sell part of its stake in Anheuser-Busch InBev SA/NV, owner of Bud.

The company has a 10% ownership stake (197 million shares) and it’s planning to sell 35 million shares. The company is planning to sell roughly $2 billion worth of stock here, or 2% of the company. Shares dropped 4% and initially saw trading halted, as Altria has been a very long-term investor in the company.

Altria has said it wants to use the cash to buy back its own stock, something it’s done for a while, and it highlights that the company has a difference in how it views its valuation and wants to spend money.

Altria Financial Outlook

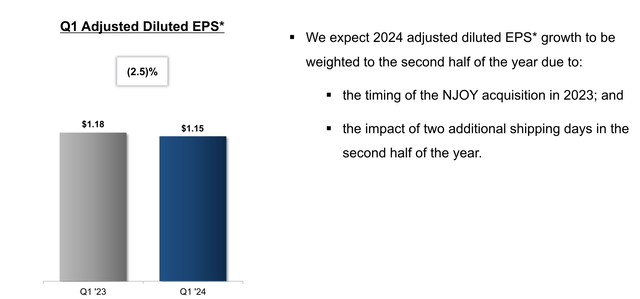

The company’s financial outlook remains strong, and it’s reaffirmed its guidance for diluted adjusted EPS in 2024 of roughly $5.1 / share.

That represents roughly 3% YoY growth for the company. The company’s 1Q 2024 guidance was $1.15, as the company expects that its EPS and growth to be weighted towards the back half of the year in 2024. That’s partially impacted by the company’s shipping delays along with the timing of the multi-billion dollar NJOY acquisition we discussed above.

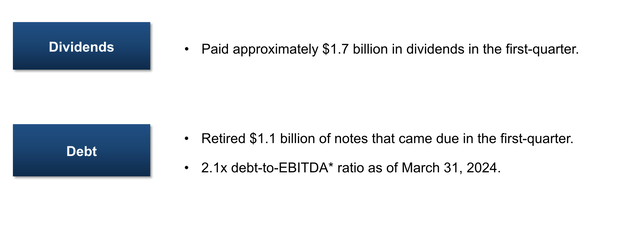

The company’s guidance for 2024 earnings is roughly $8.8 billion. The company paid $1.7 billion in 1Q 2024 dividends, and its annualized 9% yield is expected to be roughly $6.8 billion in dividends. That highlights how the company spends the vast majority of its cash on dividends, which will enable continued shareholder returns.

That, by itself, justifies investing in the company. The company also retired $1.1 billion in notes that came due and has a 2.1x debt-to-EBITDA ratio. We expect the company to continue responsibly paying down its debt, and in a high-interest environment, we like to see a lack of rollovers of debt by the company.

The company’s continued share count reduction will save on dividends and enable strong shareholder returns.

Thesis Risk

The largest risk to our Altria Group, Inc. thesis is the continued decline of the company’s core industry. The company has seen smokeable volumes decline substantially, and while it’s working to drive shareholder returns, and minimize costs, there’s a limit to how far the company can go. That could hurt the company’s ability to continue generating strong returns.

Conclusion

Altria Group, Inc. is working to build up an e-vapor portfolio, and it’s expecting that portfolio to be dramatically lower risk. That portfolio will dramatically lower the risk of a decline in smokeable products, as customers switch to lower risk products. That will enable the decline in the company’s revenues to be dramatically lower.

Altria Group, Inc. is continuing to pay a strong dividend of 9%, one that it can comfortably afford. At the same time, the company is repurchasing shares, saving it dividend expenses, and enabling growth in long-term shareholder returns. The company’s ability to continue paying off its debt is impressive, along with EPS growth in a tough market.

Putting all of this together, the company is a valuable long-term investment. Please let us know your thoughts in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.