Summary:

- Johnson & Johnson settles a consumer protection lawsuit for $75 million, a significant reduction from the initial demand of $6 billion.

- The company is facing nearly 60,000 lawsuits from ex-talc users claiming that the powder caused their cancer.

- A US District Judge is allowing the company to contest evidence linking its talc powder to cancer, providing an opportunity for new arguments in its defense.

- On top of that, the company is working on a transition to fast-growing medtech products and solutions, adding to the attractiveness of its current valuation.

Mario Tama

Introduction

Last year, I started covering healthcare giant Johnson & Johnson (NYSE:JNJ), with my most recent article on the company written on January 4 of this year, titled “Johnson & Johnson: One Of The World’s Safest Stocks Could Return +10% Per Year.”

In that article, I did a number of things, including explaining that its AAA credit rating makes it one of the safest stocks in the world. In fact, this rating is so high, that there’s nothing above it. There’s no AAA+.

Even better, although it’s a bit unfair to compare a corporation to a sovereign nation, there are just ten developed nations with similar credit ratings – the United States isn’t one of them.

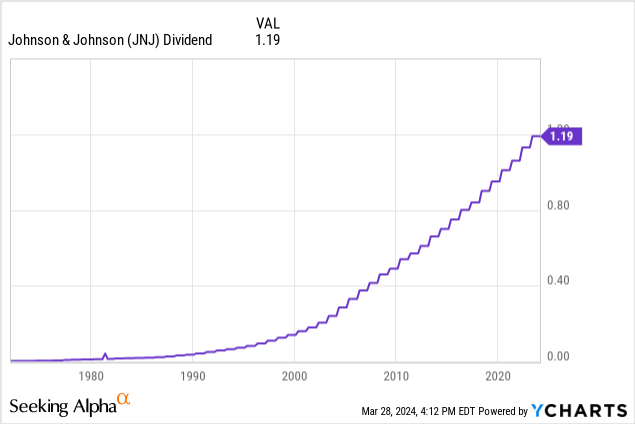

It’s also a company with more than 60 consecutive annual dividend hikes!

Another important topic I highlighted in that article is the company’s involvement in major lawsuits, which has kept a lid on the stock.

It also didn’t help that spin-offs and general post-pandemic weakness have caused some uncertainty that investors wanted to avoid.

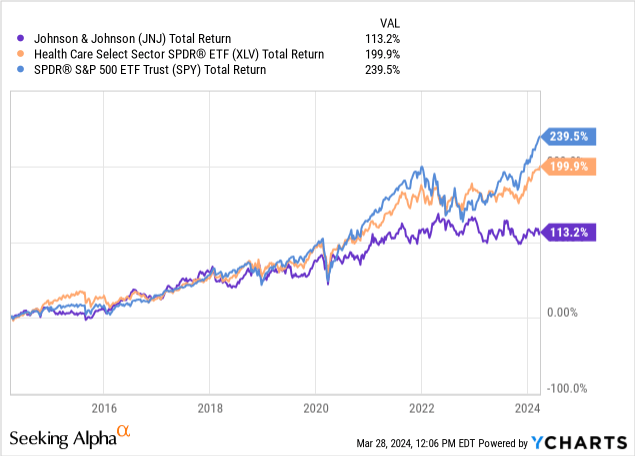

Hence, as we can see below, since 2020, the stock has started to ignore the uptrend in both the S&P 500 and the Health Care Select Sector SPDR ETF (XLV). Over the past ten years, JNJ has returned just 113%, including dividends. The XLV ETF returned 200% during this period. It also had lower risks, as it’s a well-diversified ETF.

That said, I see reasons to remain optimistic. Even better, I believe JNJ offers tremendous shareholder value!

For example, we’re seeing new lawsuit headlines that could be highly favorable for the company. We’re also witnessing new M&A that could reshape JNJ and allow it to boost future growth.

In this article, we’ll discuss all of this and more.

So, let’s get to it!

Lawsuit Headlines

If there’s one thing that has the ability to cause tremendous uncertainty among investors, it’s lawsuits. After all, it’s often impossible to estimate how bad things could get.

Like many healthcare giants, Johnson & Johnson has been involved in a number of lawsuits in its recent history. One of the biggest issues is the potential health risks tied to talc powder in its J&J Baby Powder.

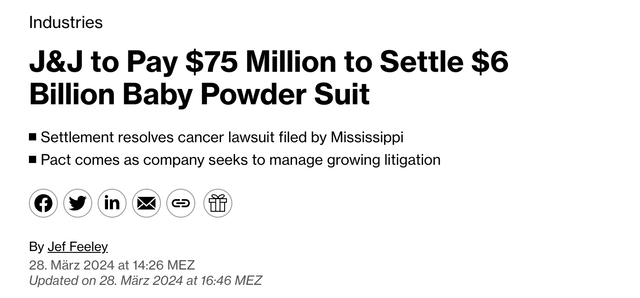

The good news is that there may be light at the end of the tunnel, as Bloomberg just reported that the company may be seeing tailwinds with regard to damage control.

Bloomberg

Essentially, the company will pay $75 million to settle a consumer protection lawsuit that was filed by the State of Mississippi over its talc-based baby powder.

This is fantastic news for JNJ, as the State initially asked for up to $6 billion.

To put things into perspective, JNJ reported $18.2 billion in free cash flow last year. $6 billion would have been a third of that. $75 million is 0.4% of that number.

Even better, the timing of this news could not have been better:

The state sued over J&J’s failure to warn consumers about the powder’s alleged cancer risks over nearly a 50-year period. The settlement comes as the world’s largest maker of health care products seeks to manage a growing number of suits by consumers accusing it of concealing the product’s risks, after two unsuccessful attempts to use the bankruptcy courts to impose a settlement on former users. – Bloomberg (emphasis added)

J&J, which also has to put warning labels on its baby powder in The Magnolia State, settled a $700 million lawsuit with 42 U.S. States in January. That deal excluded Mississippi and New Mexico.

Moreover, the Bloomberg article mentioned that Johnson & Johnson is facing nearly 60,000 lawsuits from ex-talc users who make the case that the powder caused their cancer.

A big part of these cases is consolidated before U.S. District Judge Michael Shipp in Trenton, New Jersey, for pre-trial information exchanges.

This is important because the Deccan Herald just reported that the company will be able to contest evidence linking its talc powder to cancer.

In a brief written order, US District Judge Michael Shipp in Trenton, New Jersey, who is overseeing the lawsuits that have been consolidated in his court, said recent changes in the law and new scientific evidence require a fresh review of the evidence that linked J&J products to ovarian cancer. – Deccan Herald

As a result of this decision, the company will have until July 23 to come up with new arguments that support its claims that it did not cause cancer.

So far, results have been very mixed, including a $2.1 billion win awarded to 22 women with ovarian cancer in 2021 and a failed $223.7 million lawsuit in October.

What matters is the opinion of experts. In cases like the one J&J is facing, federal judges decide what expert testimony is allowed at trial. That’s based on the Daubert v. Merrell Dow Pharmaceuticals ruling of 1993.

According to the Deccan Herald, the “Daubert” decision can be a huge turning point if there is no bulletproof scientific evidence that a certain product causes cancer.

Right now, this seems to be a big potential win for the company:

Shipp’s Wednesday order pointed to a December change to the federal rule of evidence governing expert testimony, which emphasized courts’ role in vetting experts’ conclusions and methodology before allowing them to present evidence to a jury.

J&J said that the rule change would help keep out flawed evidence, while attorneys for talc plaintiffs said that their evidence was strong enough to meet the revised standard. – Deccan Herald

In other words, what we’re dealing with here is a favorable situation, as it puts more emphasis on “the science.” Unless plaintiffs find rock-solid evidence that talc powder causes cancer, Johnson & Johnson will likely catch a major break.

A Path To A Higher-Growth Profile

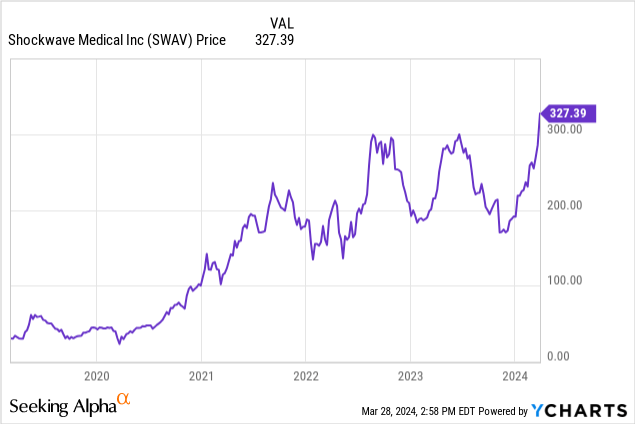

On March 26, the Wall Street Journal wrote that Johnson & Johnson will acquire medical device maker Shockwave Medical (SWAV).

The deal is likely to be completed in the weeks ahead. Shockwave had a market value of roughly $11 billion before the market started to price in an M&A agreement. It currently trades at a new all-time high.

SWAV operates in one of my favorite areas: cardiovascular health. As some may know, cardiovascular disease is the leading cause of death in the United States, with close to 700,000 thousand fatalities annually.

This year, SWAV is expected to generate at least $910 million in revenues, up 27% compared to 2023! This is a great example of the growth potential of this market.

Buying SWAV would make sense, as Johnson & Johnson bought heart device maker Abiomed in 2022 in a $16.6 billion deal.

On top of that, the company has the means to get the deal done, as it got $13.2 billion in cash from the Kenvue (KVUE) spin-off.

Even better, creating synergies would be relatively easy for JNJ, as both SWAV and Abiomed have an existing relationship working on training and dedication programs in the U.S. and Germany.

Johnson & Johnson

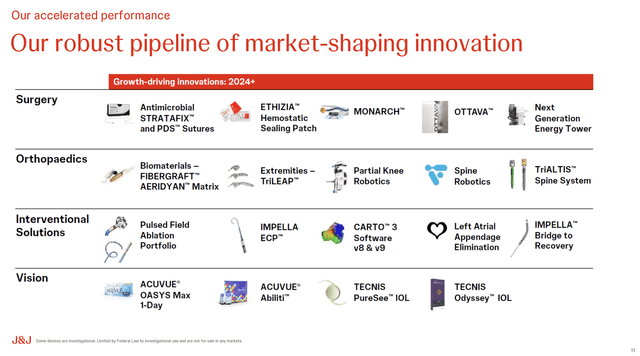

In general, I’m very bullish on medtech, which is an increasingly important area for JNJ.

For example, during the latest Cowen Annual Healthcare Conference, the company elaborated on its medtech growth.

So far, it has three active programs, including orthopedics with the VELYS program and the MONARCH flexible robotic endoluminal system for pulmonology and urology.

The MONARCH system, for example, has made significant progress, with more than 35,000 procedures performed in the U.S. and approval secured in China, to address a significant unmet need in lung cancer diagnosis.

Even better, the company’s progress in multiple surgical specialties positions it as a leader in the rapidly evolving field of robotic surgery, which has turned stocks like Intuitive Surgical (ISRG) into high-flying outperformers.

Johnson & Johnson

The only thing that’s better than a rosy growth story is strong results.

So far, JNJ’s MedTech business has shown impressive growth, with organic revenue increasing from 1.5% in 2017 to 7.8% by the end of the last fiscal year. That excludes Abiomed.

Going forward, we’re likely dealing with a company with a much bigger share of revenues coming from high-growth products.

So if you look at our portfolio in 2018, 20% of that portfolio was what we considered is high-growth segments, segments that grew more than 5%. Last year, that number was 50%. So all that tells you that J&J’s MedTech’s business is in a very strong footing. It’s exciting about what’s coming ahead. And robotics will be definitely part of what excites us about our future. – Johnson & Johnson

So, what does this mean for its valuation?

Valuation

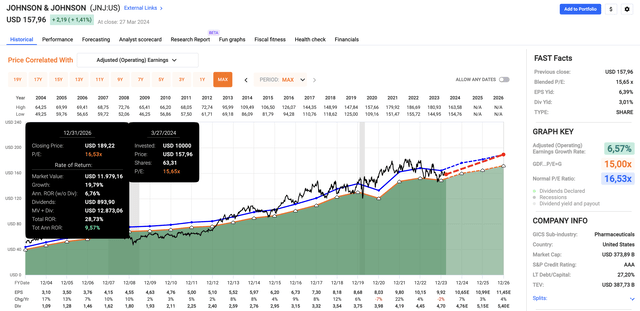

Since 2004, JNJ shares have returned 7.3% per year. Going forward, I believe that number will be significantly higher.

Using the data in the chart below, JNJ is expected to grow its EPS by 7% this year, potentially followed by 3% growth in 2025 and 4% growth in 2026.

Depending on the success of its medical devices business and potential synergies of new M&A deals, I expect growth to remain substantially higher on a long-term basis.

FAST Graphs

With that in mind, JNJ currently trades at a blended P/E ratio of 15.6x. This is below its normalized P/E ratio of 16.5x.

Combining a 16.5x multiple with its 3.0% dividend (sub-50% payout ratio, 61 consecutive annual hikes), and expected EPS growth, the company has a conservative annual return outlook of roughly 9.6% per year.

While this is obviously subject to change, I believe JNJ is in a great spot to generate higher returns than in the prior 20 years.

It also helps that it has one of the best balance sheets in the world, if rates and inflation remain elevated, potentially pressuring the Fed to maintain a “higher-for-longer” stance.

Hence, I continue to believe that JNJ is an undervalued Dividend King with a high likelihood of accelerating growth on a long-term basis and potential lawsuit tailwinds after this week’s rulings.

Takeaway

Johnson & Johnson faces significant challenges, particularly with ongoing lawsuits regarding its talc-based products.

However, recent legal developments suggest potential relief for the company, which could cause a return in investor confidence.

Additionally, JNJ’s potential acquisition of Shockwave Medical indicates a path toward a higher growth profile, especially in cardiovascular health.

In general, with a strong focus on medtech, JNJ is paving the road for elevated long-term growth.

Despite a poor performance over the past 20 years, the company’s robust balance sheet and dividend history position it as a compelling choice for long-term investors seeking both stability and growth.

Pros & Cons

Pros:

- Favorable Legal Developments: Recent settlements and favorable legal rulings suggest potential relief from ongoing lawsuits, reducing uncertainty for investors.

- Strategic Acquisitions: JNJ’s potential acquisition of Shockwave Medical signals a stronger focus on high-growth areas like cardiovascular health.

- MedTech Growth: With a robust pipeline and impressive progress in robotic surgery, JNJ’s medtech segment offers exciting growth opportunities.

- Stable Dividend History: JNJ boasts a consistent dividend track record, making it an attractive choice for income investors.

Cons:

- Lawsuit Overhang: While recent developments are favorable, the company is still prone to lawsuit risks if plaintiffs can prove that its talc powder caused cancer.

- Performance Concerns: JNJ’s stock has lagged behind the S&P 500 over the past two decades. It needs to execute well to change that.

- Competition: Competition in healthcare, especially the medtech industry, could pressure growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.