Summary:

- The increasing complexity of the industry through HBM and N2 could benefit KLA Corporation and widen the moat.

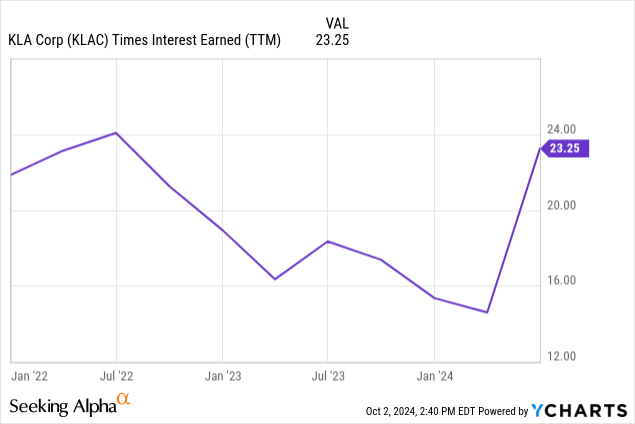

- KLAC’s robust balance sheet, with $4.5 billion in cash and manageable debt, ensures financial stability and high interest coverage.

- KLA’s high ROIC of 29% versus a WACC of 8.46% demonstrates significant value creation, supported by ongoing share buyback programs and strong growth in the coming years.

PonyWang

The KLA Corporation Investment Thesis

KLA Corporation (NASDAQ:KLAC) is a solid company in one of the hottest sectors right now that has a lot of momentum for the next few years. And since they are going to be a big part of that growth because they are going to supply the manufacturers with their equipment, I expect continued strong growth rates for years to come.

Sector And Business Overview

KLA Corporation Investor Presentation

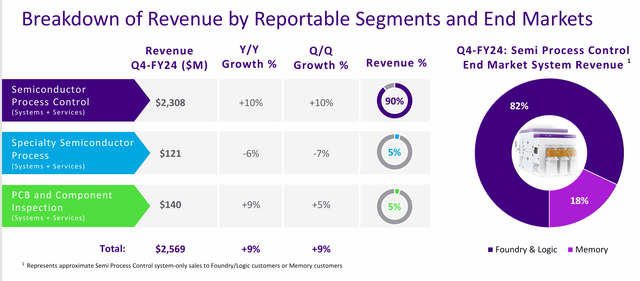

KLA is one of the companies operating in the semiconductor industry, and its role is to supply other companies in the segment with the equipment they need. In particular, they offer measurement and inspection equipment, while most of their competitors specialize in process equipment.

Broadly speaking, KLA’s systems are used to identify defects and improve accuracy so that customers can achieve their target yields. And here they are the leader in wafer inspection, which also means that KLA is very dependent on the CAPEX spending of the semiconductor industry.

In particular, TSMC (TSM), which accounts for more than 10% of sales, is a very important customer. So if TSMC increases its CAPEX and has more capacity, it will also have a positive impact on KLA’s revenues. Samsung also had a revenue share of more than 10% in 2023 and 2022, but this fell back in 2024. However, this could change again in 2025 as Memory and especially HBM will probably have a higher revenue share than the 18% in Q4/24.

HBM, which has more dies and therefore more opportunities for errors, could be an opportunity to strengthen KLA’s competitive position. This is all the more true as greater complexity in this sector also means that the competitive advantage can be increased.

In general, KLA has very good customer relationships that have been built up and maintained over many years, which is also reflected in the cooperation with TSMC for N2. But I think TSMC still has some leverage because they are by far the largest and most important customer. However, N2, which is expected to be launched by TSMC in 2025, should have a positive impact on revenues.

But it is not only HBM and N2 that should drive growth in 2025, as KLA is positioned at every corner of the semiconductor market.

KLAC’s Balance Sheet

KLA Corporation Investor Presentation

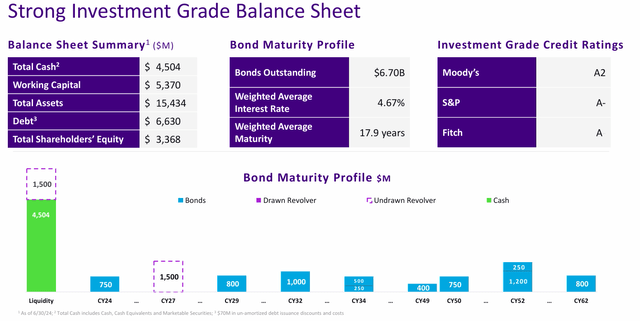

KLA has a strong balance sheet with credit ratings of A, A2 and A- from the three major rating agencies and $4.5 billion in cash and cash equivalents. This is offset by $6.6 billion of debt, of which only $750 million is due in calendar year 2024. So the debt obligations should be manageable.

Also, the interest coverage ratio of 23x is well above the average of the S&P 500 (SPY), which is around 10x for non-financial institutions. In addition, there is a backlog of $9.8 billion, of which 59% to 64% is expected to be realised within the next 12 months. Therefore, I believe that the liquidity situation is satisfactory.

KLA’s Capital Allocation

KLA Corporation Investor Presentation

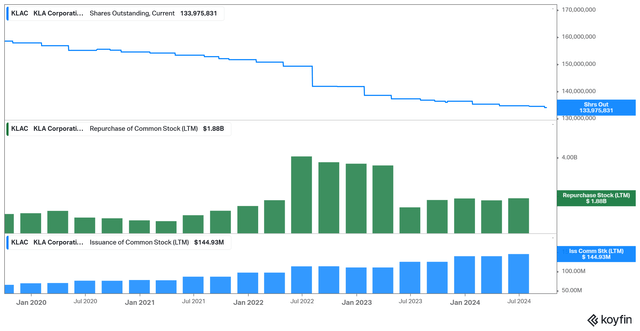

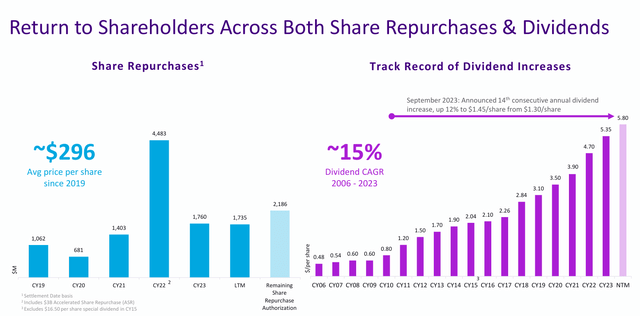

KLA bought back more than $11 billion of shares at an average price of $296. And with the stock currently hovering around $770, these buybacks have been value-creating.

In addition, the dividend has been increased for 14 years and has a CAGR of 15% since 2006. So I think it is safe to say that KLA’s management is shareholder-friendly and likes to return capital to shareholders.

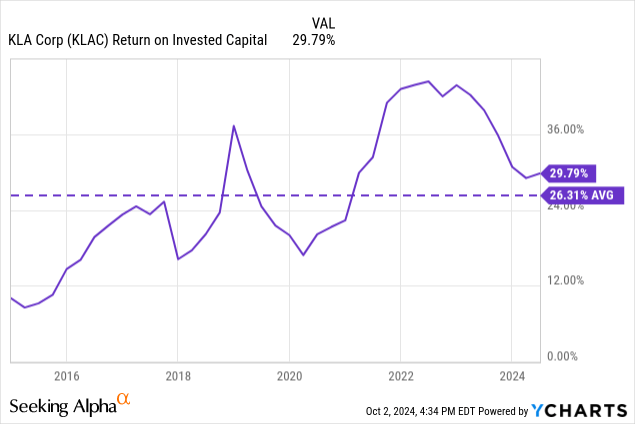

KLA’s ROIC is also excellent, with a 10-year average of 26% and a current value of 29%. If we now look at the cost of capital in the form of WACC and compare it to ROIC, we can see that KLA has an excellent ROIC-WACC spread.

ROIC: 29.79% – WACC: ~8% = ROIC-WACC Spread: 21.79%

As a result, we can clearly see that KLA’s investments are also creating value.

The previously mentioned $11 billion in share repurchases can be seen here in comparison to SBC and the extent to which they have reduced shares outstanding. Plus It is impressive that the current market capitalization is close to $104 billion and the $11 billion used for buybacks represents almost 11% of the current market cap.

And there is still $2 billion of the share repurchase program outstanding, which means that almost 2% of the market value could be bought back in the near future.

Valuation Via Reverse DCF

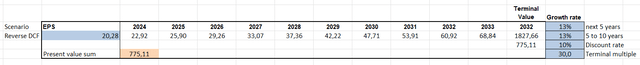

My favorite way to do a valuation is a reverse DCF, where you look at what the market is pricing into the current stock price. And right now, based on TTM diluted EPS of $20.28, the market is pricing in an EPS growth rate of 13% over the next 10 years.

However, KLA has historically achieved the following annual EPS growth rates:

- 3Y: 14.90%

- 5Y: 22.04%

- 10Y: 19.31%

So it is probably safe to say that KLA shares are currently undervalued from a historical perspective, especially considering that the semiconductor market will continue to be in high demand in the coming years. So I think the combination of buybacks and double-digit earnings growth in 2025 and 2026 is very likely to drive EPS above the 13% that is priced in.

Risks

My attitude is always that the risks you don’t have on your radar are the ones that can really hit you. And so I don’t think the China risk is really that big because everybody knows about it and there are always ways to get the tools you want if they’re really that important. For decades, trade restrictions have been circumvented by going through other countries and companies.

But on another note, KLA is kind of suffering from success because they have tools that they delivered in the ’90s that are still in service. As a result, their equipment – and ASML Holding N.V. (ASML) has partly the same problem – is so robust that customers do not need to make new purchases.

Conclusion

Both ASML and TSMC have often talked in their earnings calls about 2024 as a transition year and that 2025 will be a year of strong growth. In addition, 2026 is likely to be a strong year as well, if we can believe the current forecasts that were also voiced in the earnings calls.

And since both ASML and KLA are benefiting from the high CAPEX in the semiconductor industry, we can currently assume that the semiconductor frenzy should continue to generate rising sales for equipment suppliers for at least the next few years.

Therefore, I believe that growth is secured for the next 3 years and that KLA is undervalued at this stage of the cycle. But over the long term, I think there are companies in the semiconductor space that have a stronger moat than KLA. This could change, however, if KLA’s ability to detect errors becomes even more important to its customers due to the expected increase in complexity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.