Summary:

- The short Sirius XM Holdings Inc./long The Liberty SiriusXM Group NAV discount arbitrage has been a popular trade.

- However, some fund managers have probably been too greedy and ended up in a massive short-squeeze.

- Here is what might come next and how you can still profit from the situation.

SIRI shorts get squeezed baona

The short Sirius XM/long Liberty SiriusXM Group arbitrage

Everybody and his grandma have been aware of the large NAV discount weighing on The Liberty SiriusXM Group (NASDAQ:LSXMA, NASDAQ:LSXMK, NASDAQ:LSXMB) tracking stocks, which usually traded 25-30% below the sum of their market traded assets: an 83% stake in Sirius XM Holdings Inc. (NASDAQ:SIRI) and a 27% stake in Live Nation Entertainment, Inc. (LYV).

This is why the smartest guys came up with an easy arbitrage: Go long the Liberty tracker and hedge business risk by shorting Sirius XM Holdings. Even if SiriusXM went bankrupt, thanks to the pre-existing NAV discount, such a trade should be profitable.

The problem with this arbitrage was that it was just too popular: given the small float of only 17% of SIRI stock, corresponding to about 660 million shares (much of which are likely also owned by long-term shareholders and therefore not available for trading), the recent short interest of about 220 million shares coupled with an average trading volume of just ~20 million shares looks frightening.

Front-running the arbitrage unwind

We know that at the beginning of August, Liberty SiriusXM will split into a pure-play tracker based on only its SIRI ownership and another tracker based mainly on the Live Nation stake. Management has been quite open about the reason for the split: in some way, the move will pave the way for a merger with SiriusXM – which obviously should finally collapse the NAV discount.

More details on the transaction and its implications on the NAV discount can be found in my article from last December.

Since all this has not been a secret, some investors thought the smart thing to do was to unwind the hedge before others did. Hence, they bought back the borrowed SIRI stock and closed their short position, maintaining only the long Liberty SiriusXM position.

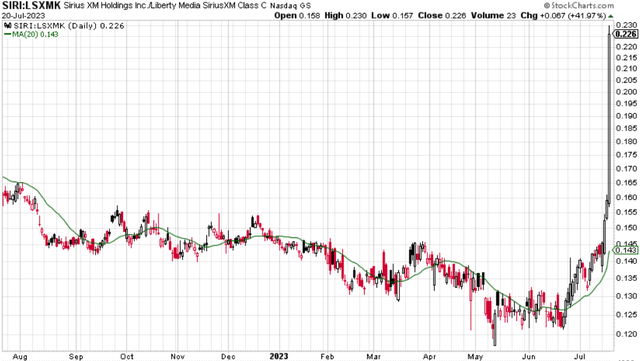

This is why in recent weeks SIRI has greatly outperformed its Liberty tracker:

Being late to the party and getting squeezed

Those that were late to realize the risk of a short squeeze were caught flatfooted yesterday, as Barron’s explained what was going on, basically calling in reinforcements. Many traders that were not at all interested in the arbitrage jumped on the opportunity and bought call options on SIRI, which required market makers to buy the stock, thus exacerbating the situation further and creating a self-reinforcing vicious cycle. Investors that had believed in a normally priced opportunity to close their SIRI short, found themselves heavily underwater, and every second the stock climbed higher and higher, triggering several trading halts on its way.

Expectations for today and beyond

Since the start of July 2023, when 220 million SIRI shares were still sold short, roughly twice as many SIRI shares have been traded. While it is possible that the entire short position has been closed, it is not likely, as just yesterday 126 million shares changed hands (6-8 times the normal trading volume), many of which were bought by market makers, short-term traders or others. So at least some of the massive short position is still waiting to be covered.

However, analysts are giving their helping hands, downgrading SIRI before the open and sending the stock a bit lower. This means that some of the holdouts may get a chance to cover without needing to chase the bid.

Overall, my best guess is that the squeeze won’t move much higher. This short covering trade had been going on for quite some time without being noticed too much.

We would need to see some massive retail speculation similar to the GameStop Corp. (GME) mania to push prices further to the moon. While this remains a possibility, so far it has not happened.

How you can still profit

If you feel sure enough that fundamentals will take SIRI back down from its current price of $7.80, you can short SIRI, although I would not recommend such a gamble.

On the other hand, the Liberty SiriusXM tracker still remains very cheap. Those buying today LSXMK for $34.50, within a few weeks should receive a pure-play SiriusXM tracker, and for every four shares they own, another share of the new Live Nation tracker, for an underlying total value north of $80.

Sure, SiriusXM is quite richly valued today. If it comes down to its old trading range, we should expect the Liberty tracker’s NAV to shrink a bit in the meantime. Yet even if we assume that SIRI will come back down to $6, the underlying value of today’s LSXMK is still about $75. You can buy it for less than half of that, and the catalyst that should finally shrink the NAV discount is likely to materialize within less than one year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LSXMK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.