Summary:

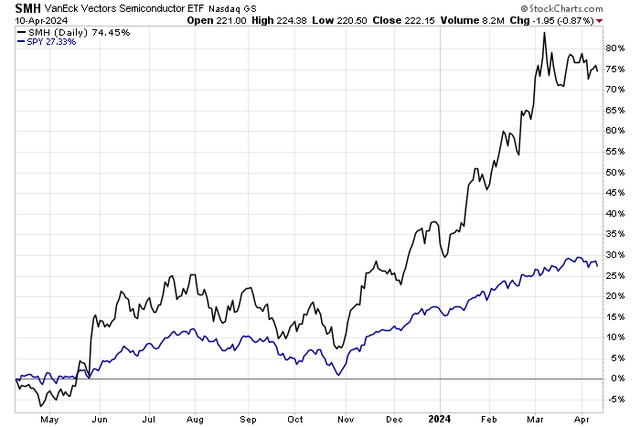

- Semiconductor stocks have stalled since reaching an all-time high in March, but are still outperforming the S&P 500 year over year.

- I have a buy rating on KLAC as I see the stock with a low-enough valuation and positive technical indicators ahead of its earnings report on April 26.

- With healthy margins and EPS growth ahead, I highlight key price levels to monitor on the chart.

Monty Rakusen

Semiconductor stocks have stalled out since notching an all-time high back on March 8. Shares of the VanEck Vectors Semiconductor ETF (SMH) spiked to near $240 on high volume before falling sharply during the trading day, closing near the lows of the session and under $225. It had the hallmarks of what technicians call a “blow-off top.” Then, earlier this month, SMH printed a bearish engulfing pattern (April 4). These are important clues for an industry that has grown to become a material chunk of the S&P 500. It bears watching as we head into the Q1 earnings season – the chipmakers don’t report until late April and into May, however.

I have a buy rating on KLA Corporation (NASDAQ:KLAC). I see its valuation slightly cheap today after a strong rise over the past year while earnings growth solid through next year. Also positive is the $92 billion market cap’s technical situation ahead of earnings on April 25.

Chip Stocks Stalled Out in March, Still Beating the SPX YoY

According to Bank of America Global Research, KLA-Tencor is a leading supplier of process control and yield management solutions for semiconductor and related nanoelectronics industries. KLAC’s comprehensive portfolio of inspection and metrology products, and related service and software, helps integrated circuit manufacturers manage yield throughout the entire semiconductor fabrication process. KLA’s products and services are used by the vast majority of bare wafer, IC, lithography reticle, and disk manufacturers around the world.

KLAC struggled after issuing an earnings beat back on January 25. The firm reported Q2 non-GAAP EPS of $6.16, which was $0.28 above analysts’ expectations. Revenue was $2.5 billion, 16% below year-ago levels. While free cash flow was more than $545 million, it was the management team’s Q3 outlook that disappointed investors.

The firm said it expects $2.175 billion to $2.425 billion in revenue for the quarter just ended, below the consensus of $2.46 billion. Bigger picture, Intel’s soft outlook put a wet blanket on the industry at the same time. KLAC dropped 6.6% the following session but then rallied to fresh highs by the next month.

Looking ahead, the options market has priced in a 5.3% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the April 25 reporting date, according to data from Option Research & Technology Services (ORATS). The operating EPS estimate is $5.13 per Seeking Alpha – that would be a slight dip YoY.

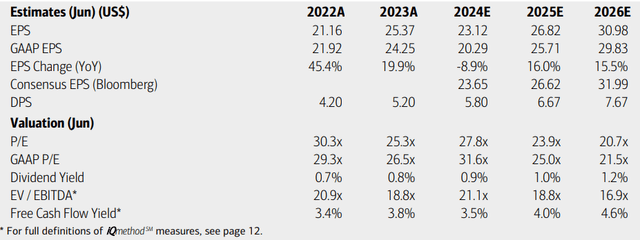

On valuation, analysts at BofA see earnings falling 9% this year. It’s important to point out that the firm is already in its fiscal Q4, so 2025 earnings are next up. With mid-teens EPS growth over the coming quarters, fundamental trends appear positive. Dividends, meanwhile, are expected to rise at a solid pace through the out year, perhaps leading to a yield above 1%.

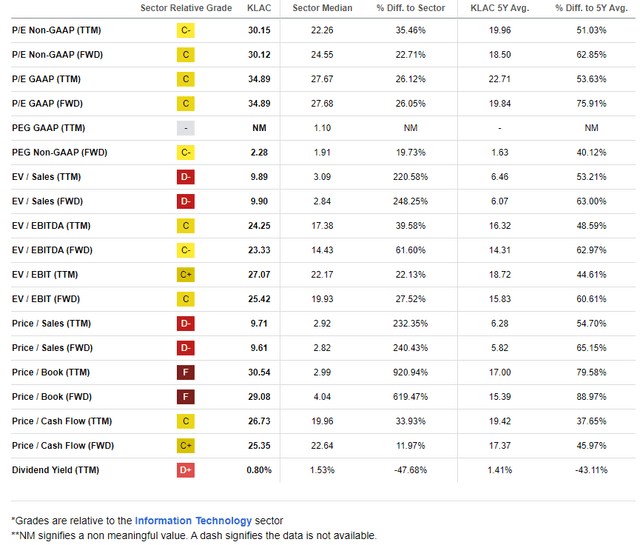

KLAC has consistent free cash flow given its recurring services business model, so that helps support a lofty valuation. The firm trades about 23 times on a forward EV/EBITDA basis, significantly above its 5-year average.

KLAC: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assign the company a 2x PEG ratio, above its long-term average given its solid margins and less cyclical exposure compared to other semiconductor firms, and assume normalized EPS growth of 16%, then shares should have a 32x earnings multiple.

Assuming $25 of operating EPS over the coming 4 quarters, then KLAC should trade near $800, making the stock still undervalued today.

KLAC: A Lofty PEG Ratio, P/E Near the Sector Median

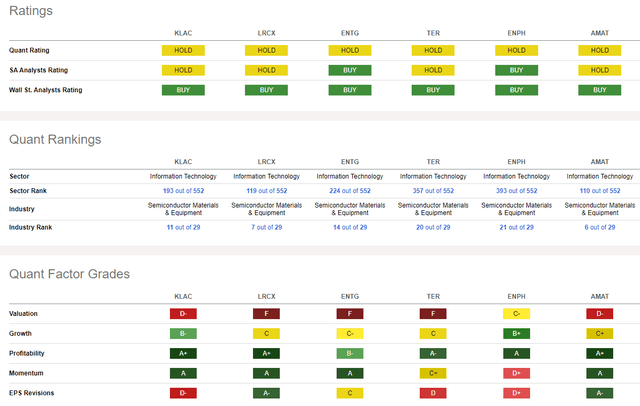

Compared to its peers, KLAC features a middle-of-the-road valuation, but that is also premium on an absolute basis given robust growth trends ahead. Profitability metrics are very healthy as the industry has been enjoying a boom period. Likewise, share-price momentum is stellar, and I will provide a detailed technical view later in the article.

What’s not to the liking of the bulls is KLAC’s weak EPS Revisions grade due to a whopping 21 negative sellside revisions in the last 90 days compared to zero upgrades. Susquehanna was one such firm slashing numbers, but they cited that the stock was merely near fair value (not predicting sharp fundamental deterioration).

Competitor Analysis

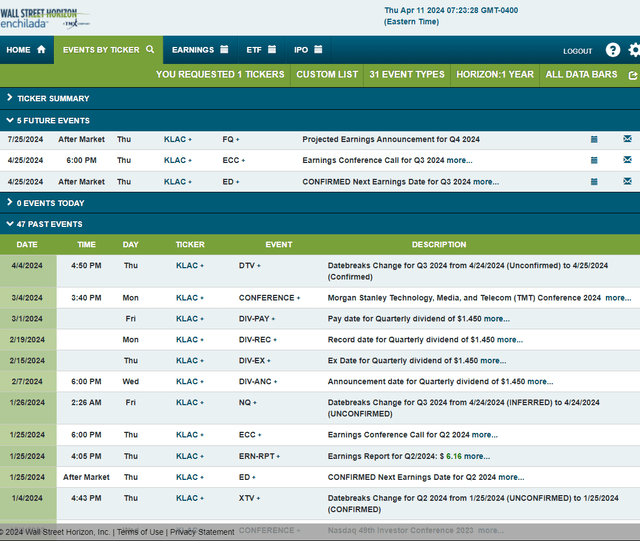

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Thursday, April 25 AMC with a conference call later that evening. You can listen live here.

Corporate Event Risk Calendar

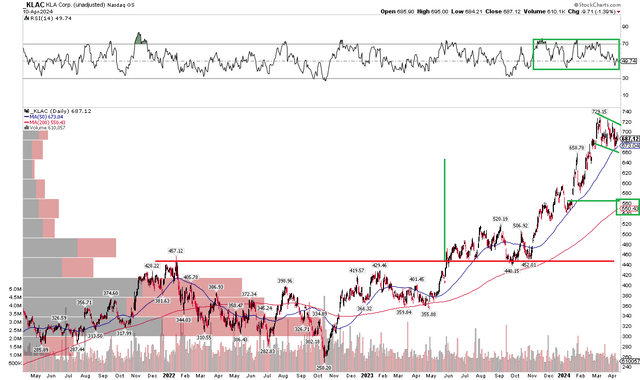

The Technical Take

While I see KLAC close to its intrinsic value, the chart is among the best you will find in the market. Notice in the graph below that shares are currently in a bull flag pattern – a low-volume consolidation of recent gains with a series of lower highs and lower lows since the middle of March. What’s more, the RSI momentum gauge at the top of the chart is in the notable bullish zone between 40 and 90. Also, the long-term 200-day moving average is positively sloped, indicating that the bulls are in control of the trend.

Where could KLAC pull back to? Take a look at a small gap down at $560. That would be a significant 22% correction off the $729 all-time high and would have confluence with the 200dma. For now, shares are approaching the 50dma as they did at the start of the year before rallying sharply throughout Q1. Finally, KLAC has over-achieved its measured move price objective to $650 from the consolidation range in 2022 through the middle part of last year.

Overall, KLAC is pausing within a powerful uptrend. The current bull flag pattern augers for higher prices ahead while RSI trends are bullish. A gap lingers just above the rising 200dma.

KLAC: Strong Uptrend, Bull Flag, Healthy RSI

The Bottom Line

I have a buy rating on KLAC. I see the stock still below fair value as EPS growth picks up later this year. The chart is bullish, so technically oriented investors and swing traders should keep this stock on their radars ahead of quarterly earnings due out later this month.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.