Summary:

- My initial bullish thesis on KLA Corporation aged well, with a 52% total return since September 2023.

- Recent quarterly earnings show strong performance, but the stock is slightly overvalued and faces substantial geopolitical risks.

- Moreover, long-term seasonality trends suggest that August and September are historically the weakest months for the stock.

Matteo Colombo

Investment thesis

My initial bullish thesis about KLA Corporation (NASDAQ:KLAC) aged extremely well since the stock outperformed the broader U.S. market since September 2023 with a 52% total return.

A lot of time has passed since I covered the stock, and today I want to update my thesis. I believe this will be useful for readers, especially in light of the recent quarterly earnings release. Despite strong quarterly performance, I tend to think that buying the stock at current levels is risky. My valuation analysis suggests that the stock is slightly overvalued, which looks risky to me in the short term. Historical seasonality trends suggest that August and September are the weakest months, and the company’s massive revenue exposure to China is a warning sign in the current complex geopolitical situation. All in all, I downgraded KLAC to “Hold”.

Recent developments

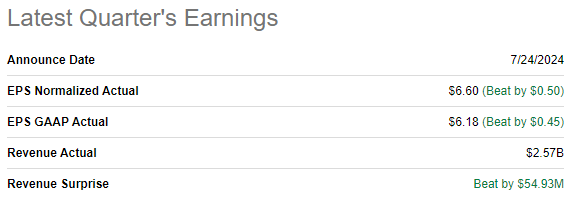

KLAC released its latest quarterly earnings on July 24, when the company surpassed both revenue and EPS consensus estimates. FQ4 2024 revenue grew by solid 9% YoY. The adjusted EPS expanded notably, from $5.40 to $6.60.

Seeking Alpha

I pay a lot of attention to the quality of the EPS expansion. In KLAC’s case, the EPS expansion was of high quality, as it was achieved with a solid operating leverage. The operating margin expanded YoY from 34.87% to 38.74% while the outstanding shares count was approximately flat.

Strong operating performance allowed KLAC to generate $614 levered FCF during the quarter. The company continues aggressive stock buybacks, with half-a-billion spent on repurchases during FQ4 2024. Dividend yield is still shallow at 0.77%, but there is an impressive 13.5% dividend CAGR over the last five years. I have to give credit to the management for its robust capital allocation as it successfully balances between fueling growth, keeping the balance sheet healthy, and returning money to shareholders via buybacks and dividends.

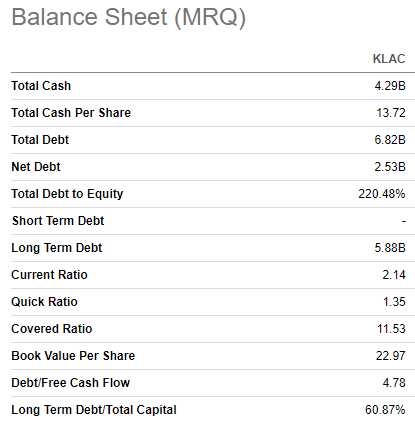

Seeking Alpha

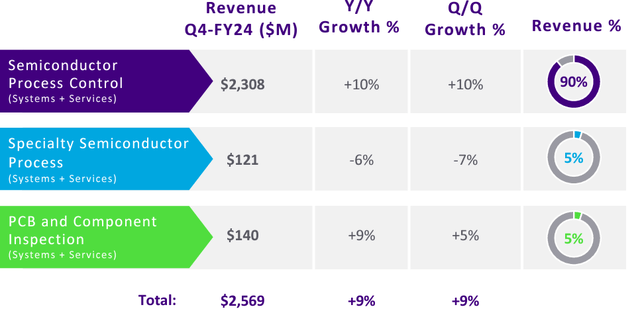

The company’s Semiconductor Process Control segment, which represents 90% of the sales, demonstrated a 10% YoY growth. I consider this to be a strong sign, as the company’s core business appears to be healthy. Two other segments, each representing 5% of the total, approximately offset each other.

KLAC’s latest earnings presentation

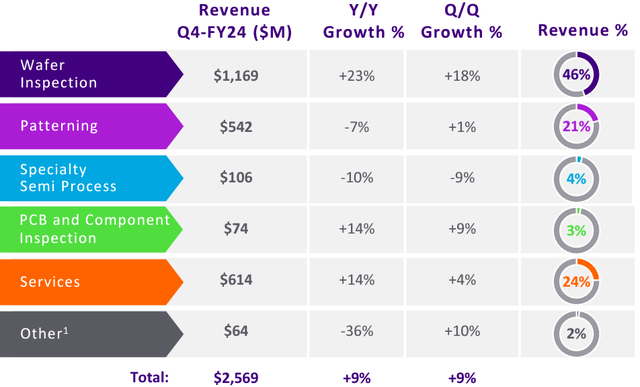

Wafer Inspection is the company’s core revenue stream, and it appears to be on fire, with a 23% YoY and 18% QoQ growth. Services are the second-largest revenue stream, and it also demonstrates solid dynamic, both on a YoY and sequential bases. KLAC’s revenue mix is well-diversified, and other revenue streams approximately offset each other.

KLAC’s latest earnings presentation

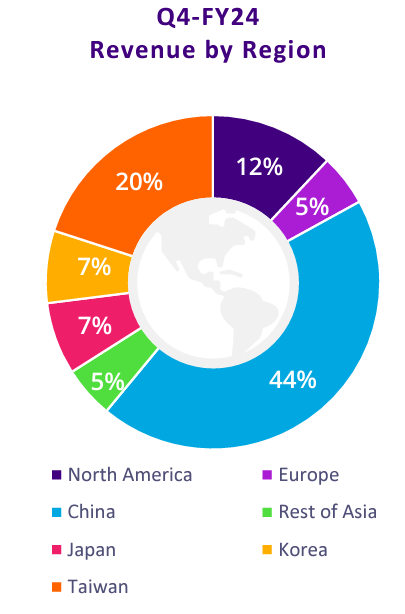

Despite overall strength across core streams, I want to remind investors about a few negative moments as well. The company generates more than 40% of its total revenue in China. That means KLAC faces substantial geopolitical risks related to tensions between the U.S. and China. The company has already faced a ban on exporting some of its products to China. Given complicated relationships between the world’s two largest economies, having such a massive exposure to the Chinese markets is an apparent risk for KLA Corporation.

KLAC’s latest earnings presentation

Generating almost 90% of its sales outside North America also means the company faces significant foreign exchange and international trade risks. Unfavorable fluctuations in foreign exchange rates might significantly undermine the company’s earnings. Changes to international trade regulations and tariffs can also potentially be a big disruptor to the company’s operations.

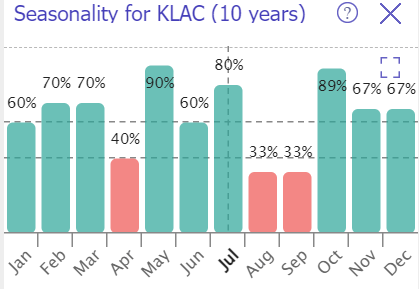

TrendSpider

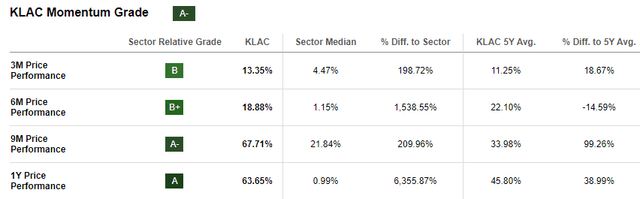

Short-term seasonality trend also looks unfavorable for KLAC in late July. August and September are historically the weakest months for the stock. Therefore, historical patterns suggest that there likely can be a pullback in the next two months. On the other hand, the last three months of a year are historically quite strong.

Valuation update

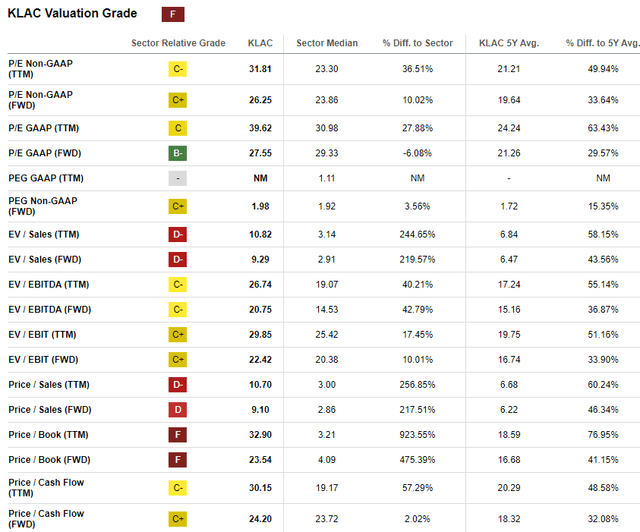

The stock outperforms the broader market over the last twelve months with a 64% rally. KLAC is also strong in 2024 with a 31% YTD rally. Seeking Alpha Quant assigns KLAC a low “F” valuation grade due to its high multiples compared to the sector median and historical averages. That said, the stock is overvalued from the valuation ratios perspective.

Seeking Alpha

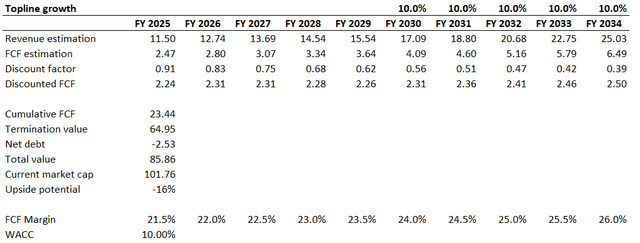

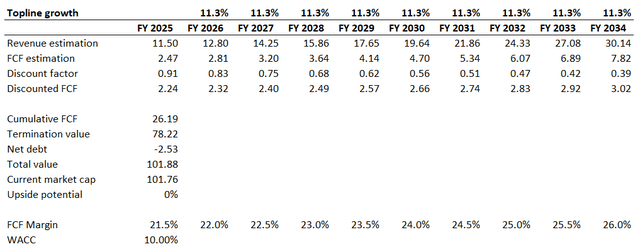

On the other hand, the company’s financial performance is still expanding notably; therefore, let me simulate the discounted cash flow [DCF] model. I use a 10% WACC for discounting, which aligns with the range recommended by valueinvesting.io. I have revenue consensus estimates available up to FY 2029 and project a long-term 10% CAGR for the years beyond. The mix of consensus estimates by FY 2029 and a 10% CAGR for the years beyond gives a 9% CAGR for the entire decade. This looks like a fairly conservative revenue growth assumption for the DCF. For the FCF margin, I use the last five years’ average, which is 21.45%, and expect it to expand by 50 basis points as the business continues scaling up.

Author’s calculations

As shown in the above scenario, the business’s fair value is around $86 billion. This indicates that the stock is overvalued at current levels. To demonstrate which revenue growth rate for the next decade justifies KLAC’s valuation, let me simulate the second scenario below.

Author’s calculations

Playing only with revenue growth rate and leaving other assumptions unchanged suggests that the current market cap is justified with an 11.3% revenue CAGR for the next decade. While consistently delivering double-digit revenue growth for a decade is a challenge, it does not look impossible either. Therefore, I would conclude that KLAC is approximately fairly valued at current levels and maybe even slightly overvalued.

Risks to my rating downgrade

Despite the recent pullback in the biggest semiconductor names, the industry is still on fire. The sentiment looks quite optimistic around the prospects of semiconductor companies due to the massive data center spending from the largest U.S. tech corporations. The current pullback in semiconductors might be just a temporary event before Nvidia and other prominent players start conquering new highs. As a notable player in the industry, KLAC might rally as well despite its already generous valuation. Moreover, KLAC’s momentum is impressive and the solid latest earnings report might help to sustain the rally for longer.

Seeking Alpha

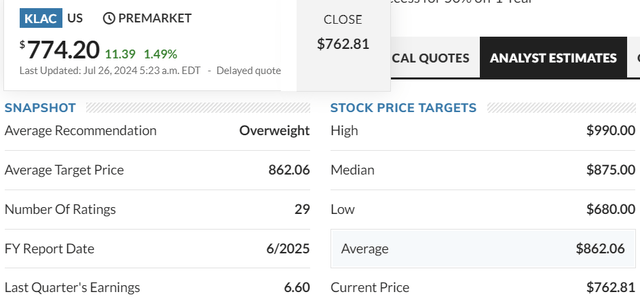

Wall Street analysts are quite bullish about KLAC. I can see it from the robust track record of consensus quarterly earnings revisions, which is usually a positive catalyst for the stock price. Moreover, the consensus target share price for KLAC is notably higher than the current price. This positive sentiment is also likely a positive catalyst for the stock price.

MarketWatch

Bottom line

To conclude, KLAC looks like a “Hold” at the moment. I think that the stock is currently fairly valued and there is a slight overvaluation. Paying a premium over the fair value does not look like a good idea considering massive geopolitical risks and historically weak stock performance in August and September. There likely will be better entry points during the upcoming two months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.