Summary:

- At $100 a share, very few people cheered for Meta.

- After rallying five-fold, everyone loves Meta.

- Funny how the human mind works.

- In investing, what is comfortable is rarely profitable.

Andriy Onufriyenko/Moment via Getty Images

Introduction

It seems like it was only yesterday.

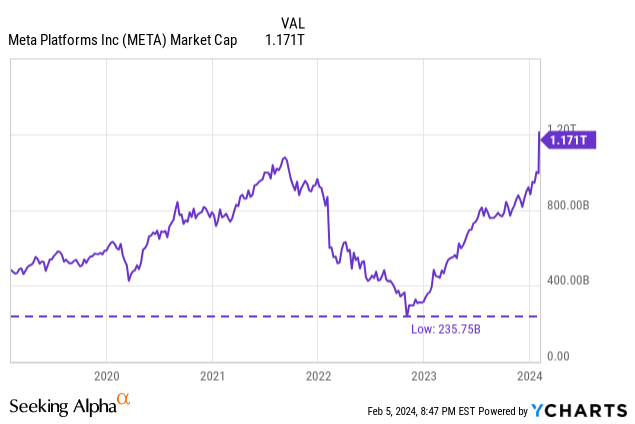

Not long ago, Meta Platforms (NASDAQ:META) was trading in the sub-100s, bottoming at $88 -equating to a $235M Market Cap for the social media giant.

Back then, Meta was trading at peak fear.

In my November Meta article, I wrote the following:

And I expect this to continue as Meta reclaims its $1T market cap status over the next few months. Its strong growth, operating leverage, and durable competitive advantages will eventually push the stock to new all-time highs. It just seems inevitable.

Three months later, Meta reclaimed its $1T status and ripped to new all-time highs. This was further catalyzed by its recent Q4 earnings report, which demonstrated “strong growth” and “operating leverage”.

At $100 a share, very few people cheered for Meta.

But now, at nearly $500 a share, everyone – retail investors, fintwit gurus, and Wall Street analysts – is holding a victory parade for Meta, touting how the company is one of, if not, the best social media/Metaverse/AI play of 2024 and beyond.

Funny how human psychology works.

Growth

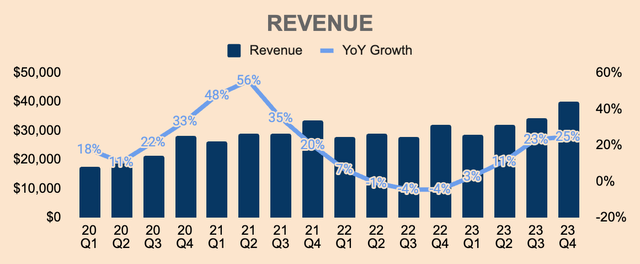

Q3 Revenue was $40.1B, a record high for the company. This was a 25% YoY increase, and as you can see, growth continued to accelerate. This also beat analyst estimates by nearly $1B, or 2.4%.

Foreign exchange rates were a tailwind in Q4 – on a constant-currency basis, Revenue would have grown “slower” at 22%.

Growth was driven by a 24% increase in Advertising Revenue, to $38.7B in Q4. This was due to:

- a 21% YoY increase in ad impressions, driven by Asia Pacific and Rest of World.

- a 2% YoY increase in the average price per ad, driven by advertiser demand and currency tailwinds. However, this was offset by strong impression growth in lower-monetizing surfaces and geographies. Regardless, this was the first time in a long time where average price per ad grew YoY, likely due to improved monetization in Reels (Reels was net neutral to Revenue in Q3, so Reels likely contributed to growth in Q4).

In addition, here are several notable points highlighted by management:

- Reels daily watch time increased 25% YoY in Q4

- Shops ads are now generating $2B of Revenue on an annual run rate basis

- Threads now has 130M+ Monthly Active Users (MAU), up from 100M in Q3

- WhatsApp continues to gain momentum. 1) WhatsApp Channels, which was launched in September last year, now has 500M MAUs. 2) WhatsApp Business drove an 82% YoY growth in Other Revenue, to $334M in Q4.

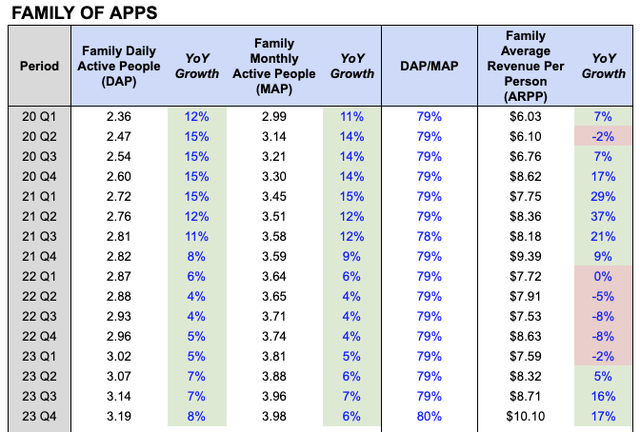

Looking at Family of Apps (FoA) metrics, Monthly Active People (MAP) grew 6% YoY to 3.98B. Daily Active People (DAP) as a % of MAP reached an all-time high of 80%, showing improved engagement within the platform.

Average Revenue Per Person (ARPP) broke the $10 mark for the first time, growing a staggering 17% YoY to $10.10, displaying improved monetization and strong pricing power.

Additionally, Facebook MAU grew 3% YoY to nearly 3.1B. Who said Facebook was dead? Daily Active Users (DAU) as a % of MAU also reached an all-time high of 69%.

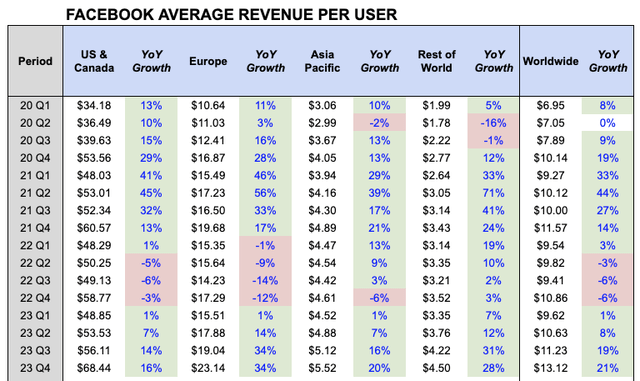

Worldwide Facebook Average Revenue Per User (ARPU) also improved by 21% YoY to $13.12. All regions showed improved monetization with Europe showing particular strength. On the other hand, Asia Pacific and Rest of World remain low at mid-single digits, which presents a good opportunity for Meta to monetize these regions in the years ahead, as most of the world’s population resides there.

Note: Meta will be discontinuing Facebook metrics starting in Q1.

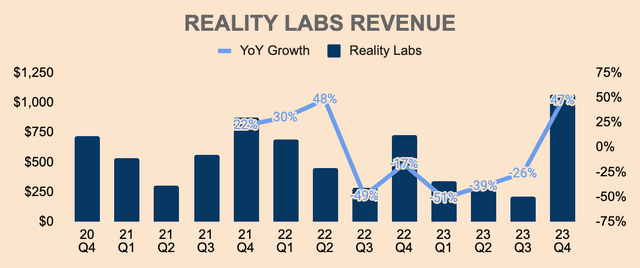

Moving on to the metaverse segment, Q4 Reality Labs (RL) Revenue was $1.1B, up 47% YoY. If you haven’t noticed, RL Revenue grew more than 400% sequentially, driven by Quest 3 sales during the holiday season, which hit shelves in October last year.

That said, the RL segment continues to be volatile as VR headsets remain highly niched in the growing metaverse industry.

All in all, Meta continues to defy expectations, showing how misunderstood and underestimated the social media company is.

What impresses me the most is that Meta was able to accelerate growth despite being such a massive company today.

In addition, engagement and monetization seem to be at all-time highs, reflecting unparalleled social media experience and advertising demand, despite macro uncertainty, competition, and policy changes.

Users, developers, and advertisers want to be in the largest, most diverse, and most relevant social media platform – there’s no doubt Meta is that platform.

Profitability

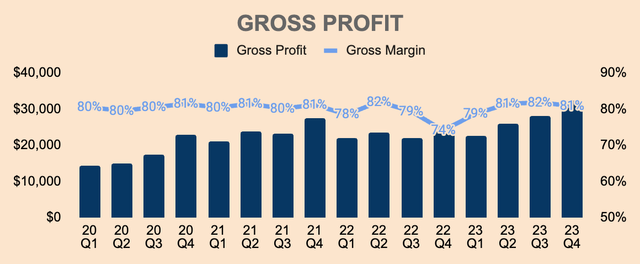

Turning to profitability, Q4 Gross Profit was $32.4B, up 36% YoY, representing a Gross Margin of 81%. As you can see, Gross Margin improved by 700 basis points YoY, mainly due to high restructuring costs incurred in Q4 of 2022, which saw Gross Margins dipping to 74%.

Nonetheless, Meta continues to maintain high Gross Margins of 80%+, reflecting high earnings potential.

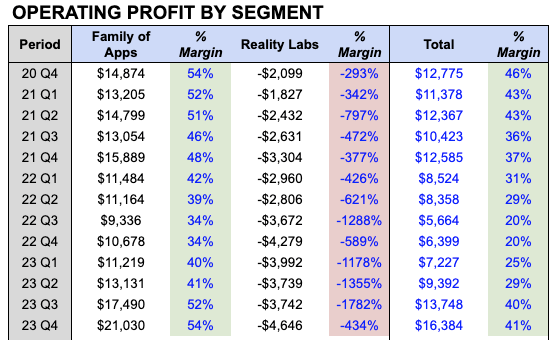

Moving down the income statement, Q4 Operating Profit was $16.4B, which is a 41% Operating Margin. This is more than double YoY, showing Meta’s cost-cutting initiatives.

Most of the operating leverage was driven by a headcount reduction of 22% YoY to 67K employees as of Q4. While headcount is down YoY, it is up 2% QoQ as Meta resumes hiring. As such, expect Operating Margins to stabilize from here.

Of important note, Meta incurred $1.1B of Restructuring Charges in Q4, so without these charges, Operating Margin would have been 44%. Since Meta’s restructuring process is nearly complete, we should see Restructuring Charges fade away, which may give way to higher Operating Margins in future quarters.

Author’s Analysis

Q4 FoA Operating Profit was $21.0B, representing a solid 54% Margin, which improved 2,000 basis points YoY. If not for the $4.6B loss from the RL segment, overall Operating Margin would have been 54%, which is insane.

That said, because of the highly profitable FoA segment, Meta has the luxury of incurring heavy losses in the RL segment, which should continue to be the case in the next few years.

In terms of the bottom line, Q4 Net Income was $14.0B, which is a 35% Net Margin.

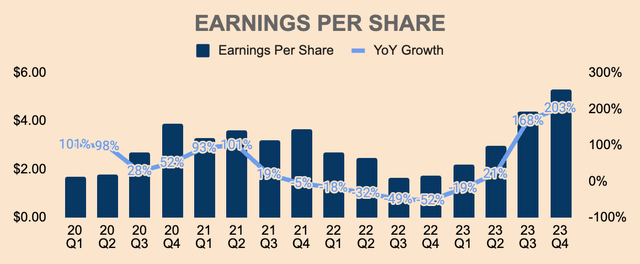

Q4 EPS was $5.33, up 203% YoY, beating analyst estimates by $0.39, or 7%. Just look at the chart below… absolute beauty.

Put simply, Q4 was an incredible, flawlessly-executed quarter.

2023 was the year of efficiency, focused on making Meta a fundamentally stronger company, capable of financially supporting its long-term ambition for AI and the metaverse.

What’s commendable is that Meta was able to accelerate growth while cutting costs – leading to unimaginable operating leverage. At the same time, the company launched breakthrough products such as Threads, Quest 3, and Llama.

Moving forward, Meta will continue to operate as a lean machine as it pursues its growth ambitions, which should not only drive meaningful earnings growth but also keep investors excited about the company’s moonshot projects.

I think that being a leaner company is helping us execute better and faster, and we will continue to carry these values forward as a permanent part of how we operate.

(CEO Mark Zuckerberg – Meta Platforms FY2023 Q4 Earnings Call)

Health

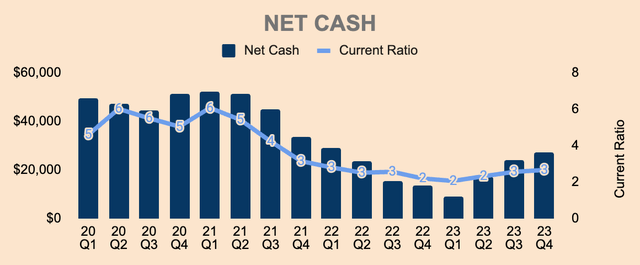

Meta’s balance sheet remains strong with Net Cash improving by $3.2B QoQ, to $27.5B – as of Q4, Cash and Short-term Investment was $65.4B while Total Debt was $37.9B.

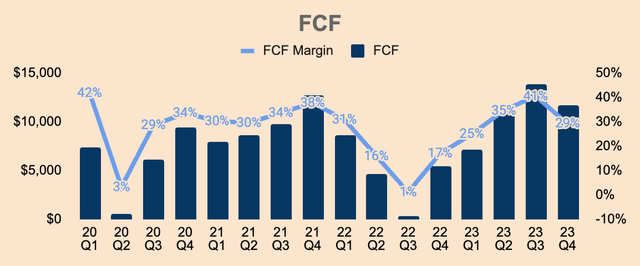

Q4 Free Cash Flow was $11.7B, representing a FCF Margin of 29%. As you can see, FCF Margin dipped meaningfully from Q3’s 41%, due to 1) deferral of income tax expenses to Q4 and 2) higher CapEx of $7.7B, which increased $1.1B QoQ.

Nevertheless, Meta remains a cash flow machine.

And with such a robust FCF profile, Meta bought back $6.3B of stock in Q4, materially higher than Q3’s pace of $3.7B. Management also expanded its buyback program by $50B, bringing its total buyback capacity to $80.9B. To put that into perspective, Meta could reduce shares outstanding by another 6% to 7%, assuming its market cap remains unchanged.

In addition, Meta declared its first quarterly dividend of $0.50 per share, which was a huge surprise to many – in a positive way of course. Now that Meta is officially a “dividend stock”, Meta could attract meaningful investment interest from both retail and institutional investors, which should support price appreciation for years to come.

Outlook

Here’s what management’s guidance looks like:

- Q1 Revenue is expected to be between $34.5B to $37B. This implies a 20% to 29% growth YoY, as compared to Q4’s growth of 25%, so growth is expected to remain strong. What’s more, the low end of management’s guidance exceeded consensus estimates of $33.9B.

- FY2024 Total Expenses to be between $94B to $99B, up from $88.2B last year, driven by 1) higher infrastructure-related costs, 2) higher payroll expenses as Meta resumes hiring, and 3) higher investments to scale the RL segment.

- FY2024 CapEx to be between $30B to $37B, up from $27.3B last year. This is due to increased expected investments in servers, data centers, and AI-related projects.

In my opinion, I believe Meta’s Q1 Revenue growth rate will be the short-term peak as tough YoY comps creep in, especially in the back half of the year, which should decelerate growth.

Regardless, Meta’s focus in 2024 and beyond will revolve around AI. During the earnings call, the CEO laid out five key initiatives for Meta’s AI aspirations:

- “World-class compute infrastructure” – this is where Meta’s higher CapEx comes into play. Meta learnt its lesson from Reels where the company underbuit its GPU clusters for Reels. To avoid capacity overload, Meta plans to amass 350K Nvidia H100 Chips (priced at $25K to $30K per unit) by the end of the year. Combined with other GPUs, Meta will have 600K H100 equivalents of compute, which should support Reels and future breakthrough products with no problem.

- “Open-source software infrastructure” – this includes Llama and subsequent models. By keeping it open-source, Meta benefits in three ways. First, open-source software is typically safer, more secure, and more compute-efficient. Second, open-source software can become an industry standard with relative ease of integration. And third, open-source systems are already popular among developers and researchers.

- “Taking a long-term approach towards the development” – this means avoiding being complacent. While working on existing products and models, Meta is also thinking ahead in terms of building Llama 5, 6, and 7, as well as scaling full general intelligence.

- “Learning from unique data and feedback loops” – this means building the architecture and systems to fully leverage its expansive dataset of “hundreds of billions of publicly shared images”, “tens of billions of public videos”, and “hundreds of millions of people interacting with AI”.

- “Culture of rapid learning and experimentation” – pilot, iterate, distribute, expand, monetize. That’s always been Meta’s product playbook.

As you can tell, Meta is going all in on AI.

And considering its sheer size, experience, and financial footing, I have no doubt that Meta will be one of, if not, the most dominant force in generative AI and general intelligence.

Combined with its invincible social media network and leading metaverse technology, Meta is well-positioned for future growth as it builds the next-generation social media platform.

Valuation

Let’s take a trip down memory lane.

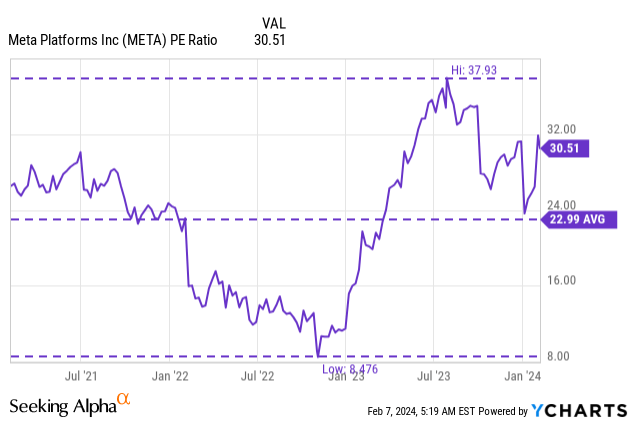

In 2021 and 2022, Meta experienced one of the most brutal selloffs in the history of big tech firms, shedding 75% of its value from $380 a share to $90 a share. In the aftermath of its crash, Meta traded at a PE Ratio of as low as 8.5x.

It was dirt cheap. Absurdly cheap.

Although I didn’t time the exact bottom, I wrote a “Strong Buy” article on Meta, explaining that it pays to be contrarian at that time.

Here are some of the negative comments from that article:

- “Go ahead, catch the falling knife.”

- “I’d buy hand over fist if Zuck was gone.”

- “FB is so last decade, the peak is behind us.”

- “META’s ability to pull people to its platform is now greatly diminished.”

- “The rest of Meta is over-monetized and in decline.”

Mind you, these comments were written after the stock had fallen 65%.

People were bearish on the stock when the market presented them with a once-in-lifetime buying opportunity.

Despite all the negativity around Meta at that time, I ended the article with:

At a P/E ratio of just 10x, investors get to buy a high-quality, wide-moat business at a large margin of safety.

These headwinds are temporary – it’s only a matter of time before conditions improve.

When things do get better, shares would have appreciated substantially.

Buy when there’s blood in the streets. Buy when there are dark, gloomy headlines. Buy when no one else wants to buy.

It always pays to be a contrarian.

And bought META stock I did.

And now, the stock is up 400% since it bottomed at $88 a share.

Guess what people say about Meta now?

- “Social media monopoly”

- “Leader in AI and the Metaverse”

- “Cash flow machine”

- “$2 trillion market cap is next”

- “Still cheap after 400% run”

People are now bullish on the stock after increasing five-fold!

Funny how the human mind works.

As the saying goes:

Be fearful when others are greedy and greedy when others are fearful.

(Warren Buffett)

But oftentimes, being a contrarian is uncomfortable. Swimming against the current is uncomfortable. Being a lone wolf is uncomfortable.

But here’s one of my favorite quotes in investing:

In investing, what is comfortable is rarely profitable.

(Robert Arnott)

In other words, to beat the market, we need to go in when things don’t look so good, when all hell breaks loose, when analysts are downgrading left and right. These kinds of scenarios create the best opportunities because fear leads to discounts.

Of course, we need to do our research and carefully determine that the company has the right fundamentals and competitive advantages to weather the storm and come out stronger on the other side – I have complete confidence that Meta has the aforementioned traits.

On the other hand, when there’s sunshine and rainbows, when there’s complete certainty where the company is heading, and when the news headlines say “Buy, Buy, Buy!”, that’s when we should stay away because stocks trade at a premium in these conditions.

Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.

(Warren Buffett)

So that’s a little lesson I learned from my Meta investment: Be a contrarian and buy struggling, unpopular – but high-quality – companies at a wide margin of safety.

It’s counterintuitive, but it gave me the best returns.

That said, how is Meta looking now from an investment standpoint?

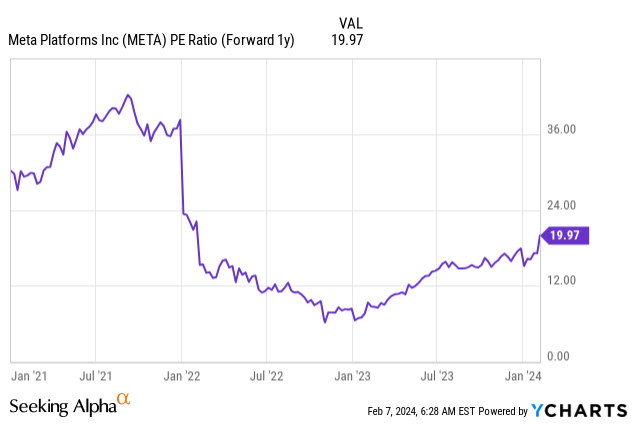

On a forward PE basis, Meta trades at a ratio of 20x which is neither cheap nor expensive. But given Meta’s growth story and fundamentals today, I think Meta still has some decent upside from here.

However, I wouldn’t be a buyer at these levels.

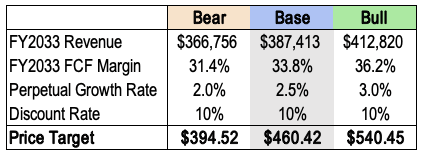

As for me, I have a Base Price Target of $460, which assumes:

- FY2033 Revenue of $387B (first three years follow analyst estimates followed by 10% CAGR for the remaining years)

- FY2033 FCF Margin of 33.8% (no material improvement from 2023 levels, which was 32.5%)

- Perpetual growth rate of 2.5%

- Discount rate of 10%

I’ve also included my Bear and Bull targets as shown below.

Author’s Analysis

Analysts have an average price target of $497 a share, so my price target is actually a little bit pessimistic – after a 400% runup, I don’t want to get caught in all the excitement. It’s best to keep myself level-headed and objective.

Nonetheless, I have no plans to sell or add at these prices.

Risks

The biggest risk, in my view, would be valuation. Given its recent rally, investors may “panic-sell” to book their profits, especially if there’s a slight pullback or negative event.

Meta is also vulnerable to policy changes within Apple iOS and Android. Evolving government regulation may also hinder growth.

Thesis

Meta closed out the year with a bang – growth accelerated, earnings exploded, buybacks expanded, guidance exceeded, and dividends were declared.

What’s more, Meta has a bright future as the leader in social media, generative AI, and the metaverse.

But this wasn’t the narrative back when the stock was trading below $100.

Instead, it was all fear and pessimism.

As I witness the stock ripping to new all-time highs within less than a couple of years, all I can learn from this experience is that it pays to be a contrarian in beaten-down, high-quality, fundamentally strong businesses.

And now, the stock is preparing to make its way higher – perhaps to $500, $600, or $700, who knows.

But there will come a time when there’s too much optimism and euphoria – so much so that valuation becomes detached from fundamentals.

When that happens, I’ll be running for the hills.

Fortunately, we haven’t reached that point yet, which is why I continue to hold Meta stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.