Summary:

- The company managed macroeconomic uncertainty through revenue growth management and pricing increases.

- Inflation has already offset much of the company’s pricing initiatives.

- The stock value is not appealing due to limited opportunities for valuation multiple expansion and no large share repurchase plan in place.

karandaev

Company Profile

The Coca-Cola Company (NYSE:KO) was founded in 1892. It produces and sells finished soft drinks, other beverages, and beverage concentrates. In 2022, sparkling soft drinks accounted for 69% of unit case sales, while Coca-Cola accounted for 46% of those sales.

The company estimated that its global market share, calculated as a percentage of volume daily consumption, was 3.5% in 2022.

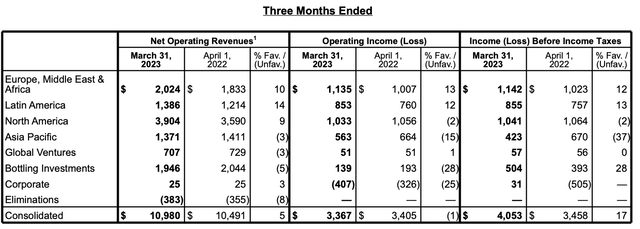

Revenues Breakdown by Region (Company’s Filing)

Key Takeaways from Q1 2023 Earnings:

- In Q1 2023, its organic sales increased by 12%, decelerating from 16% in Q4 2022, due to slower unit case growth.

- The 11% rise for the quarter was attributed to pricing and mix. Unit case sales declined 1% from Q2 2022, a significant slowdown from 3% growth in Q4 2022 growth.

- In Q1 2023, its comparable gross margin increased by 120 bps to 60.9%, from 59.7%.

- In Q1 2023, its SG&A % increased by 70 bps to 29%, from 28.3%.

- In Q1 2023, its non-GAAP operating margin increased by 40 bps to 31.8%, from 31.4%, driven by topline growth and the impact of refranchising bottling operations, offset by an increase in marketing investments and higher operating costs.

- EMEA, Latin America, and North America grew double digits in comparable currency-neutral operating income, offset by a single-digit decline in Asia.

- As of the end of Q1 2023, its inventories increased by 11.7% to $4,727 million, from $4,233 million in Q4 2022.

We have the following comments: The company aggressively increased pricing at a double-digit rate to offset inflation pressure while its unit case sales started to see a significant slowdown. By region, unit case sales declined in EMEA by 5%, followed by a 1% decline in Asia. Although we are impressed by its pricing power, it is obvious the marginal benefits of price increases started to fade out.

The company continued to increase its marketing investments to grab market share in this environment, supported by its strong balance sheet. The accumulating inventory this quarter revealed its ambition to play offense. The company had success in away-from-home businesses such as QSR restaurants.

- The company expected to grow organic revenues by 7-8% in 2023 and comparable EPS to grow by 3-4%. Commodity price inflation continued to be a headwind and will increase at a single-digit rate.

- The company projected 2023 operating cash flow from operation to be $11.4 billion and CAPEX to be $1.9 billion and free cash flow of $9.5 billion. This implied a flat free cash flow, a 3.7% growth in operating cash flow, and a 35% increase in CAPEX.

Overall, we saw the company managed macroeconomic uncertainty with enhanced capabilities in revenue growth management, which included proactive pricing increases due to an inflationary environment. The company also expanded its market share in away-from-home categories as the travel industry was in a tailwind.

Industry

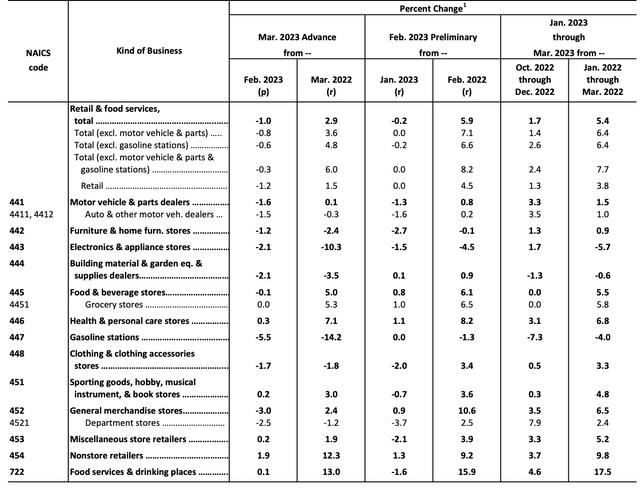

Revenues for US food and beverage retailers increased by 5% in March 2023 compared to March 2022. Revenues from food services and drinking places increased by 13% as of March 2022. These categories continued to outperform the whole retail industry, whether compared to the previous quarter or the previous year.

The travel sector tailwind continued to boost restaurants and bars. The company is well-positioned in the categories of food consumed away from home and food consumed at home. Its double-digit price increase is evidence of its powerful brands.

U.S. March Retail Sales (U.S. Census Bureau)

Valuation

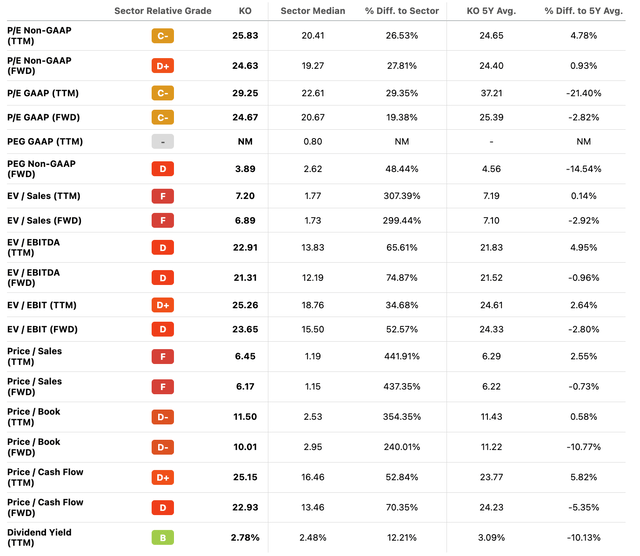

Most of its valuation multiples trade above the sector median and flat to its 5-year average, and the stock’s YTD return was 1.8%. The dividend yield was 2.87%, not attractive compared to the 1-year treasury bill. The company does not have a large buyback plan in place. We believe the only way for an investor to attain an alpha return on their investment is by means of stock appreciation.

The company has the ability to grow through pricing and premiumization packaging, but this can be offset by the inflation headwind. Hence, there is not much upside in margin expansion in our view. Thus, we do not see significant valuation multiple expansion opportunities. The stock’s FWD P/E ratio is only slightly lower than its 5-year average, therefore, we do not see it as cheap enough.

Valuation Multiples (Seeking Alpha)

Summary

The company proactively managed macroeconomic uncertainty through revenue growth management and pricing increases, with consumer activity and behavior varying across markets and affordability and premiumization being key factors in expanding the consumer base.

The company has benefited from the travel sector’s growth. The company is positioned well in both the away-from-home and at-home food categories. However, the inflation headwind already offset much of its pricing initiatives. There is limited room for margin expansion in our opinion.

Despite having a healthy balance sheet that allows it to continue spending on marketing and expanding its market share, the company anticipated higher CAPEX costs, which more than offset the predicted gain in operational cash flow.

The stock value is not appealing to us because valuation multiple expansion opportunities are limited, and there is no large share repurchase plan in place.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.