Summary:

- KLA Corp. is poised for growth as semiconductor manufacturing capacity increases domestically with the assistance of the CHIPS Act.

- The company is expected to benefit from the construction of regional AI factories, automotive ADAS systems, and AI-enabled smartphones and PCs.

- Investments in EUV lithography and advanced packaging will benefit KLA Corp. during the next cycle of investments for 3nm and 2nm chips.

koto_feja/iStock via Getty Images

KLA Corp. (NASDAQ:KLAC) is nearing a cyclical upswing as customers are nearing their major capital allocations to semiconductor manufacturing equipment as they finalize the construction of their domestic foundries. The Semiconductor Industry Association, in partnership with Boston Consulting Group, projects that the domestic capacity for semiconductor manufacturing will grow by 3x from 2022 figures with the assistance of the CHIPS Act.

In addition to this, I believe the design cycle for advanced nodes will accelerate as competition for faster and more energy-efficient chips becomes fiercer, providing more room for KLA to growth across their products and services segments. I anticipate that much of the growth will be driven by the construction of regional AI factories, automotive ADAS systems with more content per vehicle, and AI-enabled smartphones and PCs. I rate KLAC shares with a BUY recommendation with a price target of $1,057/share at 27.60x eFY25 EV/aEBITDA.

Be sure to read my initial coverage of KLA Corp. here:

KLA Corp. Will Benefit From CHIPS Act And The Infrastructure Supercycle

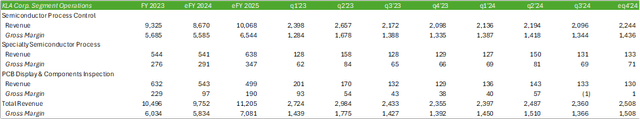

KLA Corp. Operations

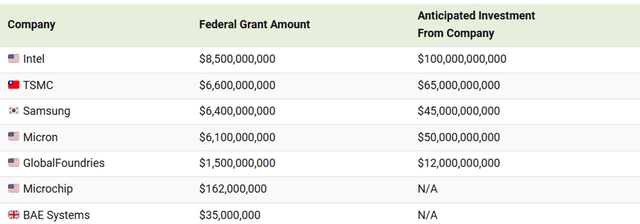

KLA is well positioned for a major cyclical upswing as the next generation of 3nm chips begin to ramp up with 2nm chips to follow. Much of the demand is associated with nearshoring the supply chain to the domestic fabs being built out as part of the CHIPS Act. As such, over half of the dedicated funding for foundry buildouts has been allocated to select semiconductor manufacturers in order to bolster the domestic production of advanced chips.

According to IEEE, the US will produce 28% of the world’s advanced logic chips by 2032. Intel Corp. (INTC) is expected to invest $100b in new fabs with the goal of becoming the go-to foundry for advanced semiconductors. Though I’m hesitant to buy into Intel’s strategy as the firm is playing catch-up with its competitors in advanced chip design and production, Mr. Gelsinger remains optimistic in attaining business from competing chip designers. Intel will be building fabs in Arizona, Ohio, New Mexico, and Oregon as part of their $100b investment. One of the differentiators Mr. Gelsinger plans to bring to the table is providing EUV lithography as well as packaging to enable 2.5D and 3D chip tile-based designs.

Taiwan Semiconductor (TSM) is also investing a significant amount into US-based chip manufacturing, which will likely maintain their chip design relationships with firms like Nvidia (NVDA). TSMC will be building their fab in Arizona to manufacture 4nm chips. Management at TSMC mentioned in their q1’24 earnings call that the firm doubled their advanced packaging capacity from the previous year and is leveraging their OSAT partners to cover excess capacity demand. On the earnings call, management discussed that their customers are working with the chip manufacturer on N3 & N2 designs as power consumption remains a major challenge for AI factories.

Micron Technology (MU) will be investing $50b through 2030 to construct fabs in Idaho and New York, which will likely bolster their DRAM & HBM production capacity. Management guided in their q3’24 earnings call that the Idaho fab will meaningfully ramp in 2027 with New York in 2028 or later. Management also mentioned that the firm will be enabling EUV in Japan to ramp the 1-gamma node.

Visual Capitalist

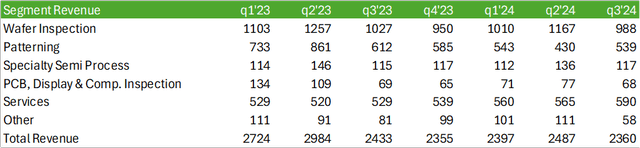

Management anticipates their foundry & logic business to experience tailwinds going into CY2h24 as the next cycle of capital investments ramps up. This will impact their process control products & tools and services business as demand grows for their metrology systems and advanced packaging systems as chip designers seek to bolster their advanced chips to support the demand driven by AI infrastructure. Management anticipates advanced packaging to have a $400mm run rate in 2024 and is expected to meaningfully grow faster than WFE.

Corporate Reports

The growth opportunity for KLA may be well beyond foundry buildouts given the rate of change for advanced nodes for AI applications and infrastructure. This may include upgrading systems, which should improve services revenue as well as new systems as advanced packaging further expands beyond the China-dominant market. Despite the -1% decline in market share as KLA decouples from the China market, the firm may have ample opportunity to turn this around as chip manufacturers nearshore operations.

Memory is expected to account for 18% of semiconductor process control systems revenue, of which 78% will be DRAM. This aligns with guidance provided by management at Micron as the firm builds out capacity for DRAM and HBM. Memory and storage will likely be a major contributor for KLA as large regional AI factories are built out to cater to localized demand. This is a factor I discuss extensively in my report covering Oracle Corp. (ORCL).

I believe the build-out of regional AI factories will drive demand for more advanced nodes as competition for speed and power consumption becomes more fierce. Many of the hyperscalers, including Microsoft Azure (MSFT) and Amazon AWS (AMZN) are designing their own accelerators in order to provide more tailored services in relation to data consumption and power efficiency. Despite the drive to bring AI to the edge on smartphones and PCs, I do not anticipate as much capacity to be catered to this area as consumer demand remains muted.

Corporate Reports

In March 2024, KLA made the decision to exit the display business and will wind down operations by the end of the calendar year. KLA will continue to provide services to their installed base. The total goodwill impairment charge for the PCB & Display segment was $192.6mm with the remaining value being distributed between two separate segments for PCB and Display. On a relative basis, the PCB & Display segment has been a low-margin business when compared to KLA’s other segments. The reported segment figures for q3’24 showed the impact post-exit of the business with a -1% gross margin.

Corporate Reports

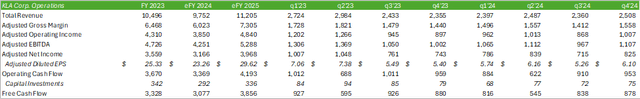

Looking at financials, I anticipate modest improvement to margins going into the end of eFY24 and eFY25. I expect growth to accelerate throughout eFY25 as capital investments begin moving to KLA for lighting up domestic foundries. Growth verticals that KLA can cater to reside in AI infrastructure as customers require more advanced nodes with better power management, automotive as ADAS requires more content per vehicle, AI-enabled smartphones and PCs for when consumers upgrade to the next generation of devices, and industrial automation. I believe KLA will realize strength in their wafer inspection systems as more advanced nodes become more and more complex. I anticipate KLA will also realize strength in their testing & packaging segment with the same rationale. As more customers push the boundaries across 3nm and 2nm and gate all around with steeper ramp ups, KLA should realize continued growth. I believe the shortening of the chip cycle will benefit KLA as competition for more powerful logic and memory chips heightens.

Valuation & Shareholder Value

Corporate Reports

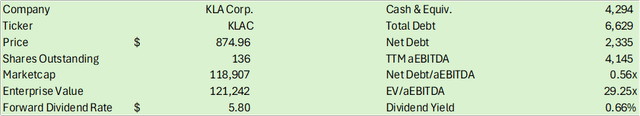

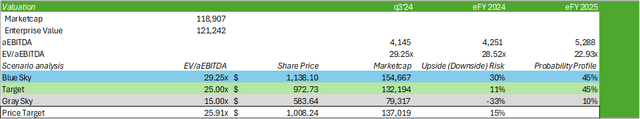

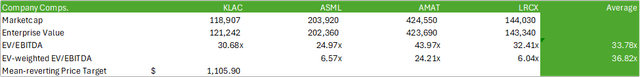

KLAC shares currently trade at 29.25x TTM EV/aEBITDA, a relatively low multiple when compared to its peers Applied Materials (AMAT) and Lam Research (LRCX). Using KLAC’s historical trading multiples, I believe the shares have some room for growth as the firm realizes their cyclical upswing in the coming year. Using a probability-based approach weighted to the upside potential, I believe the internal value for KLAC shares should be priced at $1,008/share at 25.91x eFY25 EV/aEBITDA.

Corporate Reports

Taking into consideration mean reversion, the enterprise value-weighted trading multiple for unadjusted EV/EBITDA is closer to 37x, providing significantly more upside potential for KLAC shares with a price target of $1,106/share.

Seeking Alpha

Given the growth opportunity ahead for KLAC and the relatively limited risk as it relates to business in China, as referenced in my initial report covering KLAC, I believe there remains some upside potential for shareholders. I rate KLAC shares with a BUY recommendation with a price target of $1,057/share, the average of the internal and company comparison price targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KLAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.