Summary:

- KLA leverages cutting-edge semiconductor inspection tech, partnering with industry leaders like TSMC and Samsung. This positions them to capitalize on the growing demand for 2nm and 3nm chip manufacturing.

- Holding a 50% global market share in process control, KLA benefits from the surge in AI-driven GPU demand and significant investments by major foundries, driving revenue growth.

- With a 9% Q4’24 revenue increase, high profitability, substantial share buybacks, and an undervalued stock post sell-off, KLA is poised for a potential 10-20% upside.

Monty Rakusen

Investment Thesis

I rate KLA Corporation (NASDAQ:KLAC) stock as a Buy. Backed by the company’s cutting-edge technology, the billion-dollar company KLA has some of the most advanced technologies, such as 29xx broadband plasma, which can redact a defect in the most advanced chips, 2nm, 3nm, and 5nm. Its defect inspection and review technology are used in varied substrate and chip manufacturing applications for line monitoring and wafer qualification. With TSMC (TSM) net sales projection of $23 billion in Q3 ’24, after the company recorded a 40% revenue increase in Q2’24, I expect KLA revenues to upscale as a TSMC supplier at a high percentage of 5.13%. The high demand for TSMC’s 3nm and 5nm semiconductors, which KLA has the technology to measure the quality and detect any defect, positions KLA for more business. Despite the recent plunge of major semiconductor players, especially the declining ASML bookings leading to a 15.7% share plunge, KLAC is at a better bullish entry point. The recent plunge by the major player ASML (ASML) was recorded after geopolitical tensions halted its bookings. However, the demand for EUV is still high, with a sales increase from 36% in 2024 to a projected 58% in 2028. A short-term overlook at 2025, China sales are expected to plummet from 25% to 30%, but with a 58% sales increase in the long-term overlook, I reiterate my bullish rating.

Company overview

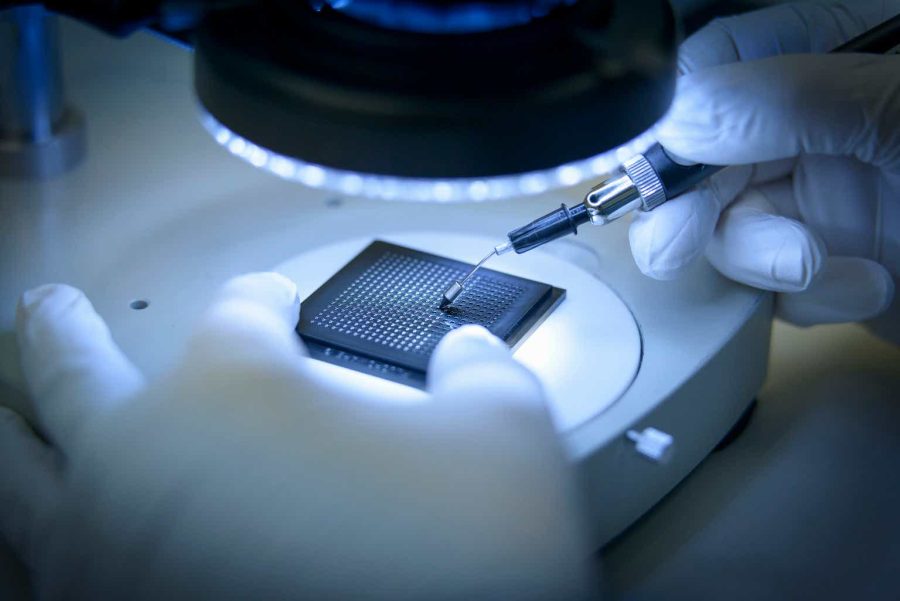

KLA is in the semiconductor wafer fabrication industry. The company specializes in process control and process enabling, which helps chip manufacturers achieve cutting-edge chip performance. For example, KLA facilitates 2nm and 3nm chip process control and process-enabling solutions to produce the iPhone 16 series. KLA has machines like broadband plasma patterned wafer defect inspection systems that inspect wafers and verify accurate measurements. The company is a large customer or supplier for the biggest chip manufacturing companies, such as TSMC and Samsung Foundry.

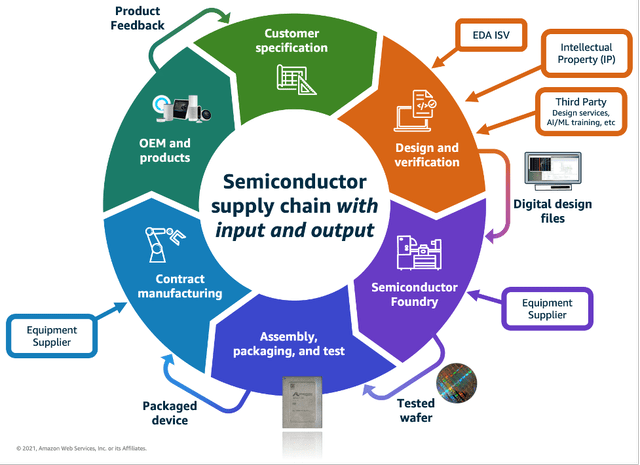

KLA’s position in the semiconductor supply chain

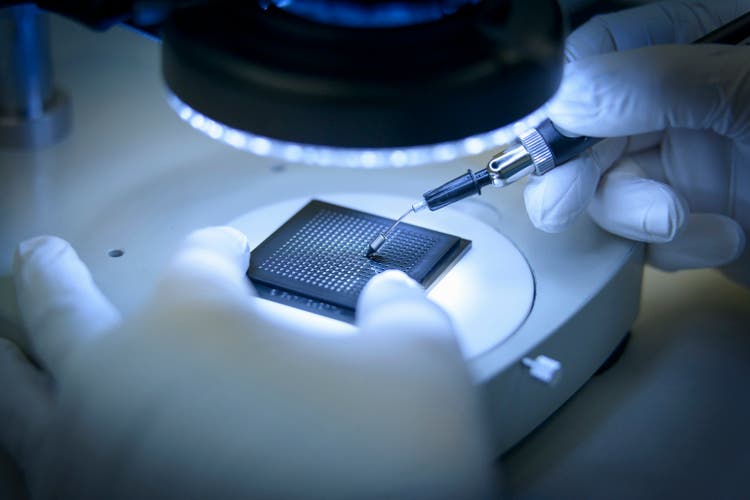

The foundry manufacturing process includes design, fabrication, assembly, testing, and packaging. Unique technologies and equipment achieve quality and high yields at each stage.

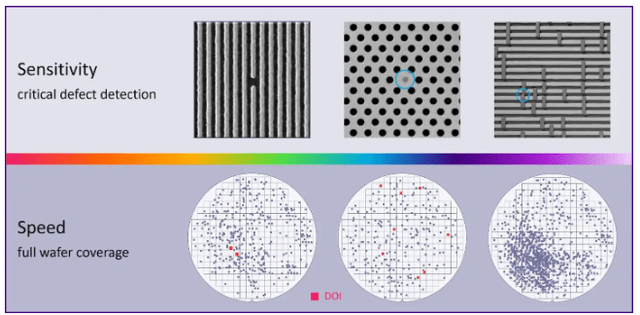

Throughout the wafer fabrication process, rigorous inspection and testing ensure the final product is functional and meets the expected quality. However, KLA’s advanced metrology techniques and tools, such as the Puma Laser Scanning Patterned Wafer Inspection System, are best used in the fabrication stage.

Inspection at this stage is critical to capturing defects before moving to assembly. In the current advanced fabrication of 5nm, 2nm, and projected 1nm wafer manufacturing processes, KLA inspection technology such as 39xx, 29xx, C30xx, Voyager, puma, 8 series, Castor, Surfscan, Surfscan SP Ax, eSL10, eDR7xxx, and CIRL are used in a full range of yield applications.

This control process and process enabling ensures wafer qualification and line monitoring. KLA super-resolution broadband plasma technology patterned wafer defect inspection system allows engineers to detect, monitor, and resolve critical yield issues, leading to a high production yield and fast yield ramp. This explains why Major leading semiconductor manufacturers such as TSMC and Samsung use KLA as a significant process control and process-enabling supplier.

I am confident in KLA’s position regarding the supply chain; its cutting-edge technology remains the most significant to its customer’s capability to manufacture advanced chips.

Maintains a firm market position

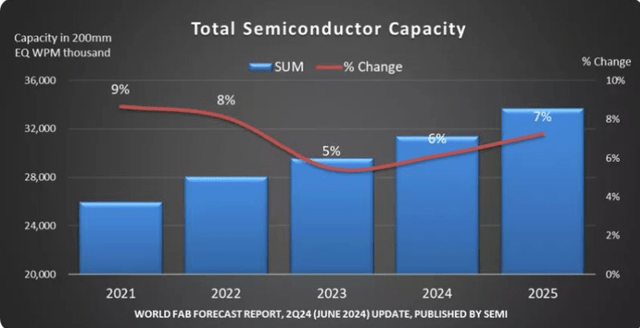

In the technology world economy that depends on chips in smartphones, personal computers (PC), data centers, high-performing computers (HPC), and the recent artificial intelligence (AI) general processing units (GPUs), KLA has a 50% market position in facilitating chip manufacturing process control and process enabling. This tells me that with a 50% global market position, KLA has the advantage of benefiting more in the 7% global fab forecast in 2025. It is expected that the wafer fabrication will hit 33.7 million per month. TSMC and Samsung, the primary customers of KLA, are projecting to produce 2nm chips at scale, hitting 17% capacity growth by 2025.

KLA’s supply to TSMC is 5.13%, a considerable percentage for a leading semiconductor manufacturer selling 90% of the world’s chips. Therefore, we can relate that a 25% increase in Nvidia (NVDA) Blackwell orders for its GB200 NVL36 server cabinets using 2nm chips increases TSMC’s spending. KLA is, therefore, expected to gain from this increasing demand for GPUs with the rise of GenAI data centers.

It is right to say that TSMC relies on KLA’s process control and process-enabling technology to manufacture high-end AI chips for NVIDIA. This benefits KLA when Nvidia increases its orders. Nvidia does not manufacture its semiconductors. With NVIDIA commanding 98% global market share of data-center GPUs, more GPU sales will demand more chips, which is the work of KLA to ensure the quality of those chips. I am confident that TSMC will continue to record more chip demand, increasing its spending on its suppliers, where KLA is positioned to benefit.

KLA’s business model is irreplaceable

Here, we argue that KLA’s irreplaceable business model is due to its active role in advanced chip manufacturing, strategic partnership, and position to benefit from domestic foundry support.

First, KLA positioned itself for success by meeting the high demand in the foundry sector for process control and process-enabling technologies. Its advanced technology, such as metrology, encompasses systems such as Archer ATL, which are capable of process control for the high-volume manufacturing of 7 nm chips and 1 nm.

The technology enables the accurate detection of errors for varied device types, process layers, patterning technologies, and design nodes. Compared to its close competitors, such as Lam Research (LRCX), I believe that KLA’s cutting-edge metrology technology shows its irreplaceability. For instance, LRCX’s current stock price is $80.85, with a larger market share in TSMC supplier score of 6.32%.

On the other hand, KLA’s current stock price of $774.80, compared to its lower TSMC supplier percentage of 5.13%, shows the quality and uniqueness of its much-needed inspection technology. LRCX supplies innovative fabrication equipment with its expertise in deposition and etch processes, which is a solution for chipmakers.

Secondly, TSMC’s strategic partnership with KLA is based on its critical, cutting-edge technology, which allows TSMC to manufacture the most advanced chips in the world. Therefore, TSMC is leveraging ON KLA metrology to meet 2nm and 1nm chip manufacturing capability. With the AI narrative continuing to receive more recognition, the demand for advanced chips is increasing for efficient and quick processing speed.

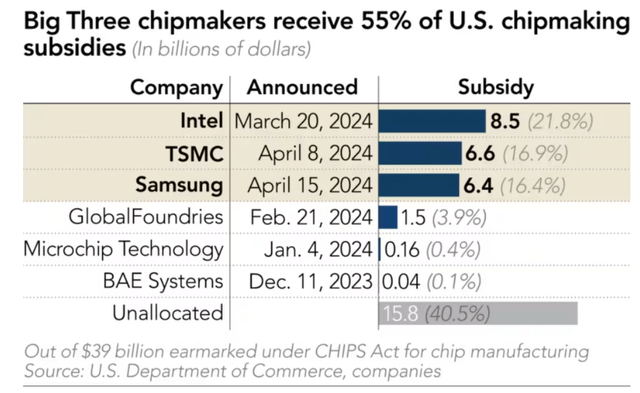

Lastly, introducing the CHIPS & Science Act has attracted the attention of KLC customers, such as Samsung and TSMC foundries in the United States. Samsung has invested roughly $45 billion in its under-construction foundry in Taylor, Texas. The fab is expected to start producing 2nm chips in 2026.

TSMC is also investing $65 billion in a fab in Phoenix, Arizona, and is expected to produce 3nm and 2nm by 2028. With the government’s support and subsidies to ensure the companies soar in semiconductor production inside the USA, KLA revenues are also poised to increase as foundries demand more KLA technology.

KLA’s customers are top world chip manufacturers, such as Intel, Samsung, and TSMC, which received the most 7 subscriptions, which signifies future revenue growth. KLA is domiciled in the US, which offers a proximity advantage to supply its process control and process systems to companies manufacturing in the US.

Implication on the Company’s Growth

I annex KLA’s process-control and process-enabling systems technology to its growth and profitability to indicate how the company has gained. Beginning with growth projection, advanced packaging, known as heterogeneous integration, performs multiple functions from varied technologies and is integrated into a single package. This innovation brings up a mix-and-match chipset solution.

This technology is used in AI GPUs driven by AI. In the last 10 years, GPU memory has topped 12 GB, but now it has topped 192GB, achieving efficiency and speed with high-bandwidth memory (HBM). KLA offers solutions for heterogeneous integration architecture in chip packaging, which will assist chip manufacturers in building advanced, high-yield, efficient, and quality devices.

As more complex packaging manufacturing increases, metrology solutions derived from front-end semiconductors that require customized packaging solutions will be demanded. Using its PCB market expertise, KLA is prepared to meet advanced packaging requirements, especially substrate and panel-level.

Rosy financial highlight – Latest earnings

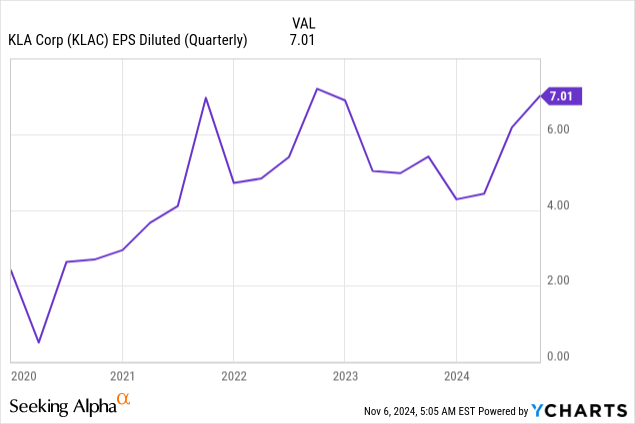

In Q4 ’24, the company recorded a 9% revenue increase to $2.57B YoY. 90% of the revenues were generated from its semiconductor process control, which was $2,308M, a 10% increase YoY. Wafer inspection is a major KLA revenue generator under the product category, with 46% growth and 23% YoY. This indicates an increasing demand for KLA’s wafer inspection as the demand for chips continues to soar. Specialty semiconductor revenue decreased by 7% QoQ and 6% YoY to $121M due to delayed capital expenditures of its key customers and cyclical market conditions.

However, I am opportunistic about specialty semiconductor revenue, as TSMC capital expenditures are set to increase by 15.6% YoY to $37B by 2025. This increase is driven by the demand for 2nm chips accompanied by high production capacity, where KLA technology is positioned in the supply chain. Printed circuit board (PCB) and component inspection soared 9% YoY to $140M.

The company’s profitability was positive in Q4’24 at 62.5%, and there was an increase in non-GAAP diluted EPS by 41.0%. This culminated in a $6.18 earnings per share from $4.43 in Q3’24

The company has shown strong performance by recording over $1,735M from Q3’24 and $1.65M as share buybacks in the last 12 months. This strong share buyback reveals the company’s commitment to boosting shareholder earnings, which explains why earnings per share scored $6.18 in Q4’24, despite an increase in share buyback from $372M in Q3’24 to $470M in Q4’24 and a dividend payment increase from $197M to $198M. Additionally, the company maintained a high free cash flow of $832M from Q3’24 at $838M, showing the strong cash available for its balance sheet.

Valuation and Target Price

First of all, I would like to stress that the almost 20% plunge in October is a completely macro and industry factor, not an idiosyncratic nor company-specific one. The plunge is primarily caused by the scandals and underperformance of an industry downstream peer, Super Micro (SMCI). In other words, my first price target will at least be at $800 where KLAC is traded at before the price action affected by a peer.

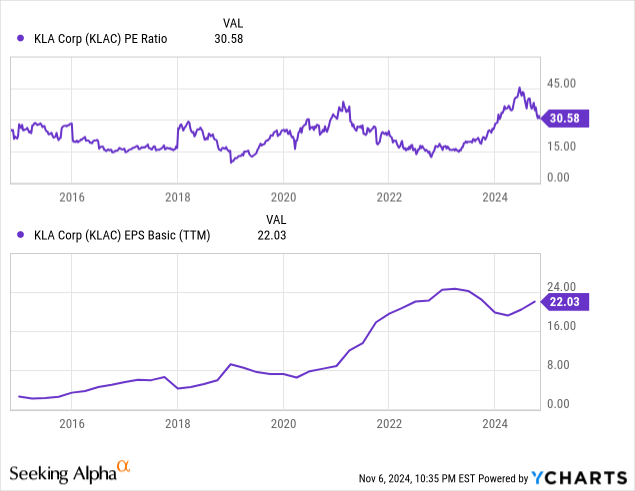

Secondly, to be fair, a P/E ratio of almost 45x is an extremely high valuation multiple based on the company’s historical level and industry level. KLAC usually trades in the range of 15x – 30x P/E, depending on market sentiment and industry hype – like 2018, it is traded at the lower end when the market took a dive. As such, under the current AI demand and computing chips frenzy, KLAC should be trading at around 25x – 28x which is the higher end, closer to it peers like TSMC’s valuation.

Full-year earnings, as provided by KLAC in the full-year guidance, is between $26.5 to $27. Therefore, this indicates the stock’s target price will be around $750.

In other words, KLAC is undervalued after the recent sell-off with 10 – 20% of upside, therefore a Strong Buy.

Investment Risks

- More intense competition – KLA’s metrology and wafer inspection systems face competition from Israel Vision and Semilab that offer advanced wafer-level packaging solutions.

- Macroeconomic uncertainties – The business faces interruption from geopolitical tensions, specifically between China and Taiwan. U.S. sanction on China for the sale of ASML EUV deems KLAC an opportunity to expand its services.

- Technology advancement and the inability to catch up – KLAC must keep up with the latest technology to meet the standards of TSMC 2nm and 1nm chips inspection services.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.