Summary:

- KLA Corporation has shown steady growth over the past 5 years and has reached all-time highs, indicating no signs of slowing down.

- The Wafer Inspection Market is expected to grow faster than the AI and semiconductor industries, driving higher revenues and operating margins for KLA Corporation.

- The development of self-driving cars presents a significant opportunity for KLA Corporation to capture a share of the growing market and drive revenue growth.

PonyWang

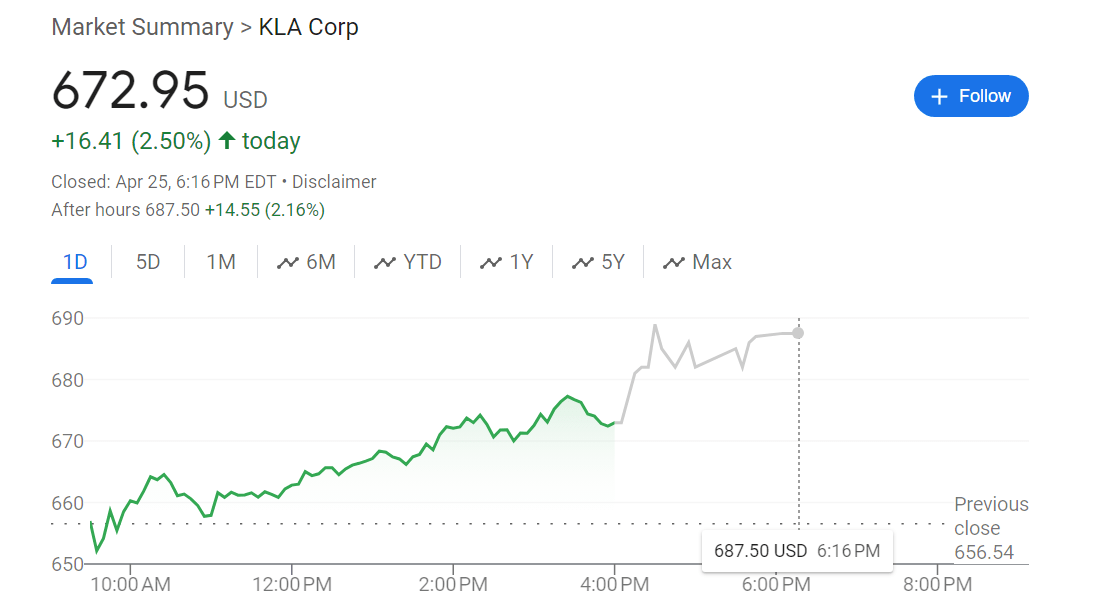

KLA Corporation (KLAC) develops equipment and services that enable innovation throughout the electronics industry while holding the majority of the market share in the Wafer Inspection vertical. Graph 1, below, shows KLAC on a steady climb over the past 5 years, up about 450% in this time frame. The stock reached its all-time high on March 7, 2024, at 723.26. Currently, on April 25, 2024, it is trading about 695 bps below this mark at $672.95 with a market cap of $91.01 billion.

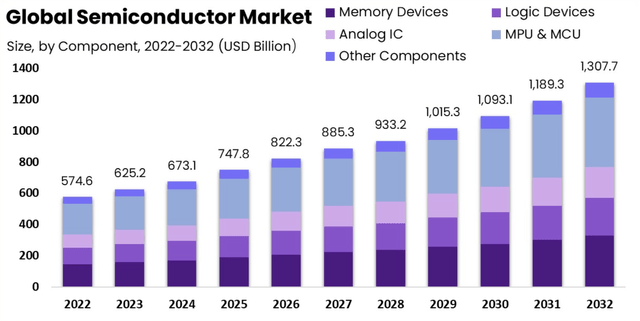

The company’s recent growth is showing no signs of slowing down as the Wafer Inspection Market, which made up a little over 40% of KLAC’s Q2 fiscal 2024 revenue, is expected to grow at a faster rate than the semiconductor industry as a whole over the next 6 years. This also doesn’t take into account recent developments in China limiting the use of chips from AMD (AMD) and Intel (INTC) for its government computers, which will pave the way for KLAC’s biggest customer, Taiwan Semiconductor Manufacturing Company (TSM), to expand even more in the region. The AI and the Semiconductor industries are continuing to grow rapidly as they are correlated because AI needs semiconductors to be developed. I believe this will cause the Wafer Inspection Market to grow faster than the AI and semiconductor industries because of the need for new process controls from customers, which will drive revenues even higher for KLA Corporation as I view its market share in Process Control to continue to grow.

Google Finance

Growth of Wafer Inspection

In simple terms, the more powerful the semiconductor chip, the more integrated circuits are needed. Integrated circuits are the main building block for semiconductor chips because they can serve as a logic gate, timer, counter, microprocessor, or computer memory, among many other roles. Substrates are the material the pieces of a semiconductor chip are attached with, and wafer inspections are used to check whether or not substrates are in good condition.

KLAC possesses a vast amount of patents, increasing the entry barriers for its competitors. 67% of its 12,751 patents are active. KLAC’s patents are spread across the globe with the maximum number of allowed patents held in the United States, and over 1,000 patents held in Japan, Taiwan, South Korea, and China respectively. In my opinion, the most valuable patents KLAC possesses are a patent that protects the technology that uses machine learning to better recognize images containing semiconductor defects and many others that protect process control and other defect recognition technology. In my opinion, KLAC’s patents that protect process controls and other defect recognition technologies, such as their machine learning algorithms to better recognize images containing semiconductor defects, are vital to protect their competitive market positioning.

In Q3-FY24, semiconductor process control made up 89% of KLAC’s quarterly revenue. Breaking this up, 64% of the revenue came from foundry & logic processes and 36% of the revenue came from memory process controls. Examining the revenue breakdown by product, Wafer Inspection Products brought in $998 million in revenue, which accounts for 42% of KLAC’s total quarterly revenue.

In 2022, the Wafer Inspection Market Size was $3.59 billion. The market is expected to grow to $9.867 billion by 2032, which means the projected CAGR is 10.6%. Moreover, the Global Semiconductor Market is only projected to have a CAGR of 8.8% over the same period.

I believe the Artificial Intelligence (AI) industry will drive both the demand for Semiconductors and, therefore, the Wafer Inspection markets. It is a significant catalyst because I view the growth will be significantly higher than anticipated. This is due to my observations that the AI market is still in the beginning stages. Therefore, I view lots of AI’s uses are yet to be discovered, and many companies are investing in R&D to try and have the next innovative breakthrough in AI.

Through my research, to support this argument, I sought to research KLAC’s customers, where three AI developers, Taiwan Semiconductors, Samsung (OTCPK:SSNLF), and Intel, make up 30% of its revenue. These companies are investing heavily in their AI products, and the Asia Pacific AI market is expected to expand at a CAGR of 37.3% between 2023 and 2030 because of this. This plays right into KLAC’s hands because 84% of its revenue came from this region.

In my base case projections, I project an increase in KLAC’s revenue by 24% year-over-year. Because more Integrated Circuits are needed for stronger semiconductor chips to produce better AI products, I assumed the demand for KLAC’s Wafer Inspection products to increase beyond market expectations, increasing both revenue and operating margins significantly.

ASML (ASML) and Lam Research (LRCX) are other key players in the Wafer Inspection market. However, KLAC brought in over $4 billion in revenue from its Wafer Inspection product in 2023, which is a market share percentage of 98%. KLAC is a clear industry leader because it possesses a market share in the Semiconductor Process Control industry of four times its nearest competitor. I expect ASML to focus on its other logic products that it has been successful with because of the dominance of KLAC.

Moreover, LRCX’s focus is on wafer fabrication, which is actually the production of the wafers that KLAC makes products to inspect. Because of this, there is no direct product competition from its main competitors, and in fact, it is beneficial for KLAC if LRCX increases its wafer fabrication supply because this would likely increase the demand for KLAC’s wafer inspection products due to the nature of the products.

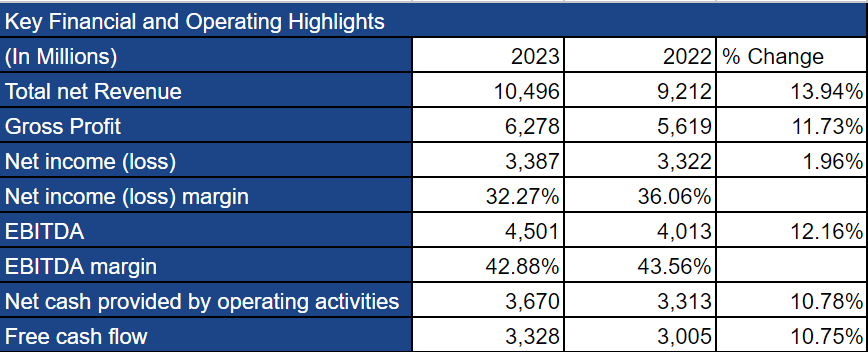

Financial Health to drive R&D

In September 2023, KLAC raised its quarterly dividend to $1.45 per share. This is KLAC’s 14th consecutive annual dividend increase. Significantly, between 2006-2023 KLAC’s dividend has produced a 15% CAGR. Moreover, as KLAC targets 85% of total capital returns, KLAC has continued to repurchase its own shares. In Q3-2024, share repurchase amounts totaled $372 million; however, since 2019 its average price per share repurchase is $288.

KLAC also shows great financial health on its balance sheet with total cash being over $4 billion while working capital is $5 billion and total assets are almost $15 billion, with only $6.7 billion in bonds outstanding at an average interest rate of 4.67% and an average maturity of 18.1 years. Most notably Fitch has increased its investment grade credit rating from an A- to an A.

I believe KLAC has a competitive advantage in its protected market share. KLAC’s strong balance sheet permits the development of new technology and the continual improvement of its existing products. I view this advantage as fulfilling a need to adapt alongside the rapidly growing and changing AI and semiconductor industry, which will fulfill customer’s needs. I expect KLAC to use its cash to continue to grow Capex by over 10% each year to continue to meet the demands of its customers.

ASML and LRCX both have large amounts of cash available, with ASML having over $7 billion in cash and LRCX having over $5 billion in cash on their balance sheets respectively. Both competitors spend on R&D, but I believe the barrier to entry is too high for its competitors to consider trying to make a rival wafer inspection product because there is both a large technological and knowledge gap to overcome, and it is estimated to be in the tens to hundreds of millions in order to catch up to a rapidly advancing field.

The opportunity cost would be too high to attempt to enter the wafer inspection market because KLAC has such a dominant percentage of market share capture. KLAC also has minimal financial risk because of the low-interest rate and long yield to maturity for its bonds issued. Because of this, I believe KLAC will continue to develop improved Wafer Inspection products and necessary specialty semi-processes to increase its market share in a rapidly growing market because of the vast amount of capital it has at its disposal.

Seeking Alpha

The Push to develop a Self-Driving Car

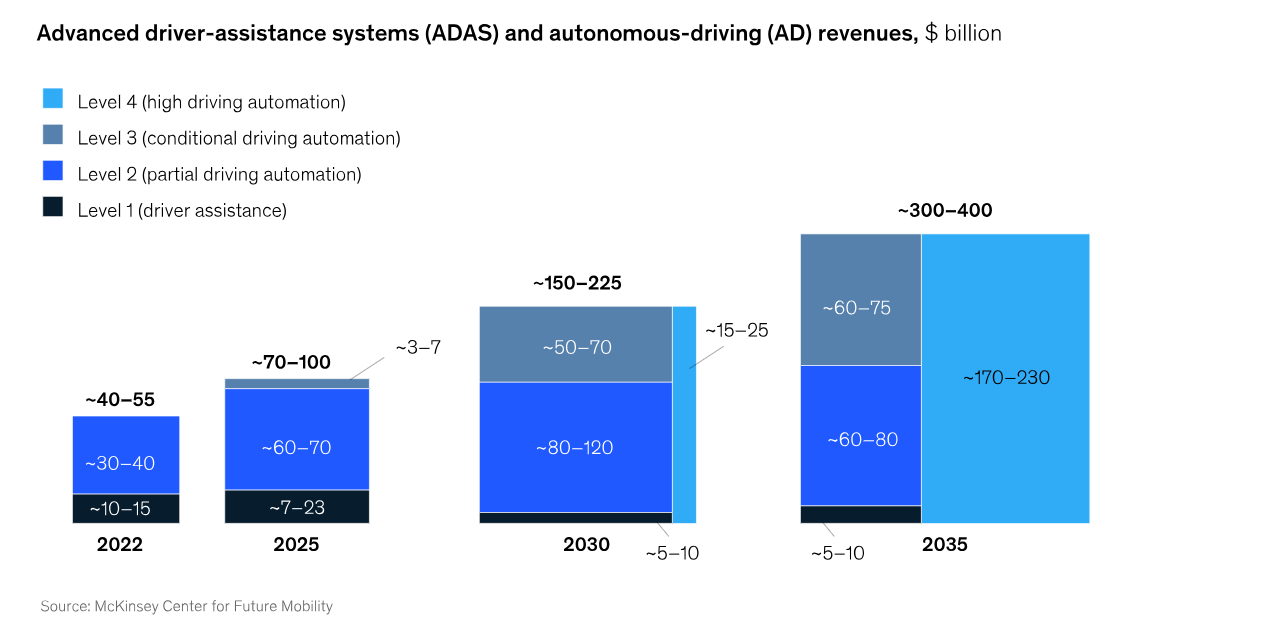

It is no secret that many big names, such as Tesla (TSLA), General Motors (GM), and Ford (F) are pushing to develop self-driving cars. Therefore, I believe that self-driving cars may be one of the biggest drivers for KLAC’s revenue growth in the upcoming years, and open the door to becoming a supplier for some of the world’s biggest automobile companies. The number one risk in making self-driving cars is the possibility of a technology defect causing an accident. Because of this, I believe there is a huge potential market for KLAC to capture with its already established product portfolio. Graph 3 below shows the market to generate over $300 billion in 2035.

McKinsey & Company

To develop completely autonomous cars, there must be zero defects, otherwise, the manufacturers will assume a large number of liability issues if defective products get to market. The automobile industry is expected to have the highest CAGR of additional semiconductor chips because of the push for autonomous driving. A CAGR of 9.3% is expected in this industry by KLAC. This presents the opportunity for KLAC to grow its revenue on its process control offerings. These additional technology improvements can come in the form of additional safety features and consumer gadgets like Apple CarPlay.

Therefore, more semiconductor chips are required as cars become more technologically advanced. The more autonomous self-driving cars become, and the more technological advancement software cars possess, there will be a greater need for more semiconductor chips to be in each car. Companies will need to invest heavily in ensuring all the software operates as expected through products such as the Wafer Inspection Product.

This paves the way for KLAC to enter its already existing product portfolio into one of the fastest-growing markets in the world, which will drive KLAC’s revenue growth in the coming years. Because KLAC holds a 98% market share in the Wafer Inspection industry, I expect this to drive KLAC’s revenue to grow 22% year over year. I don’t expect KLACs dominant position in the Wafer Inspection industry to dwindle, so this will allow the firm to capture a majority of increased sales of semiconductor defection products, which is why I expect the development of self-driving cars to drive KLAC’s revenue growth in the coming years.

My Financial Projections

Revenue Growth Rate Projections

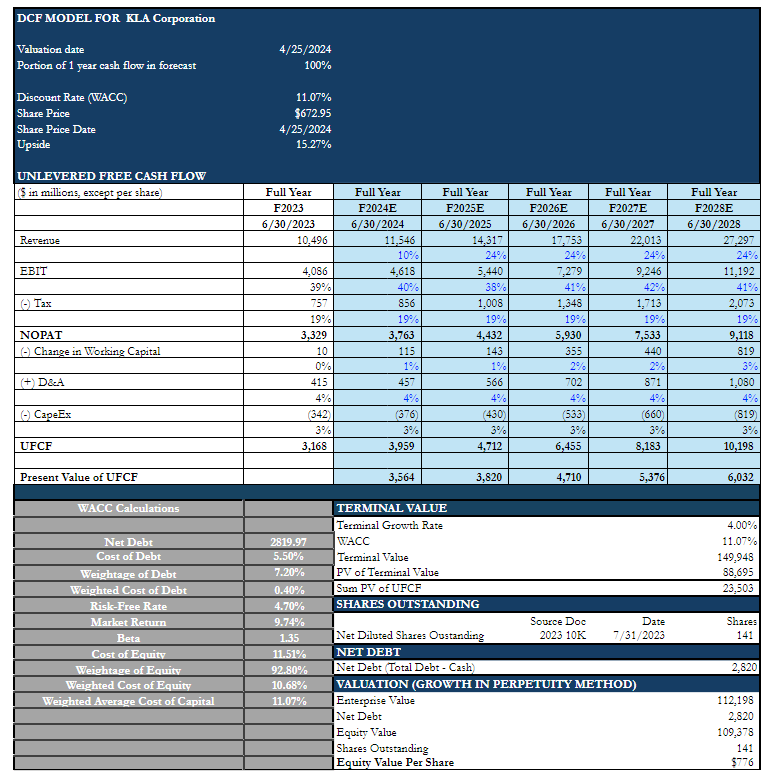

In my DCF Model, I estimate a base case revenue of 10% in 2024 as revenue growth has been slowing in the past two years. However, in the coming years, I expect AI to both drive demand for KLAC’s products and enhance KLAC’s efficiency in developing new and improving on its existing product portfolio, especially the wafer inspection product. AI will increase accuracy in detecting defects and increase efficiency in detecting defects. Because of this, in the subsequent years, I assumed revenue growth for KLAC to be at 24% year over year.

Terminal Value Projections

I then took a terminal growth rate of 4% because GDP growth rates have historically been 3%, but I believe that the use of AI in the economy will improve productivity and drive future growth to 4%.

Weighted Average Cost of Capital (WACC)

To calculate WACC, I first took the weighted average of KLAC’s outstanding corporate bonds, which have an average yield of 5.50%. I then multiplied by the weight of debt to get a weighted cost of debt of 0.40%. To calculate the cost of equity, I used the 10-year U.S. treasury bond rate. I then used the S&P 500’s average return over the last 20 years as the market return, and I used KLAC’s beta of 1.35. After multiplying by the weight of equity I arrived at a Weighted Cost of Equity of 10.67%. After adding the Weight Cost of both Equity and Debt together, I arrived at a WACC of 11.07%.

Intrinsic Value

Finally, I summed the 5 years of projected cash flows and present terminal value to find the enterprise value and subtracted it from net debt. After dividing by total shares outstanding, I was led to a target price of $776 per share, representing a 15.27% potential upside.

Risks

The main risk I see in KLAC is industry volatility in the Wafer Inspection Product Market. Because KLAC is so dependent and derived 42% of its Q3 2024 Revenue from the Wafer Inspection Product alone, the growth of this market directly correlates to the potential earnings growth for KLAC. Moreover, another big risk for KLAC is if this industry were to be replaced by another product from a competitor. Because KLAC’s second-biggest product only produces 23% of its revenue, if a competitor were to improve on the Wafer Inspection Product, KLAC would quickly need to shift gears. However, because KLAC holds a market share of 98%, it is highly improbable a competitor could penetrate this market successfully. I also believe it is in its competitors’ best interest to focus on other products in the semiconductor space, as ASML and LRCX have been doing because of the dominant position KLAC has in the wafer inspection industry.

With that being said, with the expected high growth of both the IT and IoT industry, there is little worry that the demand for Wafer Inspection Products is going anywhere. Furthermore, KLAC is committed to investing in its R&D and trying to improve its product portfolio, so I expect KLAC to continue to increase its revenues year over year even if it experiences competition in the Wafer Inspection Product market.

Takeaways

I would like to conclude this report with a Buy Recommendation for KLAC stock, with a target price of $776 with an upside of 15.27%. I believe that the growing demand and the development of Artificial Intelligence will power KLAC’s growth. Semiconductor chips will continue to be produced and therefore inspected, which will be a catalyst for KLAC’s growth moving forward. Furthermore, I do not expect the market for Wafer Inspection Products to slow down or competitors to take away KLAC’s market lead in the industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.